Summary:

- Salesforce has underperformed the S&P 500 and Nasdaq 100 YTD. The company reported its FY24 earnings where revenue and earnings grew 11% and 50% YoY respectively.

- The company is seeing strong momentum in its Data Cloud segment as it drives robust innovation by launching Einstein 1 Studio, while building new capabilities for Einstein Copilot.

- For FY25, the company expects to grow its revenues by 9% YoY, while further improving its margins by 200 basis points to 32.5%.

- I believe we need to pay attention to the management’s commentary on its cRPO growth, while assessing its progress on accelerating its Data Cloud segment in its Q1 earnings call.

- Although I am impressed by the company’s innovation pipeline and financial discipline, I will rate the stock a “hold” given its risk-reward as well as uncertainty in genAI revenue timeline.

CanY71/iStock Editorial via Getty Images

Introduction & Investment Thesis

Salesforce (NYSE:CRM) is a customer relationship management (“CRM”) technology provider that has underperformed the S&P 500 and Nasdaq 100 YTD. The company reported its Q4 FY24 earnings in February, where it grew its revenue and earnings by 11% and 50% YoY for the full year, respectively, as it continued to see strength in driving multiple cloud offerings in new deals, coupled with strong momentum from its Data Cloud Offering as businesses increasingly look to Salesforce to bring together their structured and unstructured data to leverage the power of genAI to improve productivity, customer relationships, and margins.

The company is set to report its Q1 FY25 earnings on May 29. For the full fiscal year FY25, Salesforce expects to grow its revenue by 9% to $37.85B, while further expanding its margins by 200 basis points to 32.5%. While the company management outlined that they are not expecting to see material contributions from genAI products in FY25, I believe that Salesforce is well positioned given its robust product innovation launching Einstein 1 Studio and building new capabilities for Einstein Copilot, especially as we see expect enterprises to increase their AI spending towards building and deploying their genAI applications and experiences.

However, I am not going to be initiating a new position in the company at its current price levels. Although there is an upside of 18% in my price target, based on my assumptions, I believe that the risk-reward doesn’t look attractive at the moment. Given the elevated price-to-earnings ratio of the S&P 500, which could induce a sizable pullback in the index, coupled with a lack of clarity in terms of timeline for Salesforce’s GenAI efforts to translate into scalable revenue growth, I believe there isn’t a sufficient margin of safety. As a result, I will be staying on the sidelines and rating the stock a “hold” at the moment.

A preview of Salesforce’s Q4 earnings report

Salesforce is a leading provider of CRM technology that helps businesses unlock productivity gains and deliver personalized and automated user experiences by connecting their data across sales, marketing, commerce, and IT systems on their AI-powered 360 platform.

The company reported its Q4 FY24 earnings in February, where it generated $34.9B in revenue for the full year, growing 11% YoY. During the earnings call, the management outlined that eight out of the 10 top deals in Q4 included six or more of their cloud offerings, while deals greater than $10M grew 80% YoY in FY24, which I believe showcases the company’s success in its go-to-market strategy to upsell and drive deeper adoption of its solution suite as it optimizes its pricing and packaging strategy.

Meanwhile, the company is also seeing strong momentum from its Data Cloud offering, which is approaching $400M in Annual Recurring Revenue “ARR”, growing 90% YoY, where a quarter of its deals, more than $1M, included Data Cloud. I believe that as organizations look to unlock productivity gains from AI, elevate customer relationships by delivering superior experiences, and drive higher profitability, there is a greater need to connect a company’s disconnected structured and unstructured data. This is where Salesforce’s Data Cloud and Einstein 1 platform are competitively positioned, where customer apps can securely access and unlock insights from the data, leading to more flexibility and a faster pace of innovation.

In terms of geographic distribution, while the Americas contributed 67% to Total Revenue in FY24, growing 10% YoY, the company highlighted that India is a bright spot, where it saw a growth rate of 35% YoY. I believe that given the size and scale of Salesforce, it will likely see a normalization of growth in its well-established Americas market in the coming years. However, I like the fact that the company is actively investing in emerging markets such as India, where it will see faster revenue growth. During the earnings call, the management discussed that Bajaj Finance is now the second largest Data Cloud customer globally, as they leverage the Einstein 1 platform to build and deliver genAI capabilities across their lending business that runs on Salesforce.

