Summary:

- SLB’s Q3 comments suggested slightly muted growth expectations which spooked the market.

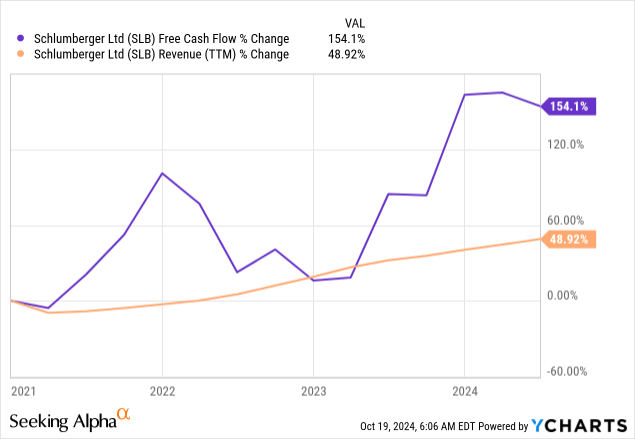

- The more important story is that the growth from the prior couple years is now trickling down to the free cash flow line.

- 2024 seems to have been the inflection year for share buybacks and 2025 will even more generous in this regard.

- All these buybacks are happening at a depressed stock price which will provide structural support for EPS down the road.

JHVEPhoto/iStock Editorial via Getty Images

Investment thesis

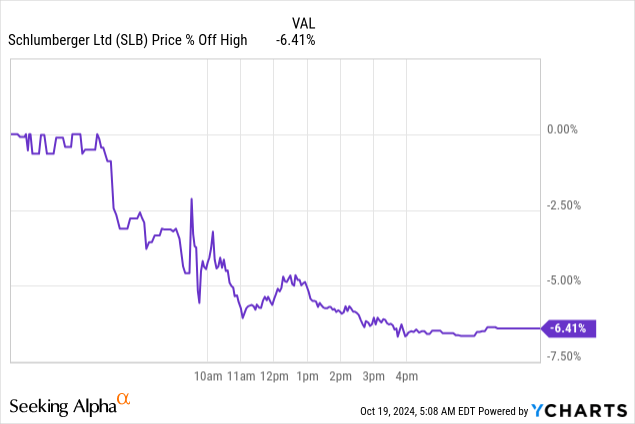

Schlumberger (NYSE:SLB), the oilfield services behemoth, reported a slight Q3 earnings beat Friday although topline revenue growth fell a bit below expectations. The market reaction wasn’t favorable to say the least:

With the exception of the well-known weakness in North America onshore, the company posted improving metrics across most of its other markets. Perhaps the part the market didn’t like were these comments from the CFO during the earnings call:

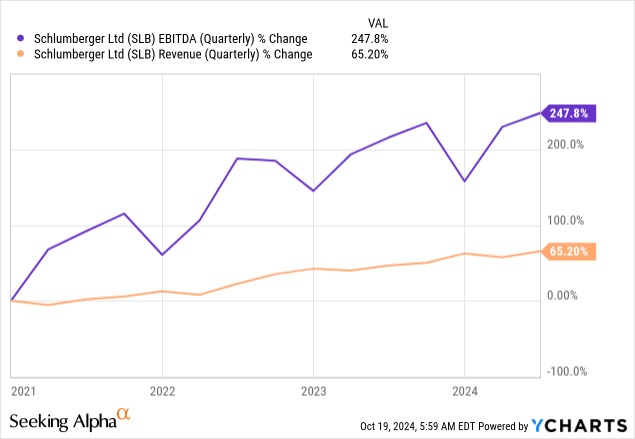

[On] 2025 and the absolute value of EBITDA compared to our long-term ’21 to ’25 CAGR ambition, it is possible that indeed, with the current macro outlook again to be refined, and [if we exclude] ChampionX, it’s possible that the ’21 to ’25 CAGR will finish in the high teens rather than breaking that 20% bar.

The relative deceleration is a negative for sure, but in absolute terms growth remains very high and likely more than what was ever priced in the stock. In addition, SLB’s profitability has already grown to a level where free cash flow generation has inflected and the company is now accelerating its buybacks:

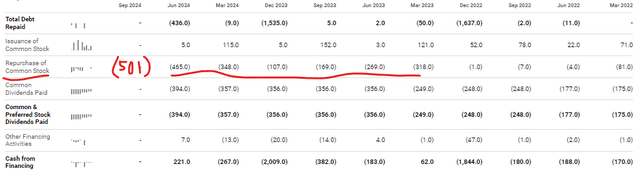

[Total] returns to shareholders, in the form of stock repurchases and dividends, was approximately $2.4 billion on a year-to-date basis. During the third quarter, we repurchased 11.3 million shares for a total purchase price of $501 million. As a result of our strong cash flow performance, we expect to maintain this level of buyback in the fourth quarter.

Consequently, we will exceed our previous commitment to return $3 billion to our shareholders in 2024. Furthermore, we reaffirm that we will return a minimum of $4 billion to shareholders in 2025, reflecting our confidence in our ability to continue generating strong cash flows.

