Summary:

- Northrop Grumman reported a 7% revenue increase in the fourth quarter, exceeding initial guidance.

- All business segments demonstrated a strong book-to-bill ratio, indicating sustained and widespread customer interest.

- Despite challenges in segment margins, the company remains strategically positioned for long-term growth with a focus on shareholder value.

Ales_Utovko

Introduction

It’s time to talk about one of my largest investments – which just got a bit larger, at least on a total share basis.

That investment is in the Northrop Grumman Corporation (NYSE:NOC), one of America’s largest defense contractors.

As most of my readers may know, I have been bullish on the company for a long time, as I am a huge fan of the benefits for long-term investors this company brings to the table, including an anti-cyclical business model, future-proof exposure in various major defense programs, a healthy balance sheet, a strong growth outlook, and a focus on shareholder distributions through dividends and buybacks.

My most recent article was written on December 16, when I used the upbeat title “Northrop Grumman – Why I Remain So Very Bullish.”

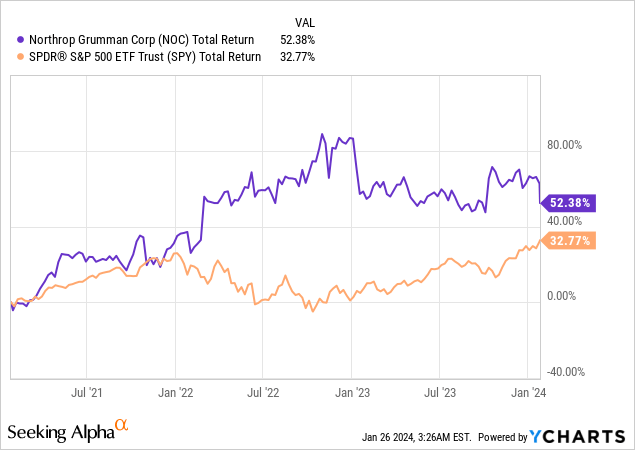

Since then, shares are down 6%, mainly because of the post-earnings sell-off that shed 6.3% off the company’s market cap.

As someone who has invested in defense companies for quite a few years, this is one of many post-earnings sell-offs I have been through. In fact, almost every single defense contractor share I own was bought during a significant (often post-earnings) stock price decline.

Additionally, NOC shares are still outperforming the S&P 500 on a three-year basis despite the wave of negative headlines regarding supply chain issues, inflation, and budget uncertainty.

Hence, in light of new developments, I’ll use this article to dive into the just-released earnings and explain what this means for the longer-term risk/reward.

So, as we have a lot to discuss, let’s get to it!

What Happened To NOC?

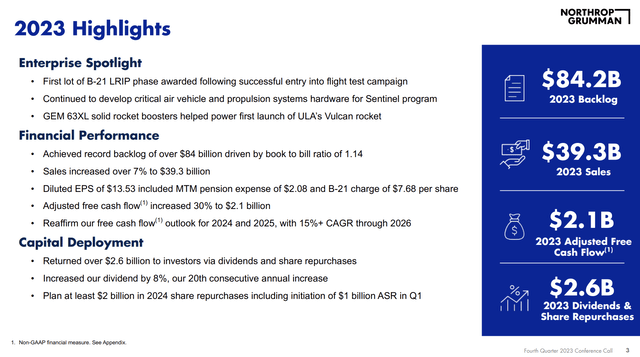

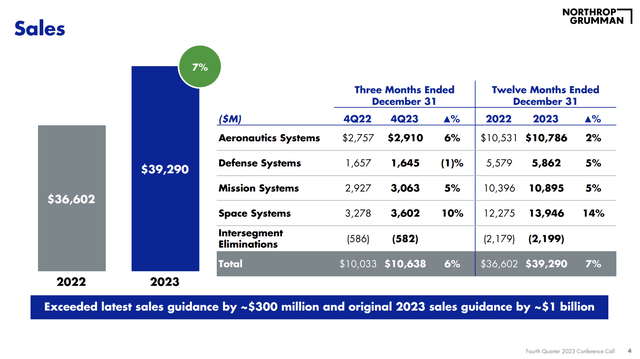

For starters, the fourth quarter wasn’t bad at all, as the company reported a revenue increase of over 7%, exceeding the initial revenue guidance by more than $1 billion.

This growth was reinforced by a strong book-to-bill ratio for the year, standing at 1.14x, consistent with the company’s solid 4-year average.

Meanwhile, the record backlog reached a significant milestone, surpassing $84 billion, providing a robust foundation for sustained growth, as a 1.14 book-to-bill ratio indicates that the company gets $1.14 in new orders for every $1.00 in finished work.

