Summary:

- Intel is rapidly transforming into a top U.S. foundry company to manufacture high-end semiconductors, with government funding support.

- Intel’s new business setup and reinvestment effort could support significant sales/income growth into 2029.

- With one of the lowest valuations in the Big Tech semiconductor sector, any unexpected rebound in earnings could catapult Intel past Nvidia for shareholder returns in coming years.

- Intel appears to be everything Nvidia is not during the summer of 2024.

Dilok Klaisataporn

I am upgrading my outlook for Intel (NASDAQ:INTC) to Buy, after suggesting a Hold to Avoid rating for a number of years. My May 2022 article here summed up the “value trap” problem plaguing the stock. Following form, the share quote has gone nowhere to down the last 24 months.

Seeking Alpha – Paul Franke, Intel Article, May 31st, 2022

Yet, after several years of heavy investment into new plant & equipment, Intel’s reimagined focus on becoming a leading foundry fabricator for the whole semiconductor industry in North America has essentially been ignored by Wall Street. Sure, excessive levels of capital spending have slashed earnings and free cash flow generation upfront. But, this business investment spree could pay off in a major way over the next couple of years for shareholders.

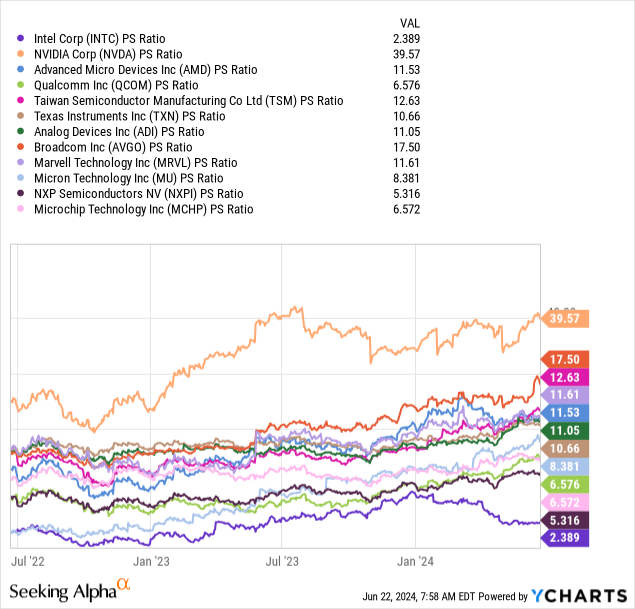

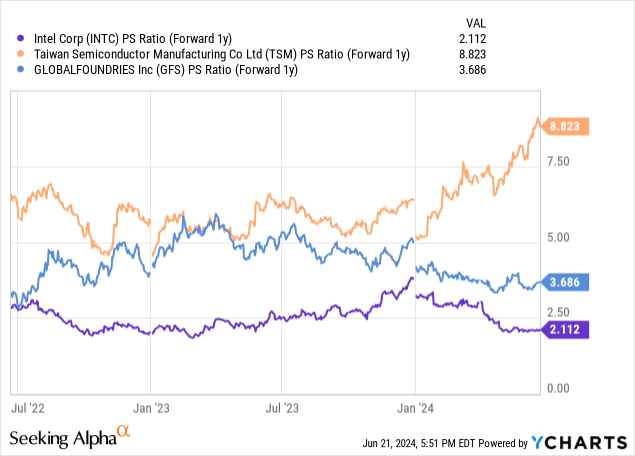

At this juncture, Intel’s cheap valuation vs. similar Big Tech semiconductor names appears to be an exercise in trailing frustration, not one anticipating a bullish upturn in operating results. As measured by the top line and important price to sales ratio against semiconductor competitors and peers, Intel’s dislike by investors has reached extreme proportions in the summer of 2024. Using this yardstick, Intel is selling for a whopping 78% discount to the industry median average today (2.4x vs. 11x)!

YCharts – Intel vs. Largest Semiconductor Names, Price to Trailing Sales, 2 Years

My bottom line… when I cross the ideas of rising future earnings with an insanely low valuation vs. peers, Intel’s buy argument now stands out in the sector. It’s a much better investment setup than a few years ago, and a completely contrarian way of viewing reality.

