Summary:

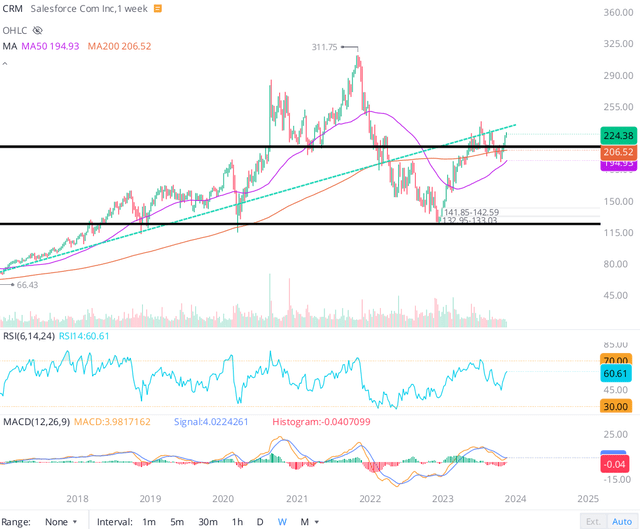

- After a late-summer correction, Salesforce stock has rebounded sharply in recent weeks and is currently in a bullish technical setup.

- Analyst estimate revisions and positive trends in the cloud software market suggest a potential earnings beat for Salesforce.

- In this note, I provide an earnings preview for Salesforce and share my latest valuation model for the cloud software giant.

Justin Sullivan/Getty Images News

Introduction

On Wednesday, Nov. 29, Salesforce (NYSE:CRM) will release its Q3 FY2024 earnings report. After suffering a ~20% decline during the mid-July to late-October broad market correction, CRM stock has rebounded sharply in recent weeks, and it’s now sitting right above the top end of its Stage-I accumulation base ($125-$210 range).

Despite Salesforce’s stock approaching overbought levels on the daily chart [RSI: 70], near-term technicals remain bullish with CRM stock trading above both 50-DMA and 200-DMA levels. While a reversal here is certainly a possibility, the odds of Salesforce regaining its long-term uptrend (marked in a green dotted line on the chart above) are quite strong.

Given its current technical setup, the upcoming earnings report could prove to be a pivotal one in relation to setting near to medium direction for the stock. A negative earnings surprise could send the stock back down into the Stage-I base, whereas a positive surprise could propel CRM to new 52-week highs.

In this note, I will provide a preview of Salesforce’s Q3 FY2024 report and share my rationale for initiating fresh longs (and adding to existing investments) in CRM at current levels.

What’s The Earnings Forecast For Salesforce?

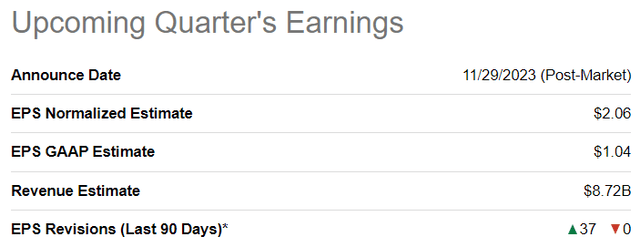

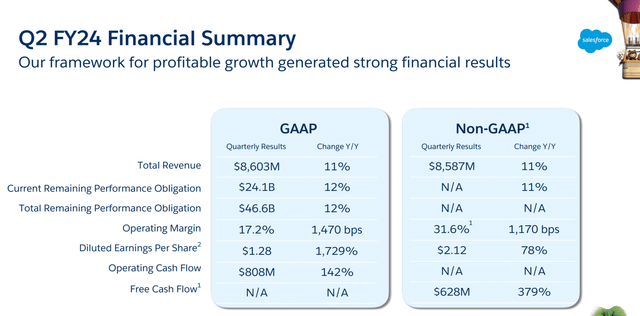

On the back of reporting yet another stronger-than-expected set of results last quarter, Salesforce’s management lifted guidance for Q3 and FY 2024.

Salesforce Q2 2023 Earnings Presentation

For Q3, Salesforce is projected to deliver revenues and non-GAAP EPS of $8.70-8.72B and $2.05-2.06, respectively. The Q3 FY2024 implied sales growth rate of 11% is in line with the growth we have seen at Salesforce in H1 2023, i.e., the business is stabilizing. While there’s no indication of a growth re-acceleration just yet, Salesforce’s CEO, Marc Benioff, was pretty optimistic about CRM’s future during the Q2 earnings call:

Based on our performance and what we see in the back half of the year, we’re raising our FY-24 revenue, operating margin, and operating cash flow growth guidance. As the No. 1 AI CRM, with industry-leading clouds, Einstein, Data Cloud, MuleSoft, Slack and Tableau, all integrated on one trusted, unified platform, we’re leading our customers into the new AI era.

