Summary:

- Schlumberger’s international division shows robust growth, particularly in the Middle East and Asia, despite North America’s decline due to weak prices and lower drilling activities.

- Tailwinds from offshore projects and the company’s focus on geographic expansion along with operational improvements should drive long-term revenue growth and margin improvement.

- SLB is trading at a discount to historical levels, making it an attractive buy given its promising long-term outlook.

Monty Rakusen

The Thesis

After delivering double-digit revenue growth in 2023, Schlumberger Limited’s (NYSE:SLB) North American division experienced a decline for two consecutive quarters in 2024 due to weak prices and lower drilling activities in the region. However, the company’s International division continued to show strength, which I expect to continue further in 2024 as activities related to onshoring and project development remain robust, primarily in the Middle East and Asia region. Long-term, on the other hand, should benefit from investment in gas deepwater projects in a resilient market internationally and the company’s focus on geographic expansion, which should drive revenue growth in the coming years. Margin also looks good as the company remains focused on quality revenue with higher margins and improving operational efficiency. The company’s stock is currently trading at a notable discount to its historical levels. While there is a risk from volatile oil prices affecting the company’s business, Schlumberger’s promising long-term outlook makes it a good buy at current levels for the long term.

Business Overview

Schlumberger Limited is a leading oilfield services company engaged in providing technology, information solutions, and integrated project management for the energy industry in North America and Internationally. The company mainly operates through four business divisions:

-

Digital & Integration: In this business division, the company provides field development, hydrocarbon production, and carbon management services. This segment also offers reservoir interpretation, data processing, and subsurface geology evaluation.

-

Reservoir performance: This segment enhances reservoir interpretation, data processing, well construction, and production improvement and supplies pressure and flow rate measurement, pressure pumping, and well stimulation.

-

Well Construction: This business division offers mud logging, directional drilling, measurement while drilling, drill bits, well cementing, and other related services.

-

Production Systems: This division supplies lift production equipment, optimization service, completion technologies, and integrated subsea solutions through OneSubsea.

