Summary:

- In light of a +35% jump in CRM stock over the last four months, Salesforce’s long-term risk/reward has shifted drastically.

- Today, we will review Salesforce’s valuation and recent business performance.

- I am downgrading the Company from a “Buy” to a “Hold”.

hapabapa

Introduction

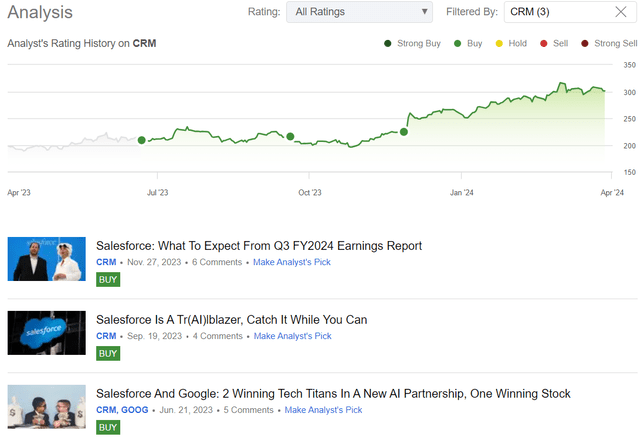

In late November 2023, I reiterated my bullish view on Salesforce, Inc. (NYSE:CRM) at ~$220 per share ahead of its Q3 FY-2024 earnings report, citing improved business fundamentals and reasonable valuation:

As of now, Salesforce is trading slightly above our fair value estimate of $222 per share. However, CRM’s expected five-year CAGR of 17.8% handily exceeds our investment hurdle rate of 15% and long-term S&P 500 returns of ~8-10%. Therefore, Salesforce is a solid “Buy” at current levels under our valuation methodology.

Earnings tend to bring volatile price swings with Mr. Market free to react in either direction. However, given Salesforce’s attractive long-term risk/reward, I’m a buyer of CRM stock ahead of the Q3 FY2024 earnings release.

Since the publication of this report, Salesforce’s stock has rallied up by more than 35% over the last four months, handily outperforming the broader market (SPY) (QQQ). Despite an ongoing growth slowdown, Marc Benioff & Co. have transformed Salesforce’s margin profile (cash flow generation) over the last 12-18 months and instituted huge capital return programs to curtail shareholder dilution. And with the recent launch of Einstein AI Co-pilot, Salesforce is firmly staking its claim as a software leader in the era of GenAI.

I have previously covered some of Salesforce’s AI efforts, and you can read more about them here; however, in today’s note, we will focus on CRM’s long-term risk/reward, which has shifted significantly in recent weeks.

The Rally Has Rendered Salesforce A “Hold”

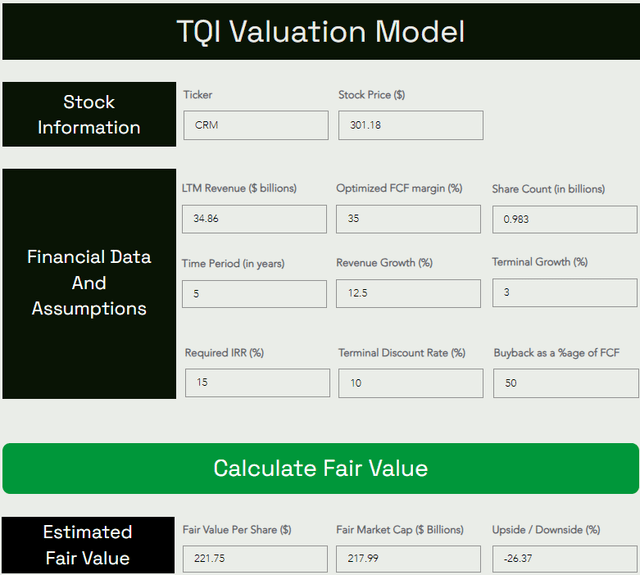

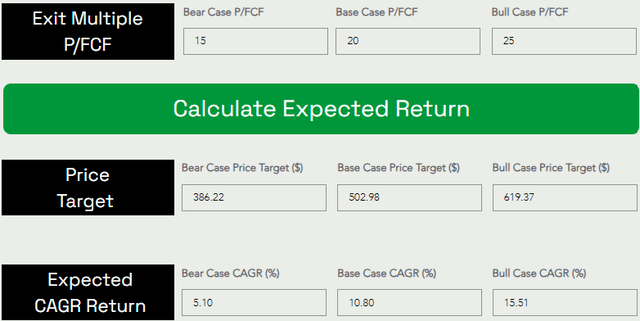

As you know, the price we pay for an asset is a key determinant of future returns. With CRM’s stock rising from ~$220 to ~$300 per share in a matter of weeks, our 5-year expected return has dropped sharply from ~18% to ~11%, as you can see in our updated valuation model:

TQI Valuation Model (TQIG.org) TQI Valuation Model (TQIG.org)

Considering our investment hurdle rate of 15%, Salesforce is no longer a “Buy” under our process. Yes, investors buying CRM here can still expect to beat the market (S&P 500 long-term return of 8-10%); however, we are now pausing accumulation and moving to the sidelines in anticipation of a price or time correction.

While you now know where I stand on the stock, let’s dig into Salesforce’s recent business metrics to understand this lukewarm stance!

Salesforce’s Q4 Report And FY-2025 Guidance

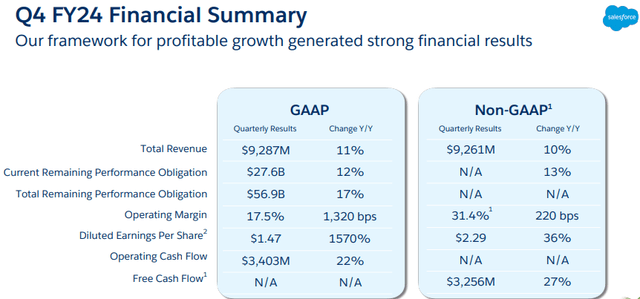

In Q4 FY-2024, Salesforce recorded total revenues of $9.3B (up 11% year-over-year), beating consensus street estimates by $66.5M. Furthermore, Salesforce continued making progress on the profitability front, with its normalized EPS of $2.29 for Q4, coming in slightly ahead of consensus expectations.

Salesforce Q4 FY-2024 Earnings Presentation

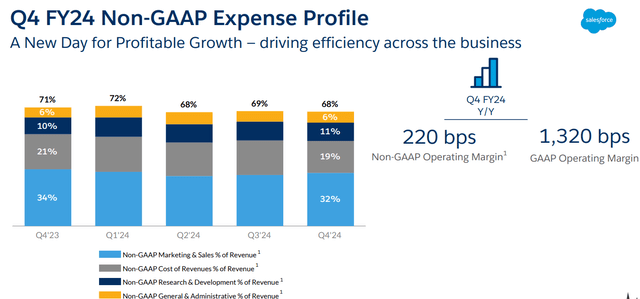

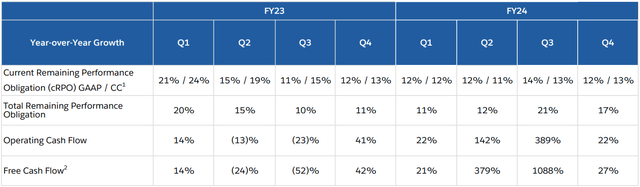

Based on healthy top-line growth and solid operating margin expansion, Salesforce’s free cash flow generation increased by 27% y/y to $3.25B during the quarter. While I was somewhat concerned about Salesforce’s AI investments reversing some of the recent efficiency gains in late November, CRM’s management is successfully reeling in costs across Sales & Marketing [S&M] faster than expanding their Research & Development spending [R&D] to deliver greater operating leverage.

Salesforce Q4 FY-2024 Earnings Presentation Salesforce Q4 FY-2024 Earnings Presentation

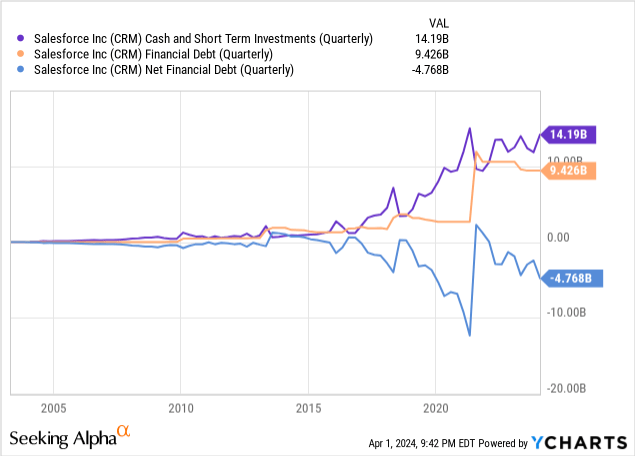

Now, turning to the balance sheet, as of Q4 FY-2024, Salesforce held $14.1B in cash and short-term investments against financial debt of $9.4B, resulting in a net cash balance of $4.8B [up from $3B in Q2 at our last assessment].

