Summary:

- Salesforce’s revenue growth is slowing due to increasing competition, particularly from AI-driven sales tools, which pressures margins and market share.

- Despite a 35% rise in stock price since my last publication, Salesforce’s premium P/E ratio is unjustified given the deceleration in growth and negative earnings revisions.

- I believe CEO Marc Benioff’s optimism about AI agents is misplaced; the AI sales-tech space is becoming commoditized, further threatening Salesforce’s market position.

- I am still a strong sell rating on Salesforce, as the company faces significant challenges in sustaining its competitive edge and justifying its valuation.

JasonDoiy

Co-Authored by Noah Cox and Brock Heilig

Investment Thesis

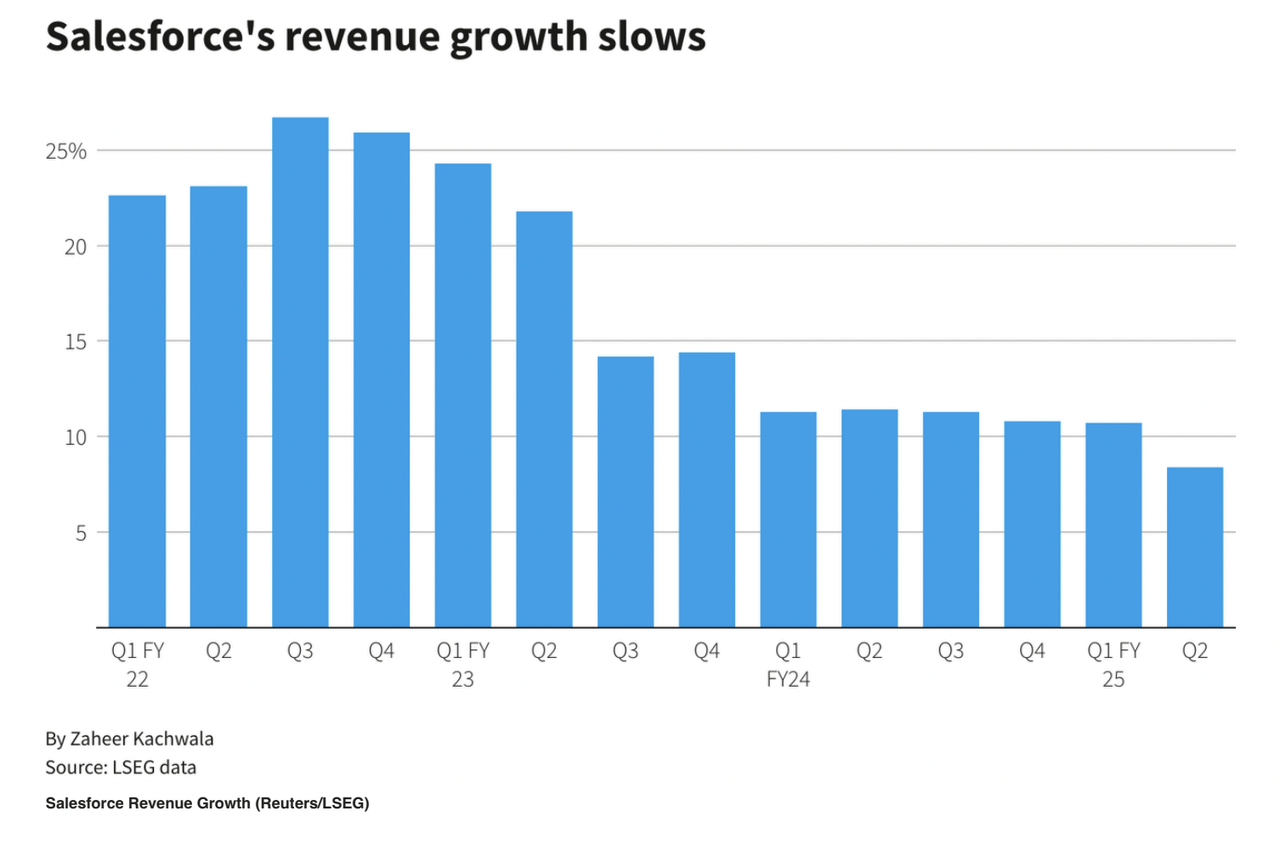

While Salesforce (NYSE:CRM) shares are up roughly 34.61% since the last time I wrote on the software maker, I continue to be bearish on the technology giant on the back of increasing sales software competition. While shares have responded well to what I believe was a lukewarm quarter, there is now clear evidence that revenue growth is continuing to slow.

