Summary:

- Schlumberger has 4 key revenue streams and operates globally. Its narrative is focusing on capital discipline, operating efficiency and margins as it improves margins.

- Schlumberger’s strong cash flows provides flexibility to give back to shareholders through share repurchases and dividends. Its optimized, de-levered financials brings more synergies through strategic acquisitions for future development.

- The industry outlook does not provide assurance to investors, especially for a cyclical sector like energy. However, Schlumberger’s broad portfolio, long-term contracts and upstream specialty enhances resilience to short-term fluctuations.

- Schlumberger remains well-positioned to scale the latest energy technologies, either as licensed solutions or through partnerships with their growing customer network. This will let them lead the front in the next-generation of energy services.

- Given its current undervaluation and the gradual recovery of the US economy, I rate Schlumberger a buy.

AdrianHancu

Schlumberger – Overview and Analysis

Schlumberger (NYSE:SLB) is an energy giant that operates in the oilfield services industry. It provides solutions for customers worldwide to balance secure, affordable energy while advancing decarbonization efforts for a sustainable future. Their value lies in offering advanced technologies for exploration, production and reservoir management, which help customers optimize performance, reduce costs, and accelerate returns. This is done by decarbonizing the industry, innovating in oil and gas, scaling new energy systems and delivering digital at scale.

Macro Outlook

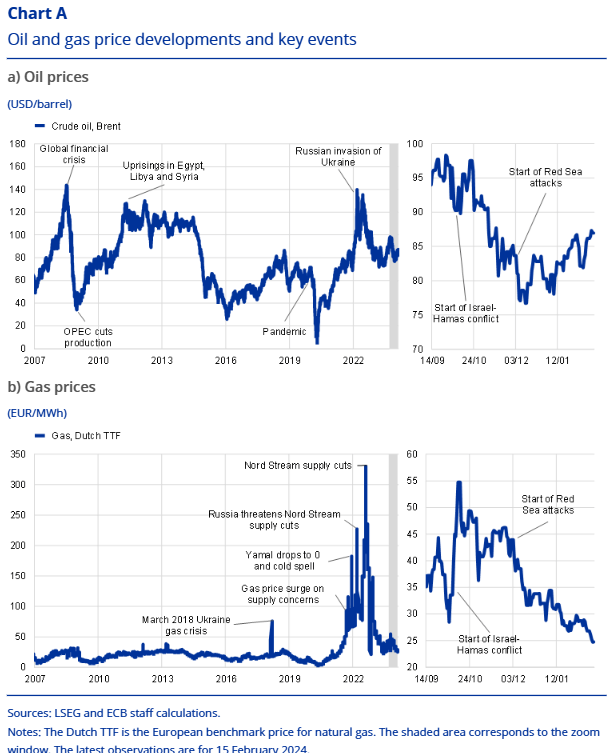

A study by the ECB also showed that speculation has a limited impact on the transmission of fundamental demand or supply shocks to oil prices. Weakened demand and an excessive supply has led consumers to hold back, in turn reducing discretionary spending and activity levels in SLB’s customers.

Diving deeper, oil prices are more sensitive to geopolitical events and the volatilities that come along with it, while natural gas prices are more affected by resource/supply related concerns, being less sensitive to international conflicts and tensions such as the Israel-Hamas conflict. Ultimately, oil and natural gas are key components in energy, which in turn drives economic activity globally. Hence, the effect of cyclical forces are pronounced in the near term, especially for commodity prices and consumer spending behavior.

Oil and Natural Gas Prices (European Central Bank)

Potential Donald Trump energy-related policies including more drilling of oil and gas may scream to investors as a telltale sign of deregulation and a major tailwind for the highly-cyclical industry.