In my view, Salesforce’s rapid growth days are a thing of the past. That said, the cloud software giant is still growing at a healthy double-digit clip. Furthermore, CRM’s ongoing AI efforts have the potential to boost growth rates in the near to medium term and keep them elevated in the mid to high teens for several years to come.

CRM’s Earnings History (Seeking Alpha)

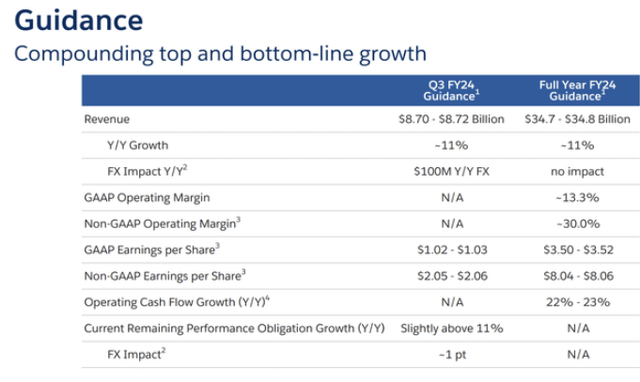

Since CRM’s management has a history of sandbagging guidance (and outperforming estimates), I expect to see another quarterly beat on Wednesday. While CRM will most likely exceed management’s guidance, can it live up to investor expectations?

Well, only time will reveal the truth. All we can do as investors is try to understand current market expectations through consensus analyst estimates and price action (technicals). We already know that CRM stock has bullish technical momentum, so, we will now review consensus analyst estimates to complete our reading of market/investor expectations. But before we do that, let’s briefly discuss the previous quarter’s earnings report.

How Was Salesforce’s Q2 Earnings Report?

In Q2 2023, Salesforce recorded total revenues of $8.6B (up 11% year-over-year), beating the high-end of management’s guidance range by $70M. Despite a stabilization of top-line growth at ~11% over the last couple of quarters, Salesforce is making great strides on the profitability front, with normalized EPS for Q2 coming in at $2.12 (up 78% year-over-year)) well ahead of consensus street estimates of $1.90 by $0.22 per share.

Salesforce Q2 2023 Earnings Presentation

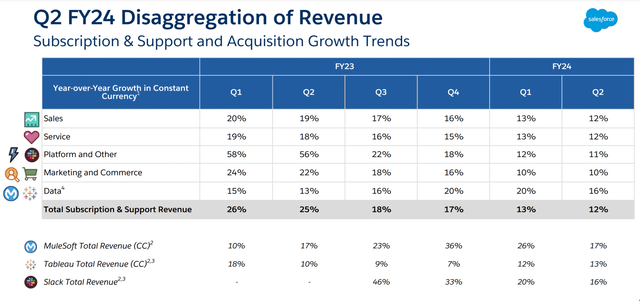

Amid ongoing macroeconomic challenges, Salesforce has reported a sharp moderation in growth since 2021-2022, with the slowdown affecting all segments of its business as evidenced by the disaggregated revenue table shown below:

Salesforce Q2 2023 Earnings Presentation

While its sales growth has moderated down to low double digits, Salesforce is racing to bring Einstein AI to the market in order to increase its share of wallet among existing enterprise customers in a ~$70B CRM software market that’s expected to grow at ~12% per year until 2030.

Back in September, Marc Benioff hammered home Salesforce’s AI advantage at the Dreamforce 2023 conference. According to news reports, Salesforce is hiring 3,300 employees across departments as management’s confidence in a new AI-fueled tech investment cycle has grown. And these recruitment efforts are seemingly in full flow, with Benioff recently posting this wild advert on X (formerly Twitter) to woo OpenAI researchers:

Salesforce will match any OpenAI researcher who has tendered their resignation full cash & equite OTE to immediately join our Salesforce Einstein Trusted AI research team under Silvio Savarese. Einstein is the most successful enterprise AI Platform completing 1 Trillion predictive & generative transactions this week! Join our Trusted AI Enterprise Revolution. [heart emoji]

While some investors are rightly concerned about Salesforce’s recent profitability improvements amidst this news, CRM’s leadership remains committed to striking a balance between growth and profitability. Here’s what Benioff said at Dreamforce:

Our job is to grow the company and to continue to achieve great margins

– Marc Benioff, Salesforce CEO

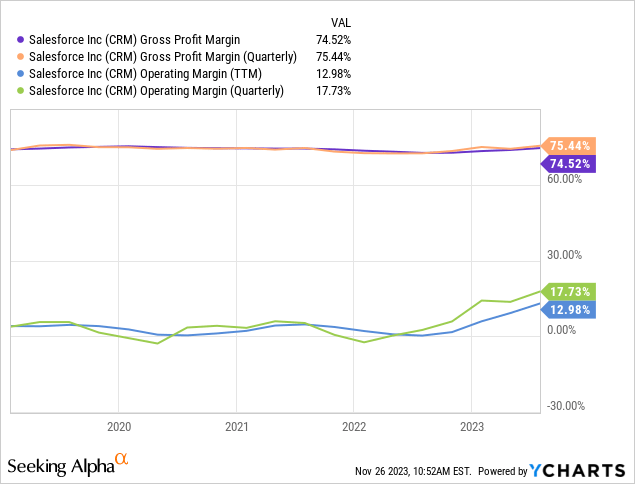

Over the last few quarters, Salesforce has made tremendous strides on the margin front as management embarked on cost-cutting exercises amid pressure from activist investors. In Q2 2023, Salesforce’s non-GAAP operating margins reached 31.6% (GAAP operating margins: ~17%), with significant moderation in CRM’s D&A and stock-based compensation expenses.

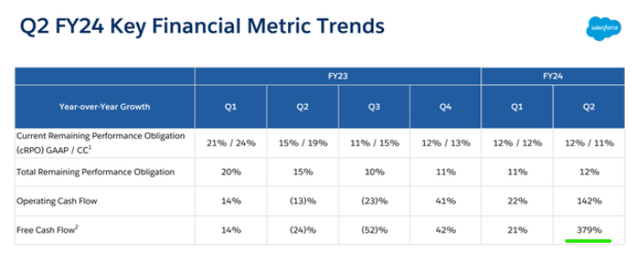

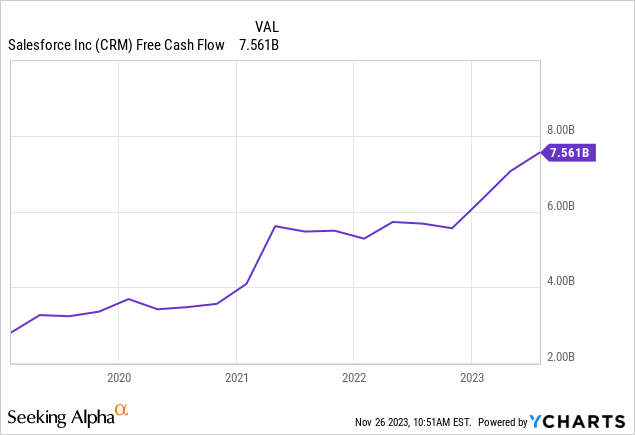

With healthy double-digit revenue growth and robust margin expansion, Salesforce has seen a big jump in its free cash flow generation over the last year or so. In Q2, Salesforce recorded operating cash flows of $808M (up 142% y/y) and free cash flows of $628M (up 379% y/y), owing to the cost-efficiency initiatives taken by the firm.

Salesforce Q2 2023 Earnings Presentation

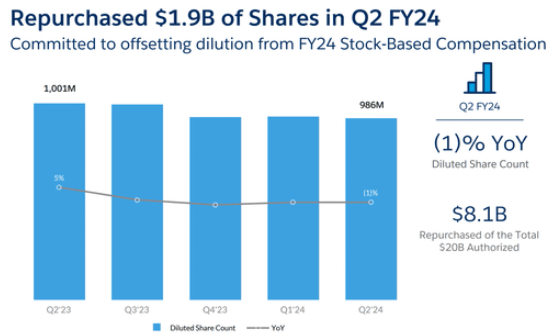

As you may know, Salesforce’s management adopted a shareholder-friendly stock buyback program last year, which has seen them return $8B to shareholders via stock buybacks over the last twelve months. In Q2 2023, Salesforce bought back $1.95B worth of its stock to bring total buybacks in the first half of this year to $4.1B.

