Summary:

- Salesforce has a high P/E ratio of 550, but Morningstar displays a P/E of 34, suggesting further analysis is needed.

- Depreciation and amortization expenses should not be included in the valuation of Salesforce in my opinion, as they are unlikely to materially affect the fundamental quality of the company’s business.

- Salesforce’s restructuring expenses are also expected to be short-lived.

- If we exclude these non-material expenses, the resulting intrinsic value suggests the company is significantly undervalued.

Sundry Photography

Investment Thesis

Salesforce (NYSE:CRM) has a P/E of about 550 which appears unreasonably high. To put this in perspective, Morningstar shows the stock with a P/E of just 34. This suggests investors need to look deeper into the financial line items of the company instead of taking the bottom line at face value when valuing the company.

A large portion of CRM’s expenses comes from depreciation and amortization expenses. In my opinion, these expenses are unlikely to result in any material chances of financial distress, meaning they should not be included in the valuation of CRM.

CRM is also undergoing a massive restructuring that appears to incur significant expenses on its income statement. These expenses appear to be non-recurring in the long run according to historical trends, meaning they should not be included in the valuation of CRM.

According to Morningstar, CRM’s top-line growth is expected to be 12%, which is aligned with our projected FCF growth, meaning the topline growth is likely to trickle down to its bottom line and FCF. This suggests the growth is driven by a sustainable business model instead of from non-operating means.

Using these growth figures and the adjusted net income as a proxy for FCF, I believe the company is significantly undervalued.

Morningstar’s Opinion

Morningstar’s full article describing its fair value valuation model is a paid article. We will try to make our best effort to understand based on the freely published synopsis.

We summarize the key points in Morningstar’s valuation:

Projected FY 2024 financial performance:

- “Our fair value estimate for Salesforce is $245 per share,”

- “which implies a fiscal 2024 enterprise value/sales multiple of 7 times,”

- “an adjusted price/earnings multiple of 34 times,”

- “3% free cash flow yield.”

Projected growth until 2028:

- We model a five-year compound annual growth rate for total revenue of 12% through fiscal 2028;

- Our revenue forecast assumes modest revenue acceleration after depressed growth in both fiscal 2023 and 2024.

- We forecast non-GAAP operating margin expanding from 23% in fiscal 2023 (actual) to somewhere in the low 30% range in fiscal 2028.

Projected “3% free cash flow yield”

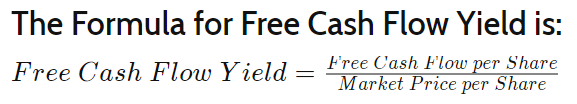

According to Investopedia, FCF yield is calculated as follows:

Free Cash Flow Yield (Investopedia)

Morningstar projected a “3% free cash flow yield” and a fair value of “$245” per share for FY24 (end of 2023). The company’s last reported ‘Total Common Shares Outstanding‘ is 977M.

Assuming this fair value is priced into the stock market as CRM’s “market price per share”, we can derive that:

- the projected FCF per share = 3% x $245 = $7.35.

- the projected FCF = $7.35 x 977M = $7,180.95M.

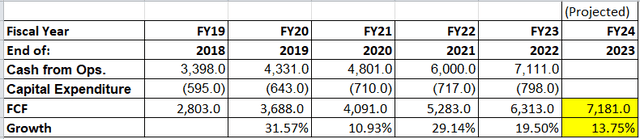

If we tabulate the historical FCF with Morningstar’s projected figures, we can expect CRM’s FCF growth for FY24 to be 13.75%. (FCF assumed to be “Cash from Ops” – CAPEX)

FCF Growth (Compiled from Seeking Alpha)

Recall that Morningstar expects top-line revenue growth to be “12% through fiscal 2028”. This figure is very close to our calculated projected FCF growth of 13.75%. Overall, in my opinion:

- Morningstar is expecting CRM to have an FCF growth of 13.75% in FY24, which is largely due to growth in revenue of 12% that trickled down to its bottom line and be reflected in the FCF.

- Since the FCF growth is fueled by the company’s improving sales revenue performance instead of through other non-operating means, such growth is expected to be sustainable in the long run.

Projected Price/Earnings multiple of 34

The current PE of CRM is currently about 550 but Morningstar is projecting CRM’s adjusted PE to be just 34. How did Morningstar ‘adjust’ the company’s earnings to have a PE of just 34 (from a whopping 550)?

Recall that:

- PE = Price per share /earnings per share (or EPS).

