Summary:

- Salesforce is focusing on profitability and has shown more discipline in its corporate strategy.

- The company’s valuation is attractive, with aggressive margin growth justifying a low-20s P/E multiple.

- Growth in each of the company’s core cloud verticals is sustaining above double digits, showcasing the strength of its sales engine.

- The variety of Salesforce’s offerings, from CRM to e-commerce to Slack and Tableau, gives it a wealth of cross-selling opportunities.

Stephen Lam

It has been a rocky earnings season so far. Investors have demanded nothing short of perfection to justify sky-high valuations; even when companies beat guidance and Wall Street expectations, big losses are ensuing as the markets unwind a chunk of the past months’ interest rate-driven rally.

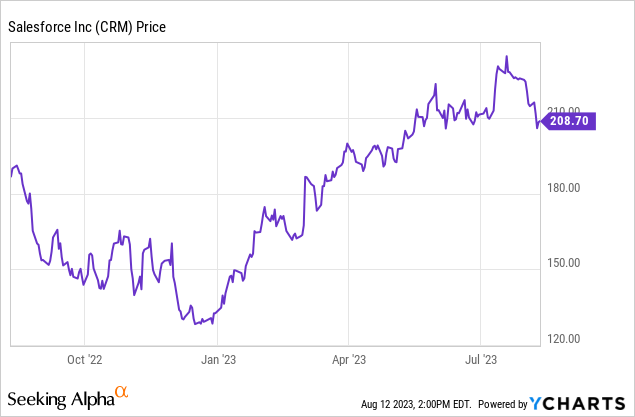

Salesforce.com (NYSE:CRM) doesn’t report earnings until the end of August, but the stock is already down ~10% since the start of the month in tandem with other big tech names. And though the stock remains up more than 50% from a year-to-date basis, I think this dip is a great entry point in this software giant:

Salesforce is finally taking profitability seriously

A well-known adage is that a good crisis can often present a great opportunity. For much of the past decade, Salesforce.com was riding high on the cloud boom, easy and cheap money, and skyrocketing valuations. It may have been one of the key poster children for excess in the tech sector, and its corporate strategy wasn’t far off either: as organic growth slowed, Salesforce deployed its balance sheet for aggressive M&A, acquiring the likes of Tableau, MuleSoft, Slack, and Quip for billions to expand its cloud software empire.

Amid greater macro pressure, however, Salesforce has started to show more discipline. M&A and the costs of integrating acquired targets have long held Salesforce’s operating margins down. Headcount expansion to fill offices across the world, including in its home city of San Francisco where Salesforce Tower and many other high-rises are sitting at low occupancy, has held off profitability. True: Salesforce was the original blueprint for a high-growth software company that would initially burn lots of cash but become incredibly profitable later at a more mature stage, on the back of high gross margins and recurring revenue.

That “later” took many years to arrive, but I believe we’re finally there. The company has finally turned its focus to the bottom line, laying off a slew of workers this year. And since the Slack deal in 2021, the company has not acquired another major target since.

Valuation looks buyable, on either an earnings or revenue basis

And so, at long last: The company is finally expanding its bottom line in a meaningful way. Its valuation can also be supported by its earnings. For the next fiscal year FY25 (the year for Salesforce ending in January 2025), Wall Street expects Salesforce to generate $8.99 in pro forma EPS, up 21% y/y on the back of $38.4 billion in revenue, up 11% y/y.

At current share prices near $209, this puts Salesforce’s valuation at 23.2x FY25 P/E – which, for a company expected to grow pro forma earnings at north of a >20% clip, is quite attractive (considering a high-teens multiple for the S&P 500 which is weighed down by much slower-growing industries).

On a traditional revenue basis: Currently, Salesforce’s market cap sits at $203.27 billion, and after netting off the $13.98 billion of cash and $9.60 billion of debt on Salesforce’s most recent balance sheet, its resulting enterprise value is $198.89 billion. So against consensus FY25 revenue targets, Salesforce’s revenue-based valuation stands at 5.2x EV/FY25 revenue – again, not unreasonable.

My year-end price target on Salesforce is $243, representing a 27x FY25 P/E multiple or a 6x FY25 revenue multiple.

The long-term bull case for Salesforce

When we look beyond the short term for Salesforce, I find quite an attractive multi-year bull case for this company.

The key upside catalysts I see are:

- Best-in-breed reputation will shield Salesforce as smaller competitors dry up. In the software industry, few brands are as recognizable as Salesforce, particularly in the CRM space, where Salesforce has a dominant market share. Amid a tough macro environment where many smaller software companies are folding, Salesforce will continue to gain share.

- Very diverse array of software products. Though we may decry Salesforce’s past penchant for acquisitions, the truth is that Salesforce is now left with a very wide net of software products, all of which carry strong cross-selling potential. Outside of its core CRM and marketing tools, Salesforce has enterprise communication via Slack and Quip, API tools via MuleSoft, BI via Tableau, and a variety of other best-in-class software offerings.

- Pure recurring revenue. Outside of one-time professional services and implementations which make up a very tiny portion of Salesforce’s revenue, Salesforce is unsurprisingly built on an entirely recurring subscription revenue base. Given as well that most of Salesforce’s products are seat-based (meaning it’s priced per user), Salesforce has plenty of opportunity to expand within its current install base as well.