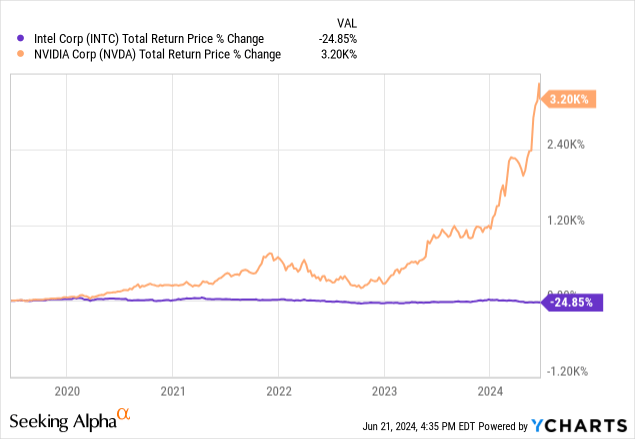

Honestly, Intel is everything NVIDIA (NVDA) is not. Despite operating in the notoriously cyclical semiconductor space, Nvidia’s record-breaking leap in price (to an unheard of level as the most valuable U.S. company by equity market capitalization over $3.2 trillion) has been pushed on the average investor everywhere you read business news stories or watch stock market-related television. In stark contrast, Intel’s $130 billion market cap (4% of Nvidia) appears to be sitting in the exact opposite investor sentiment position, completely kicked to the curb, with a brighter future than most realize.

Let me explain why I recently bought unloved Intel shares, the undervalued gem in the semiconductor space, during June 2024.

Business Turnaround in Progress

Intel has missed out on many of the new chip markets created over the past decade plus, like the revolutionary AI semiconductor inventions of Nvidia, or chips for the Apple (AAPL) iPhone. During 2023-24, management has been playing a game of catchup to stay relevant in the AI space.

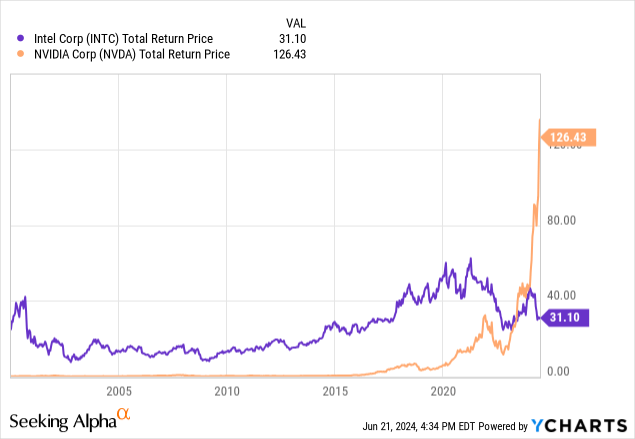

The king of PC processors starting in the early 1980s has been searching for an encore with limited success. It has entered an array of markets as a worthy competitor, but profit results have been mixed. This struggle is clearly evident in a flatlined total-return stock pattern, really since the original 1990s technology/dotcom stock boom peaked in the year 2000. In terms of recent performance, comparing the largest winner of the Tech 2.0 bubble, Nvidia, with declining business sales at Intel highlights the dichotomy between past and present chip market dynamics.

YCharts – Intel vs. Nvidia, Total Return Price, Since January 2000 YCharts – Intel vs. Nvidia, Total Return Percentage Change, 5 Years

But, here’s the rub. Nvidia is now priced for perfection. Valuation ratios have reached some of the highest readings for any company since the original technology boom ended 24 years ago. And, while I do expect Nvidia sales to increase rapidly for a few more years, actual business profitability could turn lower as intense AI-based competition heats up from every major semiconductor name. In the end, incredible profit margins during 2023-24 at Nvidia are set to plummet from new AI-chip entries. Don’t fool yourself. Economic forces and the profit incentive all but guarantee Nvidia margins will decline from early 2024 levels. It’s the same competition problem Tesla (TSLA) is now facing. Decent sales growth, absent much for operating income.

