Summary:

- Salesforce’s revenue growth has slowed from over 24% in past years to 8-9% projected for fiscal 2025.

- Q2 FY2025 non-GAAP operating margin improved to 33.7%, with full-year margin guidance raised to 32.8%.

- AI and multi-cloud services are key growth drivers, with 25 trillion Einstein AI transactions processed across all clouds.

- Salesforce’s forward P/S ratio of 6.67x is significantly higher than the sector median, raising valuation concerns.

- Multi-cloud deals account for 80% of new business, with over 16,000 customers adding new cloud services.

John M. Chase

Investment Thesis

Salesforce, Inc. (NYSE:CRM) is at an inflection point, where it will evolve from a high-growth tech giant to a more mature and slower-growing one. Though the sales growth has softened, the company still proves its strength through strong profitability while extending its AI and multi-cloud solutions footprint.

Salesforce’s bold push into these innovative areas positions it well for the future. However, with a premium valuation and slower growth, investors must consider whether its stock still justifies the price, leading to our hold rating.

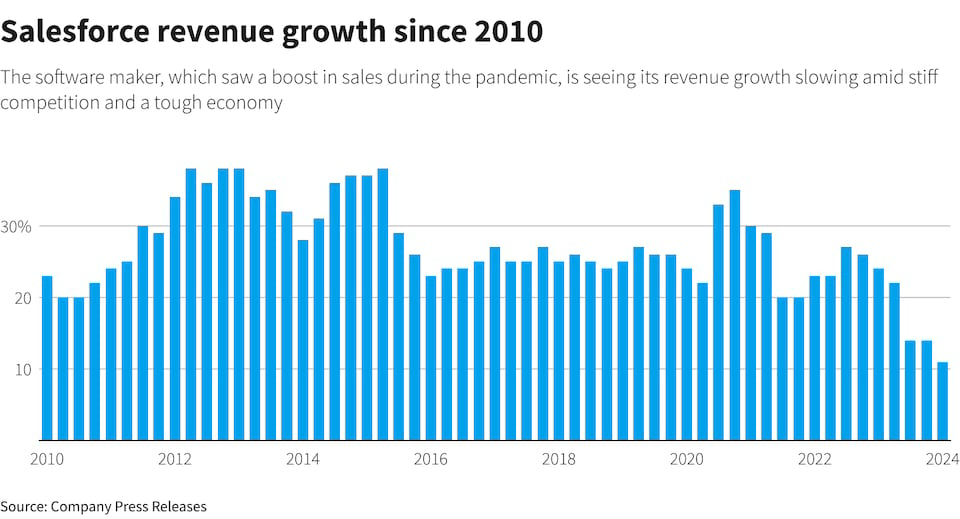

Salesforce’s Top-line Growth Deceleration: From Tech Giant to Slowdown Struggles

Salesforce reported leading revenue growth rates above 24% between 2015 and 2022. In January 2015, its high-growth period, the annual growth of the sales force reached 32%. Growth rates recorded by the company were from 24% to 29% until January 2020, but it stabilized at 24.3% in fiscal 2021 and 24.7% in 2022 before rapidly decelerating to 18.4% in 2023 and just 11.2% in fiscal 2024. The TTM growth rate has fallen to 10.26%, suggesting a slowing down rapidly approaching single digits.

Going forward, Salesforce’s fiscal 2025 guidance indicates 8%-9% revenue growth. For Q3, the company projects revenue between $9.31 billion and $9.36 billion, representing only 7% YoY growth. Furthermore, midterm fiscal year consensus estimates for 2025–2027 point to quite a flat trend. For instance, Salesforce could post revenue of $37.86 billion in fiscal 2025, up only 8.6% YoY. Accordingly, the 2026 and 2027 estimates point to 9.1% and 9.3% YoY growth, respectively, which would logically mean that this company’s growth trajectory will likely continue below 10% within the next few years.

Looking ahead, Salesforce’s guidance for fiscal 2025 suggests revenue growth in the range of 8%-9%. Q3 revenues are forecast at $9.31 billion-$9.36 billion, which is only 7% YoY growth. Moreover, analyst consensus estimates point toward a flatter trend for the midterm fiscal years 2025 and 2027. For instance, in fiscal 2025, Salesforce could post revenue of $37.86 billion with a YoY increase of only 8.6%. By then, the estimations for 2026 and 2027 indicate 9.1% and 9.3% YoY growth, respectively; this means its growth trajectory will likely remain below 10% in the next couple of years.