- RPOs continue building. Remaining performance obligations, which is a measure of Salesforce’s contracted subscription revenue, continue to build at a nearly equivalent pace as revenue, which is a strong leading indicator that revenue deceleration isn’t in the near-term cards.

- Rule of 40. Salesforce has a high-20s pro forma operating margin and mid-teens revenue growth and classifies as a “Rule of 40” software stock – which makes Salesforce even more appealing in the current market which has shifted away from a growth-first mindset to one that considers bottom-line expansion as well. Salesforce also generates healthy free cash flow that adds an additional buffer on top of a balance sheet loaded with more than $13 billion in cash, which is useful fodder for its regular acquisitions.

Stay long here and buy the dip.

Recent trends show healthy growth across cloud verticals amid margin expansion

Though Salesforce has been hit by its fair share of macro slowdown impacts – which, in the software sector, has delayed IT purchases and increased scrutiny on deal approvals, lengthening the sales cycle – it is still showing growth across all of its key cloud verticals while also boosting profitability.

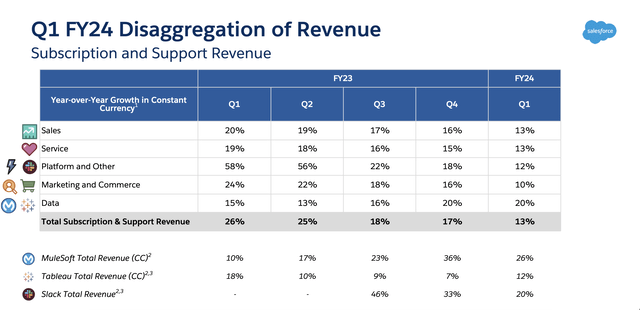

Salesforce growth by cloud (Salesforce Q1 earnings deck)

The chart above shows that each of Salesforce’s core cloud verticals saw double-digit growth on a constant-currency basis in Q1 – including and especially Sales Cloud, Salesforce’s core CRM product that started the company. It’s worth noting as well that Tableau, which wasn’t much of a growth champion when Salesforce acquired it in 2019, saw revenue growth accelerate to 12% y/y in the quarter, which helped to offset MuleSoft’s declaration in the “Data” segment. Looking at the chart above, FX-neutral revenue growth in the Data cloud has accelerated substantially versus early FY23.

The company’s core priority now, however, is the bottom line: A sentiment echoed by founder and CEO Marc Benioff on the recent Q1 earnings call:

On our last call in March, we told you about how Salesforce had radically accelerated our transformation to profitable growth. We share with you how we hit the hyperspace button across the key areas of our transformation, restructuring for the short and long-term, reigniting our performance culture by focusing on productivity, operational excellence, and profitability, prioritizing our core innovations that drive customer success, building even stronger relationships with you, our investors.

Our Q1 results show that we continue to make great progress. As I said in March, we’re just getting started with this incredible transformation. We continue to scrutinize every dollar investment, every resource, and every spend and we’re transforming every corner of our company. Our progress over the last 5 months, while it’s very impressive and I cannot be more grateful to our entire team for their leadership. In fact, you may hear me say that several times on this call. Our transformation drove our Q1 financial results.

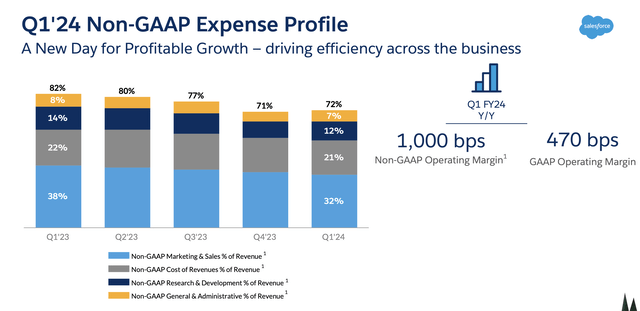

As I said, on our last call, well improving profitability is our highest priority. As a result, we significantly exceeded our margin target for the quarter, delivering a non-GAAP operating margin of 27.6%, up 1,000 basis points year-over-year, incredible. And there’s no greater point of evidence to our transformation than this amazing result following the tremendous operating margin Q4.”

The chart below shows Salesforce’s progress: The majority of the 10-point improvement in margins came from reducing sales and marketing costs as a percentage of revenue by 6 points:

Salesforce margin trends (Salesforce Q1 earnings deck)

Pro forma operating income soared 74% y/y on a nominal basis to $2.27 billion, representing a 27.4% margin – which, when stacked on top of 13% constant-currency revenue growth, still squarely puts Salesforce in the “Rule of 40” category. Pro forma EPS, meanwhile, grew 72% y/y to $1.69.

Key takeaways

Salesforce has hidden its profitable bones underneath a mass of corporate hiring and a multi-year M&A shopping spree, but as the company turns its focus to efficiency and profitability, we’re starting to see the benefits of massive operating income and EPS growth. Don’t forget top-line strength as well, as Salesforce continues to leverage the breadth of its product portfolio to sustain double-digit growth across each of its key product lines. Stay long here and buy the dip.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.