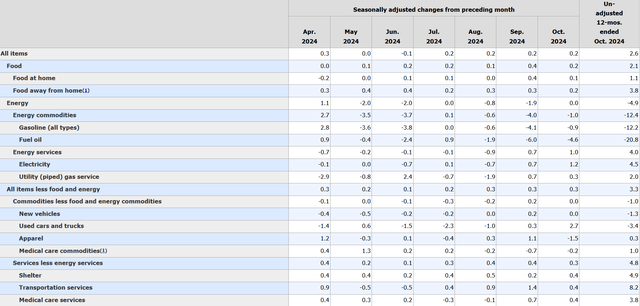

Yet, commodity prices have faced downward pressure in recent months, mainly due to concerns about market oversupply. This stems from increased production by non-OPEC+ countries, the possibility of higher U.S. supply amid reduced economic growth, and uncertainty surrounding OPEC+ supply decisions. In terms of demand, the US Consumer Confidence Index (‘CCI’) shows that consumers remain cautious. Even though the CCI has recovered to 99.06 in October, we have yet to see the impact of the US election and Trump’s presidency, which involves a series of economic proposals that may worsen inflation and growth. In my view, even if inflation approaches recovery, consumer psyche around inflation dynamics benefits the overall economy rather than energy stocks in particular, because the impact on markets are not as clear cut with broader concerns like geopolitical risks or fluctuating energy prices (energy costs have been decreasing consistently, but energy services costs rebounded in Sep and Oct).

CPI Item Prices (US Bureau of Labor Statistics)