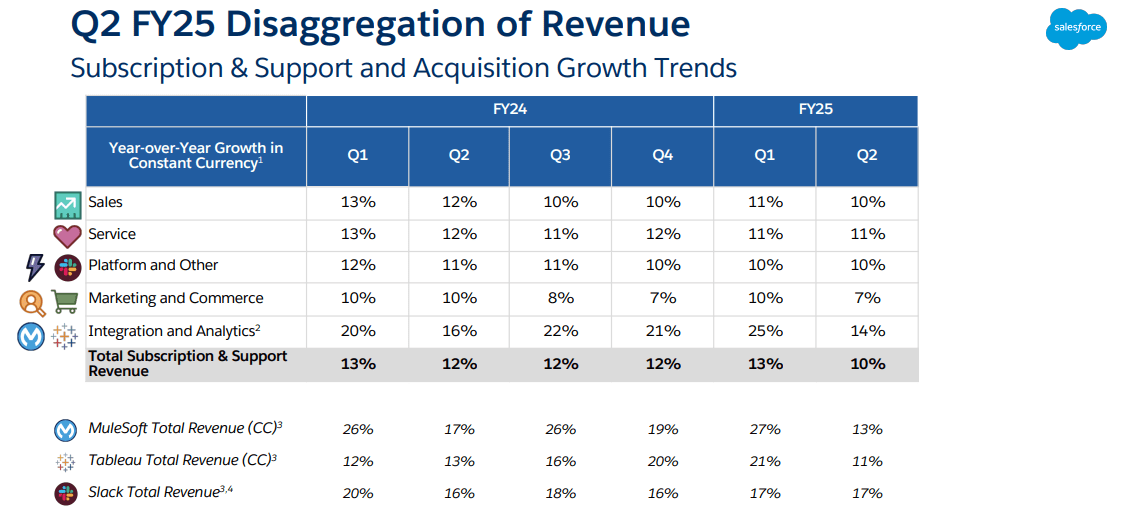

A drop from 32% in 2015 to 9% in 2027 describes a negative slope and portrays the company’s transition from a high-growth technology firm to a slower increase. This is not desirable for any technology company, and a reduced growth rate may shrink Salesforce’s market value, as it would not qualify as a high-growth technology investment. Moreover, slower growth may hurt the AI edge as it points out fundamental adversities in penetrating new markets and expanding in the current market (gaining additional clients). This trend can be observed in dropping total subscription and support revenue to 10% in Q2 fiscal 2025 against 12% in Q2 2024.

reuters.com

Is Salesforce’s Premium Valuation Justified Amid Slowing Growth?

As a result, the deceleration in revenue growth raises concerns about Salesforce’s valuation. CRM’s forward P/S ratio at 6.67x is considerably higher than the sector median of 2.82x. This represents a 136.5% premium against its sector peers, indicating whether Salesforce’s current valuation is justified given its slowing top-line growth. High-growth tech companies attach premium valuations based on their top-line expansion rate. Salesforce’s decelerating growth may no longer warrant such a significant premium relative to the broader tech sector.

Moreover, Salesforce’s forward P/S ratio is only 10% lower than its historical average (5Y) of 7.41x, suggesting that the market has already begun to discount the company’s slower growth prospects. If revenue growth decelerates, there is potential for further compression in Salesforce’s valuation multiples.

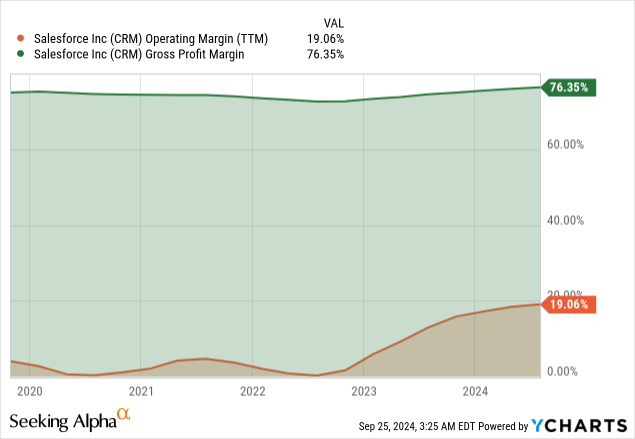

Finally, Salesforce’s exceptional operational edge is becoming the primary driver of CRM market value expansion. 1.46 Salesforce’s PEG ratio is 23.5% lower than the sector median of 1.91, suggesting that CRM stock might be relatively undervalued compared to its peers, given its bottom-line growth expectations. Salesforce’s current PEG is 34.2% lower than its 5-year average PEG ratio of 2.26. The significant discount relative to its historical average indicates that the market might be underestimating Salesforce’s profitability growth potential relative to its previous high-growth years.