Salesforce Q2 2023 Earnings Presentation

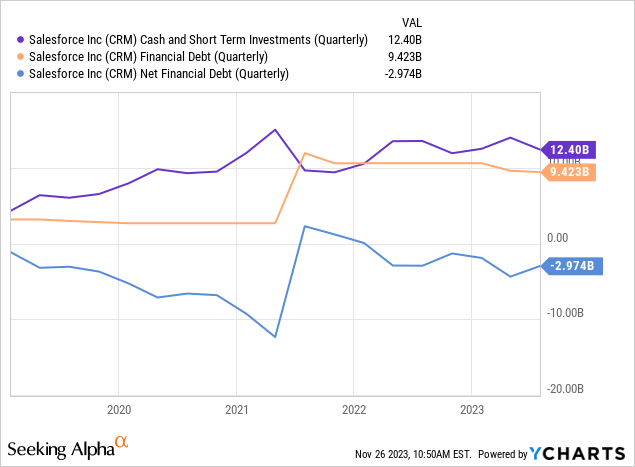

Salesforce is buying back its stock aggressively, and given its strong balance sheet, I expect the company to keep devoting future free cash flows toward share buybacks in the upcoming quarters too. As of Q2 2023, Salesforce held $12.4B in cash and short-term investments against financial debt of $9.4B, resulting in a net cash balance of $3B. Given its hefty net cash balance and robust free cash flow generation, I don’t see any liquidity issues at Salesforce for the foreseeable future.

With a renewed focus on efficiency, Salesforce has turned into a massive cash cow over the last few quarters. While I expect more of the same in Q3 (growth stabilization and robust free cash flow generation), I’m looking forward to learning about the margin impact of CRM’s aggressive investments in AI.

Is CRM Expected To Beat Earnings?

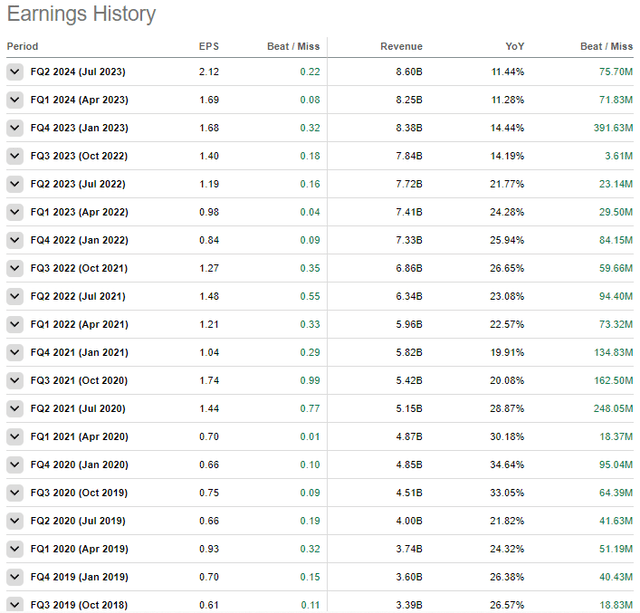

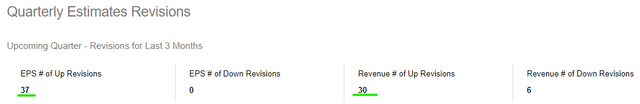

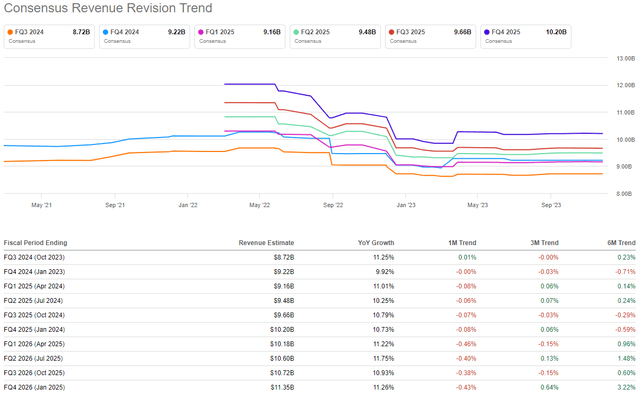

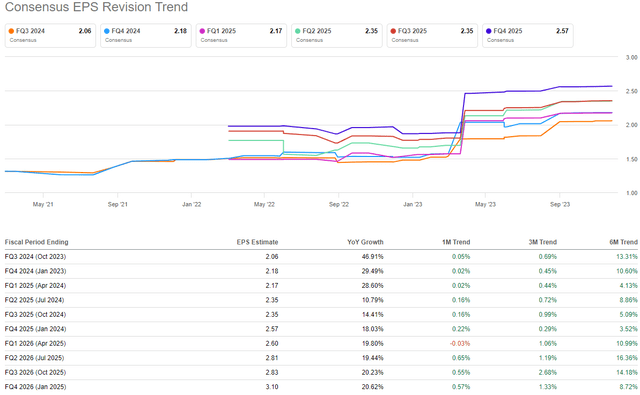

As we noted earlier, Salesforce’s earnings date is Nov. 29, with numbers expected to be released in post-market hours. According to consensus analyst estimates, Salesforce is set to deliver total revenues of $8.72B for Q3 FY2024 (top end of management’s guidance range), and the range of these analyst estimates is from $8.67B to $8.82B. FYI, Salesforce has seen 30 upward and six downward revisions for revenue from Wall Street over the last three months.