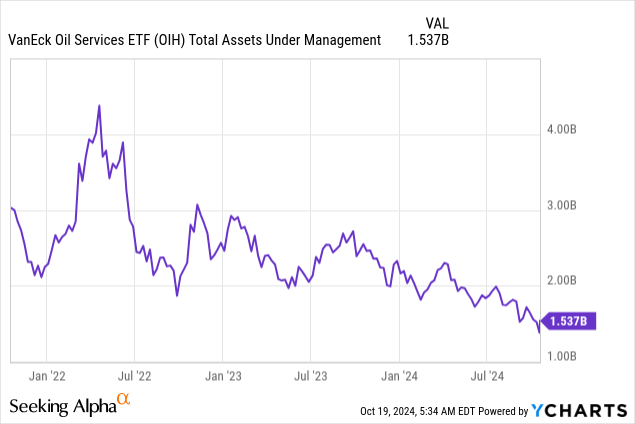

This means we are looking at a minimum distribution yield of 6.5% for 2025. In my view, the cash flow generation will be more important in the near term as the marginal buyer for oilfield services stocks appear to be the companies themselves through buybacks. Growth is important to attract new investors but the reality is that capital has already been flowing out of the energy services sector for 3 years now:

Lastly, the ChampionX acquisition now set to close in Q1 2025 is expected to contribute synergies which aren’t yet reflected in the 2024 reporting.

The Q3 performance was solid

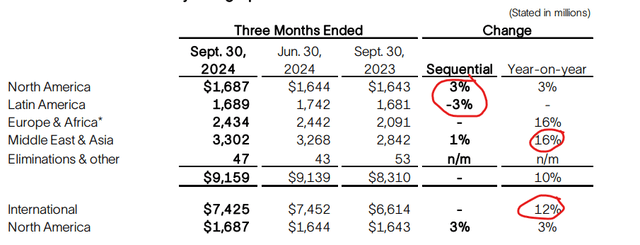

SLB’s revenue growth YoY was still in the double digits for the more important international market:

The Middle East in particular, which spooked investors in January after the Saudi abandonment of its prior expansion plans, is still growing at 16% annual rate. North America is a known variable so probably the slowness in LATAM is the only surprise here.

The quarterly EBITDA margin was north of 25% and EBITDA growth continues to outpace revenue:

EBITDA conversion to free cash flow at about 80% was exceptionally strong in Q3. This implies a free cash flow margin on revenue of close to 20%.

Free cash flow is a volatile metric due to timing issues but the trend over the past several quarters is clear:

Generally, when the fortunes of a business improve, revenue tends to lead, followed by EBITDA and finally cash flow. I think for SLB 2024 is the year when we finally see the revenue growth from the past couple years starting to trickle down to the free cash flow line.

The buybacks are just starting

An important point that probably got missed by yesterday’s headlines is that the growth is no longer capex fueled, especially on the side of the promising digital business:

[Our] growth in digital doesn’t trigger incremental capital intensity because it’s really smooth over many, many years. I would say that the heavy investments have been made in the past already now is just enriching the platform and supporting the enriched offering for the customer.

This bodes well for buybacks and Q3 was also a record quarter in that regard:

It has really been just 3 quarters so far with material buybacks and that will only get better in 2025. The minimum $4 billion distribution target, assuming $1.6 billion will go dividends, implies a minimum buyback of $600 million per quarter.

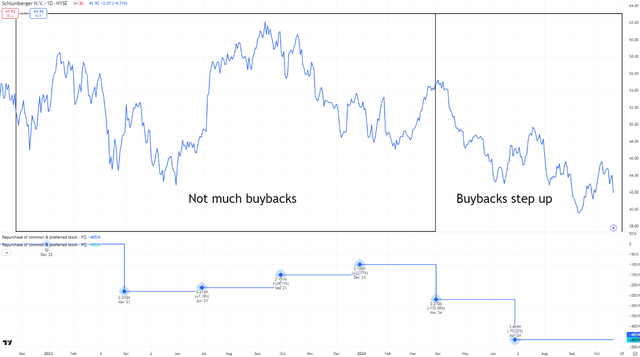

Also perhaps by design, perhaps by luck – SLB didn’t buy back much in 2023 when the stock price was in the $60s; instead we are seeing the firepower deployed now when SLB trades in the low $40s:

The good timing of these buybacks implies greater effect on EPS down the road. The ChampionX acquisition probably also proved fortuitous in this regard as the deal was announced when SLB stock was comfortably in the $50s.

Price targets remain optimistic

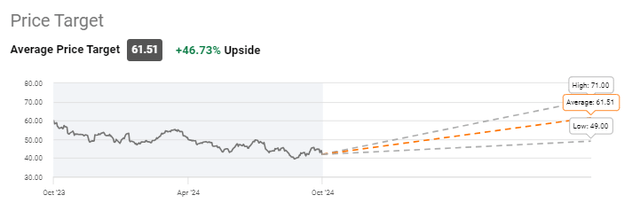

Analysts usually slash down their targets if the stock underperforms their expectations but on SLB they have remained stubbornly bullish:

I find the targets range, from a $50 bear case to $70 bullish scenario, to be reasonable. Even if CAGR drops from 20% to the “high teens” at $41 entry price SLB looks to be a safe bet. All this assumes oil remains around $70 too so we are not betting on any type of “commodity super-cycle” here.

Takeaway

Energy services is a cyclical industry so growth having ups and downs shouldn’t surprise anyone. The important takeaway for SLB investors is that in less than 4 years since the pandemic the company has managed to achieve record profitability and is already generating significant free cash flow. Even with lower topline growth, the cash returns are set to increase and that will be a tailwind going into 2025.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

My articles, blog posts, and comments on this platform do not constitute investment recommendations, but rather express my personal opinions and are for informational purposes only. I am not a registered investment advisor and none of my writings should be considered as investment advice. While I do my best to ensure I present correct factual information, I cannot guarantee that my articles or posts are error-free. You should perform your own due diligence before acting upon any information contained therein.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.