Summary:

- We’re upgrading Salesforce, Inc. to a buy.

- We believe weakness in the global IT spending environment is now priced into the stock and believe Salesforce top line results can remain resilient despite the current cautious IT spending environment.

- We think the company’s price increase in August will reflect positively in its 2HFY24 financial performance.

- We expect the company margins to expand and organic growth to meet or exceed double-digit percentage as it combines restructuring efforts and monetizes its new AI CRM roadmap.

- We believe Salesforce will outperform its peer group in 2H23 and in 2024.

DKart/E+ via Getty Images

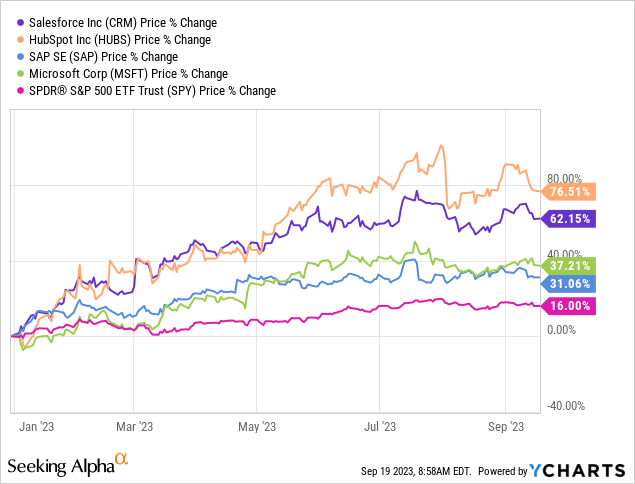

We’re upgrading Salesforce, Inc. (NYSE:CRM) to a buy. We now think the weaker IT spending environment is priced into the stock; Salesforce grew 57% in 1H23, and outperformance has moderated in 2H23, with the stock up 2% since July to date, relatively in-line with the S&P 500 (SP500). Our upgrade is driven by our belief that Salesforce is now better positioned to drive top line growth in spite of the current cost-cautious environment as management monetizes its new A.I. CRM roadmap with price increases and restructuring efforts pay off. We believe Salesforce will outperform its peer group in 2H23 and 2024.

The following graph outlines Salesforce stock performance against the S&P 500, HubSpot (HUBS), SAP (SAP), and Microsoft (MSFT).

YCharts

Guidance raised, again

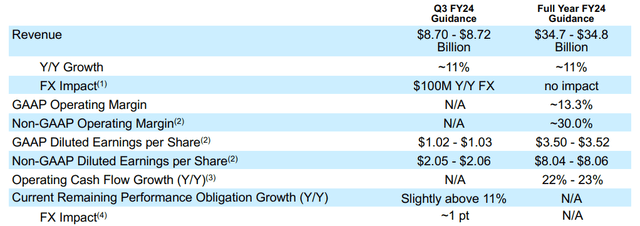

We think Salesforce will be among the more resilient names in the current macro backdrop; in fact, we think the company will expand margins and maintain consistent revenue growth in 2H23 despite the market downturn. Management now guides above consensus for FY24 revenue, raised this quarter to $34.7-$34.8B from previous estimates of $34.5-$34.7B. We expect the company to report solid double-digit revenue growth in the second half of FY24. Salesforce is among the few SaaS names that didn’t experience a materially slower Y/Y revenue growth percentage this year; the company maintained an 11% Y/Y revenue growth in 1Q24 and 2Q24 and a slight QoQ increase; we don’t expect hyper revenue growth in 2H23 but see an upward trend playing out into 2024. Guidance for 3Q23 revenue is another ~11% Y/Y increase to $8.70B to $8.72B from $8.6B this quarter.

The following outlines Salesforce’s guidance for FY24 and 3Q24.

Salesforce 2Q24 Earnings Press Release

Additionally, we think management’s restructuring efforts after spending big on acquisitions like Slack for over $20B and Tableau for $15.7B and post-pandemic restructuring efforts are paying off big time. Margins expanded substantially Y/Y and sequentially this quarter to 17.2% in GAAP operating margin and 31.6% in Non-GAAP operating margin compared to 5.0% and 27.6% in 1Q24. Margins are also up materially compared to a year ago quarter in which Salesforce reported a GAAP operating margin of 2.5% and a Non-GAAP operating margin of 19.9%. Management’s original plan was to hit the 30% mark three quarters from now, so the company is both ahead of schedule and consensus. FY24 operating margins were also raised this quarter to ~13.3% for GAAP and ~30.0% for Non-GAAP Operating Margin.

We expect margins to expand further on the back of two factors. The first is management’s restructuring efforts; earlier this year, Salesforce laid off 10% of its work staff and oversaw cost-cutting measures. Now, management announced the hiring of 3,300 employees, which would account for hiring back 40% of the layoffs in 1H23. We think this is a sign of strong growth momentum and customer appetite. The second, and more recent catalyst is the price list increase across Sales Cloud, Service Cloud, Marketing Cloud, Industries, and Tableau by an average of 9% put into effect in August.

We believe the price increase will be well-received as this accounts for Salesforce’s first price increase in seven years; we think the price increase will reflect positively on the second half of FY24. Management actually expects the price uplift to hit the customer base over the next 1-2 years on renewals rather than have a material change this FY. We think the stock’s risk-reward profile is increasingly favorable into 2024.

