Summary:

- Salesforce faces heightened competition from AI startups, which are making software development cheaper and faster, challenging Salesforce’s premium pricing and market position.

- Despite robust earnings, Salesforce’s growth has slowed, and its forward P/E ratio appears overly optimistic given the increasing competition and potential margin compression.

- Salesforce’s legacy infrastructure and high costs to integrate advanced AI could hinder its ability to compete with more agile, AI-native startups.

- I am a strong sell for Salesforce, anticipating a forward P/E of 15 to better reflect the risks and competitive pressures ahead.

Sundry Photography

Investment Thesis

Salesforce (NYSE:CRM) has long been one of Silicon Valley’s flagship companies. Arguably, they are one of the biggest beneficiaries from the SaaS business model revolution and the enterprise migration to cloud-based software solutions.

Over the past 25 years, their core products, including CRM systems and enterprise cloud applications, have made them a leader in the market.

However, the rapid evolution of AI and the proliferation of AI sales-startups present more challenges than opportunities for the company in the long term in my opinion. Competition is now more fierce than ever for Salesforce. Even if they win against these AI challengers, this doesn’t mean they will come out the other side nearly as profitable.

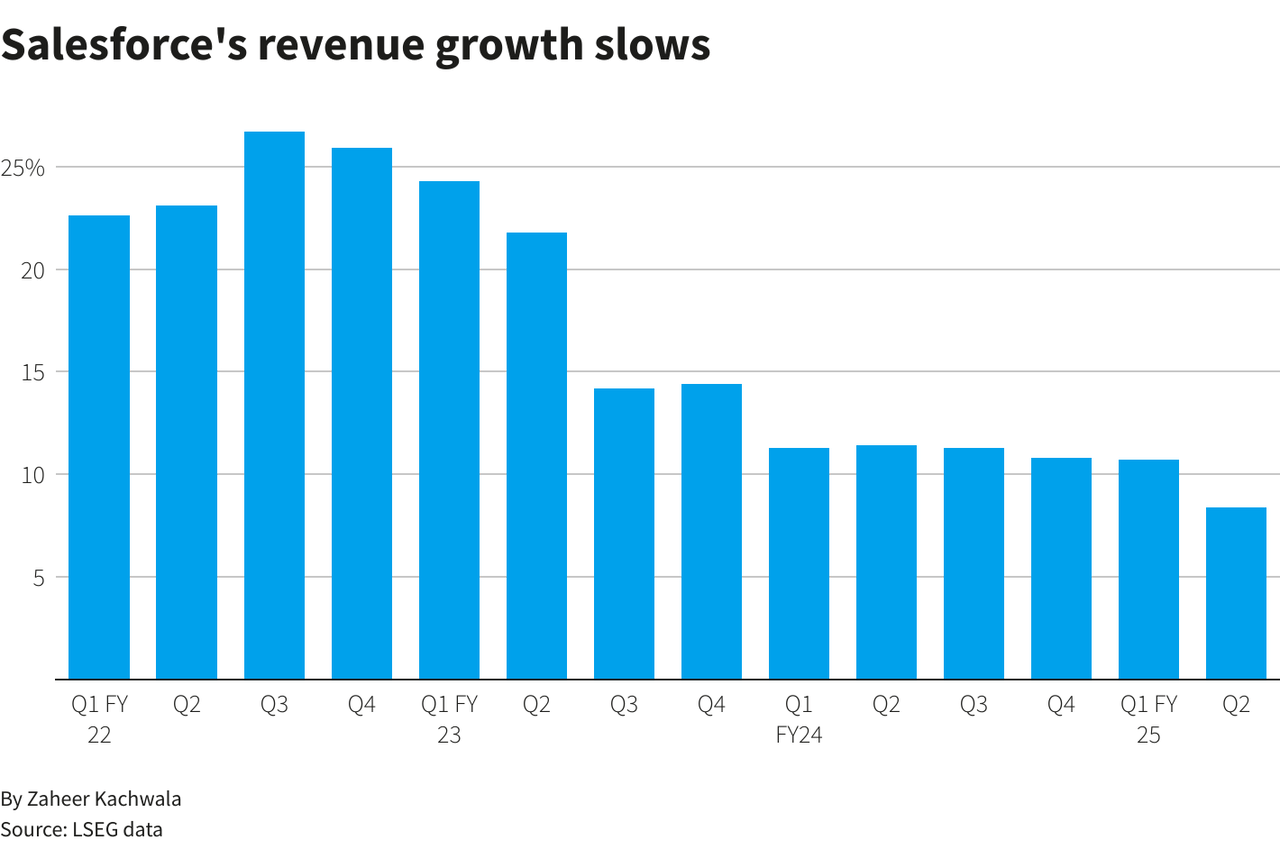

Already, Salesforce has experienced more tempered growth, with analysts painting a mixed picture with some revising revenue estimates downward and growth in more recent quarters clocking in at its slowest in years. Clear AI winners like Palantir (PLTR) are seeing growth go the other way (accelerate). I think this is telling.

