Summary:

- Salesforce has recovered from a May selloff, showing robust sales and profit growth, and closed its stock chart gap, a bullish indicator.

- The company is undervalued at 22x leading profits, with strong growth prospects, share repurchases, and a new AI acquisition to boost future growth.

- Salesforce’s 2Q25 earnings were strong, with operating income up 21% YoY, and the company raised its profit guidance for the current fiscal year.

- The acquisition of AI voice agent firm Tenyx highlights Salesforce’s commitment to leveraging AI, enhancing its CRM platform’s appeal and growth potential.

JHVEPhoto

Salesforce Inc. (NYSE:CRM) went through a period of panic selling in May, but the stock has fundamentally recovered and even managed to fully close its gap in the stock chart, a bullish indicator.

In the last quarter, Salesforce also produced solid growth in terms of sales and profits, aiding its stock price recovery.

I think that Salesforce is a widely undervalued software-as-a-service investment for investors and the company’s share repurchases are providing support.

Salesforce is selling for a mere 22x leading profits though the company is growing quickly and just announced a new AI acquisition to boost its growth.

My Rating History

My last stock classification on Salesforce was Buy as the stock plummeted in May and a quickly expanding total addressable market as well as significant growth opportunities for the cloud-based customer relationship management platform made the stock compelling, in my view.

Salesforce appears to be on a solid recovery path and 2Q25 earnings were quite robust. I think CRM offers investors a favorable risk/reward relationship, particularly because the stock is so cheap.

Salesforce Is Growing Quickly, Has Enormous Profitability

Salesforce is a leading SaaS company that impresses first and foremost with its consistent and expanding profitability. Salesforce offers its customers, most of which are businesses, tools to integrate data, streamline processes, and automate tasks that free up human resources and help companies save money.

Specifically, Salesforce is a leader in the market for customer relationship management software and has a unique opportunity to leverage artificial intelligence to grow its scale moving forward.

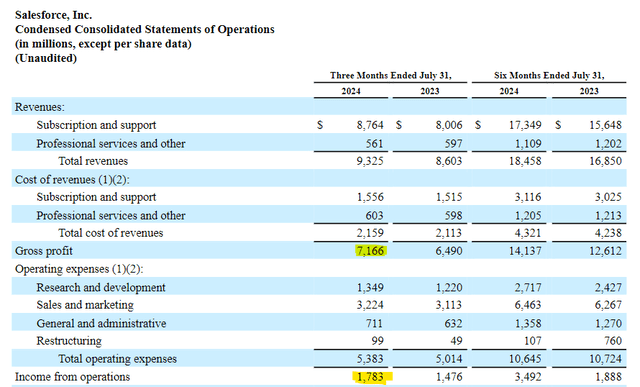

In the second quarter, Salesforce produced total sales of $9.33 billion, up 8% YoY. Salesforce’s subscription sales, however, rose 9% YoY to $8.76 billion. The software company is quite profitable and generated $7.17 billion in gross profits in the second quarter, up 10% YoY. Gross profit margins amounted to 77%, up from 75% in the year ago quarter.

Gross Profit (Salesforce Inc.)

Some investors like to focus on gross profits while others prefer to primarily zero in on operating income as a key metric that is worth analyzing. For me, I prefer operating income because it reflects the impact of a business’ total expense structure, including research & development, sales & marketing and general & administrative expenses. In some cases, even non-recurring restructuring expenses are reflected in operating income.

Salesforce’s operating income reached $1.78 billion in 2Q25, up 21% YoY. This 2Q25 operating income reflected a margin of 19% compared to 17% in 2Q24.

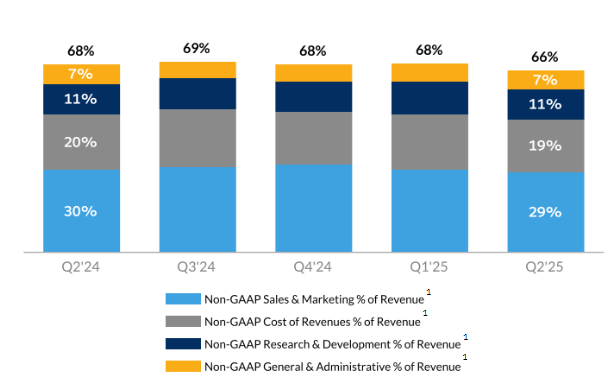

The software-as-a-service company has been able to grow its (GAAP) operating income margins predominantly as it put the screws to its expenses, particularly cost of sales and sales & marketing. Salesforce has more margin upside moving forward and one way to improve margins and grow sales is through the acquisition of new companies.

GAAP Operating Income Margins (Salesforce Inc.)

Growth could be fueled by acquisitions which is always an easy fallback option for companies that see slowing sales growth. In this regard, Salesforce just signed an agreement to acquire AI voice agent company Tenyx.

The Tenyx acquisition plays a crucial role in the company’s attempt to utilize AI technology to improve its products and services. The acquisition also comes on the heels of a strategic partnership with Workday to develop a personalized, AI-powered assistant for employees.

