Summary:

- We called ‘Buy’ on Salesforce in November last year, triggered by a simple catalyst – the reassumption of full managerial control by Marc Benioff.

- Benioff has form for this – when times are tough, recruit a co-CEO; when times are looking up, have them spend more time with their family.

- We believe good times remain ahead for tech in general and Salesforce itself, but with the stock up more than 50% in only seven months, we’re calling Sell.

- This closes out our Buy idea from November. It doesn’t mean we think the stock is going to dump from here. But free money is free money, never any harm in banking it.

Benioff Declares The Win DNY59

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

It Would Be Rude Not To

Back in Q3-Q4 last year in our ‘Growth Investor Pro’ subscription service here on Seeking Alpha, we called ‘Accumulate’ on growth stock after growth stock. We published some of these ideas on the main site, too.

For the most part our drive to buy was because we saw the same pattern in all these stocks – high volumes of stock traded, price kept in a sideways channel within a key Fibonacci retracement level – which reeked of market bigs buying whilst normal folk sold in fear of the Great Recession being promulgated all over the internet.

This buying opportunity turned out to be golden. Not all those buys have mooned – some remain in accumulation mode – but plenty of them have. We wrote up MongoDB recently, a great example of these trade wins. Our ‘Distribute’ call on Palo Alto Networks was another.

Our November 2022 ‘Buy’ idea on Salesforce (NYSE:CRM) featured the same chart logic, but the specific catalyst was different, being that the founder Marc Benioff had for the second time had a change of heart on sharing the big chair with a colleague. Out went the co-CEO and back came the white cat.

November 2022 Salesforce Article (Seeking Alpha, Cestrian Capital Research, Inc. )

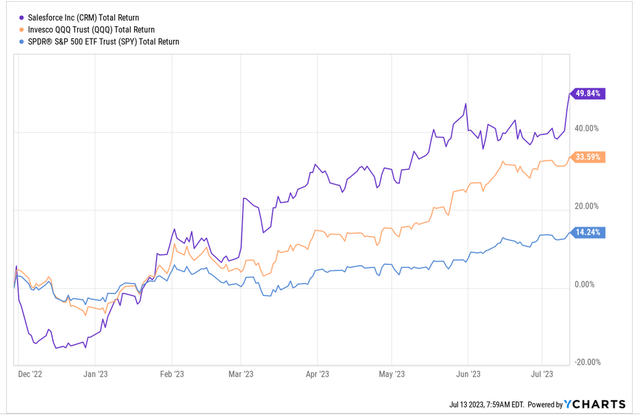

Since November as you know, the Nasdaq in particular has reached for the skies. Up around 34% on a total return basis vs. the S&P up around 14%, using the ETF proxies of QQQ and SPY respectively. Salesforce has outgunned both indices comfortably, delivering approximately 50% in the same period.

CRM vs. SPY vs. QQQ Total Return (YCharts.com)

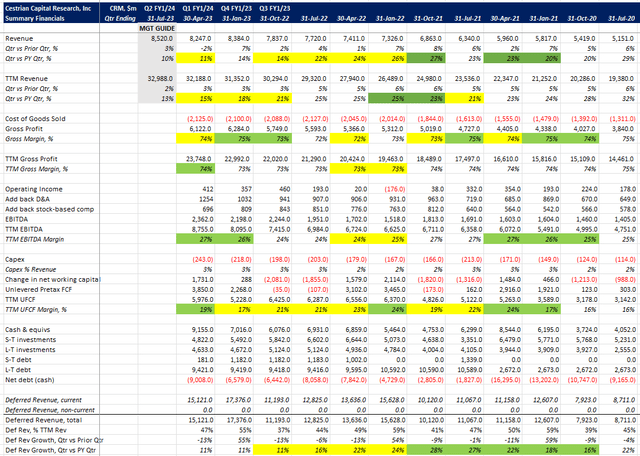

The company continues to do well, and we believe has a bright future too. If you are looking out over a 12-18 month timeframe there is every reason it can continue to chalk up gains. Here’s the fundamentals.

CRM Fundamentals (Company SEC filings, YCharts.com, Cestrian Analysis)

Growth has slowed some since November but as the economy continues to hold up that may yet accelerate once more. Cashflow margins looked to have troughed in the January quarter with a step back up in April. The balance sheet, with $9bn net cash, is a tour de force.

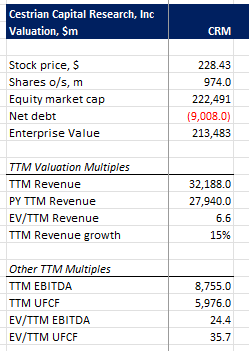

Valuation?

CRM Valuation Multiples (Company SEC filings, YCharts.com, Cestrian Analysis)

Unremarkable. Neither expensive nor cheap vs. the revenue growth and cashflow margins, in our view.

So if you want to hold for the next leg up in the markets, you can certainly justify doing so.

But if you bought at the November lows, you may prefer to cash in the free money now. We look forward, of course, to the chorus of comments about why selling is dumb, folks should just buy and hold forever the way your asset manager wants you to, and blah. What your asset manager won’t tell you, however, is the power of IRR, meaning, if you can churn money quickly and find other compelling places to put it to churn it quickly there too? Then the moral high ground of buying stock in your teens and selling it as a nonagenarian may lose some appeal. Right now, had you bought CRM at the close on 30 November at $146, and sold it at the close yesterday, 12 July, at $227, you would have achieved a share price gain of 55%, and an IRR of 105% (which is to say you achieved a little more than 50% gain in a little more than 6 months, so, an ‘annualized’ way of looking at this – which is what IRR gives you – is that you made the equivalent of around double your money in a notional year).

Ah, you may say. But where can I put the money now that is offering that kind of return in that kind of time? This is an excellent question of course. But if you apply that same methodology, looking for where Big Money is placing their accumulator bets right now, there are plenty of stocks up and down the S&P500 and the Dow Jones that have yet to enjoy the fruits of 2023’s rally. Just look for that trademark accumulation pattern, and when you see it? Get to work and figure out if it can be a runner.

So – we rate Salesforce at Sell for the purposes of closing out that November buy.

Cestrian Capital Research, Inc – 13 July 2023.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives.

Business relationship disclosure: See disclaimer text at the top of this article.

Cestrian Capital Research, Inc staff personal accounts hold long positions in CRM.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

GET INSTITUTIONAL GRADE BUYSIDE RESEARCH FROM CESTRIAN CAPITAL RESEARCH

We provide investment research prepared to institutional investor quality, presented in a way anyone can understand. Our work allows you to make sense of company fundamentals and stock technicals without resort to jargon or esoterica. We provide actionable ideas and disclose all staff personal account positions in covered stocks. Superb investor community works together 24/7 to achieve better outcomes. Join us! Click HERE for more.