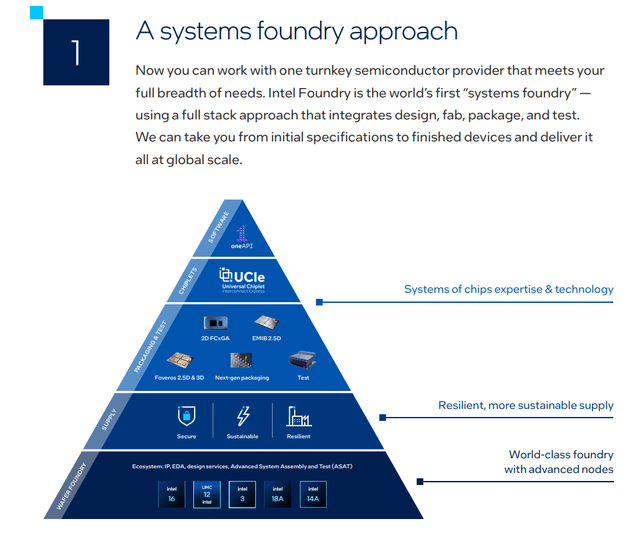

Intel, on the other hand, has decided to transform itself into the top U.S. foundry company. Outsourcing fabless companies without production assets will increasingly have the option to manufacture high-end state-of-the-art semiconductors inside America. If you will, Intel is investing tens of billions to quickly steal the thunder of Taiwan Semiconductor Manufacturing (TSM) in Asia, as the new go-to U.S. resource for hundreds of fabless chip firms in North America.

Intel Website – Foundry Services, June 21st, 2024 Intel Website – Foundry Services, June 21st, 2024

With the help of tax breaks and subsidies from the CHIPS and Science Act of 2022, the U.S. government is shouldering a significant portion of Intel’s construction effort ($8.5 in proposed direct funding, income tax credits of up to $25 billion, and $11 billion in low interest-rate federal loans) for Intel’s record-breaking $100+ billion investment in its U.S.-based future over five years (up to $200 billion globally). According to a March 20th, 2024 press release,

… the U.S. Department of Commerce and Intel Corporation announced a preliminary memorandum of terms under which Intel will receive approximately $8.5 billion in direct funding under the CHIPS and Science Act. Funding will help advance Intel’s critical semiconductor manufacturing and research and development projects at sites in Arizona, New Mexico, Ohio and Oregon – U.S. locations where the company produces some of the world’s most advanced chips and semiconductor packaging technologies.

CHIPS Act funding aims to increase U.S. semiconductor manufacturing and research and development capabilities, especially in leading-edge semiconductors.

Intel is the only American company that both designs and manufactures leading-edge logic chips. The company’s strategy is centered on three core elements – establishing process technology leadership, building a more resilient and sustainable global semiconductor supply chain, and creating a world-class foundry business – all of which align with the objectives of the CHIPS Act to bring manufacturing and technology leadership back to the United States.

Together, CHIPS Act funding and Intel’s previously announced plans to invest more than $100 billion in the U.S. over five years constitute one of the largest public-private investments ever made in the U.S. semiconductor industry.

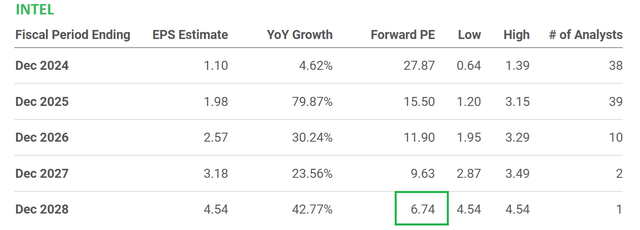

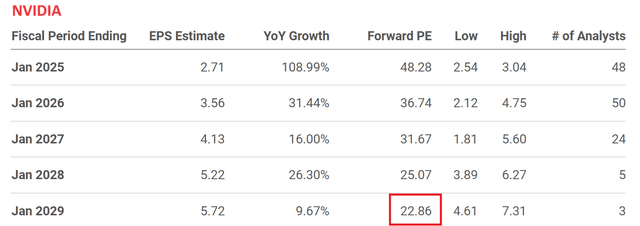

Obviously, the Intel business setup of 2029, five years into the future, will be quite different than today. To boot, its sales and income growth performance over time could be quite eye-popping again, just like the 1990s. Don’t just take my word for it. Review Wall Street forecasts for super-sized growth in EPS for Intel vs. Nvidia after 2024 has ended. Believe it or not, the 2028-29 P/E ratio projection under 7x for INTC (boxed in green below) looks dramatically more appetizing the Nvidia’s still outrageous and likely overoptimistic 23x forward estimate (boxed in red)!