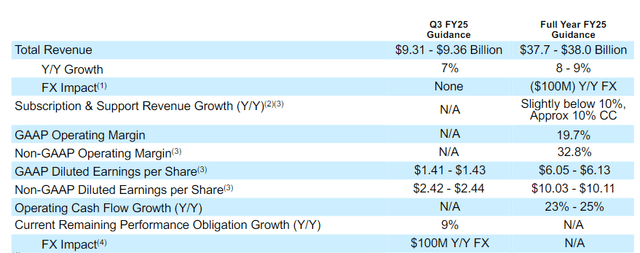

Salesforce Forecast

The software-as-a-service company revised its profit guidance higher in August and now anticipates $10.03-10.11 per share in adjusted profits, up from $9.86 to $9.94 per share in the prior quarter. The guidance does not include the impact of the company’s latest acquisition.

Guidance (Salesforce Inc.)

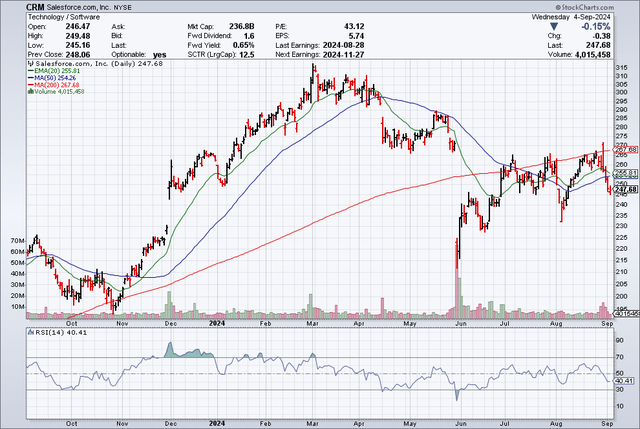

Technical Chart Setup

Salesforce crashed through the 20-day and 200-day moving average lines in May as the company guided for slower sales growth in 2Q25, triggering a panic selloff. However, Salesforce’s stock has steadily recovered since and even closed its yawning gap in textbook fashion at the end of August. Salesforce’s stock is now technically in neutral territory (the Relative Strength Index is at 40.4). Presently, the stock is going through a bit of a pullback which caused the stock to fall again below the 20-day and 50-day moving average lines.

The raised profit forecast and the latest acquisition news could help lead a retracement, however, and taking into account Salesforce’s low valuation based on profits, I think investors would want to be a buyer here.

Moving Averages (Stockcharts.com)

Sales Multiple

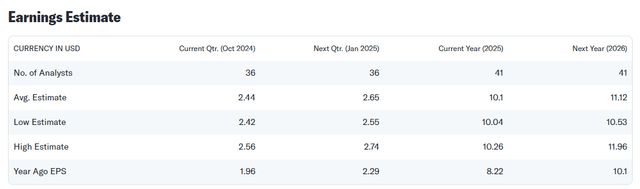

The market models $11.12 per share in profits for Salesforce for next year which reflects a YoY profit growth rate of 10%. In the present financial year, Salesforce is expected to see a 23% profit jump compared to last year and estimates have moved broadly to the upside since my last review of the CRM company. This means that the software-as-a-service enterprise is presently valued at a leading profit multiple of 22x.

Oracle Corp. (ORCL) is also selling for a 22x profit multiple and the CRM company is anticipated to see 15% profit growth next year. ServiceNow Inc. (NOW) is selling for 50x sales and the company is looking at 20% profit growth next year.

I think that Salesforce is the most attractive in CRM market here as the company is first, a market leader, focused on acquisitions and repurchasing shares.

In February, Salesforce announced a $10 billion increase in its share repurchase program which should yield substantial support for the company and limit any future downside potential.

Earnings Estimate (Yahoo Finance)

Why The Investment Thesis Might Not Work Out

With artificial intelligence experiencing wide-spread acceptance and adoption, smaller CRM companies now have the opportunity to compete with the big companies in their industries on a level playing field. Artificial intelligence, so to speak, is a great equalizer and makes the competitive position of large CRM companies like Salesforce more vulnerable to new market entries.

If Salesforce’s customers cut back spending on its CRM tools and AI products, then the company might suffer a substantial sales slowdown and lower profitability.

My Conclusion

Salesforce is growing its sales and profits, and the software-as-a-service company is anticipated to keep growing fast, a reflection of robust demand for its products that help companies integrate, scale and automate crucial sales processes, among other things.

Salesforce raised its profit forecast for the present financial year as well and just completed, from a technical angle, a textbook gap close which is a bullish indicator.

Salesforce also just announced that it was acquiring AI voice agent firm Tenyx which means the company is doubling down on the artificial intelligence opportunity.

Investors are presently paying just 22x leading profits for Salesforce customer relationship management platform and I think that the company has considerable opportunities to enhance the appeal of its software products by leveraging artificial intelligence.

All things considered, 2Q25 earnings were robust and the risk/reward relationship remains favorable.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.