Summary:

- Schlumberger, with a $62 billion market cap, faces challenges during downturns but has rebuilt operations to generate strong returns.

- The company’s future opportunities and shareholder returns are promising, despite risks tied to industry downturns and weaker oil prices.

- The Federal Reserve’s potential rate cuts could signal an economic downturn, impacting Schlumberger’s ability to drive future returns.

- Schlumberger’s robust operations and strategic positioning support a positive outlook, though industry volatility remains a significant risk.

JHVEPhoto

Schlumberger (NYSE:SLB) is one of the largest oilfield service companies in the world, with a market capitalization of roughly $60 billion. Oilfield service companies tend to suffer more during a downturn as capital expenditures dry up much quicker than production, and Schlumberger is no exception. However, the company has worked to build back up a robust operation and can generate strong returns.

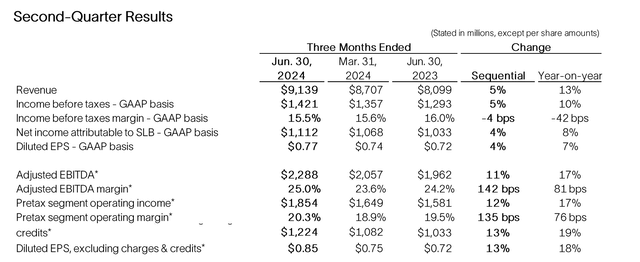

Schlumberger’s 2Q 2024 Results

Schlumberger has seen strong results showing a growing ability to take advantage of the operating expenditure “pie”.

The company saw $9 billion in revenue in the most recent quarter, resulting in $0.77 in diluted GAAP EPS. This was supported by 7% YoY growth, as the company’s business has continued to see substantial strength. The company continues to trade at a P/E of ~15x, which highlights the strength of its earnings potential.

The company is continuing to achieve growth along with strong investments highlights the investment appeal.

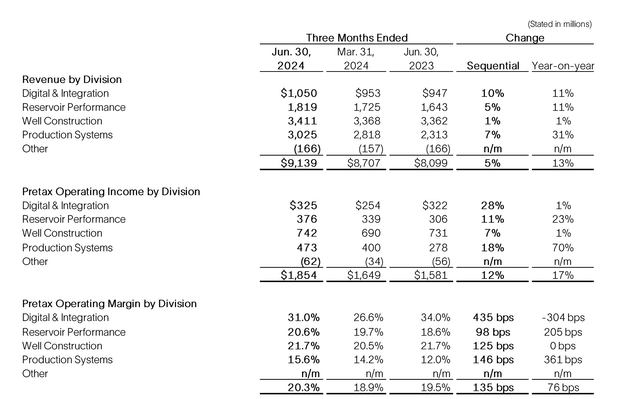

Schlumberger’s Segment Performances

The company has continued to see strong performance in its segments, with especially strong growth seen in its Production Systems business.

The company’s Production Systems saw 70% YoY growth, with pretax operating income growing to $473 million. This business saw 31% revenue growth YoY and is expected to continue growing. With potential analysis coming out that the Permian Basin is depleting faster than originally thought, production systems that focus on quality wells are maximizing recovery are important.

The company has 4 main segments which drive its overall performance, and each shows its goal to maximize recovery and profits for customers. The company does have the risk that it’s more dependent on capex, which declines faster than production, however, its overall assets remain strong.

Schlumberger’s Future Opportunities

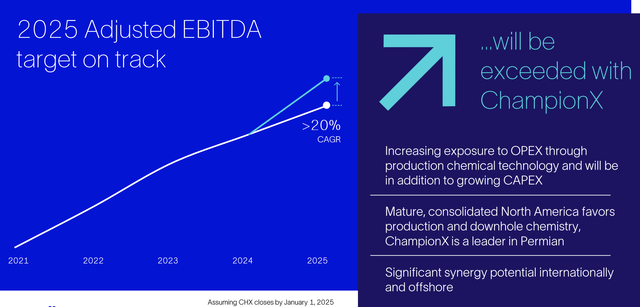

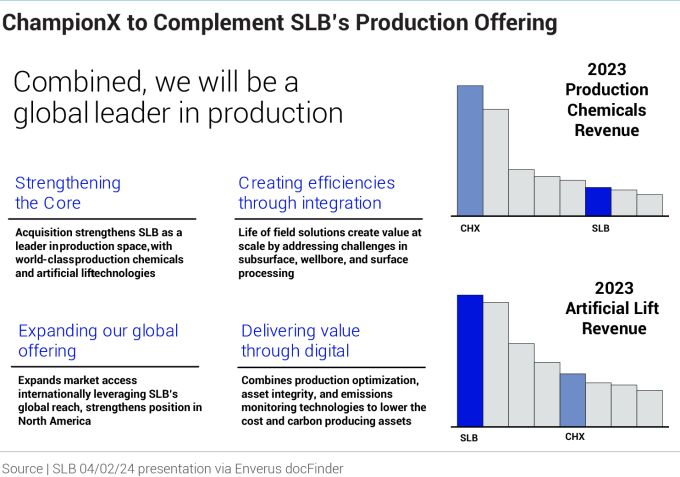

Schlumberger is focused on continuing its future shareholder returns, supported by its acquisition of ChampionX, an $8 billion acquisition.

Schlumberger Press Release

The acquisition is the company’s largest acquisition since 2016. The acquisition enables the company to strengthen its positioning in its key segments where ChampionX’s focuses are production chemicals which are supplemented by various automation technologies the company has. The company will benefit well from Schlumberger’s scale.

At the same time, it will enable Schlumberger to become a major player in a market it currently has a minimal position in.

The company expects >20% annualized adjusted EBITDA growth from 2021 to 2025, supported by ChampionX. The company will continue to benefit and grow as extraction from the Permian Basin becomes more difficult and the company’s assets become more valuable. This combination helps to support Schlumberger’s ability to drive future returns.

As the industry becomes more and more difficult, this consolidation is important.

Thesis Risk

The largest risk to our thesis is how exposed Schlumberger is to a downturn in the industry, especially as oil prices remain weaker. The company has seen this with other downturns, but as we hit the end of an economic cycle, with the Federal Reserve preparing to lower rates, there’s the risk of a downturn that could hurt the ability to drive future returns.

Conclusion

Schlumberger has the ability to continue driving shareholder returns. The company has a dividend of 2.4%, one that it can comfortably afford, and above the dividend yield of the S&P 500. The company has modestly repurchased in 1Q 2024 and has announced shareholder return targets of $3 billion in 2024 and $4 billion in 2025.

That represents a 5% and 7% yield in each year respectively and is a yield that the company can comfortably afford with its ChampionX acquisition. It shows the strength of the company’s portfolio and its continued ability to drive returns, making the company a valuable investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.