Q3 Results

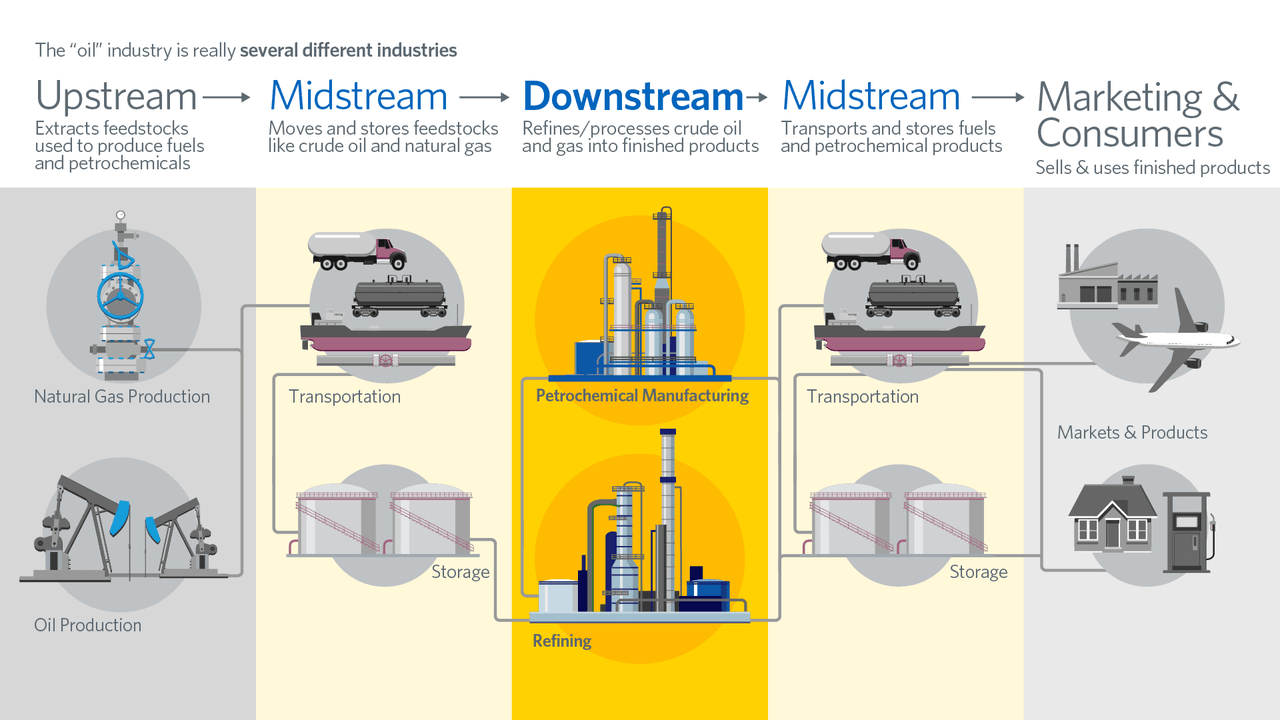

Overall, the results show that SLB not only faces macroeconomic push and pull forces, for instance lower rig activity from more cautious, discretionary spending, but also market level forces such as lowered commodity prices and hence profit for such providers. However, its expanding technology portfolio and strong offshore activity provides some degree of resilience and navigation around current and future headwinds. In particular, SLB has greater depth in terms of integrated solutions rather than pure equipment provisions across the various streams of services (with upstream being their main stream) compared to their competitors, offering more advanced solutions in terms of digital expertise. Thus, because SLB serves as the main service provider to the bedrock of all oil and gas activities, it is unlikely that the company will lose its steady revenues, operating incomes and cash flows.

Infographic On Different Streams of Oil (American Fuel & Petrochemical Manufacturers, or AFPM)

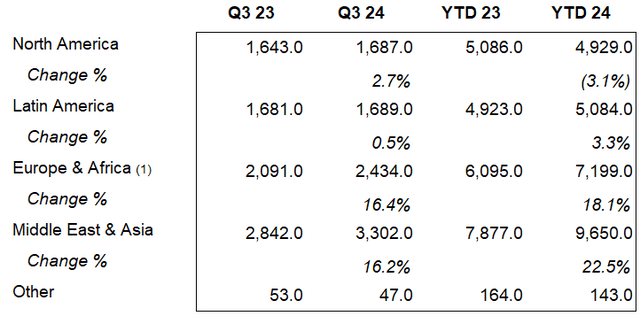

Furthermore, I believe investors do not need to worry about revenues from North America currently considering that most of SLB’s plans are still in action, including strategic acquisitions that I will elaborate on below.

Q3 Revenue by Region (Q3 ’24 Earnings)

Revenue Segments

SLB generates revenue through its four key segments: Digital & Integration, Reservoir Performance, Well Construction and Production Systems. CFO Stephane Biguet elaborated more on each segment in the Q3 earnings call.

Digital & Integration

Digital & Integration revenue of $1.1 billion increased 4% sequentially with margins expanding 456 basis points to 35.5%.

The sequential revenue growth was entirely due to higher digital sales, as APS revenue was flat. The strong margin performance was driven by improved digital profitability as a result of the higher uptake of new digital solutions and the optimization of our digital support and delivery structure.

Reservoir Performance

revenue of $1.8 billion was flat sequentially as higher intervention activity in international markets was offset by lower evaluation revenue in Latin America and the Middle East. Margins contracted 53 basis points due to the unfavorable technology mix.

Well Construction

revenue of $3.3 billion decreased 3% sequentially on lower rig count in U.S. land and Saudi, and the completion of drilling projects in certain offshore markets. Margins decreased 19 basis points as a result of the lower activity.

Production Systems

revenue of $3.1 billion increased 3% sequentially driven by higher sales of surface production systems, completions, and artificial lift, led by North America and the Middle East & Asia.

Q3 Revenue by Stream (Q3 ’24 Earnings)

All in all, Digital & Integration shows to be SLB’s differentiator amidst its competition, offering 10.8% growth YoY. It leads the industry with its digital platform partner program with different independent software developers, data analytics for operational analysis and over 150 engineered AI including DELFI and the recently announced LUMI. These will catalyze future growth as it continues to scale digital solutions in a data-rich market. CEO Olivier Le Peuch noted in the Q3 earnings call that the total addressable market of digital is still increasing even as upstream capex slows, highlighting the immense room for further adoption. Production Systems performed even better with 31.1% growth YoY. In addition, Le Peuch also mentioned that sizable bookings continue to be secured for the future. This will provide SLB a resilient stream of revenue and will aid SLB in its eventual focus towards returns in the longer term.