Importantly, all four business segments demonstrated a full-year book-to-bill ratio surpassing onetime sales, indicative of sustained and widespread customer interest.

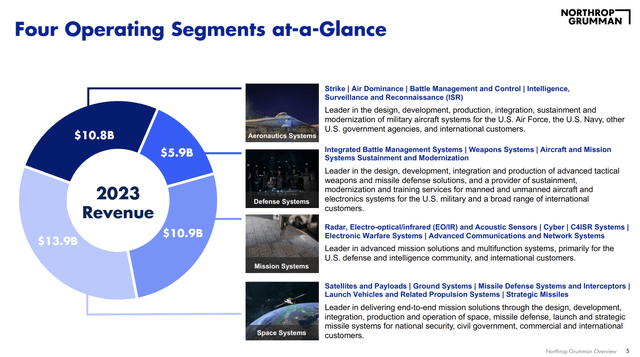

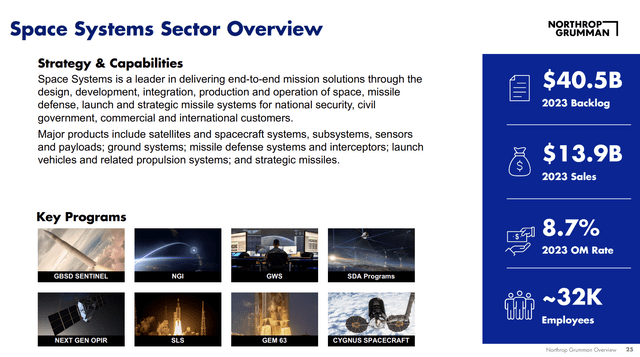

The overview below shows the company’s segments. Note that the space segment, benefitting from massive secular growth, accounts for a third of total revenues!

Speaking of its segments, the financial performance of the company’s well-diversified business segments merits some attention, as it not only tells us a lot about the company but also about the defense industry in general.

- Aeronautics, for example, showed a 2% sales growth rate, surpassing earlier expectations of growth. Growth was primarily driven by increased volume on restricted programs, effectively offsetting declines in mature production programs.

- In the Defense Systems segment, sales grew by 5%, led by heightened volume in the weapons and missile defense portfolio.

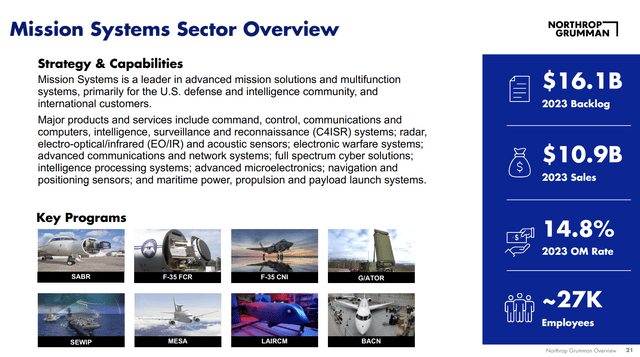

- The Mission Systems segment also saw a 5% sales increase, fueled by elevated restricted sales on advanced microelectronics programs and augmented volume on marine systems initiatives.

- Meanwhile, the Space business marked another quarter of impressive double-digit top-line growth, registering a sales increase of approximately 14% for the year.

So far, so good.

The bad news is that despite the overall positive financial performance, the company had to deal with challenges related to segment margins, notably influenced by the B-21 program, which is the program to replace the B-2.

According to the company, the imposition of charges on the B-21 program came from a convergence of lower assumptions regarding macroeconomic disruption funding and elevated production cost projections.

This is how The Drive put it (emphasis added):

Northrop Grumman has disclosed a loss of nearly $1.2 billion on the B-21 Raider stealth bomber program. The company also now says it expects to take a financial hit on each of the first five low-rate production lots of these aircraft. This all comes just days after the Pentagon disclosed it had awarded the first B-21 low-rate production contract. Still, a loss at this time pales in comparison to the revenue the program could generate for the company over its lifetime, if it’s executed as currently envisioned.

Note the comment regarding the massive potential of the program in the years ahead.

