Summary:

- Salesforce stock has been moving sideways since June, struggling to break above the $240 level. However, investors must be patient as buyers accumulate.

- The company is focusing on monetizing its AI initiatives implementing fixed-base and consumption-based pricing models. It’s still early in its monetization approach.

- Salesforce’s approach to trust as a core tenet in AI is critical for maintaining its reputation and fending off competition. Investors must give due credence to its moat.

- I explain why CRM investors looking to add more positions should capitalize on its current consolidation zone before it takes off toward higher levels.

Stephen Lam

Salesforce, Inc. (NYSE:CRM) investors who anticipated a further breakthrough in its upward momentum over the past three months are likely disappointed. CRM has been moving sideways since forming its early June lows before surging toward its July 2023 highs at the $240 level.

That level has proved challenging to crack, as a robust fiscal second-quarter of FQ2 earnings release at the end of August wasn’t enough to drive further sustained upside. I last updated investors at the end of June, encouraging CRM holders to add more exposure.

I have confidence that the thesis remains intact, seeing the recent sideways movement as a consolidation zone, allowing buyers to accumulate after a surging run in the first half of 2023. Such zones could tire impatient investors, particularly momentum investors worried about CRM’s stiff resistance zone at the $240 level.

However, I urge investors to consider Salesforce’s wide moat business model as a critical underpinning on its nascent AI initiatives as the company looks to cash in on monetization. Management updated in an early September conference, stressing that Salesforce would likely implement fixed-base and consumption-based pricing models to deliver its AI products. Given the compute-intensive nature of generative AI models, I believe the approach makes sense.

Notwithstanding the lack of near-term monetization, Salesforce is astutely leveraging its multi-cloud approach while ensuring that customers can deploy their models or use Salesforce’s models. Also, Salesforce highlighted one of the core tenets of the company’s AI infrastructure is focusing on trust. Enterprise users want to ensure the data can be “trusted.” As such, market leaders like Salesforce have significant reputational risks to uphold as they build the backbone ensuring data privacy and governance for their customers.

This is one of the most critical aspects of generative AI that investors must assess carefully when considering whether other smaller AI competitors could snatch significant share from SaaS behemoths like Salesforce. Companies would likely be wary about deploying AI models they couldn’t trust as they review the offerings from various SaaS companies. While it’s still early as the competitive landscape evolves, I’m confident that Salesforce’s approach with trust as a core tenet is right.

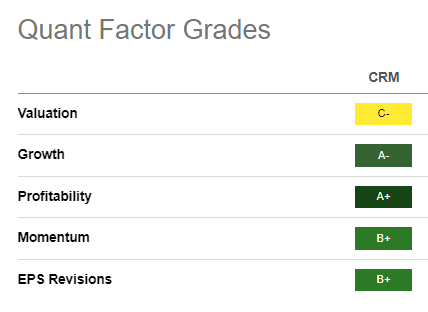

CRM Quant Grades (Seeking Alpha)

CRM isn’t aggressively priced (“C-” for valuation), given its “A-” growth grade as assigned by Seeking Alpha Quant. With a best-in-class “A+” profitability grade, I believe growth investors are still early in capitalizing on a “growth at a reasonable price” or GARP proposition.

Its solid momentum and earnings revisions grade corroborate the market’s confidence in management’s execution.

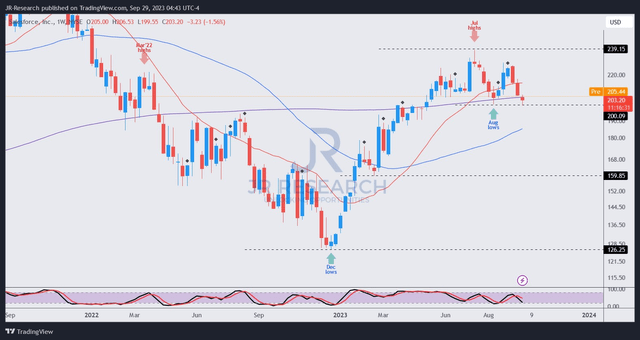

CRM price chart (weekly) (TradingView)

With CRM consolidating at the $200 level, buying sentiments have remained robust. The recent pullback hasn’t led to a steeper decline in CRM, suggesting the current support zone should be firmly defended. As such, momentum investors could return with conviction following the accumulation phase, potentially starting the next surging run as CRM looks to close the distance toward its all-time highs ($312 level).

However, investors shouldn’t rule out the possibility of CRM falling between the $160 to $200 zone if the broad market selloff intensifies. That should proffer investors a more attractive risk/reward upside, allowing more aggressive opportunities to add further.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!