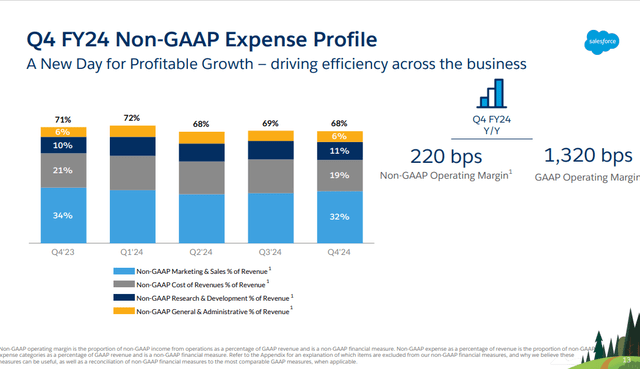

Shifting gears to profitability, Salesforce generated $10.6B in non-GAAP operating income in FY24, which grew 50% YoY with a margin of 30.5%, which is an improvement of 800 basis points YoY. This was driven by a combination of streamlining operating expenses, especially Sales and Marketing as well as driving significant sales price uplifts from existing customers who are upgrading to Einstein 1 edition while attracting new logos who are increasingly purchasing more offerings along with Einstein 1 as they rapidly infuse conversational AI across their product portfolio.

Q4 FY24 Earnings Slides: Improving profitability

Key Updates since the last earnings call

During the last three months since the earnings call, Salesforce hosted their developer conference Trailblazer DX, where they announced the general availability of Einstein 1 Studio, which includes their Copilot Builder, Prompt Builder, and Model Builder, which will allow Salesforce admins and developers to build, customize, and embed AI experiences tailored to their business and customers’ needs. I believe that Einstein Studio can become a game changer for businesses because it makes it easier to interact with AI in the flow of work and build AI models that fit their use cases while having access to trusted data, thus ensuring accurate and relevant outputs.

Simultaneously, the company also expanded its Einstein Copilot capabilities by adding new features for marketers and merchants last week, which will help businesses design marketing activities such as generating campaign briefs, personalized content, and email campaigns while streamlining storefront setup and personalized promotions, which I believe will lead to improved customer experiences leading to higher conversion rates and average order value, as they unlock insights about their customers’ journeys in a single view.

Things to look for in Salesforce’s Q1 earnings

Looking forward, the company expects to generate approximately $9.145B and $37.85B in revenue in Q1 and FY25, which would represent a growth of 11% and 9% YoY, respectively. For the full year FY25, the company expects to further expand its non-GAAP operating margin by 200 basis points to 32.5%. The company is set to report its Q1 FY25 earnings on May 29th, and I believe these are the key metrics and commentary to look for in order to assess the investment thesis of the company.

1. Revenue guidance: While investors will be paying attention to whether Salesforce achieves and/or exceeds its Q1 revenue targets, I believe a higher weight will be placed on the management’s forward guidance, especially given the set of product innovations around Einstein Copilot to enable businesses to take advantage of their data across systems and apps in one single view and build AI applications and experiences to unlock productivity gains, build superior customer relations, and broaden margins. Therefore, in order to assess the underlying customer demand, we need to pay closer attention to the following metrics and commentary within the revenue guidance:

- Current Remaining Performance Obligation “cRPO”: In Q4, the company ended with a cRPO of 12%. Should we see a decline in cRPO, it will indicate that Salesforce is facing weakness in its customer renewal rate relative to the pace of new logo acquisition on the platform, which could be driven by macroeconomic factors. Furthermore, another area of concern that I would like to point out is that Salesforce is not expecting any material contribution from their genAI products in FY25 revenue guidance. While most of the investments in AI are currently taking place at the infrastructure layer, I believe that as enterprises increase their spending on building and deploying genAI applications, we should see an acceleration in Salesforce’s Data Cloud segment coupled with increasing usage of the Einstein 1 platform. Therefore, I will be paying close attention to the management’s commentary on the Data Cloud segment and their success in driving the solution across new deals and existing customers to assess the evolution of the enterprise AI landscape translating into revenue.