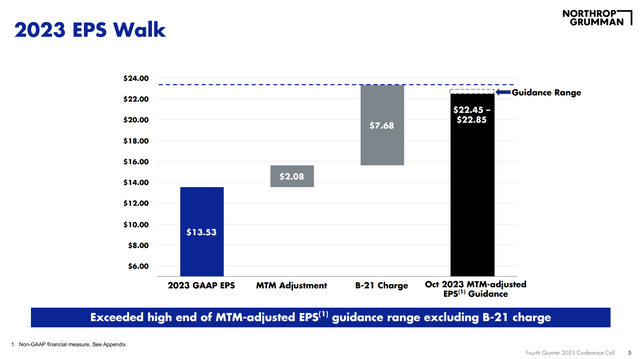

However, before we discuss the company’s outlook, I need to mention that the EPS result for the fiscal year 2023 requires attention, particularly in light of a $2.08 unfavorable mark-to-market adjustment from pension plans and a $7.68 per share impact from the aforementioned B-21 charge.

Adjusting for these items, the company would have exceeded the high end of the previously guided EPS range by more than $0.40.

As a result, 2023 EPS came in at $15.61, down from $25.54 in 2022.

With that in mind, what’s next?

NOC Remains In A Fantastic Position For Long-Term Growth

Despite some cost-related issues, the company remains focused on what it does best: delivering top-tier defense solutions.

In alignment with this strategy, the company invested over $2.9 billion in Research and Development and Capital Expenditures (“CapEx”) during 2023, representing 7.5% of its sales.

As a result of being on top of the biggest defense programs, it continues to achieve major success.

For example, one significant achievement involved the successful launch of ULA’s Vulcan using the GEM 63XL solid rocket booster, which is the world’s largest monolithic solid rocket motor, indicating promising growth opportunities in the space industry.

The GEM 63 is also pictured in the Space Systems overview below.

Furthermore, the demand for weapon systems experienced an upswing in 2023, and the company anticipates this trend to persist.

We’re a supplier of propulsion systems, warheads, fuses and cannons across a highly diversified customer base and a prime contractor for predominantly air-to-ground missiles including AARGM-ER and Stand In Attack Weapon. Weapon Systems currently represents approximately 7% of total revenue and based on the demand we’re seeing, we expect this business to grow faster than the company average for the foreseeable future with a significant portion of this expansion coming from international customers. – NOC 4Q23 Earnings Call

Adding to that, noteworthy contributions came from the Mission Systems business, which demonstrated exceptional strength with a book-to-bill ratio exceeding 1.2x in 2023.

This business segment focuses on developing advanced microelectronics, sensors, processors, and secure communications, positioning customers with a decision advantage in an advancing technology environment.

Furthermore, Northrop Grumman remains optimistic about the future due to the escalating global security spending.

The company strategically aligns its portfolio with customer priorities, including the Triad, space, and weapons.

Notably, U.S. franchise programs receive consistent support from Congress and the Department of Defense, providing confidence in the company’s outlook even within a potentially constrained U.S. budget environment.

The passing of the National Defense Authorization Act and ongoing appropriations progress further enhance this optimism.

In other words, by focusing on the most pressing defense programs, the company can somewhat avoid budget uncertainties in other areas.

Looking at the bigger picture, Northrop Grumman anticipates sustained growth in the coming years, building upon its solid financial performance.

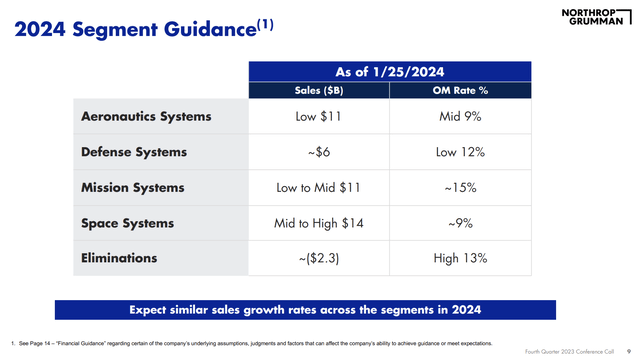

Meanwhile, organic sales have demonstrated consistent growth at a rate exceeding 5% annually since 2019, while the company’s 2024 outlook indicates a sales growth forecast of 4% to 5%.

- Aeronautics sales are projected in the low $11 billion range, with growth driven by key programs such as B-21, F-35, and E-2D.

- Defense Systems sales are anticipated to reach roughly $6 billion, reflecting low single-digit growth from the previous year. However, there is optimism in this segment regarding the potential for sustained growth, particularly in weapons and missile defense capabilities.

- Mission Systems sales are expected in the low to mid-$11 billion range, continuing the trend of mid-single-digit growth with segment margins around 15%.

- In the Space segment, sales are forecasted in the mid-to-high $14 billion range, accompanied by approximately 9% margins.