CRM Q2 FY25 Earnings Presentation

Salesforce’s Margin Expansion, AI Integration, and Multi-Cloud Mastery Drive Growth

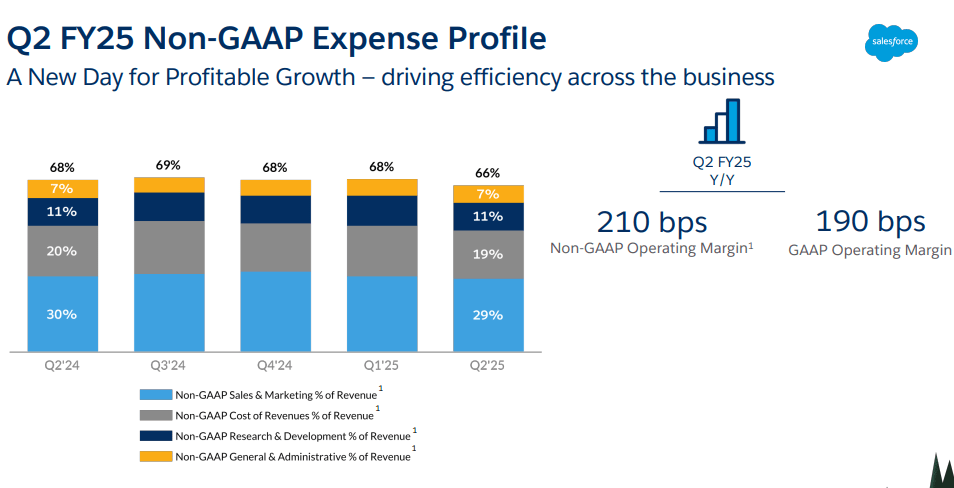

Financially, Salesforce is yielding consistent margin expansion with effective operational scaling. For instance, the company’s non-GAAP operating margin of 33.7% in Q2 fiscal 2025 holds a 2.1% improvement YoY. Over the past 24 months, Salesforce has undergone a significant transformation in terms of cash flow growth along with margin expansion. An example is the cash flow growth to $892 million in Q2 with a 10% increase YoY. This operational edge is a byproduct of Salesforce’s lead in scaling its AI and multi-cloud solutions.

CRM Q2 FY25 Earnings Presentation

Looking forward, Salesforce has raised its fiscal 2025 non-GAAP operating margin guidance to 32.8% with an increase of 2.3% YoY. This forecast points to Salesforce’s constant margin expansion and reaffirms that the company’s operations have reached a scale where profit margins can continue improving despite incremental AI investments. With Salesforce’s growing scale and margin discipline, this bottom-line trend has become a fundamental strength that provides continued growth and increased stock value.

Moreover, the correlation between Salesforce’s high operational margins and its scaling AI and multi-cloud capabilities may continue to push its ability to capitalize on economies of scale. Salesforce’s integration of AI and data through platforms like Einstein and Data Cloud is a vital growth factor. In Q2, Data Cloud processed a staggering 2.3 quadrillion records, which signifies the massive scale of Salesforce operations. Moreover, the number of paid Data Cloud customers grew 130% YoY. With that, customers spending more than $1 million annually has nearly doubled. Large enterprises’ rapid adoption of Salesforce’s data solutions further solidifies its market lead.

Further, the power of AI at scale is observable in Salesforce’s 25 trillion Einstein AI transactions processed across all clouds, alongside the 1 trillion workflows now managing 250 petabytes of client data. The scale of operations enables the company to derive higher revenue and manage costs effectively through automation. By automating customer interactions, service recommendations, and report generation processes, Salesforce offers its clients a significant return on investment. How? Salesforce’s clients can deploy solutions in days, not weeks, and see immediate productivity gains and cost reductions.

Additionally, Salesforce’s AI initiatives fundamentally enhance client efficiency by altering business operations. The introduction of Agentforce (which combines AI, data cloud, and automation) marks a significant leap forward. For this, the company signed 1,500 AI deals in Q2 with major global brands such as Alliant and Bombardier, leveraging AI to boost top-line sales and client engagement. The correlation between the increasing number of AI deals and the overall operational scale points to the potential for additional AI-led top-line and bottom-line growth. This is particularly relevant given that AI is a high-margin value proposition.

Similarly, Salesforce’s capability to provide an integrated, scalable solution through its Customer 360 platform has also been a cornerstone of its lead. In Q2, Multi-cloud deals hold ~80% of the company’s new business, deepening client engagement across multiple service lines. As a result, it is translating into higher margins based on cross-selling synergies.

The Customer 360 platform integrates various cloud solutions, allowing clients to manage sales, service, marketing, and data from a single interface. In Q2, 16K clients added a new cloud, and more than 4,500 added two or more clouds. Salesforce’s ability to cross-sell and upsell different clouds within the same ecosystem leads to its growing revenue per user.

Takeaway

Salesforce’s growth is slowing, but it remains profitable and innovative regarding AI and cloud services. Given its high valuation and decelerating momentum, investors should watch for signs of renewed growth or a better entry point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.