Company Narrative

SLB has been prioritizing capital discipline, efficiency, and strong returns, focusing on margin expansion for growth beyond consistent strategy and delivered impressive results. They remain on track to achieve their ambitious 20% EBITDA CAGR target for 2021-2025. I believe that this disciplined approach reflects a consistent commitment to sustainable growth and operational excellence. However, Stephane Biguet shared that there has been a “shift in focus from deleveraging to returns”. This will boost their percentages of cash flow to shareholders, which is good news. For the company’s future viability, Le Peuch shared in Q3’s earnings call that:

Despite these evolving market conditions, we believe the long-term fundamentals for oil and gas remain in place. Demand for energy is increasing and energy security remains a global priority, as witnessed by recent commodity price fluctuations tied to geopolitical tensions in the Middle East. In this environment, gas will continue to play an increasing role in the energy transition, while oil will remain a large part of the energy mix for decades to come.

I believe that SLB can continue to provide leading oil and natural gas solutions for its clients as global upstream investment continues in the years to come. This will expand SLB’s capability set and position it to be a dominant player in digital and sustainability not just in the industry, but across industries for companies looking for related decarbonization services. Hence, it will harness such secular trends in the medium and even long term through its wide portfolio of solutions and planned acquisitions respectively, explained more below.

Strong Cash Flow for Share Buybacks and Dividend Issuance:

The financials of the company in Q3 shows great signs of health and margin of safety as a protection against significant downside.

First, great cash flows. Management reported strong cash flow performance in Q3, with $2.4 billion generated from operations and $1.8 billion in free cash flow. This marks a $1.0 billion quarter-over-quarter increase, driven by substantial customer collections. In addition, the asset purchase agreement (‘APS’) of the Palliser block in Canada by the end of this year. This is not due to a lack of confidence to maintain the facility, but rather to reduce future abandonment liabilities, SLB’s direct exposure to commodity prices and also capital intensity as shared by CFO Stephane Biguet in the earnings call. This will lead to the decommissioning of asset retirement obligations from the balance sheet, reducing overall D&A and improving liquidity ratios.

Next, reduced debt obligations. Repayment of long-term debt increased $416m YTD compared to $0m in 2023. The balance sheet thus shows a reduction in short-term borrowings and current portion of long-term debt of $1,059m versus $1,123m last year and net debt reduction from $(7,976) to $(8,461) YTD. This shows progress in de-levering and strengthening the balance sheet.

Lastly, stock repurchases and dividends. Cash outflows from the stock repurchase program increased by over 208% to $1,236m (11.3 m shares in Q3), and dividends paid also increased by 16% to $1,144m. This is notably with increased M&A associated fees that nearly doubled from $280m to $552m in 2024.

Q3 Cash Flows of Financing Statement (Q3 Earnings)

With these numbers, it should be no surprise that SLB’s business model allows it to give back to shareholders, establish further relations with environmentally friendly energy technology providers and repay debt to keep its balance sheet robust. In its current path, SLB will exceed their commitment to return $3.0b to shareholders this year, increasing this return to $4.0b showing its confidence in generating strong cash flow even with increased acquisition costs and expansion plans.

Acquisitions For Synergies:

SLB has been strategic with its acquisitions, optimizing phases of the oil and gas operations cycle.

First is the pending ChampionX (CHX) acquisition, which is on track to be finalized by Q1 2025. This deal brings geographic synergies by integrating ChampionX’s “strong production-focused” expertise in North America with SLB’s extensive global footprint, diverse portfolio, and legacy of innovation. This combination strengthens SLB’s position in the “less cyclical and growing production and recovery space,” enabling customers to optimize their operations during those phases. Additionally, the acquisition enhances SLB’s capabilities in production optimization and extends the lifespan of equipment. These advancements are expected to increase operational efficiency, driving higher margins through lower maintenance expenses and quicker service delivery. As a result, SLB will be better positioned to collaborate with clients throughout every stage of the production lifecycle and deliver distinct value more effectively in North America, a market where SLB currently has limited presence.