- International expansion: As I discussed earlier, although Salesforce generates 67% of their revenue from the Americas, it is a mature market and therefore will likely see revenue normalization over the coming years. I believe that Salesforce has realized it, and therefore it is driving investments outside of the Americas to gain market share. Therefore, the pace of its international expansion is something worth paying attention to in order to assess its growth trajectory in the coming years.

2. Profitability guidance: I am impressed by the management’s focus on expanding its profitability thus far. As the company announced its first-ever dividend and $10B share buyback program, investors will be paying close attention to its Q1 earnings performance as well as looking for further direction on whether the management revises its FY25 non-GAAP operating margin higher to reflect improving unit economics by accelerating the addition of new logos and deepening adoption among its existing customer base. On the other hand, should the company see some degree of revenue weakness, it will certainly put downward pressure on its margins, given the pace of R&D spend to drive its product innovation, which can temporarily hurt investor confidence.

Is Salesforce a buy?

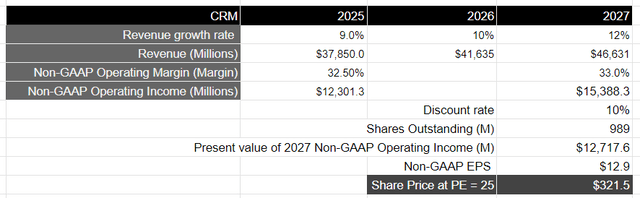

Assuming Salesforce achieves its FY25 revenue target and then grows at a slightly higher growth rate in the low teens over the next two years until FY27, where we see Salesforce benefiting from revenue acceleration at scale with its Data Cloud and Einstein 1 platform, as companies embark on a software buying cycle to build and deploy genAI applications and experiences en masse, it should generate approximately $46.6B in revenue.

In terms of profitability, I believe that Salesforce should be able to maintain its current margin over the coming years as it sees growing ARR by successfully upselling multiple cloud offerings in its new deals while deepening adoption among its existing customer base, thus allowing it to unlock economies of scale. This would translate to a non-GAAP operating income of $15.4B, which is equivalent to a present value of $12.7B when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period with a price-to-earnings ratio of 15–18, I believe that it should trade at approximately 1.5 times the multiple given the growth rate of its earnings. This translates to a PE ratio of 25, or a price target of $321, which represents an upside of 18%.

While the company has consistently exceeded its earnings expectations over the last four quarters with an average beat of 5%, I believe that there are two risks that we need to be cognizant of. The first risk is pertaining to the elevated PE ratio of the S&P 500 at its current levels relative to its 5- and 10-year averages of 19.1 and 17.7, respectively, which could induce a sizable pullback of 10% or more, leading to a downside of at least 13% for Salesforce given its beta value of 1.3. This would mean that, given my assumptions for my price target of $321, I will have a net margin of safety of 5%, which doesn’t look attractive to me. The second risk pertains to my assumption that the company will see a demand uptick from AI spending in the coming years. Should it not materialize or get delayed by a macroeconomic slowdown, the company’s growth prospects will be dampened, and the fading of investor optimism can lead to a significant price correction. While the management commentary in Q1 can provide investors with more clarity, I believe that the risk-reward doesn’t look attractive to initiate a new position in the company. Therefore, I will be staying on the sidelines and waiting for a better entry point, rating it a “hold” at its current levels.

Conclusions

While I am impressed by Salesforce’s product innovation with the Einstein platform and positioning itself to lead the next wave of enterprise spending in AI, coupled with rigorous financial discipline, there are uncertainties as to the timing of its genAI efforts translating into scalable revenue growth. Meanwhile, given the growing likelihood of a 10% (or higher) pullback in the overall index, my margin of safety is squeezed given my price target, and therefore I will be staying on the sidelines and rating the stock a “hold” at its current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.