- And Morningstar’s fair value (price/share) is $245.

Therefore, to achieve Morningstar’s fair value of $245, CRM needs an EPS of:

- Price per share/PE=245/34= ~$7.2.

This implies that CRM should have an ‘adjusted’ earnings figure of $7.2 per share. Right now, based on a PE of 550 and a stock price of about $210 per share, CRM has an EPS of 210/550 which is just $0.38.

Therefore, the key question to ask is:

“How can CRM’s EPS be adjusted upwards from just $0.38 to $7.2?”

CRM’s shares outstanding sit at 977M on its balance sheet. That means:

- An EPS of $0.38 implies CRM’s latest annual earnings at face value=$0.38 x 977M=$371.26M.

- An EPS of $7.2 implies CRM’s projected adjusted earnings=$7.2 x 977M=$7034.4M.

Taking the above 2 points together, we understand that while CRM’s earnings have a face value of just $371.26M; Morningstar believes CRM deserves to be valued based on adjusted earnings of $7034.4M instead.

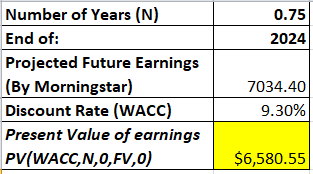

Note that $7034.4M is the projected earnings at the end of fiscal 2024. Right now, CRM announced only their Q1 2023 earnings. That means:

- $7034.4M is the expected future earnings/value (“FV”) of CRM at the end of 0.75 years (or 3 Quarters).

Together with the WACC of 9.3% from FinBox (“WACC Mid”), we can calculate the present value of Morningstar’s projected future earnings:

PV of earnings (Calculated by Author)

Based on the PV, we understand that:

Morningstar believes the company should be valued based on present earnings of $6580.55M instead of $371.26M.

Obviously, the present earnings of $371.26M is a far cry from the expected $6580.55M.

Therefore,

The next step is to look for cost items in the company’s financial statements that can be reasonably adjusted back to arrive at an amount close to $6580.55M.

Income Statement Analysis

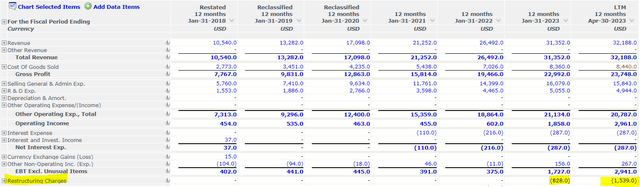

We look at CRM’s income statement to check for cost items that might be one-time and not likely to persist in the long run:

From the income statement we understand that in the last 12 months:

- CRM’s costs of goods are relatively low and take up just 8B/32B=25% of total revenue.

- Operating expenses are enormous and take up 20B/32B=63% of total revenue. These operating costs will also include non-cash items of depreciation and amortization costs.

- There is a relatively low but still significant amount of “restructuring charges” of 1.54B. Looking at the historical trend, it appears that these costs are not recurring and hence, we can add it back to achieve our adjusted net income.

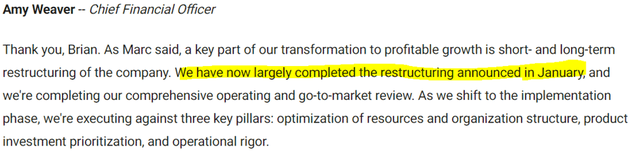

Moreover, if we infer from the latest earnings call transcript, the CFO also assured investors that the company’s restructuring efforts are nearing completion:

CFO comments (Earnings Call Transcript)

This further strengthens our belief that the restructuring charges are expected to be short-lived.

Cash Flow Analysis

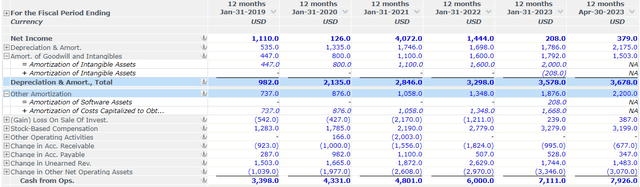

In spite of having an unusually low net income, CRM has a very favorable cash flow profile which is increasing year after year:

In particular, we can observe 2 unusually large cost items added back to the Net Income to arrive at the figure of “Cash from Ops”:

- Total depreciation and amortization cost amounts to ($3.7M + $2.2M$=$5.9M). These are the results of spreading the costs of acquired assets across an extended period of time to fulfill the company’s accounting obligations. Hence, they are not likely to cause any financial distress, meaning it is reasonable to adjust back to CRM’s earnings.

