Summary:

- Schlumberger announced their acquisition of ChampionX on April 1, 2024, adding significant upside potential to both firms by bringing production chemicals to the international market.

- Management increased their shareholder benefits from $2.5b to $3b for 2024 and $4b in 2025.

- International well development and domestic enhanced oil recovery and CCUS will drive growth for Schlumberger in 2024-2025.

AdrianHancu

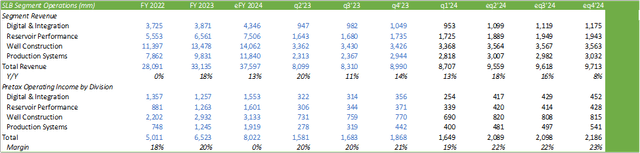

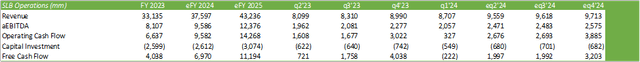

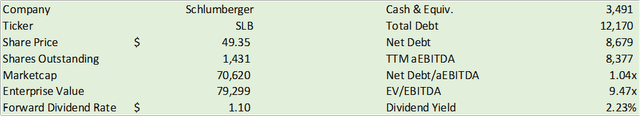

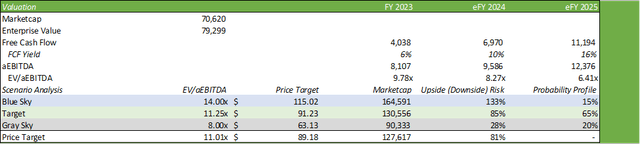

Schlumberger (NYSE:SLB) reported a strong start to FY24 with revenue growing 13% paired with aEBITDA margin expansion. Though the firm came in shy of my forecast, management remains adamant that the firm will experience strong and durable growth in the coming quarters. In addition to improvements in international production, management reaffirmed their agreement to acquire Houston, TX-based ChampionX Corp. (NASDAQ:CHX) in an all-stock deal valued at $7.8b at the time of the original announcement April 1, 2024. I believe this acquisition will be accretive as it will enhance areas that Schlumberger falls behind in, such as advanced chemicals. I reiterate my BUY recommendation for SLB shares. I am also increasing my price target for SLB shares from $83.15 to $89.43/share at 11.01x eFY25 EV/aEBITDA as a result of potential synergies that the firm should realize in eFY25.

Schlumberger Operations

Schlumberger experienced significant strength in topline growth internationally across the Middle East, Asia, Europe and Africa as operators sought to bolster their long-cycle production for both oil and gas production. Net of Aker contributions, international revenue grew 10%. This growth was paired with a -3% decline in North America as operators pull rigs as a result of more effective oil recovery, as seen with firms like Occidental Petroleum (OXY), Diamondback Energy (FANG), and Devon Energy (DVN). I anticipate that rig count in North America will remain in a relative decline as gas producers continue to face a soft market and liquids producers leverage enhanced oil recovery technologies. As North American gas producers are faced with a potential limit on gas exports, I expect that Middle Eastern producers will pick up gas capacity in order to fulfill international LNG demand. This can be seen with QatarEnergy increasing their gas production and LNG export capacity, which should benefit Schlumberger’s business on multiple fronts, including production systems, reservoir performance, and well construction.

One area management highlighted was that operators are making a major shift from heavy CAPEX to OPEX spend. This means that E&Ps are shifting their focus away from heavy drilling and completion to maximizing production at every well site, whether it’s through the use of CO2 and other chemicals to enhance flows, refracking, or the combination of the two. I believe that this shift will drive significant value to Schlumberger as their acquisition of ChampionX closes given their presence in well-enhancing chemicals production. I anticipate this feature to bring long-term value to Schlumberger as spending continues to shift towards EOR tactics. This should also significantly play into Schlumberger’s New Energy portfolio with their CCUS technology. My presumption is that this is what’s driving the reduction in rig count in North America as US production remains near all-time highs.