Last Quarter Performance

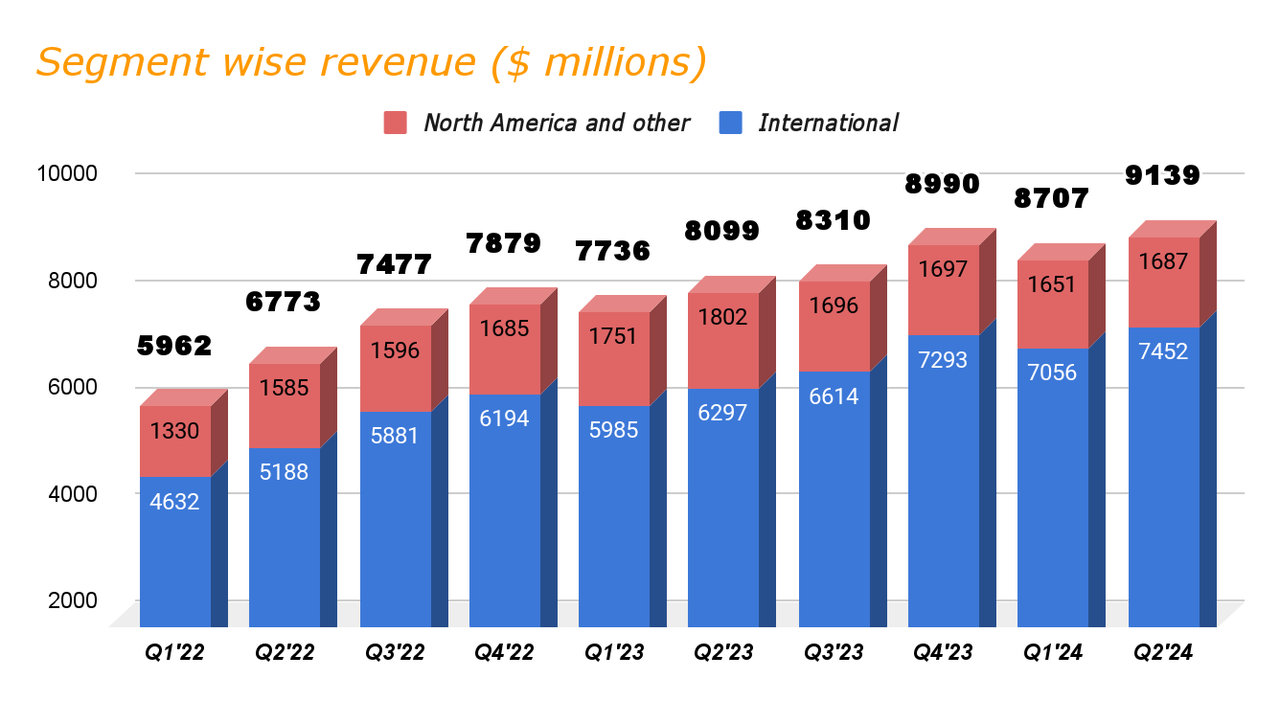

As the company exited the first half of 2024, the strong growth momentum continued in its international business, primarily in the Middle East and Asia. This resulted from the highest quarterly revenue of the cycle in more than half of its 12 GeoUnits posted, leading to international revenue growth of 18.3% versus the prior year. The company’s North American business, on the other hand, continued to experience softness despite increased drilling and higher digital revenue in the Gulf of Mexico, activity levels remain lower in the U.S. land which along with weaker gas prices in the region resulted in yearn on year revenue decline in mid-single digit in the region. Overall, the strong growth in the international business helped the company deliver double-digit growth year-on-year as the company’s top line grew 12.8% to $9.14 billion in the second quarter of 2024.

SLB’s quarterly revenue (Research Wise)

The company’s margin also expanded during the quarter, with its adjusted EBITDA growing 80 bps versus the prior year’s same quarter, reaching 25% during the last quarter. This was primarily driven by higher digital sales, favorable conversion of backlog, and improved profitability in Subsea Production systems and artificial lift. EBITDA growth during the quarter also helped in bottom-line performance as the company’s adjusted EPS increased 18% to $0.85 versus $0.72 in Q2’23, beating the estimates by $0.02 in the second quarter of 2024.

Outlook

The company’s topline growth in 2023 was in the high teens due to strong double-digit growth in the initial half of the year. However, the growth rate started to moderate in the second half, which continued into 2024 primarily due to challenging market conditions in the North American region with lower-than-expected rig counts and market consolidation. In my opinion, this should continue to affect land drilling activities in the region, which along with weaker gas prices should continue to put pressure on the region’s topline in the quarters ahead despite healthy activities and benefit from higher digital revenue in the Gulf of Mexico.

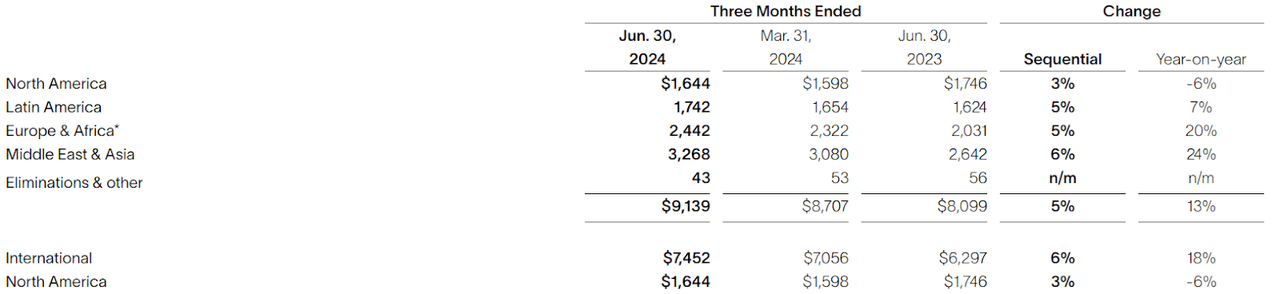

While the North American division remains under pressure, the company’s international business division is expected to continue its momentum due to a healthy demand environment followed by ongoing capacity expansion programs and continued investments in new projects related to gas and oil fields, particularly in the Middle East and Asia. Offshore developments and deepwater projects are also expected to drive a high level of activity, which should further help the company drive consolidated revenue growth in 2024.