Seeking Alpha Table – Intel, Analyst Growth Projections, Next 5 Fiscal Years, Made June 21st, 2024 Seeking Alpha Table – NVIDIA, Analyst Growth Projections, Next 5 Fiscal Years, Made June 21st, 2024

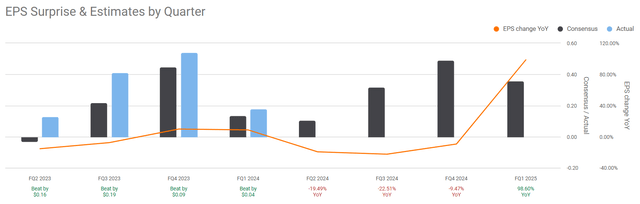

When will Intel’s income trend reverse higher? Wall Street analysts are projecting weak earnings to continue throughout 2024. Then, a positive acceleration in EPS is slated to start during Q1 2025. So, if the stock market anticipates major business changes 3-6 month in advance (common Wall Street lore), Intel could be ready to rebound in the weeks ahead.

Seeking Alpha Table – Intel, Quarterly Analyst Estimates & YoY Growth Rate, Q2 2023 to Q1 2025

So, if you want to invest in the future, not the past, Intel may prove a materially better choice for your portfolio than alternative semiconductor picks including Nvidia, starting right now. I know it’s hard to swallow, if you cannot take your eyes off the minute-to-minute quote changes in high-flying Nvidia. However, the math is the math.

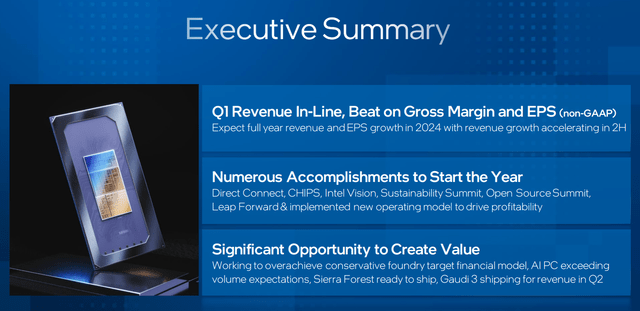

Intel – Q1 2024 Earnings Presentation Intel – Q1 2024 Earnings Presentation Intel – Q1 2024 Earnings Presentation

Valuation Differences, Low vs. High

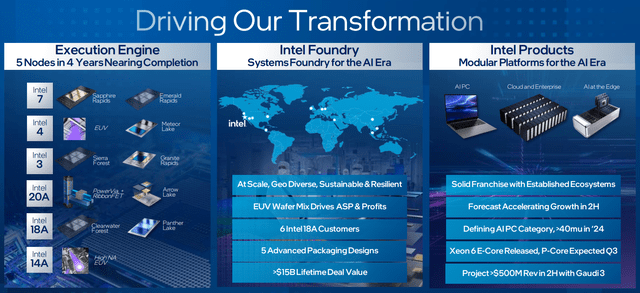

The largest contrast in valuations between the most hated Big Tech semiconductor firm and the most loved is seen in the price to tangible book value number. Intel is sitting at 1.8x its net tangible assets (on cost accounting and depreciated values) vs. Nvidia’s 71.1x.

YCharts – Intel vs. NVIDIA, Price to Tangible Book Value, 1 Year

Of course, tangible book value is more of a net liquidation idea, when a company is struggling or going out of business. However, when we look at other data points, the distance between investor valuations of the two businesses is equally as wide.

When we include equity and debt totals for each business, then subtract cash holdings, enterprise valuation [EV] stats give us a useful comparison of total business worth vs. underlying operating results.