Salesforce’s quarter continued to show slower year-over-year growth, which I find to be concerning. The company trades at a premium P/E multiple for revenue growth that is now in the single digits (and slowing)

I emphasized this before in my last piece of research, but the big problem with companies like Salesforce is the fact that innovation in the sales-tech space is accelerating, and the company needs to adapt in order to stay relevant. I believe the quarter offered evidence that the firm will need to make changes to their flagship CRM product in order to compete with AI upstarts.

With this, I continue to be a strong sell on the stock.

Why I’m Doing Follow Up Coverage

When I last covered Salesforce in September, my bearish thesis was really based on their increasing competition, leading to slowing growth.

While slowing top line growth was a theme of this quarter, this wasn’t the first time revenue decelerated. Revenue growth started to decelerate after a multi-quarter plateau in FY Q2 (this plateau had been in place since Q1 FY 24).

For reference, the company was pushing more than 25% YoY growth in Q3 and Q4 of FY 2022. Now, Salesforce is struggling to stay above 10% YoY growth.

In my opinion, a big reason why revenue growth has stalled over the last few quarters is because of the rise of AI. When ChatGPT launched in November 2022, it created a new avenue for competitors that have risen up and begun to take away market share from Salesforce. I’ve talked about this before, but competitors are starting to reimagine AI in the world of CRMs with AI SDR (sales development reps). One company is Artisan.

While Salesforce did release Einstein, its AI-driven platform, I think Salesforce is building a hopeful solution for the wrong competitor.

The company is still trying to make Business Development Representatives ((BDRs)) and Sales Development Reps ((SDRs)) more efficient, while other companies in competition are automating these roles.

The purpose of this follow up coverage is to show that a lot of the concerns that I had about Salesforce a few months ago are still valid today. In fact, I think operating data shows that these concerns may be materializing.

Growth Is Still Slowing

On Tuesday after the bell, Salesforce announced its Q3 earnings.

Salesforces’ Q3 Non-GAAP EPS came in at $2.41, which missed projections by $0.04/share.

Revenue was slightly more impressive for Salesforce. The company posted total Q3 revenues of $9.44 billion, which outperformed expectations by $90 million.

Early projections from management estimate that Salesforce will pull in roughly $9.9 billion to $10.1 billion in sales in FY Q4. If these expectations hold, this would represent just 7% to 9% revenue growth year-over-year.

Keep again in mind the powerful growth the company had just a couple years ago. While revenues are certainly higher than they were in FY 22, the sharp deceleration in growth tells me there is more to the story than just scale.

While Salesforce Chair, Chief Executive Officer and Co-Founder Marc Benioff is confident that the company can avoid the growing competition concerns, I think we have to closely scrutinize his wording to understand what competition he is paying attention to.

I just want to compare and contrast that against other companies who say they are doing enterprise AI. You can look at even Microsoft. We all know about Copilot. It’s been out, it’s been touted now for a couple of years. We’ve heard about Copilot. We’ve seen the demos. In many ways, it’s just repackaged ChatGPT that you can really see the difference where Salesforce now can operate its company on our platform -Q3 Call.

While Benioff seems optimistic I’m still bearish. I think his commentary is focusing on the wrong competitors. There are a lot of new AI sales tools that have popped up over the last 12 months.

Like I mentioned before, tools like Artisan AI and Jasper, which, through the power of new AI models, are both able to produce large amounts of personalized AI content for leads, which is key for sales and marketing. Both of these companies are in direct competition with Salesforce, and with more companies popping up as AI becomes more capable I don’t see how competition doesn’t increase from here. Most often, when competition goes up in a space, profits go down.

Salesforce spent $1.356 billion on R&D just in Q3 alone. This is up from $1.204 billion in the same quarter last year. At this rate, R&D is growing at 12.62% YoY. Revenue is only growing 8.3% YoY as of Q3 (according to the 10Q). R&D this quarter was 14.36% of revenue. For competitors like Microsoft (MSFT), R&D was $7.544 billion in the most recent fiscal quarter.

Salesforces’ R&D spend is up over 50% since 2020 when it came in at just $902 million for FY Q3 that year.

With all of Salesforce’s R&D spend, Wall Street is asking questions as well. Analysts this week post-earnings have began to question when these investments will convert into faster growth. My fear is that they won’t.

