Summary:

- Q1 2023 showed strong growth with a 12% increase in cRPO and a 13% rise in revenues.

- Q2 2023 guidance projects a 10% growth in cRPO and revenues, slightly below expectations.

- Softening demand in the Financial Services/Technology vertical and Marketing Cloud segment is impacting Salesforce’s performance.

- By applying a ~19X multiple, stock should trade around $225. (Providing investors ~10% upside from current trading price).

Stephen Lam

Revenue narrative and recent performance:

In the first quarter of April, the company exhibited robust growth performance, with a 12% increase in contracted Remaining Performance Obligations (cRPO) and a 13% rise in revenues. Looking at the guidance for Q2 2023, the projected 10% growth in both cRPO and revenues is slightly below the expected benchmark of around 11%. However, this deviation is in line with expectations if we exclude the one-point impact on cRPO due to weaker revenue growth in professional services.

The forecasted 10% growth for cRPO in the second quarter implies a sequential decrease of $450 million. This contrasts with the previous three July quarters, which saw sequential cRPO growth of zero, +$900 million, and +$700 million, respectively. Despite the apparent decline, this projection appears achievable. Salesforce is basing its estimates on the assumption of a similarly challenging demand environment in fiscal year 2024 and is adopting a cautious approach, citing that they are being appropriately conservative in their outlook.

The apparent softening in the tone of demand, which has been observed across several software firms, is particularly notable in the Financial Services/Technology vertical. This trend is particularly evident in the Marketing Cloud segment, where there is pressure on marketing technology budgets and softer sales in Commerce software. The impact of this subdued demand is also evident in the Slack acquisition.

While this situation paints a weak overall picture, it has broader implications, especially for Professional Services and Marketing Technology (Martech). It remains uncertain whether this trend is indicative of industry-wide challenges affecting multiple companies, such as Adobe and Braze, or if it’s more specific to Salesforce’s circumstances.

Margin and AI Perspectives:

The uplift of 100 basis points to FY24 Operating Margins (effectively 60 basis points to GAAP Operating Margins) was an encouraging development, and the prospects for margin improvement still hold promise. However, there are two important considerations to keep in mind.

- Firstly, the incorporation of AI investments and usage comes with associated costs. Salesforce has indicated that while pursuing AI initiatives, it will give lower priority to other Research and Development projects. This strategic adjustment aims to safeguard the overall margin narrative.

- Secondly, the forthcoming actions to reduce costs will be implemented over a more gradual and multi-year timeline. In fairness to Salesforce, this approach has been communicated beforehand. The specifics regarding the monetization of AI will be disclosed in detail soon.

What to watch/expect in Q2 Earnings:

Salesforce’s guidance points to a growth rate of 10% in USD and 10% on a constant currency (c/c) basis for contracted Remaining Performance Obligations (cRPO), with an adjusted 11% when excluding the 1-point Pro Services impact on cRPO growth. This guidance implies a sequential decline of -$450 million (or -$235 million excluding the 1-point headwind) compared to the past two quarters, which reported flat and +$900 million in sequential dollar growth.

When considering the organic cRPO growth from the previous two quarters (+$890 million and +$315 million), it appears that the 2Q guidance is taking a conservative stance. Even if the upcoming Q2 2023 reports a c/c cRPO growth that beats expectations, it would still result in negative sequential dollar growth.

Moreover, the macroeconomic conditions, although challenging, seem consistent with both Salesforce’s guidance and our previous findings. Investors are well-aware of the persistently challenging macroeconomic environment. Given this awareness, it’s probable that the market’s anticipation leans toward a slight outperformance for Q2 2023 cRPO growth, possibly ranging between 10.5% and 11%.

Valuations:

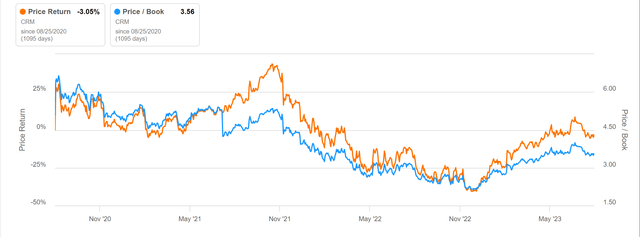

With the post-market valuation, Salesforce’s shares are trading at approximately 26.5X and 17X of respective FY24 and FY25 estimated Free Cash Flow (FCF). While Q1 2023 performance wasn’t entirely seamless and the growth projections appear mixed, I believe there’s significant potential for the margin shift to materialize, thereby constraining the downside risk for the stock in the short term.

I am using a conservative multiple of 19X for valuation purposes. This is relatively lower compared to the historical trading range of the stock over the past 5 years, where the median P/E (Price-to-Earnings) ratio has been around 22X. Despite being on the lower end of historical valuations, I believe this lower multiple is justified due to anticipation that the market will begin compressing the multiple. This expectation is based on the substantial increase in earnings I foresee in the upcoming quarters.

By applying a ~19X multiple, the stock should trade around $225. (Providing investors ~10% upside from current trading price)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.