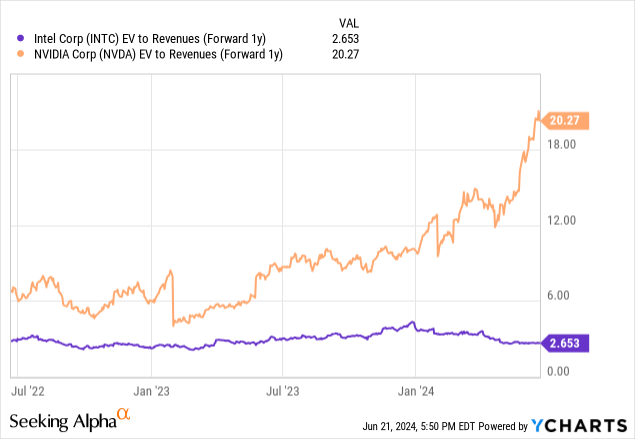

In this exercise, EV to forward 1-year sales takes into account immediate expected advances (or declines) in operations, with a theoretical net-zero debt setup for each. In many respects, enterprise value calculations are the easiest and most direct way to compare apples to apples, if you will, from two companies that might be operating with vastly different balance sheets and management styles. While Intel and Nvidia traded closer to parity on EV to sales during early 2023, today’s spread valuation is quite extraordinary. Intel’s 2.7x ratio is measured against 20.3x for Nvidia.

YCharts – Intel vs. NVIDIA, EV to Calendar 2025 Sales Estimates, 2 Years

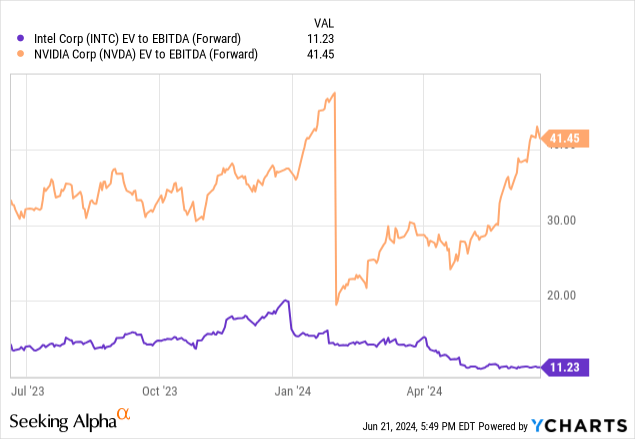

EV to EBITDA multiples are almost as far apart as sales. Intel’s 11.2x ratio is quite reasonable, on core cash generation basically sitting at a depressed level today. If higher growth rates are coming for Intel, at rates the same or higher than Nvidia after 2024, why do I want to own Nvidia’s outrageous 41.45x EBITDA multiple on PEAK income margins???

YCharts – Intel vs. NVIDIA, EV to Calendar 2024 EBITDA Estimates, 1 Year

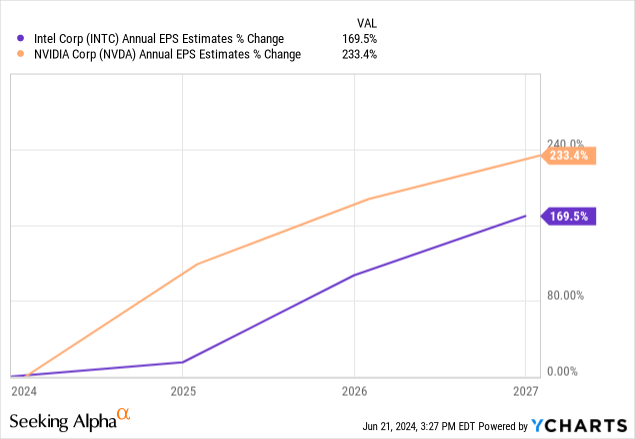

For future shareholder returns, it really comes down to approaching EPS growth at Intel. After 2024, Wall Street analysts are projecting Intel income expansion rates the same or better than Nvidia. Plus, I honestly believe Nvidia’s EPS growth will stall from competition, while Intel’s new foundry business could support steady and exceptional growth over the next 5-10 years.