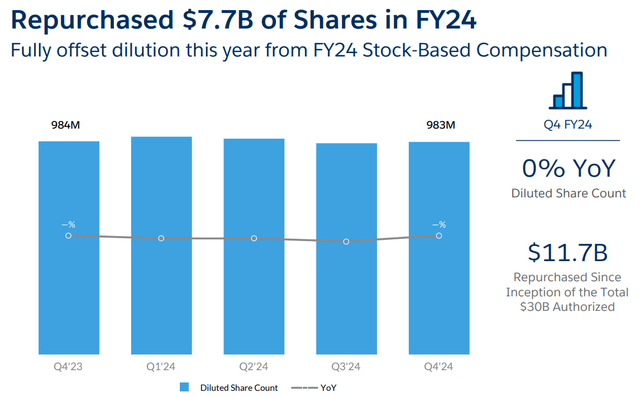

In Q4, Salesforce repurchased $1.7B worth of its stock. Overall, Salesforce spent $7.7B on buybacks in FY-2024, and these buybacks completely offset shareholder dilution from stock-based compensation, which was a significant Achilles heel for Salesforce’s investors for a long, long time.

Salesforce Q4 FY-2024 Earnings Presentation

In my previous assessment, I shared an expectation of an even bigger capital return program from Salesforce. And that’s precisely what we are getting from the software giant. With its Q4 report, Salesforce announced the addition of $10B to its share buyback program and a first-ever quarterly dividend of $0.40 per share.

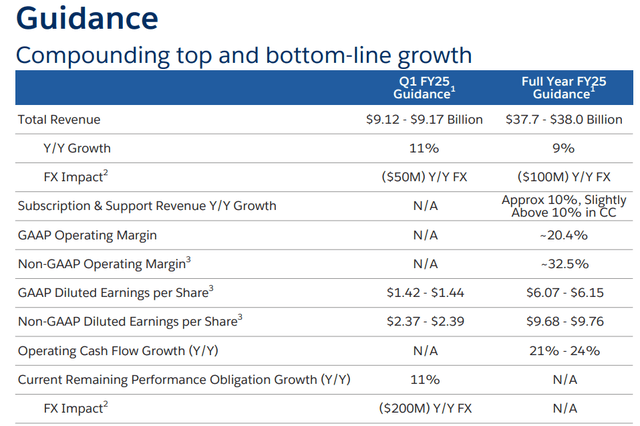

For Q1 FY-2025, Salesforce guided for revenues of $9.145B (growth of +11% y/y) and non-GAAP EPS of $2.38 per share. While the Q1 guide was stronger than the pre-Q4 consensus estimates, Salesforce’s full-year top-line guide of +9% y/y growth to $37.85B fell short of estimates.

Salesforce Q4 FY-2024 Earnings Presentation

On the earnings call, Salesforce’s management highlighted their Data Cloud as the fastest-growing product in the company’s history, pitching it as the next big growth driver. There’s no AI strategy with a data strategy, and Salesforce is a gold mine of data! Hence, I think it is a natural winner in the era of AI. Einstein AI copilot is now live, and I believe this product will help Salesforce increase its share of wallet among existing enterprise customers in a ~$70B CRM software market that’s expected to grow at ~12% per year until 2030.

In my view, Salesforce’s AI efforts are yet to show up in the numbers, but they are still very likely to bear fruit in upcoming quarters. As such, I have stuck with our 5-year CAGR sales growth assumption of 12.5%, expecting a top-line re-acceleration in CY-2025/2026.

Final Thoughts

From a business standpoint, Salesforce remains a high-conviction play for me, despite management’s projection of further moderation in top-line growth to high single digits. We own Salesforce and plan to continue to do so for the foreseeable future.

That said, given the significant deterioration in Salesforce’s 5-year expected CAGR return from 18% to 11%, I am downgrading CRM stock to a “Hold”.

Key Takeaway: I rate Salesforce a “Hold/Neutral” at $302 per share.

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below or DM me.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We Are In An Asset Bubble, And TQI Can Help You Navigate It Profitably!

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – "The Quantamental Investor" – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.