SLB Transaction History (CapIQ)

Next, SLB collaborates with next-generation companies to scale-up technologies and make them accessible to their network of clients and customers. Their project with John Cockerill (global leader in hydrogen technology) intends to accelerate clean hydrogen development. The partnership “combines their commercial portfolio of pressurized alkaline electrolyzers and technology development expertise (for clean hydrogen production)… with SLB’s technology industrialization expertise” to accelerate the deployment of the technology portfolio. Secondly, their project with ILiAD DLE scales up direct lithium extraction (DLE) technology, whose footprint is a fraction of traditional lithium extraction methods. This reduces physical footprint, carbon emissions and water used in operations.

These collaborations will unlock synergies in innovation, bringing us one step closer towards cleaner energy alternatives and making it accessible by industrializing proven low carbon technologies along with developing new ones. This move into the future of renewable energy provides SLB an early advantage once the next step in hydrogen or lithium production becomes more prominent. On top of approximately 150 AI capabilities offered by SLB, such scaling by providing first access to their customers and partners serves as another incentive for companies to work with them upstream and tap into these potential efficiencies earlier on.

Valuation

P/E (FWD) indicates that SLB is relatively lower valued than its competitors. 33 analyst estimates gives SLB an average target price of $57.33, a 29.5% upside to the current price of $44, which also shows that SLB is currently undervalued and may have room for upside growth in better macro and industry conditions.

Moving Forward

Olivier Le Peuch shared that specific to Q4, SLB expects “muted revenue growth” driven by year-end digital and product sales, but tempered by U.S. E&P budget exhaustion and cautious international spending. Nonetheless, they expect to continue expanding EBITDA margins in Q4, reaching their 25% goal by optimizing costs effectively. Looking ahead, SLB has shifted its focus from deleveraging to revenue, so its plans to scale new technologies via more licensing or partnerships, leveraging recent acquisitions to collaborate with their expanding customer network should drive revenue growth in the coming quarters, assuming no sudden tailwinds or headwinds.

SLB aims to scale the latest and upcoming technologies, either as a licensed solution or through partnerships, to develop and implement it alongside their growing customer network moving forward. This is further catalyzed by the above acquisitions.

Conclusion

SLB is poised for robust financial performance, supported by its streamlined cost structure, strategic portfolio adjustments, strong presence in key international and offshore markets, and leadership in digital innovation. These factors are expected to drive further margin growth, higher cash flow, and greater returns for shareholders, positioning SLB as a leader in next-generation energy services.

Schlumberger has successfully evolved its business model to remain a leader in the energy sector while positioning itself for the future through digital and sustainable energy initiatives. Even though Q4 results are suggested to be muted, I believe that its growth strategy and financial resilience brings continued opportunities for the future, not to mention its undervaluation as added room for share price growth.

Risks remain due to the mixed forces on the energy markets. However, its deep network of clients and customers, long-term contracts and its specialty in upstream services on the supply chain covers bases to reduce risks that it may face when it comes to economic headwinds, but still tap into secular trends of digitization and renewable energy for the long haul. Even if this force is delayed due to political factors, it is still inevitable. In the meantime, SLB’s wide portfolio of existing solutions and services across the streams will need to ensure that it levers healthily as it focuses on revenue-driven growth, because margin expansion will not last forever.

I believe that it is unlikely that the economy reverses its progress towards a soft landing, and that recovery on different indicators such as inflation, consumer confidence and employment will continue towards a soft landing state. This recovery will hence provide tailwinds for SLB to gain momentum and perform with its continuously strong financials.

With this, I rate SLB a buy for the next 6 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SLB over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.