Summary:

- Seagen Inc.’s acquisition by Pfizer Inc. has received unconditional approval from the European antitrust regulator.

- The deal is expected to be neutral to slightly accretive to Pfizer’s EPS and has a potential upside of 6.21% for investors.

- The absence of objections from the European regulator bodes well for treatment by other regulators, but there is still a risk of deal failure.

David Dee Delgado

Seagen Inc. (NASDAQ:SGEN) is being acquired by Pfizer Inc. (NYSE:PFE). The European antitrust regulator just approved the $43 billion deal unconditionally. The deal has received a second request from the Federal Trade Commission. It is a large deal but Pfizer should be able to pull it off easily enough. It is a pharma giant with a market cap of $176 billion, EBITDA of $31 billion, $12 billion in free cash flow, and $44 billion in cash. It has $60 billion in debt.

The stock barely responded to the European approval. In my experience, it’s a good sign if a major regulator raises no objections to a deal closing as planned. The European regulator justified its seal of approval as follows (emphasis in original):

…the transaction would not lead to either the:

- discontinuation, delay or re-orientation of the parties’ ongoing and overlapping lines of research or pipeline projects. The parties’ activities target different segments of patients, and they are not substitutable since they do not have the same mode of action and concern different lines of treatment; or

- loss of innovation resulting from a structural reduction of the overall level of innovation, given that there is a significant number of players engaged in research & development activities in the broader oncology space and, more specifically, in ADCs, an area in which Pfizer wishes to grow.

But the commission also looked at the deal in terms of potential effects on healthcare prices (emphasis in original):

Moreover, the Commission found that the transaction was unlikely to have negative impact on prices, given that the parties’ offerings are differentiated and complementary and that the markets for the treatment of the various cancer types examined are sufficiently competitive.

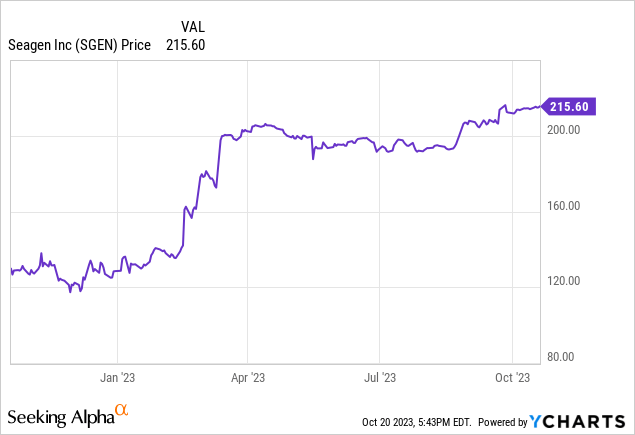

Meanwhile, Seagen is trading at $215.60 only. That means there is still 6.21% upside left to the deal price of $229.

That’s an attractive return, given the companies originally planned to close the deal in Q4 2023 or Q1 2024. This may be all done by Christmas. If not, my bet is on the end of January. Alternatively, the FTC could go after the deal, even if just to slow it down. Lately, the agency has been quite active. The outside date for this deal is March 2023, but this can be extended until September 2024. Even if the deal can be prevented from closing until mid-2024, the annualized return is still reasonable but not spectacular. If the deal fails to close, the share price will fall back to the $130-$170 range. On average, that would be a ~30% loss. Given it is a biotech merger, that’s not too bad.

Positively, Pfizer expects the transaction to be neutral to slightly accretive to EPS relatively quickly. This tends to help buyers to maintain motivation and get financing at agreeable terms.

Bottom line

The recent unconditional approval of Seagen’s acquisition by Pfizer from the European antitrust regulator is an overlooked milestone. The stock’s initial response has been modest. However, the absence of objections from a major regulator bodes well for treatment by other regulators (most importantly the FTC). The EU regulator’s assessment highlighted the presence of competitors in the relevant spaces and the unlikely pricing impact.

With Seagen’s current trading price at $215.60, as of writing, and the deal set at $229, there remains a promising 6.21% upside potential for investors. The potential for an earlier closing, possibly by Christmas, adds to the appeal. Regulatory hurdles, although not expected, could impact the timeline negatively. There is a risk of deal failure, but the potential loss, in the biotech merger context, is relatively manageable. Realizing a 6% upside or roughly 30% downside, likely in under four months, is a decent risk/reward to hold or add to my portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SGEN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Check out the Special Situation Investing report if you are interested in uncorrelated returns. We look at special situations like spin-offs, share repurchases, rights offerings and M&A events like Celgene. Ideas like this are especially interesting in the current late stages of the economic cycle.