YCharts – Intel vs. NVIDIA, Analyst Estimates for EPS Growth into 2027

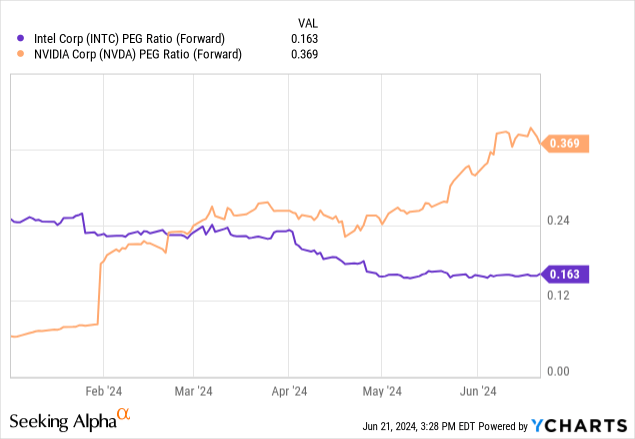

Perhaps the best indicator that illustrates the direction of stock pricing as a function of expected earnings growth is the PEG Ratio. When we take into account estimated earnings growth as a function of the P/E valuation, Intel is looking more interesting by the day in 2024. On a forward projected EPS basis, Intel has moved from a reasonable PEG idea at $50 per share to very undervalued over six months at $31 per share. Flipping the script, Nvidia’s split-adjusted price under $50 in early January has exploded to $125 today. And, on the graph below, you can see the forward PEG valuation has quadrupled. Why not invest in the lower valuation – strong earnings rebound candidate, is my question to you?

YCharts – Intel vs. NVIDIA, P/E to Forward Growth PEG Ratio Estimates, Since Jan 2024

Chart Trading Momentum

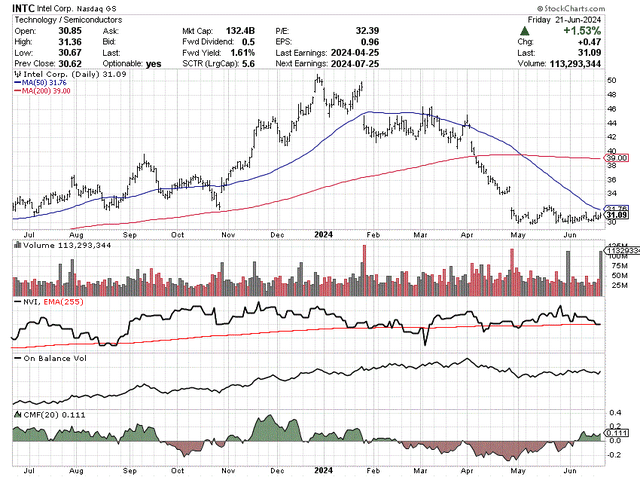

Despite lagging share performance from Intel over the past 12 months, serious selling pressure does not appear to be part of the problem. It’s been a string of disappointing Intel earnings releases, matched against new capital rushing into the AI darlings of the day.

You can review below how the Negative Volume Index (measuring trading inflows/outflows on slower volume days) and On Balance Volume indicators have been zigzagging higher in a healthy fashion.

Price has been basing for months, and could be ready to jump above its 50-day moving average for the first time since January. Another bullish sign is the 20-day Chaikin Money Flow reading has been in positive territory for several weeks.

As a consequence, I am getting prepared for a price reversal higher soon. In my research, a material and sustainable down move in price from $31 may be possible only with a large selloff in Big Tech names generally (which remains a serious risk to contemplate before buying any stock on Wall Street in June).

StockCharts.com – Intel, 12 Months of Daily Price & Volume Changes

Final Thoughts

Intel could morph into a huge Big Tech winner without warning, if China gets serious about invading Taiwan, or at least changes (through military and political pressure) the current low-risk supply chain argument for semiconductors from TSM production. For example, Nvidia sources most of its chip supply from Taiwan, which could become a huge operational risk overnight. Any slide toward heightened Chinese belligerence could cause geopolitical shock waves in the high-tech community, where fabless firms contract future production to new Intel facilities under construction.

