Summary:

- Salesforce has had a difficult 18 months, with high-profile executives leaving the company.

- The stock is close to being as cheap as it’s ever been, but that doesn’t make it a buy.

- Activist pressure could yield positive results, but the outcome is far from certain.

FinkAvenue/iStock Editorial via Getty Images

Thesis

Salesforce (NYSE:CRM) has had a tumultuous twelve months. The client relationship management software giant has had a number of public struggles in regard to establishing a solid succession plan for CEO Marc Benioff, with two high-profile executives who were slated to take over the top job leaving. The company has struggled to grow organically as well, relying on acquisitions as the primary engine of growth.

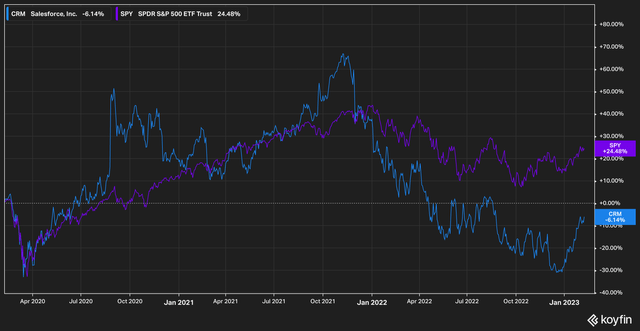

CRM stock has traded largely sideways for the past three years.

Investors in the last three years have been rewarded with a negative 6% return versus a return from the S&P 500 of 24%.

To boot, activists have taken interest in the company, posing further questions about the direction of Salesforce in the future. In this article we will break down what we believe are Salesforce’s prospects for the future and cover some of what we believe are the current major pain points for investors.

Acquisition-Drunk

It’s no secret that Salesforce is a serial acquirer. In 2021 the company completed its largest acquisition ever when it purchased Slack for $27 billion dollars. The deal was not without critics at the time, not least of which were concerns about the overall price of the deal especially when you considered that Slack was unprofitable.

The move came after a period when Benioff had stated that Salesforce wasn’t interested in acquisition, and the purchase itself wasn’t an immediately obvious value-add for Salesforce. It is unlikely, for instance that enterprise sales teams were clamoring for a better way to connect that wasn’t being supplied by Salesforce’s current management software, and, in the event that they were, it stands to reason that Salesforce–itself a software company–could simply develop a messaging service itself. Presumably for less than $27 billion.

At any rate, after a short honeymoon phase things deteriorated with Steward Butterfield, slack’s CEO. He announced his departure from the company only a week after Bret Taylor, Salesforce’s co-CEO, announced his departure.

These departures followed a long, grinding downward trend in the stock’s price, and served as the cherry on top for investors to start asking–what’s going on at Salesforce?

Stock-Based Comp

Silicon valley companies often suffer from a particular disease, one that affects shareholders particularly badly–an addiction to stock-based compensation. This practice, while useful in retaining and attracting talent, is easily abused, and we can’t help but point out that Salesforce is a heavy user of the tool.

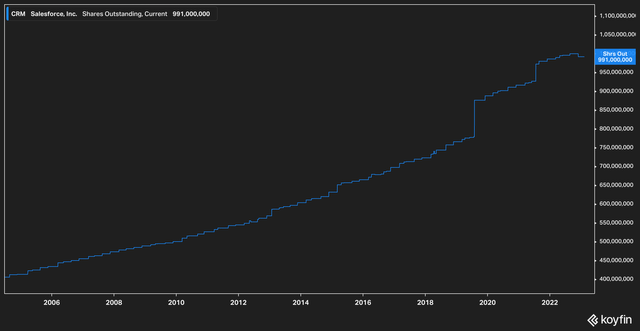

CRM Shares Outstanding (Koyfin)

The chart above shows the outstanding share count of Salesforce for the duration of its life as a public company. The chart paints a picture of serious dilution for shareholders, with the amount of outstanding shares growing by a whopping 144% from first count.

Those with a short term focus will point out that Salesforce recently bought back over a billion dollars‘ worth of stock in a move that investors applauded–but it’s a cold comfort for long-term shareholders against the dilution they’ve already experienced. In fact, you can see the effect of $1 billion in share repurchases in the upper right corner of the chart. On the larger timeline, it’s clear what an insignificant blip it is.

Enter The Activists

When you add together all the ingredients: a major company with a lagging share price, high-profile executive exits with little explanation, questionably expensive acquisitions, and heavy amounts of share-based compensation, you are likely to get one thing–activist investors.

The activists that have begun to take stakes in Salesforce are heavy hitters. Mentioning the name of Paul Singer, founder of Elliott Management, probably causes board members to break out in cold sweats. Jeff Smith of Starboard Value cuts a bit more of a cuddly figure, but he nonetheless has waged high-profile takeover campaigns at major companies like Darden Restaurants (DRI). Recently, Dan Loeb of Third Point also waded into the fray.

