Summary:

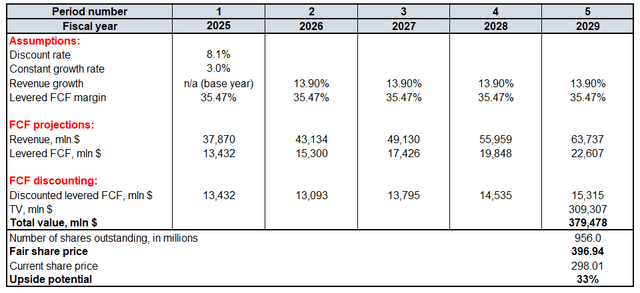

- Despite a solid rally of the last few months, the discounted cash flow model suggests that there is a 33% upside potential.

- Salesforce’s innovative integration of AI technologies positions it as a leader in the CRM market, offering significant growth potential and a competitive edge over rivals like Microsoft.

- Under the confident leadership of Marc Benioff, Salesforce is well-equipped to navigate competitive challenges and capitalize on emerging opportunities, making it an attractive investment.

- The company’s strong market presence and strategic expansion efforts enhance its ability to capture a larger share of the growing demand for cloud-based solutions.

FinkAvenue

Introduction

I shared a thesis about Salesforce, Inc. (NYSE:CRM) back in August with a ‘Strong Buy’ rating. It looks like it was a good recommendation because the stock price grew by 24% since then, a much stronger performance compared to the S&P 500.

Despite solid share price dynamic, the stock is still around 33% undervalued. Such a discount looks like a big gift for investors. CRM is well-known for its ability to drive growth and innovation, and recent developments suggest that the company is still aggressively seeking new opportunities to differentiate. At the same time, CRM does not prioritize innovation over delivering value to shareholders now. The profitability keeps expanding, which is a solid basis for maintaining aggressive innovative approach for longer. I think there are no reasons to downgrade, meaning that CRM is still a ‘Strong Buy’.

Fundamental analysis

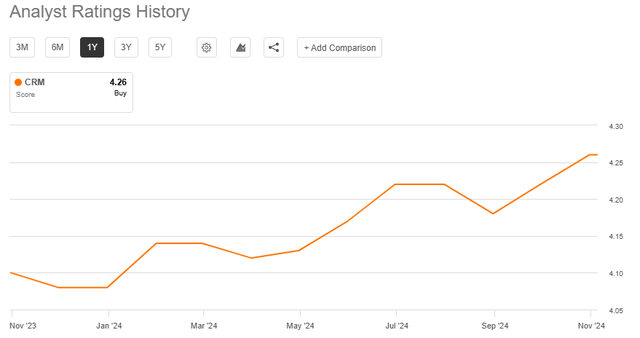

Wall Street analysts are currently much more optimistic about CRM than they were a year ago. I think that there are several positive indicators that underpin Wall Street’s optimism.

The introduction of CRM’s Agentforce offering in mid-September was a big event that was met with optimism. The new application leverages AI and is aimed to improve experience for customers by implementation of the AI functionality in tasks beyond routine ones. The potential appears robust, as Agentforce seems poised to elevate the sophistication of AI capabilities within enterprises. This optimism is further supported by Salesforce’s historically strong track record of delivering compelling offerings to its customers. According to Stifel, Agentforce might open multi-billion growth opportunities for CRM. Another factor underscoring Agentforce’s bright prospects is that CRM teams up with giants like Google (GOOGL) and Nvidia (NVDA) to enhance the offering.

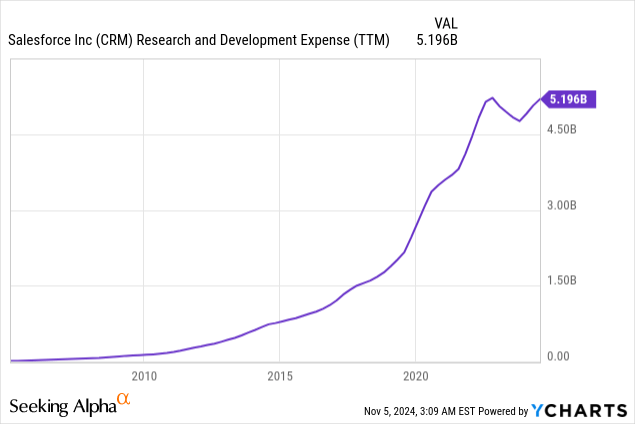

There are reasons to expect that CRM will roll out new interesting offerings over the next few quarters. The company is well-known as an aggressive innovator. CRM’s strategy to boost innovation includes both investing aggressively in-house, and acquisitions of startups. From the perspective of in-house spending, CRM is still in a pedal-to-the-metal mode with its above $5 billion TTM R&D expense.

