Summary:

- Salesforce’s Einstein AI technology enhances the Customer Success Platform, offering personalization, better decision-making, and higher efficiency.

- The global AI in retail market is expected to have a high CAGR over the next decade, contributing to CRM’s revenue growth.

- Salesforce’s strong balance sheet and internal efficiencies make it well-positioned for long-term growth, but valuation risk is a concern.

- Primarily due to the significant opportunity in the fast-growing AI market, my analyst rating for CRM stock is a Buy.

SOPA Images/LightRocket via Getty Images

Salesforce (NYSE:CRM) is one of the most compelling investments to make for exposure to AI at this time, particularly for retail applications. It is tempting to totally ignore the valuation risk based on the exceptional results so far and the expected high market growth in the future. However, we must be aware of market risks, as over-allocating to CRM could prove costly.

Einstein AI

Salesforce’s Einstein AI is its comprehensive artificial intelligence technology, which enhances the Salesforce Customer Success Platform. It enables companies to utilize AI for personalization for customers, better decision-making, and higher efficiency. It utilizes machine and deep learning, predictive analytics, and natural language processing for response automation, outcome prediction, and insight provision across its Sales, Service, and Marketing Clouds, among others.

The technology’s abilities include predictive scoring by analyzing historical data to prioritize leads and opportunities based on the probability of conversion or closure. This maximizes efficiency within a workforce. It can also make recommendations for sales reps, service agents, and marketers about the most effective action to take. Also, data entry is automated into the CRM system, and Einstein AI can provide insights from data analysis; this is vital in identifying trends for opportunities and risk protection. Einstein Voice allows users to update Salesforce records and use the platform with speech commands; this uses natural language processing, and it is also used in the analysis of text from emails, chats, and web pages to gauge sentiment, intent, and other implications. Einstein Vision integrates deep learning models to identify and classify images, allowing for visual search, brand detection, and product identification.

2024 updates include Salesforce introducing Einstein Copilot, which is a conversational AI assistant built into each Salesforce application, driving efficiency through improved workflow. It has also added a Data Cloud Vector Database and Einstein Copilot Search, grounding generative AI prompts in enterprise data. Additionally, it is connecting Salesforce data with the full power of large language models (LLMs) for customizable outputs; this is crucial in leveraging generative AI technology for data security and compliance specific to organizations.

Market Outlook & Financial Considerations

Grand View Research reports the global AI in retail market was valued at USD 5.79 billion in 2021, and its expected CAGR from 2022 to 2030 is expected to exceed 23.9%. This is primarily driven by growing internet users, smart devices, and higher autonomics in retail generally.

Alternatively, Fortune Business Insights reports a retail AI market of USD 5.5 billion in 2022 and projects a CAGR of 34.1% from 2023-2030. North America was the global market leader, with a share of 40% in 2022.

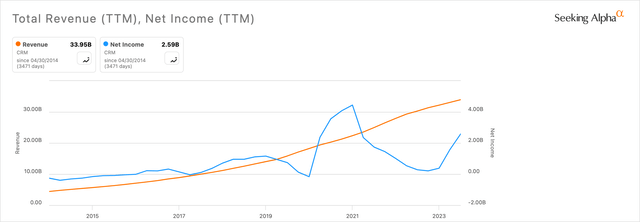

Such a high-growth market should contribute significantly to CRM’s revenue growth. Of course, its growth prospects are one of the leading reasons investors are drawn to the stock at this time.

Additionally, the benefits of Einstein AI’s technologies utilized at Salesforce will also improve its own internal efficiencies. By helping its employees automate routine tasks and through AI-driven insights, Einstein AI’s technologies will likely be assisting employees with workflows, opening doors for human work to be focused on strategy and oversight rather than repetitional responsibilities.

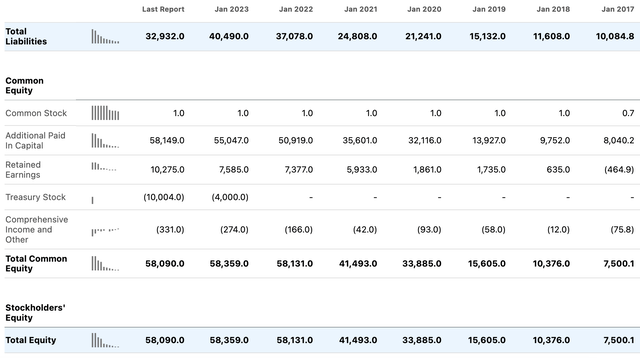

Salesforce also notably has a very strong balance sheet, which provides it with the ability to continue financing advancements in automation both to serve its internal workforce and to sell to clients. These upgrades are critical reasons why long-term growth is expected to continue for CRM, as we are obviously only at the beginning of understanding the full capabilities of artificial intelligence.