Further, Salesforce’s consensus non-GAAP EPS estimate has moved up to $2.06 per share, with 37 upward and 0 downward revisions. Clearly, Wall Street analysts are optimistic about Salesforce hitting the top end of management’s guidance for revenues and non-GAAP EPS going into Wednesday’s report. And, in my view, positive read-through from other cloud software giants such as Microsoft (MSFT) and ServiceNow (NOW) justifies this broad optimism.

SeekingAlpha SeekingAlpha SeekingAlpha

Based on recent business trends, bullish price action, management’s (historically conservative) guidance, and in-line analyst expectations, I think we’re nicely set up for a positive surprise (earnings beat) from CRM.

Concluding Thoughts: Is Salesforce A Buy, Sell, Or Hold Ahead of Q3 FY2024 Earnings Report?

Despite facing macroeconomic headwinds, Salesforce beat top and bottom line estimates last quarter and expressed a healthy outlook for H2 2023. Furthermore, Salesforce is well-positioned to lead a growing CRM software market in the era of AI, driving healthy growth in sales and earnings over the long run.

While the Q3 earnings report could trigger a significant short-term move in CRM stock, it’s unlikely to alter the investment thesis. In order to make an informed investment decision, we shall now evaluate CRM’s absolute valuation and expected five-year CAGR returns through a longer-term lens.

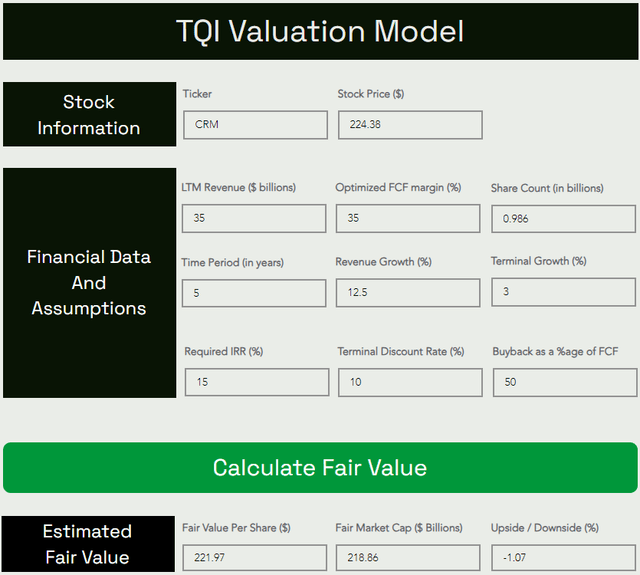

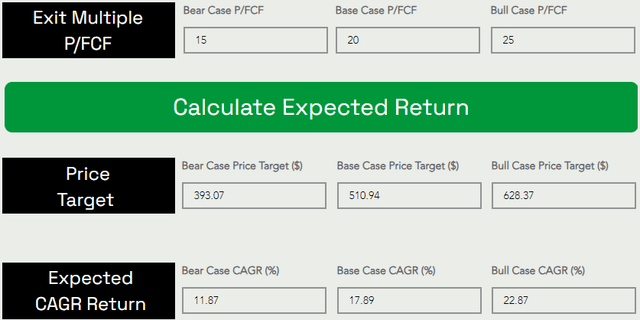

Salesforce Fair Value And Expected Return

TQI Valuation Model (TQIG.org) TQI Valuation Model (TQIG.org)

As of now, Salesforce is trading slightly above our fair value estimate of $222 per share. However, CRM’s expected five-year CAGR of 17.8% handily exceeds our investment hurdle rate of 15% and long-term S&P 500 returns of ~8-10%. Therefore, Salesforce is a solid “Buy” at current levels under our valuation methodology.

Earnings tend to bring volatile price swings with Mr. Market free to react in either direction. However, given Salesforce’s attractive long-term risk/reward, I’m a buyer of CRM stock ahead of the Q3 FY2024 earnings release.

Key Takeaway: I rate Salesforce a “Buy” in the $220s.

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

How To Invest In This Environment?

In order to navigate this tricky economic period, we are pursuing “Bold, Active Investing with Proactive Risk Management” at our investing group – “The Quantamental Investor“. With a laser focus on valuations, profitability, and balance sheet strength, we are buying the winners of tomorrow! Furthermore, we are utilizing index-based options to guard against significant broad-market declines. Join us today to prepare for whatever the market may throw at you in 2024, now at a deeply discounted price this holiday season: