Summary:

- Salesforce is encountering some issues recently and this has contributed to the stock losing roughly half of its value in the previous year.

- Bret Taylor, the co-CEO of Salesforce, and Stewart Butterfield, the CEO of Slack, both announced their resignations about a month ago.

- One component of technology that Salesforce is expecting will boost sales is artificial intelligence.

- Salesforce has a wide window for expansion as the global adoption of the remote work trend is still in its infancy.

- I rate the stock as a HOLD.

Stephen Lam

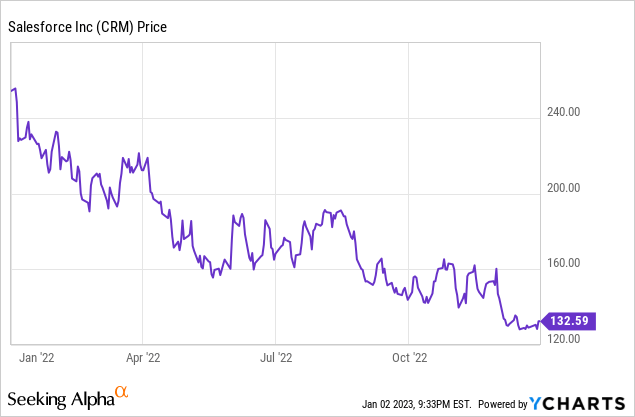

Investment Thesis

Salesforce (NYSE:CRM) is an American cloud-based firm that delivers subscription-based software. Its software simplifies the organization and management of sales operations and customer connections for organizations. The business has also expanded into marketing, e-commerce, and data analytics. There are a lot of CRM and project management software applications, but Salesforce is likely the most well-known. Founded in 1999 by entrepreneurs Marc Benioff and Parker Harris, Salesforce soon surged in popularity thanks to its creative, user-friendly features. However, the company is encountering some issues recently and this has contributed to the stock losing roughly half of its value in the previous year with a substantial amount of it being after the company released its Q3 FY23 results.

Almost a month has gone by since the previous earnings release for Salesforce and shares have dropped about 12% in that time frame. This fall in the stock price has prompted many investors to question if the recent downward trend will continue leading up to Salesforce’s next earnings report, or if the company is about to see a breakout.

Financials

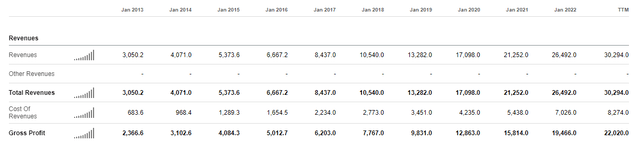

In recent years, Salesforce has experienced consistent revenue growth. Unfortunately, the company’s finances have slowed significantly in 2022. The company’s revenue hit about $26.5 billion in 2021, a 25% rise from the previous year. However, the corporation has increased its revenue by over 14% this year, bringing it to $30.3 billion. Even though 14% is a respectable growth rate, it is significantly lower than the 25% to 35% that the company’s shareholders are used to.

The earnings situation is even worse. Salesforce has lost over half of its earnings from the previous year, resulting in a net margin of less than 1%, or less than $300 million. Much of the company’s revenue went into interest expenses, resulting in a decline in net income and stock price. However, the company’s exceptionally high gross margin of more than 72 % leaves a significant amount of room for profit improvement. This is likely one of the factors that analysts consider when estimating a 15%-25% yearly increase in EPS for the next five years.

Layoffs And Resignations

Because of the current macroeconomic climate, businesses are scrutinizing their budgets and reducing investments, and Salesforce is no different. Deals might remain in Salesforce’s pipeline for a longer period of time as a result of this climate, increasing the pressure to make new sales and retain current clients. Deals could take longer to close, which causes billings to be unpaid for longer than in previous cycles, lowering cash flow and operating capital. Naturally, Salesforce has now turned to layoffs. Although it would not provide an exact figure, the corporation let go of hundreds of employees two months ago and claimed that the total was fewer than a thousand.

However, managing layoffs is not the only difficulty the business is facing. Some high-level executives resigned on their own, which likely worries some of the company’s stockholders even more.

salesforce.com

Bret Taylor, the co-CEO of Salesforce, and Stewart Butterfield, the CEO of Slack, both announced their resignations a month ago, and the stock fell to a 52-week low after the company’s earnings report. While this might seem worrying, it’s not unusual for executives of acquired businesses to leave after a mutually agreed-upon exit date. It’s not altogether shocking to see Butterfield leaving given that the Slack deal was made about two years ago.

On the other hand, it’s a little confusing why Taylor left. Taylor has a track record of co-founding businesses and making a profit through acquisitions. Benioff claimed that Taylor departed Salesforce to create a new business. When Taylor was questioned about leaving, he replied:

After a lot of reflection, I’ve decided to return to my entrepreneurial roots. Salesforce has never been more relevant to customers, and with its best-in-class management team and the company executing on all cylinders, now is the right time for me to step away.

Taylor was the former chairman of the board at the social networking business Twitter in addition to his duties at Salesforce, it should be mentioned and it’s been a turbulent year for Twitter and its leadership. In the end, while Taylor’s departure is a setback for Salesforce, investors should also remember that Benioff effectively ran the company for approximately 15 years, demonstrating not just his managerial skills but also his business acumen. As a matter of fact, he has already found the next “engine” that will drive growth to the company.