These three are not idle figures. It is likely they are working actively with the company at the highest levels now to enact changes. Singer, whose company has a multi-billion dollar stake in Salesforce, often works to install his own representatives on boards of the companies he invests in. And Starboard Value recently published a slide deck outlining their concerns about Salesforce’s growth rates and profitability.

While information on what activists intend to do is currently limited, their mere presence has shifted us overall from negative to neutral on the company, especially given the track record of the activists involved.

A Question Of Value

The tumult surrounding Salesforce, combined with slowing organic growth prospects, have taken its toll on the stock.

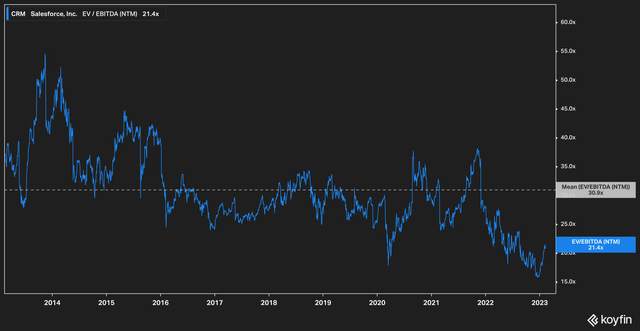

Salesforce currently trades at 21x forward EV/EBITDA, well below the 10-year average of 30x. For reference, we prefer this metric as opposed to forward price to earnings, as earnings can often be clouded by various accounting practices. EV/EBITDA helps us assess the company as a potential buyer would.

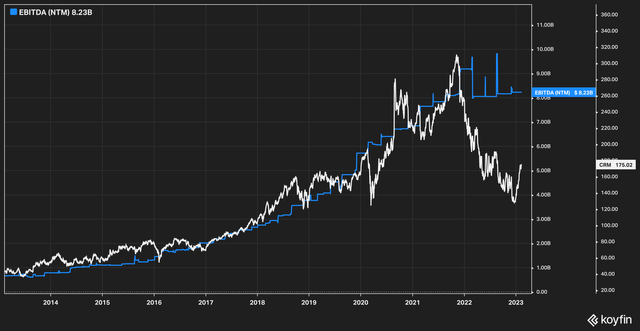

More striking, however is the breakdown in Salesforce’s price-to-EBITDA relationship.

When you layer Salesforce’s stock price over its NTM EBITDA estimates, a pattern quickly emerges. For the last 10 years the stack has only rarely traded at a discount. 2022, however, changed all that. The stock currently trades at a massive discount to its NTM EBITDA.

So does that make the stock a buy? Not necessarily. EBITDA growth estimates, as you can see in the chart and as we have noted above, have stalled out. Since stocks are valued on future earnings potential, it makes sense that this relationship would break down.

But wait, there’s more. Looking under the hood of the business raises some additional red flags. Specifically, we have concerns about Salesforce’s returns on capital.

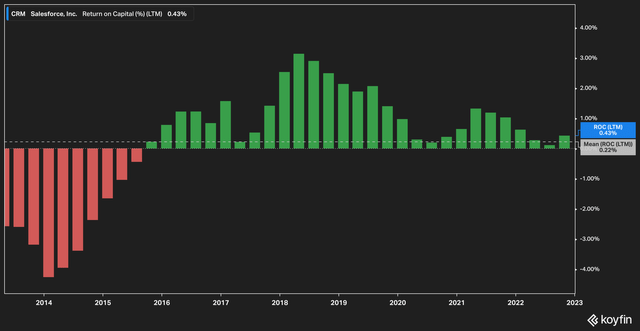

For the last 10 years, on a trailing-twelve-month basis, Salesforce has never exceeded a return on capital of more than 3.5%. More troubling, ROC is declining quarter by quarter on average.

This alarms us for a few reasons (some of the same reasons, we suspect, that drew the attention of activists). When a company struggles to deliver consistent and high returns on capital, questions arise about the company’s ability to deploy capital in an effective manner.

Further, the company must earn a greater return on its capital than its cost of capital if it wants to avoid a slow, grinding fate. Given that the risk-free rate is currently just south of 5%, we would conservatively estimate the cost of capital for Salesforce to be in the 9% range.

This is, we hope, an area that activists will address.

The Bottom Line

We had been working on an article about Salesforce for some time when it was announced that activists were getting involved with the company. These announcements, in our view, materially changed the outlook from negative to uncertain.

As such, we believe that Salesforce is likely to undergo a serious transformation over the next 12-24 months. If the activists are successful in installing one or multiple board members, it is unlikely in our view that Marc Benioff will remain the CEO much longer (this isn’t a surprise–he’s actively been trying to find his replacement for some time).

Thus, for all the reasons outlined above, we approach Salesforce with caution. The abundance of uncertainty surrounding the stock will keep us on the sideline for the time being.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.