More specifically, the quantity of the competitors that are competing against Salesforce has me concerned for Salesforce’s ability to maintain a core position in the market over the long run.

Valuation

While competition is increasing and growth is slowing, Salesforce continues to trade at a premium price-to-earnings ratio, even though revenue growth is clearly slowing (and personally I don’t see a reasonable path for it to meaningfully accelerate from here).

There is a notable drop off in revenue growth over the last 12 to 18 months. Guidance implies this will continue going forward.

Salesforce’s forward non-GAAP P/E of 36.64 is currently at a 38.84% premium to the sector median of 26.39. Seeking Alpha grades this as a C-. I really believe shares are at too much of a premium to the sector median.

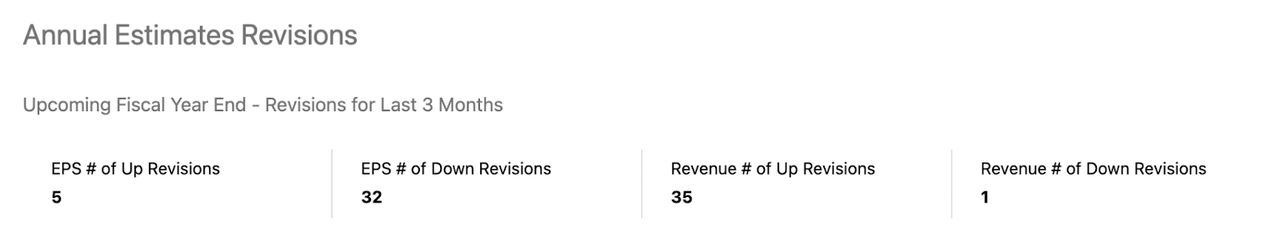

For a company whose revenue growth is slowing down, they should not be trading at this much of a premium to the sector median. Let’s keep in mind that earnings revisions have been overwhelmingly negative over the last 3 months.

Earnings Revisions (Seeking Alpha)

With this, I think shares should trade at the sector median forward P/E. If we saw shares converge down to this forward P/E of 26.39, this would represent 29.98% downside for the stock.

Bull Thesis

To be clear, while I am concerned about their slowing growth, Salesforce is still the market leader in the CRM space with 21.7% market share according to IDC earlier this year. This is 3 times higher than the runner up (Microsoft) at 5.9% CRM market share.

The biggest bull thesis that I see here is that the company knows they face competitive risks (and is trying to counter it). Executives from Salesforce talked about their excitement for their new suite of AI agents on the earnings call. They believe these agents can help them to accelerate growth.

…Salesforce has become right out of the gate here, the largest supplier of digital labor and this is just the beginning and it’s all powered by these autonomous AI agents. All of you know that. This is fundamentally reshaping how businesses operate. It’s fundamentally reshaping how we operate our business and how we think about the industry itself and how you’re thinking about the industry, how we’re thinking about Salesforce

And with Salesforce, Agentforce, we’re not just imagining this future, we’re already delivering it. And you still know that in the last week of the quarter, Agentforce went into production. We delivered 200 deals and our pipeline is incredible for future transactions. We can talk about that with you on the call, but we’ve never seen anything like it. We don’t know how to characterize it -Benioff Q3 Call.

While Benioff is optimistic about the future here for Salesforce, I think the issue is that the software firm is focused on building agents that will have little (or no moat). So while the company is innovating, I think the fundamental rules of software are changing. Software is increasingly becoming commoditized. Salesforce risks falling for this same trend. I did not see a lot of evidence on the earnings call or in the earnings report to indicate otherwise.

Takeaway

While Salesforce shares are up almost 35% since I last wrote on the tech company in September, I still think there are too many obstacles at this point for the firm to justify its premium valuation. I think this is a classic case where the firm’s stock has gotten ahead of the underlying performance.

While Co-Founder and CEO Marc Benioff seems confident that Salesforce is headed in the right direction, I tend to disagree with his assessments on who their real competitors are (based on what he is voicing). I also disagree with their push into AI agents, as I believe this will soon be a commoditized space as well.

In essence, I still think there are far too many competitors in the AI sales-tech space, with each competitor looking to establish themselves as the go-to AI sales tool. More competitors means more competition. More competition means prices tend to come down to compete in a fiercely competitive market. I think this is a big part of the slowing revenue growth story. User satisfaction for Salesforce tools is low as is. New options/alternatives will not help

With Q3 in mind (and a lot of the same concerning trends continuing), I continue to be a strong sell on Salesforce.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.