In fact, “safer” supply-chain sourcing could be the main reason to consider adding Intel to your portfolio at reduced share pricing this summer, given an estimated 75% of high-end semiconductor supply globally comes from Southeast Asia. Under worst-case scenarios for geopolitical trouble in Asia, the transformed Intel as a leading foundry organization could stand tall as a critical national-security asset to own, supporting a local chip infrastructure and supply chain (with leaping operating profitability down the road).

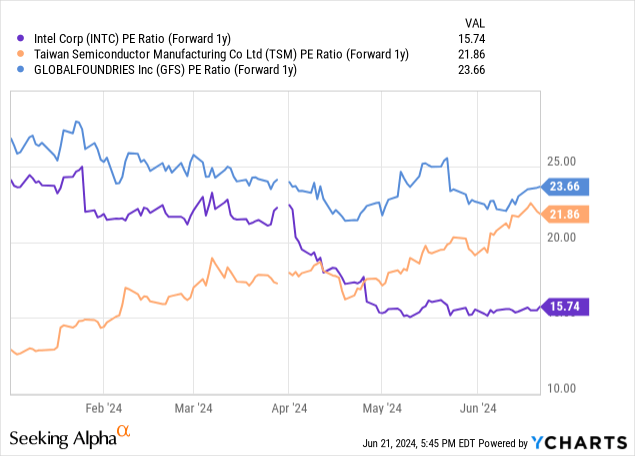

The hybrid business model of producing its own chips and manufacturing product for fabless outsourcing companies like Nvidia could be the winning design for shareholders. In this vein, comparing Intel’s valuation to the top two chip foundry businesses makes sense. My conclusion: Intel appears to be just as amazingly inexpensive vs. both Taiwan Semi and Global Foundries (GFS). On price to forward 1-year estimates for earnings and sales, Intel remains an outlier bargain.

YCharts – Intel vs. Taiwan Semi & Global Foundries, Price to Estimated 2025 Earnings, Since Jan 2024

YCharts – Intel vs. Taiwan Semi & Global Foundries, Price to Estimated 2025 Sales, Since Jan 2024

What are the risks owning Intel around $31 per share? The primary headwind risks would be a Big Tech bust in share pricing overall on Wall Street, and/or an industry-wide recession in chip demand. I do feel both have decent odds of playing out into 2025 (25% to 50% range). For sure, the likelihood or not of Intel trading down to $25 or even $20 in a deep, prolonged recession are worth weighing in your decision process.

I will interject, I fully expect Intel to “outperform” the chip sector, no matter which direction general stock pricing trends move. If Intel does decline by -20% or -30% in price over the next 3-6 months, the semiconductor space would almost surely fall at a greater pace, perhaps to the tune of -40% to -50% from its clearly overvalued position currently (led by Nvidia).

Nevertheless, Intel’s upside potential in future years is quite substantial at $30. Fair value targets of $60 to $80 are not out of the question over the next five years, especially if analyst estimates prove on the low side of reality. Total returns of +15% to +20% annualized, including 2% in yearly dividends, are my forecast on today’s $31 purchase number. A P/E multiple of 15x $4.50 EPS and 3x sales of $90 billion gets you closer to $70 for price by late 2028.

In terms of buying on weakness, prices of $25 or $20 could open a rare opportunity to compound money for long-term investors. With a $70 quote forecast in five years, buying at $20 could support future annualized total returns in the +25% to +35% range.

When I review all the pros and cons, Intel may be sitting in the exact opposite investment position as Nvidia, bullish vs. bearish. A very low INTC valuation vs. an extremely high NVDA one is the loudest difference. Unusual negative investor/analyst sentiment about the old-school semi king vs. insanely optimistic views on the world’s AI-chip leader is another. Plus, the hard to accept forecasts of rebounding Intel earnings vs. sharply decelerating income growth at Nvidia (on exploding AI competition), round out the foundational ideas to consider when investing for the future.

I am upgrading my rating of Intel to Buy, and own a small position. My plan is to increase portfolio exposure and sizing if the stock quote declines appreciably under $30. I peg Strong Buy territory under $25, all other variables remaining the same.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.