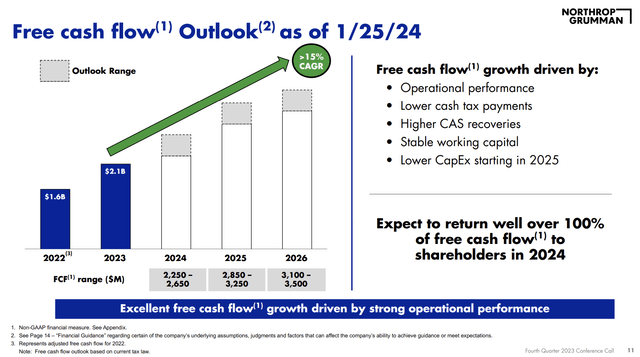

Even better, beyond the current fiscal year, the company outlined its long-term outlook, emphasizing the expectation of double-digit free cash flow growth for several years.

This growth trajectory is anticipated to be driven by sustained business expansion, robust operating margin volume, and efficient conversion of profits into cash.

Beyond 2027, it expects this trend to continue, including tailwinds from the B-21 program.

Furthermore, as we can see above, the company continues to focus on shareholders, as it is expected to return more than 100% of its free cash flow to shareholders this year.

The company can do this, as it has a strong free cash flow outlook of 15% annual compounding growth and a 2024E net leverage ratio of less than 2.0x EBITDA. It has an investment-grade credit rating of BBB+, which is one step below the A range.

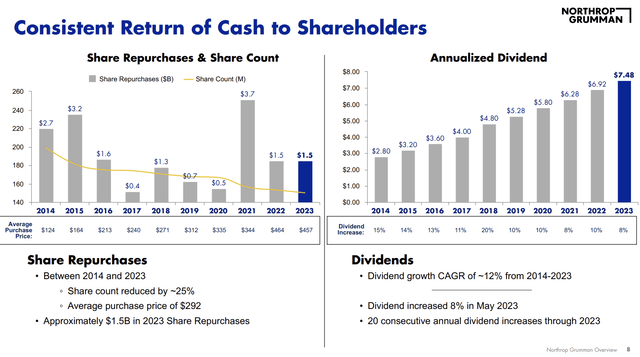

- Since 2014, the company has bought back a quarter of its shares.

- Its dividend has grown by 12% per year during this period.

- As it has 20 consecutive annual dividend hikes, the company is five years away from becoming a dividend aristocrat.

- NOC currently yields 1.8%.

So, what about its valuation?

Valuation

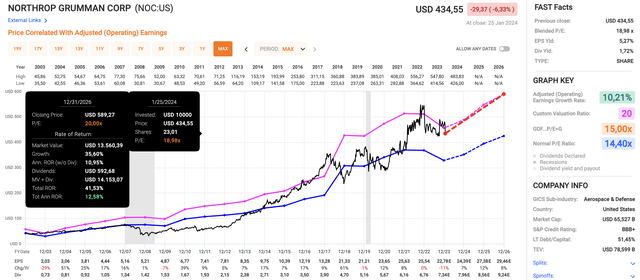

Northrop Grumman, which has returned 12.6% per year since 2003, is attractively valued despite a slow start to its growth recovery.

Using the data in the chart below:

- NOC is trading at a blended P/E ratio of 19x.

- Its normalized long-term earnings multiple is 14.4x, which, I believe, is too low for the expected growth trajectory.

- Hence, just like in my prior article, I’m using a 20x earnings target (the pink line).

- This year, analysts expect EPS to grow by 7%, potentially followed by 12% growth in 2025 and 8% growth in 2026.

- Combining a 20x multiple, its dividend, and expected EPS growth, the company has a path to 12.6% annual returns, which would be equal to its performance since 2003.

Despite ongoing risks like budget and supply chain/inflation risks, I really like the longer-term risk/reward here, which is why I added to my position.

While NOC may not be as cheap as its peer, RTX Corporation (RTX), which I discussed in this article, it offers exactly what I am looking for in my portfolio, which is the high likelihood of long-term outperformance with subdued economic risks and consistent shareholder distribution growth.

Takeaway

My new focus on Northrop Grumman reveals both challenges and opportunities.

Despite a 6% dip post-earnings, the fourth quarter showed a robust 7% revenue increase, surpassing initial guidance.

Notably, all business segments had a strong book-to-bill ratio, supporting future growth.

Meanwhile, challenges in segment margins, particularly the B-21 program, led to a disclosed loss of nearly $1.2 billion.

However, NOC remains strategically positioned for long-term growth, investing over $2.9 billion in R&D in 2023.

With an optimistic outlook, organic sales growth, and a commitment to shareholder value, NOC presents an enticing long-term investment opportunity despite ongoing risks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NOC, RTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.