Second quarter revenue by Geographical Area (In $ millions) (Company press release)

The company’s long-term outlook appears to be good as well, with potential for recovery in the North American region as market conditions stabilize and land drilling activities improve. This, along with increasing investments in the long-cycle gas deepwater projects and a focus on geographical expansion, should drive topline growth in the coming years. Currently, the company is focusing on offshore projects and developments in resilient markets, including key international regions like the Middle East and Asia. The company is leveraging its fit-for-basin technology and integration capabilities to provide solutions for the Middle East’s unique geological conditions, which is expected to enhance efficiency for its customers in exploration and production, which should further strengthen the company to capitalize on rapid growth gas development and oil capacity expansion in the region.

In my view, this, along with tailwinds from high-value contracts and partnerships from OneSubsea join the venture and traction for the company’s production and recovery solutions due to customer focus on offsetting natural declines and maximizing asset value, should drive revenue growth for the company in the coming years. Overall, in the near term, the company’s topline appears to continue its growth despite softness in North America. On the other hand, the company’s continued focus on leveraging its technology to drive efficiency for its customers and tailwinds from investment in long-cycle projects should drive growth for the company in the coming years.

Valuation

In the past year, the company’s stock price has declined by approximately 25%. This is possibly a result of investors’ concern over a potential slowdown in the highly cyclical oilfield services industry after multiple years of high oil prices and significant investment in this industry post-2020. Currently, the company’s stock is trading at a forward Non-GAAP P/E ratio of 12.67, based on FY24 EPS estimates of $3.48, representing a year-on-year growth of 16.92%. In comparison with its five-year average P/E of 25.43x, the stock appears to be priced attractively.

SLB Consensus EPS estimates (Seeking Alpha)

In comparison with the P/E of its sector median of 12.33x, the stock’s valuation appears to be in line with its close peers like (BKR) (TS) and (HAL) in terms of their market valuations and TTM revenue, which is well over $10 billion. However, considering the forward growth rate, SLB’s stock appears to be more attractively valued as compared to its peers as we can see in the table below.

| Company | Forward P/E (Non-GAAP) | Forward Revenue Growth | Forward EBITDA Growth |

| SLB | 12.67x | 13.32% | 17.36% |

| BKR | 16.63x | 11.19% | 19.22% |

| TS | 9.17x | 1.05% | -8.15% |

| HAL | 9.49x | 6.49% | 11.20% |

I expect the company’s topline to continue its double-digit steady topline growth into the remainder of 2024 as activity across most of the geographic area in its international business remains healthy. In my view, benefiting from higher revenue in the coming quarters along with efficient project execution, and advanced technologies should help the company in margin expansion in its international division more than offsetting the impact of the ongoing weakness in the North American division. This should result in bottom-line growth in the latter half of 2024, leading to further improvement in the company’s stock valuation in the coming quarters.

Risk

While the long-term growth prospect of the company remains favorable, the SLB stock faces significant risks due to volatility and declining crude oil prices. Lower prices can lead to reduced activities related to exploration and drilling by energy companies, which can potentially lead to lower demand for the company’s services, which can affect the company’s margin growth in the coming quarters. This could also impact the company’s bottom-line, leading to deteriorated valuation, which could potentially result in poor stock performance in the future.

Conclusion

As we discussed above, in the past year, the company’s stock has declined significantly, which along with bottom-line growth has enhanced the stock valuation and currently trading at a notable discount to its historical average. The near-term prospects look favorable despite softness in the North America division, as activity remains healthy internationally. The margins are also expected to continue its growth in the rest of 2024. While the longer-term growth prospects are also promising, I would recommend “BUY” this stock at the current levels for the longer term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.