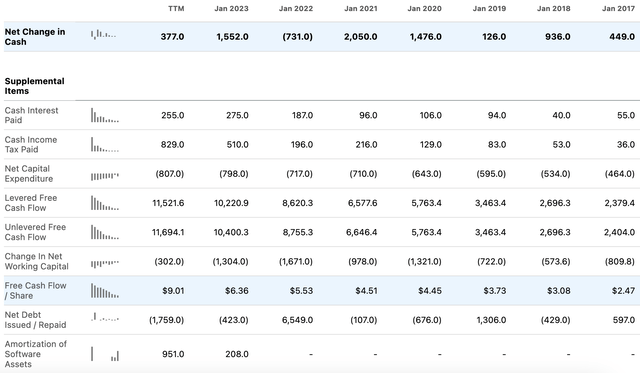

The company also has high free cash flow per share and net changes in cash recently:

Valuation Risk

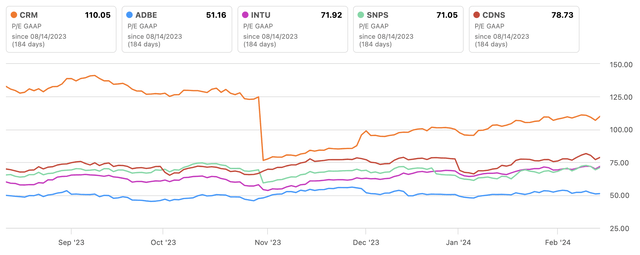

CRM’s largest risk is undoubtedly its valuation. Its TTM P/E GAAP ratio is 109.35 at the time of this writing, 284.84% higher than the sector median of 28.41. Its forward P/E GAAP ratio is 71.67, 157.44% higher than the sector median of 27.84. Notably, its TTM PEG GAAP ratio is 0.13, 88.89% lower than the sector median of 1.16; this shows the significant growth CRM is experiencing, which is generally expected to continue.

Relative to its major industry peers, CRM is significantly higher valued based on P/E GAAP ratios, making it clear that the valuation risk at this time is real and something investors should account for when deciding on how much to allocate to the company:

Based on free cash flow growth of 21.89% over the last five years as an annual average, I have projected a 20% free cash flow average annual growth rate for CRM over the next decade for my discounted cash flow analysis. I also considered a 4% terminal stage growth rate and an 11% discount rate. My outcome supposes a fair value of around $279.38 at the time of this writing, a -0.74% margin of safety on a $281.45 stock price.

Market Risk

The significantly high valuation for Salesforce at the moment could easily become a problem if the artificial intelligence market proves to gain less long-term traction than currently expected. While the market is presently pricing in high future value on autonomics based on expected increases in efficiencies, we also have to be aware that cultural shifts, economic recessions, and geopolitical uncertainties can affect the trajectory of technological evolution. As such, a heavy weighting to CRM and AI stocks in general may be unwise, in my opinion.

Activist Investors Update

In 2023, Salesforce faced considerable risks from a range of activist investors, including Starboard Value and Elliot Management. The main advocacy of these groups was for operational efficiencies and strategy shifts to contribute to higher profitability.

Discussions between Salesforce and Elliot Management were ongoing, indicating cooperation between parties. As one of the most attractive companies on the planet involved in AI, this level of pressure and interest is understandable and to be expected to some degree.

By the end of June 2023, Salesforce’s results came in better than expected, some of the activist investors cut their CRM stakes or exited completely. Starboard Value, for example, cut its stake by 20%. Inclusive Capital Management exited even earlier. CRM stock grew in price significantly in 2023, particularly during the first quarter when the activists were insisting on changes that the company then delivered. At this time, the situation seems to have eased and is much less of a risk, if at all.

Q4 Earnings Expectations

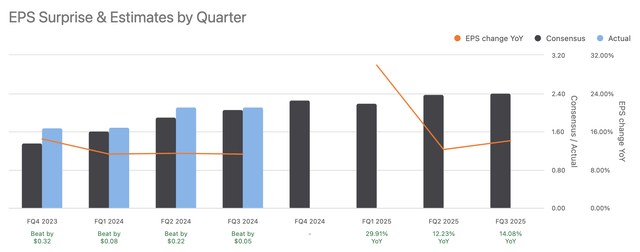

Salesforce will be releasing its next earnings results on the 28th of February, 2024. The consensus normalized EPS estimate of $2.26 is a significant improvement on last year’s $1.68:

Q4 revenue guidance was $9.18 billion to $9.23 billion in CRM’s Q3 results, up 10% YoY. It has narrowed its full-year revenue guidance to $34.75 billion to $34.8 billion, up 11% YoY. Full-year operating cash flow growth guidance is 30% to 33% YoY.

Conclusion

CRM is undoubtedly one of the best stocks to own in the world right now for exposure to AI, and arguably the best if we are looking for investment in retail AI applications. However, the valuation risk is a significant concern, and due to some low-probability risk in AI market dynamics, my analyst rating for CRM stock is a Buy rather than a Strong Buy as indicated by SA’s Quant.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CRM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.