Kick-starting monetization: A.I. CRM roadmap

Salesforce recently held its Dreamforce event, and unsurprisingly, it was all about A.I. Management noted on the earnings call that they expect “AI is about to really ignite a buying revolution” for them and the peer group. In our coverage of SaaS businesses, we’ve been less than optimistic about management promises of A.I. growth tailwinds due to the current subdued demand environment; more specifically, we don’t expect A.I. integration to materially drive revenue growth. Still, competition in the SaaS market is intensifying, and the race over who can best leverage the A.I. opportunity is on between Salesforce, Microsoft (MSFT), and HubSpot (HUBS), among others. We think Salesforce is uniquely positioned to leverage the A.I. opportunity into growth due to the timing of its A.I. CRM roadmap and price increases. Management announced new A.I.-focused products to expand its customer-facing portfolio and integrated A.I. into new tools, including EinsteinGPT, SlackGPT, and TableauGPT.

Valuation

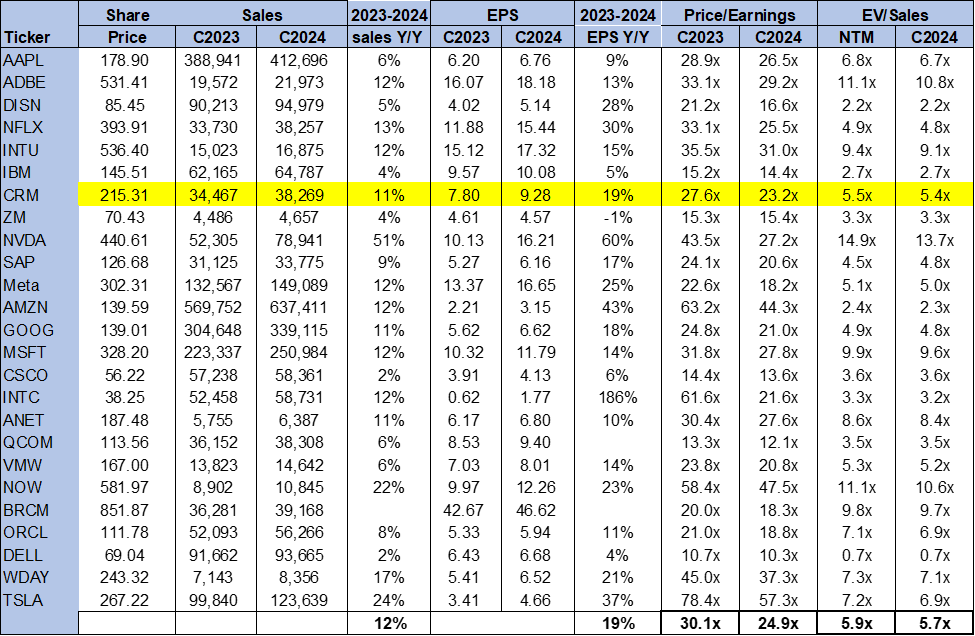

Salesforce is relatively cheap, trading below the peer group average. On a P/E basis, the stock is trading at 23.2x C2024 EPS $9.28 compared to the peer group average of 24.9x. The stock is trading at 5.4x EV/C2024 Sales versus the peer group average of 5.7x. We think Salesforce will continue to push earnings growth; the stock’s historical EPS growth rate is 24.5%, while its projected EPS growth is 43.3% this year, above the industry average of 10.9% EPS growth. We see attractive entry points at current levels.

The following chart outlines Salesforce’s valuation against the peer group average.

TSP

Word on Wall Street

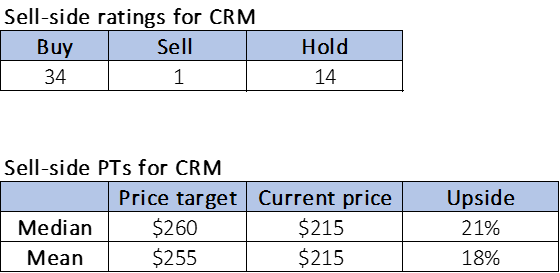

Wall Street shares our bullish sentiment on the stock. Of the 49 analysts covering the stock, 34 are buy-rated, 14 are hold-rated, and the remaining are sell-rated. The stock is currently priced at $215 per share. The median sell-side price target is $260, while the mean is $255, with a potential 18-21% upside. We see the stock testing 52-week highs of $238.22 into 2024.

The following charts outline Salesforce sell-side ratings and price-targets.

TSP

What to do with the stock

We’re upgrading Salesforce to a buy; we think the stock will outperform the peer group in 2H23 and 2024. We’re constructive on management’s discipline with restructuring efforts and now see the company shifting its relationship to the post-pandemic hangover and tight IT spending environment with the rehiring, A.I. CRM roadmap, and raised guidance. The weaker global IT spending environment has not washed out, but we believe the macro headwinds have been priced into the stock and see a clearer path of consistent growth into 2024 driven by customer appetite for the A.I. integration and price increase expanding margins. We recommend investors explore attractive entry points into the stock at current levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2 week free trial of Tech Contrarians, our Investing Group service. The first wave of subscribers gets a significant lifetime discount on annual subscriptions after the 2 week free trial so we hope to see you in our group soon.