- Stock-based compensations (SBC) are also significantly large. While these are non-cash incentives to align the interests of executives with those of shareholders, they come with the possible downsides of dilution of ownership, leading to a significant loss in value for the company. As such, it should rightfully be reflected in the overall earnings. We shall not adjust SBC back to its net income.

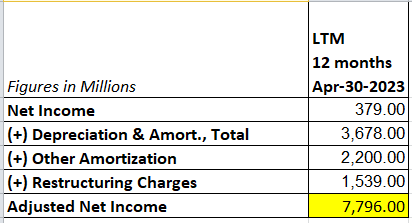

Adjusted Net Income

If we perform the adjustments to calculate what we think is the rightful net income that CRM should be valued on using insights from the previous sections, we arrive at the figure of $7796M:

Adjusted Net Income (Calculated by Author)

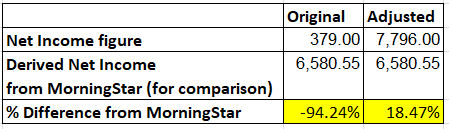

This figure is much closer to our derived estimate of $6580.55M based on Morningstar’s projections:

Comparison with Morningstar (Tabulated by Author)

Still, $7796 is still ~20% different from $6580.55M. This is not unexpected. We do not know exactly what finer assumptions were made by Morningstar to arrive at their opinions.

In my opinion, the key takeaway from this adjusted figure is that our opinions and assumptions are likely to be generally aligned with Morningstar’s.

DCF Valuation

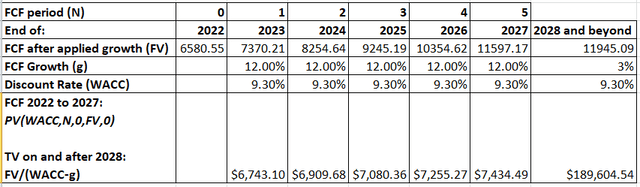

Based on previous discussions, we will make the following assumptions/inputs into the calculation of CRM’s intrinsic value:

- In the earlier sections, we discuss how we start with the projection of P/E 34 and a fair value of $245 per share to calculate the FV of CRM’s adjusted Net income for FY24 and discount it using the WACC to get the present value of $6580.55 (FY23). Since most of these adjustments were done by adding back large amounts of non-cash expenses, the resulting earnings are expected to be mostly cash-based. Hence, we will use this adjusted earnings figure as a proxy for CRM’s FCF at the end of 2022 (Start of our FCF projection).

- Morningstar thinks that CRM’s compounded annual revenue growth is 12%. We will assume this top-line growth will largely trickle down to its FCF from 2023 to 2027 before the growth matures and tapers off to 3% from 2028 and beyond.

- The WACC value of 9.30% is taken from FinBox as cited previously and will be used as our discount rate.

- We assumed the company’s shares outstanding will stay the same at 977M indefinitely.

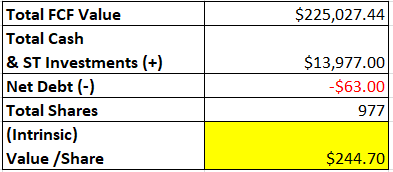

DCF Calculations (Calculated by Author)

With the above assumptions, the present value of the projected FCF is calculated for each year and summed up.

DCF Calculations (Calculated by Authors)

Taking into account the total debt and cash that the company is holding, the final intrinsic value is about $244.70.

This is comparable to Morningstar’s fair value of 245, implying the analyst is likely to be using a valuation model similar to what we have.

Assuming a current market price of 210, the stock is:

(244.7 – 210) / 210=16.52% undervalued.

Conclusion

CRM appears to operate a fundamentally profitable business model that is growing its FCF at a high double-digit percentage rate.

The company also expected to complete its employee restructuring exercise by the end of FY2024 and real estate restructuring by FY2026. Hence, the current restructuring costs incurred are likely to be short-lived.

Its bottom-line earnings have been depressed drastically due to the accumulation of depreciation and amortization costs. In my opinion, these costs are not likely to affect the fundamental quality of the business and hence, should be excluded when calculating the company’s actual value.

Overall, the perceived underperforming financial number of CRM is due to factors that do not materially affect the quality of its business model. If these factors are removed from the calculation of CRM’s intrinsic value, the current market price appears to be undervalued.

Investors should consider adding more positions of CRM as a long-term investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.