Much of the rig growth in q1’24 occurred in the Middle East, specifically in Saudi Arabia, as the country switched from oil to gas production with nearly 60 rigs deployed. This has also driven the shift from offshore to onshore rigs, which Schlumberger has capacity to cater to. Gas production in the region is expected to grow by 60% through 2030 as a result of the growing global LNG demand. I believe that much of the region’s growing gas supply is in part the result of the US pauses on new approvals for LNG export facilities. As discerned in my report covering Antero Resources (AR), the US has excess gas production and I anticipate relatively flat domestic production throughout the duration of eCY24. I expect much of the stranded gas that was anticipated to be utilized for LNG exports to be picked up by gas production in the Middle East and North Africa. If LNG market share is captured by these regions, I anticipate a more challenging gas market in the US as LNG supply contracts have an average duration of 10+ years. This may result in more challenges to come in dry gas production in the US and may result in fewer gas rigs being deployed in the Haynesville/Bossier Basin and the Appalachia region. If this is the case, I believe there will be the need for further consolidation in the gas basins or for gas producers to refocus their energy mix into more liquids-rich plays to support operations. If consolidation does occur as a result, I anticipate a further reduction in deployed rigs in the US in an attempt to support higher gas prices.

In addition to growth in the Middle East, management anticipates strong tailwinds coming out of Asia and Latin America. Given Exxon Mobil’s (XOM) success in Guyana, other operators are increasing their exploration in surrounding offshore areas in the region, such as Suriname. This should support various segments for Schlumberger such as well construction, as new production sites are explored. On the note of Guyana, Schlumberger continues to benefit from their contract with Exxon Mobil regarding well construction and enhanced recovery.

Looking ahead, management anticipates a rebound in activity in the Northern Hemisphere paired with robust activity in international markets, primarily in the Middle East, Asia, and Africa. Management expects this to support sequential margin expansion across all segments and geographies. Management anticipates significant strength in reservoir recovery as operators seek to manage down their capital investments to preserve higher-tier wells while squeezing as much liquids out of each and every wellsite. I expect this drive to preserve capital will push operators to spend more heavily on production chemicals as provided by firms like ChampionX, and carbon capture technology and utilization.

Comparing my previous forecast, I anticipate stronger revenue growth and margin expansion for Schlumberger as a result of the ChampionX acquisition. I believe that this acquisition will further bolster Schlumberger’s US presence as well as realize tailwinds in their international production chemicals business. I anticipate these synergies to be realized beginning in eFY25.

Valuation & Shareholder Value

Since the announcement of the acquisition of ChampionX, Schlumberger has announced that they will be increasing shareholder returns from $2.5b to $3b in 2024 and $4b in 2025. Schlumberger repurchased 5.4mm shares in q1’24 for $270mm, leaving significant room for investors to take advantage of these additional shareholder benefits in CY24.

Management anticipates significant synergies between the two firms as each company supports each other’s deficits, such as ChampionX’s robust production chemicals segment and Schlumberger’s artificial lift segment. Given the recent delays in M&A activity in the US between Exxon (XOM) & Pioneer (PXD), Chevron (CVX) & Hess (HES), and Southwestern (SWN) & Chesapeake (CHK), I anticipate some delays as the current administration is pushing deeper review into antitrust. Though I do not anticipate the deal to be blocked given the limited overlap between the two firms’ operations, I do expect a similar treatment as oil prices remain elevated in an election year. The planned acquisition is expected to bring $400mm in synergies over the next four years, which should support stronger margins paired with revenue expansion as Schlumberger brings ChampionX’s production chemicals business into their international mix. The deal, as announced on April 1, 2024, valued ChampionX at ~$7.8b at the time of the announcement in an all-equity deal with a share conversion rate of 0.735:1 CHX:SLB.

Looking at valuation, I am increasing my price target for SLB shares from $83.15 to $89.43/share at 11.01x eFY25 EV/aEBITDA. This price target increase is primarily the result of potential synergies that will be realized as a result of the ChampionX acquisition as stated above. This price improvement is also paired with Schlumberger’s increased shareholder benefits that should support a higher share price. I reiterate my BUY recommendation for SLB shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.