Salesforce’s AI Platform

salesforce.com

One component of technology that Salesforce is expecting will boost sales is artificial intelligence. The cloud-based “Einstein” artificial intelligence software platform was introduced by the creator of business software in September 2016. The initial Einstein AI software tools supported salespeople in making predictions regarding which deals were most likely to close based on historical data relating to leads and accounts.

In addition, over the course of the past three years, Salesforce has introduced AI approaches into other enterprise software packages, with a particular emphasis on industries such as the financial services sector that are undergoing digital transformation. Einstein AI mostly functions through the utilization of chatbots.

On its first-quarter earnings call, Salesforce stated that its customers were making more than 164 billion Einstein predictions every day, which is an increase over the 100 billion forecasts that were produced a year earlier. However, Salesforce has not yet published any financial data that indicates the amount of money that is brought in by the Einstein AI platform.

AI And Tableau

salesforce.com

Salesforce agreed in 2019 to acquire data analytics firm Tableau for $15.7 billion in an all-stock deal. Tableau is a company that provides software for the visualization of data. In addition to this, it enables users to generate databases, graphs, and maps utilizing time series analytics, which is a way of examining a collection of data points that are sorted chronologically.

Salesforce now expects Tableau’s business intelligence software and the Einstein artificial intelligence products to work in concert. Additionally, Salesforce also announced that it would rebrand Einstein Analytics as Tableau CRM.

The Future Is Promising

The digital transformation movement, which surged in early 2020, helped all cloud-based businesses, and Salesforce took advantage of this chance with its subscription-based business model and proprietary apps.

Revenue growth has slowed down this year after two years of exceptional performance, which has caused investors to penalize the company. As mentioned before, this slowdown has been caused by macroeconomic headwinds as companies of every size are cutting back on spending and postponing large software deals. Currency headwinds have also been caused by the strengthening dollar, which has been supported by increased interest rates and analysts predict that revenue will increase by only 9% in the fourth quarter due to these macro factors.

Despite these reservations, Salesforce has a wide window for expansion as the global adoption of the remote work trend is still in its infancy and Salesforce’s addressable market (TAM) will grow in the upcoming years as businesses from highly regulated industries move to the cloud.

salesforce.com

In a leading enterprise cloud marketplace that offers ready-to-install apps, solutions, and consultants to help businesses save money, improve efficiency, and drive customer success on commerce cloud, Salesforce announced that it will add more than 250 commerce partner apps to AppExchange. This move might also contribute to the expansion of the business in the future.

Valuation

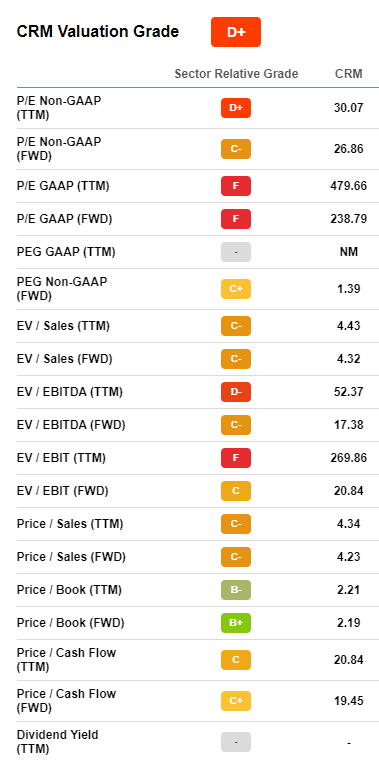

Seeking Alpha

Salesforce received a D+ in Seeking Alpha’s valuation model, as can be seen above. Apart from the P/B ratio, the company scored poorly on nearly all metrics, and the majority of them indicate that the company is overvalued even in comparison to its rivals. However, there are a few reasons why the business might be deserving of this premium:

Moat

In the field of customer relationship management, Salesforce is a pioneer. The company’s network impact and strong brand have supported the construction of its moat. Due to its high switching expenses, it has a high client retention rate and because of its size, it has access to a variety of services. Yet, the highly competitive nature of the CRM sector poses a danger to Salesforce’s moat. However, investors should take encouragement from the high pricing on the company’s long-term contracts. Additionally, Salesforce was a pioneer in the CRM space, and its impeccable timing allowed it to establish a lead. With a 24% market share, Salesforce continues to be the industry leader in CRM.

Future Prospects

Analysts predict that Salesforce’s revenue will increase by double digits for at least the next eight years in addition to expanding at a respectable rate over the past several years. By 2028, analysts predict that the company’s EPS will be 12.56. With a P/E ratio of 20, you get to a future price of around $251. This suggests an ROI of almost 13% annually for the next five years.

It is therefore clear that even if the stock is now trading at a premium, the company’s moat and projected earnings could more than make up for it, bringing the stock closer to a fair valuation.

Conclusion

Overall, Salesforce has shown great financial performance and has been able to take advantage of the rising demand for cloud computing services and CRM software throughout time. Although the business will face risks and difficulties, its history of innovation and adaptation implies that it is well-positioned for future success. The difficulties the tech industry is facing, however, make it doubtful that the negativity toward Salesforce will improve anytime soon. In the long run, though, Salesforce is well-positioned to provide strong earnings growth. Having said that, I believe the company’s stock is properly valued because the potential for a promising future has already been factored in. Therefore, I rate the stock as a HOLD but I will keep an eye on it and probably start a position if it falls in the $100-$110 range.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.