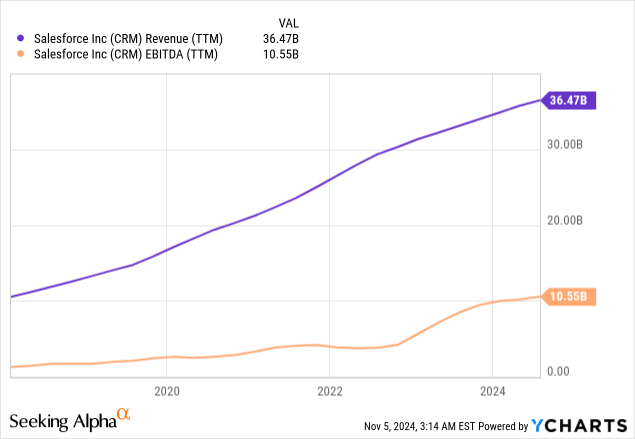

From the perspective of powering innovation through M&A, the company also remains quite aggressive. Over the last few years, successful acquisitions of Slack (2020), Tableau (2019), and MuleSoft (2018) allowed the company to benefit from synergies which allowed to deliver aggressive revenue growth while expanding its profitability. The above chart indicates that CRM delivered a rapid revenue and EBITDA growth since 2018.

Recent acquisitions are not as big as Slack or Tableau mega-deals but are still notable. In early September, it was announced that CRM is buying a SaaS data-protection startup Own for $1.9 billion cash. In late September, CRM announced that it has agreed to buy a leading data management provider for unstructured data called Zoomin. It appears that both acquisitions aim to further improve experience for customers, which will highly likely create new cross-selling opportunities. Another important positive factor is that both startups are long-lasting partners of CRM, meaning that the integration of new companies into CRM’s ecosystem will highly likely be smooth.

I find some of the recent developments around the CEO, Marc Benioff, as bullish for investors as well. The CEO is in talks to sell Time, which I consider positive because if Mr. Benioff eventually sells the media asset, it will likely let him focus more attention to Salesforce. What I also like is Marc Benioff’s strong confidence when he speaks about competition with Microsoft (MSFT) in the space of AI agents. He argues that CRM’s offerings provide better accuracy and more seamless integration than Microsoft’s AI agents do. Such a differentiation reinforces CRM’s positioning as one of the most innovative companies in the world.

Valuation analysis

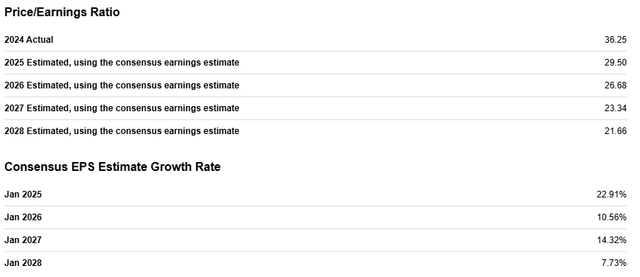

CRM’s current P/E ratio might look high at 36. On the other hand, the EPS is expected to expand with impressive pace. This will make the P/E ratio shrink significantly over the next five years. Since CRM has been historically strong in driving revenue growth and profitability expansion, we can conclude that there is high level of probability that CRM’s P/E ratio will actually decrease significantly over time.

Another way to look at CRM’s valuation is by building the company’s discounted cash flow (‘DCF’) model. Future cash flows will be discounted using an 8.1% WACC. A $37.9 billion FY 2025 revenue assumption is from consensus. The revenue growth rate for the next five years is 13.9%. The TTM levered FCF margin is 35.47% which is already quite aggressive, and that is the reason why I do not incorporate any expansion for the future years. According to Seeking Alpha, there are 956 million CRM shares outstanding. Constant growth rate for the terminal value (‘TV’) calculation is a very tricky assumption. Since my previous thesis aged well, I reiterate the same 3% constant growth rate. I believe that such a constant growth rate is an extremely conservative assumption for innovative and a highly profitable company like CRM.

CRM’s fair value per share is $397, around 33% higher compared to the last close. Therefore, both the DCF model and projected aggressive P/E ratio’s contraction suggest that CRM’s valuation is compelling.

Mitigating factors

While I share Marc Benioff’s optimism about the company’s ability to beat Microsoft in the AI agents space, let us not forget that Salesforce and Microsoft are companies from different weight divisions. Microsoft is a $3 trillion company which invests in R&D more than $7 billion per quarter while CRM invests $5 billion per annum. Due to Microsoft’s financial power and its ability to recruit the best talent, there is substantial risk that CRM might be unable to compete over the long-term.

The market’s expectations around CRM appear to be inherently high. The stock plummeted after the FQ1 earnings release because of a subtle revenue miss against consensus and a very slight outlook downgrade. Therefore, an earnings release might be a big negative catalyst for the stock price even if the company delivers decent quarterly performance. CRM’s closest earnings release is planned for late November.

Conclusion

CRM remains a top pick, in my opinion. A 33% upside potential looks like a gift for such an innovative and highly profitable company. High R&D spending and recent acquisitions suggest that CRM remains an aggressive innovator, which increases chances of releasing new awe-inspiring offerings to its customers.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.