Their growth, while steady, has slowed, particularly as enterprises start to evaluate AI challengers that claim to offer better service in their AI driven CRMs.

Despite a robust FY Q2 earnings report, where they beat estimates with $9.33 billion in revenue, the 8.39% revenue growth marks the slowest pace in over a decade.

Salesforce Revenue Growth (Reuters/LSEG)

In light of this, I think the company’s forward price-to-earnings multiple appear overly optimistic. I don’t think the current valuation sufficiently accounts for the risks posed by new competitors developing AI-native platforms.

Given this, I now see Salesforce as a strong sell. The competition from AI startups means Salesforce will need to spend far more for them to maintain market share and be competitive.

AI Is Making Software Cheap To Produce

We’ve all seen the recent advancements in AI and how this has lifted shares of tech companies on the hopes that their AI-infused businesses will see a strong pick-up in revenue. What these advancements are really doing is making software cheaper to develop as AI helps developers multiply their productivity.

OpenAI’s latest model, o1, for example, shows this transformation by making coding faster and more efficient. The o1 model’s key reasoning capabilities allow it to solve complex coding and scientific problems that were previously out of reach for traditional models and were mainly in the hands of highly skilled developers.

OpenAI’s o1 comes at a key time as another AI tool, Devin, offers even more granular benefits to the software engineering process, according to its developer Cognition.

The company claims that their product can autonomously write, debug, and deploy software across multiple programming languages, and act as an extra engineer. At its core this AI capability allows companies to scale their software development without needing to hire additional developers. It really reduces the costs of bringing new solutions to market.

In essence, what we’re seeing is that AI has swiftly extended beyond just being a text-completion tool like ChatGPT.

New models like o1 with deductive reasoning mean that a whole new suite of AI tools can handle increasingly complex coding problems. It means that startups can pursue innovation at a faster pace, which results in the technical gap between industry incumbents like Salesforce, and smaller competitors, like AI SDR (Sales Development Rep) Artisan. These smaller startups were once constrained by limited resources (they don’t have the billions of dollars that Salesforce does), but now have the potential to produce high-quality software that rivals long-established firms.

I think this is a real challenge for Salesforce. For the 25 years of existence, their decades of knowhow building the world’s largest CRM product acted as a moat for anyone else that wanted to build a competitor.

Now, however, Salesforce’s extensive legacy code could soon become a liability, especially as newer firms can pivot and innovate more quickly. Newer firms can build AI tools that are far more seamless with the SDR teams of today. Salesforce has code written for how SDRs have run their sales process historically. These two work-patterns are diverging.

Competition Is Everywhere, Software Prices Will Trend Down

ChatGPT’s launch in November 2022 started a wave of new software companies. Now, dozens of competitors have emerged. For instance, the AI company I mentioned before (Artisan) launched their sales development and automation tool Ava, which they claim functions as an AI-powered Business Development Representative (BDR) that automates 80% of outbound sales activities. The tool leverages data from over 300 million B2B contacts, streamlining lead generation, enrichment, and communication, according to Artisan, with minimal reliance on human intervention.

In contrast, Salesforce has integrated Einstein, their AI-driven platform, which is designed to assist in various aspects of customer relationship management (CRM). The platform allows for low-code development and is deeply embedded into Salesforce’s ecosystem that features predictive analytics, AI-powered email generation, and sales insights. Einstein also supports the development of custom applications and models, and is said to offer more flexibility for developers working across multiple business functions beyond sales, according to the company.

I will admit this is a key innovation, but Salesforce here is building a solution to fight the wrong competitor. Salesforce is assuming their objective is to make BDRs and SDRs more efficient. In reality, their competition is automating these roles away.

So their solution at its core will need to change fundamentally.

Aside from their competition, Salesforce itself faces stiff feedback from customers. The company’s key software tools have been getting negative feedback due to their premium pricing and clunky features. Salesforce’s pricing model, which is based on a subscription tier system, often becomes prohibitively expensive for smaller businesses. The higher-end packages with full access to Salesforce’s most advanced features, including Einstein, come at an even higher cost.

Customers report that the platform can be overly complex and difficult to navigate, especially for users that are not highly tech-savvy who complain about the steep learning curve, and with some users describing it as cumbersome and lacking intuitive user experience design.

In the past, Salesforce could face their competition head on and propose acquisition offers that they couldn’t refuse. This is now a huge challenge as US regulators tighten scrutiny on mergers and acquisitions through antitrust regulations.

Historically, Salesforce has relied on large acquisitions, such as their purchases of Slack and Tableau, to fuel growth and innovation. With increased regulatory barriers, I think the company will find it difficult to buy many of the new AI-focused startups, forcing them to compete directly rather than acquiring potential competitors.

Don’t get me wrong, the company is still doing acquisitions, such as Own at the beginning of this month for $1.9 billion, but this was not the buyout of a competitor.

What this means is that Salesforce must now enhance their internal R&D to remain competitive, especially in the face of rapidly advancing AI.

I still believe that Marc Andreessen’s famous 2011 claim that “software is eating the world” remains relevant today. However, it’s now closer to Nvidia’s CEO Jensen Huang’s quote from 2017:

Software is eating the world, but AI is going to eat software. -Huang.

AI Will Eat Software (Reddit)

Valuation

Salesforce continues to trade above the sector median in terms of its forward P/E ratio, sporting a valuation that exceeds many of its peers in the information technology sector, even while I think their risk to disruption is well above the median Information Technology firm.

The forward P/E for Salesforce stands at 26.33, compared to the sector median of 24.23, reflecting an 8.65% premium. Historically, Salesforce has traded at a premium because they were sporting growth that was strong and frankly unique.

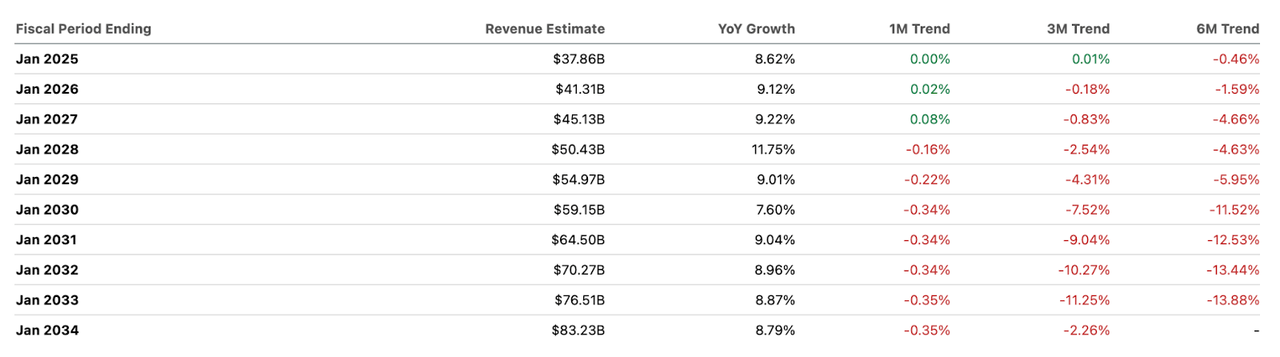

Now, revenue estimates for Salesforce have drifted downward, as analysts start to price in this increasing competition. Long run revenue estimates are starting to see notable, double-digit revisions. All of this has happened in the last 6 months.

Forward Revenue Estimates (Seeking Alpha)

With more competitors entering the market, Salesforce’s legacy software infrastructure, burdened by technical debt, could make it harder for them to respond quickly and cost-effectively. I think we’re going to see increasing price cuts in order to keep growth going. This could cause margins to compress.

As competition intensifies, I believe Salesforce’s shares should see a compression in their earnings multiple.

If we saw shares move down to a more reasonable 15 times earnings, I think this would more accurately reflect their increased competition but also their incumbency position in the industry. A forward P/E of 15 would represent 43% downside in shares.

Bull Thesis

Competition is real. So real that Salesforce recognizes it and has responded with their Einstein AI tool that I mentioned before.

To help accelerate Einstein’s development, they’ve also partnered with Nvidia to invest heavy into AI capabilities and build even more powerful AI agents to accompany their flagship CRM platform.

With my strong sell thesis I’m not arguing that the company is blind to its threats. Rather, I’m saying that the company is facing a combination of increasing costs and lower margins in order to stay relevant.

Integrating advanced AI into their existing platform is expensive. As more cost-effective AI solutions enter the market, I think they’re going to be forced to lower their prices to remain competitive, particularly as startups are developing fully autonomous sales development representatives.

My forward P/E ratio of 15 assumes that the company stays relevant and continues to be a key part of many enterprise workflows. But it also assumes that competition will eat away at its margins and market share.

Takeaway

Salesforce has built a robust platform, but the rise of AI has made software development cheaper, and this now challenges their premium pricing strategy that that company has become revered for.

As software becomes more customized (via AI), I think that the company will struggle to command the same price points. AI-driven automation is accelerating competition in the software market, and Salesforce’s legacy infrastructure is burdened by 25 years of code. Given these dynamics, I think the company’s forward price-to-earnings ratio appears too optimistic, and I see Salesforce as a strong sell. If we saw shares converge on a forward P/E of 15 I think this would more accurately reflect the risks the company faces ahead. Salesforce is not going out of business. But they are going to have to undergo a major change in order to survive. Right now, they are not a winner in my opinion.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.