Summary:

- According to reports, the U.S. Federal Trade Commission may sue Amazon soon, an effort to break up the company and promote ecommerce retail competition.

- Amazon’s business practices are also under scrutiny in the EU, further adding to regulatory concerns.

- The share valuation remains excessive/unreasonable vs. 5% risk-free cash yields, amid a slowdown in annual sales growth into the single digits during 2022-23.

ymgerman/iStock Editorial via Getty Images

Drumbeats have been getting louder in recent days, regarding the likelihood the U.S. Federal Trade Commission antitrust unit is about to sue Amazon.com (NASDAQ:AMZN) over how it runs the world’s leading ecommerce retail site. Rumors are even suggesting, the government is looking to break up the company to promote stronger online sales competition.

What’s interesting to me is little attention is being paid to this news by the stock price. With earnings already fleeting after 25 years in business, the main buy argument for the company is found in its diversified and integrated operations. Having one unit cross-promote its services to customers on the other side of the business have been a primary reason for outstanding sales growth, alongside the hopes of gargantuan free cash flow generation someday. (Think AWS Cloud services pushed on independent retailers selling on Amazon. Or, Ring doorbells connected and integrated into your annual Prime membership.)

If the company is broken up into a number of separate businesses (starting with ecommerce retail), and all are required to sink or swim on their own, existing Amazon shareholders may not be happy with the financial results. Growth rates could be cut off at the knees, and new accounting/managerial/marketing costs for each could make immediate operating profitability difficult to achieve or sustain both individually and for the existing whole of the organization.

FTC’s August Meeting with Company Attorneys

Perhaps the last chance to reach a compromise agreement with the government passed in August. According to Seeking Alpha reporting overnight (September 5th, 2023),

The Federal Trade Commission is expected to file an antitrust lawsuit against Amazon.com later this month.

Members of Amazon’s legal team had a video call with the FTC last month in an effort to avert a lawsuit, according to a WSJ report on Tuesday, which cited people familiar with the matter. Amazon’s lawyers didn’t offer any concessions in the meeting to try to persuade the regulator to refrain from filing a lawsuit.

The lawsuit is expected to focus on some of Amazon’s business practices, such as its Fulfillment by Amazon logistics program and pricing on Amazon.com by third-party sellers, the WSJ said. The suit is expected to recommend that Amazon make “structural remedies” that may include breaking up the e-commerce giant.

And, yesterday the European Union announced (in coordination or not with U.S. regulators) it was targeting Amazon and five other Big Tech names as “gateway” keepers of the internet. Basically, the EU is giving Amazon and peers six months to comply with the continent’s Digital Markets Act. Under the DMA, Amazon’s business practices will be scrutinized like never before, where new requirements on “fair play” with independent retailers on Amazon.com will be enforced.

However you slice it, Amazon’s business model of owning and controlling much of the online retail marketplace is now coming under attack. So, if you own shares, you need to start paying closer to attention to the unfolding regulatory environment.

Valuation Remains Excessive

Because the stock has paid little to no heed to the quickly changing news flow approaching, its stock valuation remains overly rich, in my opinion. And, if a major drag on expected operating results past 2024 is next on a company break up, Amazon can easily be argued as a Sell today.

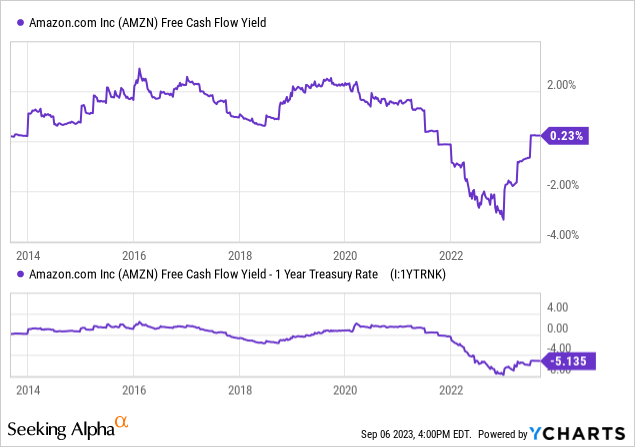

I will harp on this first data point again for regular readers of mine, earnings, and free cash flow yields provided by the Big Tech names make absolutely no rational sense today, when measured against risk-free Treasury yields above 5%.

For example, Amazon’s 0.2% in free cash flow yield is awful to begin with, but the spike in short-term interest rates over several years means Wall Street analysts and investors are not doing their valuation homework. Sure, if short-term interest rates were pegged at ZERO like 2020’s pandemic low, a minor free cash flow yield from Amazon could be argued as mathematically acceptable.

Yet, the only way Amazon’s lack of earnings and free cash flow makes any sense to own is either through massive company growth (which has stalled to a great extent in 2022-23) or a sharply lower stock quote to rebalance its valuation with acceptable investment returns in the bond market. A relative -5.1% in negative Treasury-yield adjusted, free cash flow is beyond absurd to me.

YCharts – Amazon, Free Cash Flow Yield vs. 1-Year Treasury Rate, 10 Years

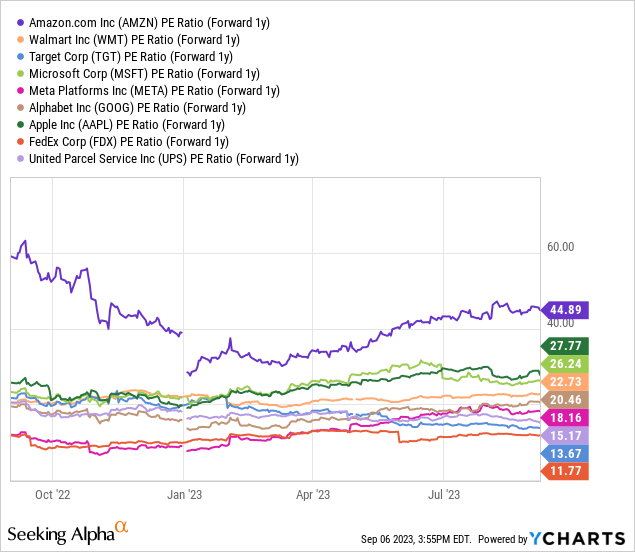

Even when we look ahead to projected 2024 results, Amazon’s 1-year forward P/E is quite nuts at 45x vs. the closest major retailers of Walmart (WMT) and Target (TGT), or the Big Tech group of sometimes competitors Microsoft (MSFT), Meta Platforms (META), Alphabet-Google (GOOG) (GOOGL), and Apple (AAPL), or the goods delivery leaders of FedEx (FDX) and United Parcel Service (UPS). At best an owner will get 2.2% for an equivalent earnings yield (using analyst estimates), with 1-year Treasury rates pushing 5.4%.

YCharts – Amazon vs. Peers/Competitors, Price to Forward 1-Year Estimated Earnings, Over 12 Months

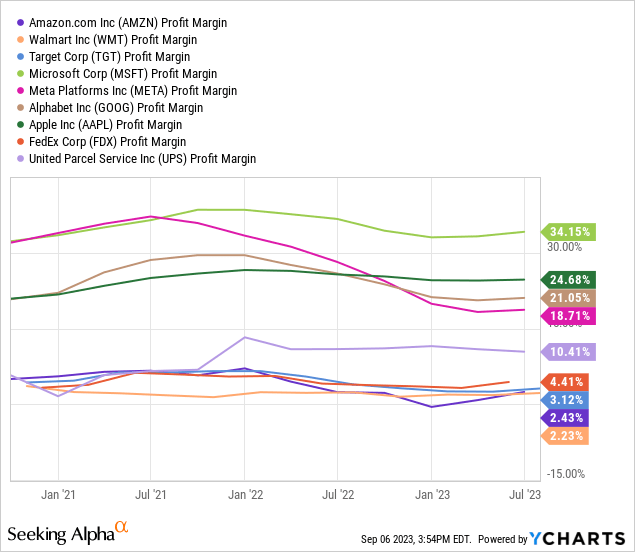

Versus all of its peers and competitors, Amazon scores the worst on profit margins. And, if the company is split into separate pieces, earnings will be more difficult to achieve, no doubt.

YCharts – Amazon vs. Peers/Competitors, Profit Margins, 3 Years

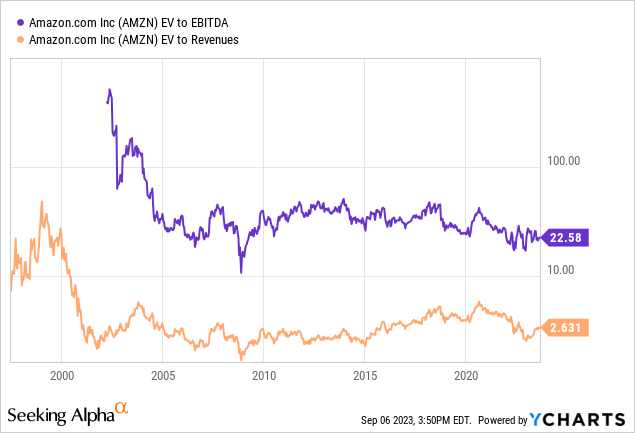

Then, we can include debt and subtract cash from the equity market capitalization to create enterprise value. On EV to EBITDA or revenues, Amazon is selling very near its 10-year averages, despite sales growth plummeting the last couple of years to single digits. Weaker growth rates should equal a far lower valuation setup.

YCharts – Amazon, Enterprise Valuations, Since 1998

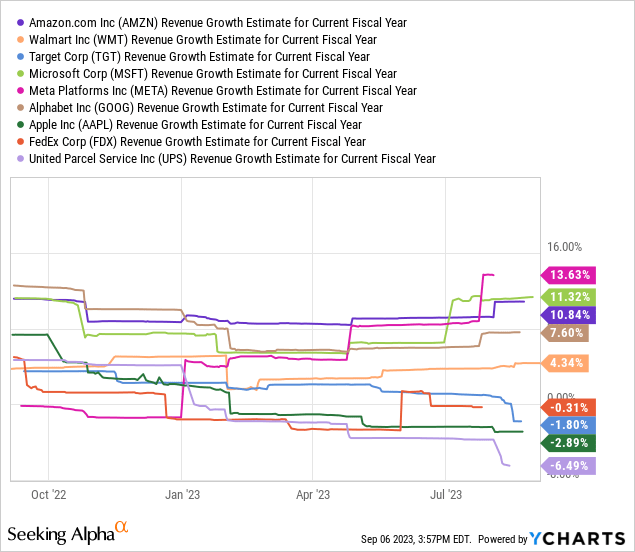

With 4% inflation in the economy, growing the company by 9% or 10% YoY is not saying much. Although Amazon is surviving 2023 better than some of its peers, truly massive company size and competition in a stumbling economy have hampered the growth story.

YCharts – Amazon vs. Peers/Competitors, 2023 Sales Growth Estimates, 1 Year

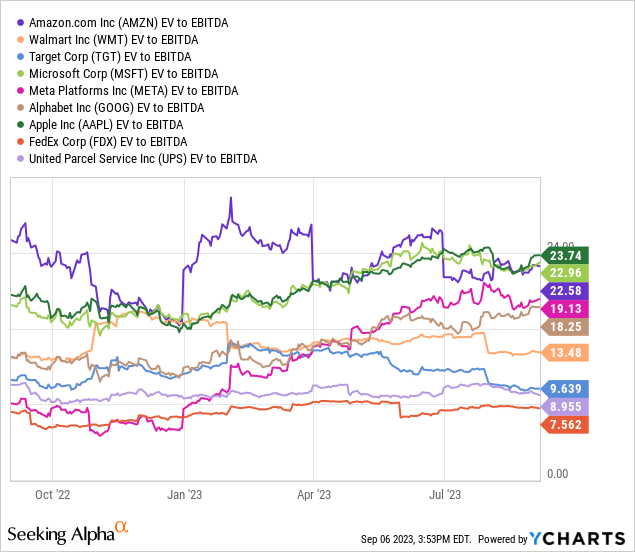

On EV to trailing EBITDA, Amazon remains one of the most expensive Big Tech plays, and that’s assuming the government is not about to break up the successful Amazon band.

YCharts – Amazon vs. Peers/Competitors, EV to Trailing EBITDA, 1 Year

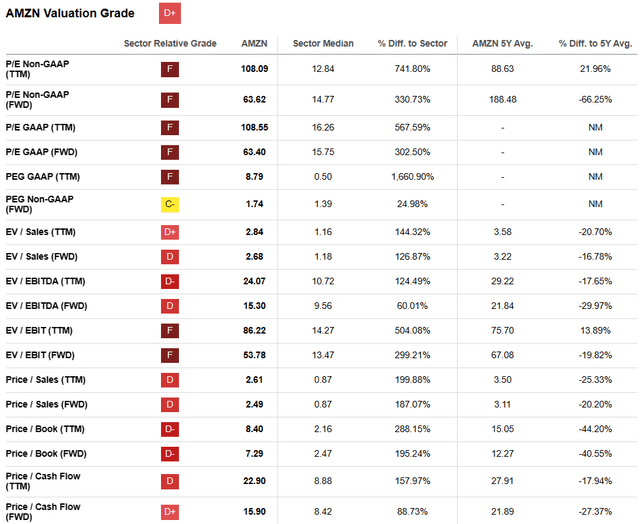

Seeking Alpha’s computer ranking system puts a “D+” grade on Amazon’s overall valuation, which I believe is quite generous.

Seeking Alpha Table – Amazon, Valuation Grade, September 5th, 2023

Weakening Technical Momentum

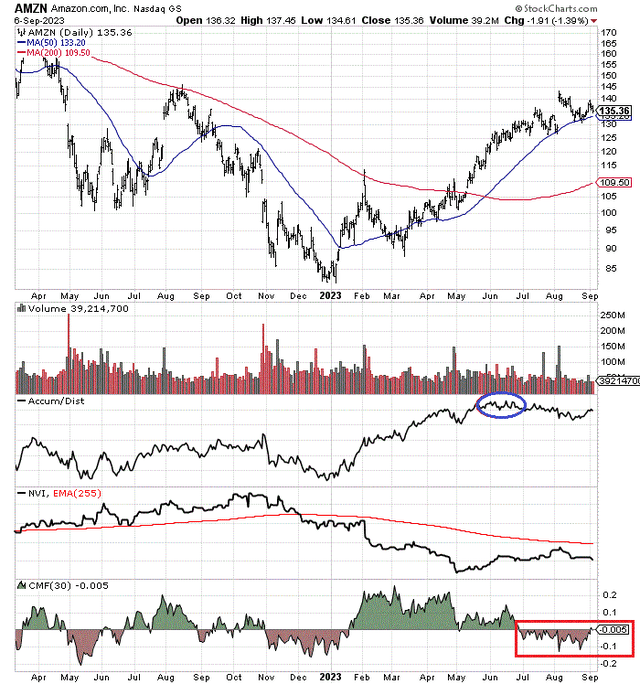

Another issue with Amazon shares in early September is momentum indicators have rapidly rolled over since June.

Despite a rising price trend over the latest nine weeks, the Accumulation/Distribution Line has transitioned from marked strength in the first half of the year to uncommon weakness (peak circled in blue below).

The Negative Volume Index has highlighted steady selling on slower news, weaker volume days all year.

In addition, the rare circumstance of deep 30-day Chaikin Money Flow selling has been part of the technical equation since late June. Usually, this type of action is witnessed during sharp price declines, not rising quote trends.

My chart readout is any drop underneath the 50-day moving average ($133 now) in coming days/weeks could lead to a meaningful price decline over the autumn months. Long-term support may not appear before $115 (February’s high) or the 200-day moving average closer to $110 today (likely rising to $115 into early October).

StockCharts.com – Amazon, 18 Months of Daily Price & Volume Changes, Author Reference Points

Final Thoughts

My opinion has not really changed on Amazon over the past few years. Slowing company growth and rich overvaluations do not mix well in a rising interest rate environment. The next catalyst for a price downturn may be an announcement by the U.S. government that it intends to break up Amazon (or at least parts of the business). And, that decision could be filed with a federal court in coming days.

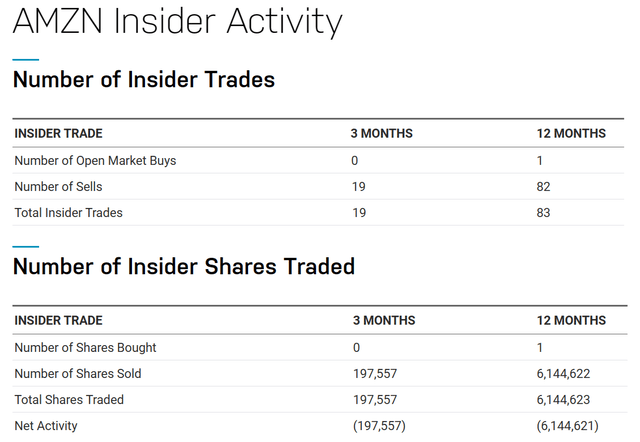

Insider trading has been a decidedly one-way affair: nearly all selling over the last 12 months. The board of directors, upper management, and top shareholders have been regular net sellers. In terms of a vote of confidence, insiders are running away from the company.

Nasdaq.com – Amazon, Insider Trading, 12 Months

How low can Amazon’s share price go? That’s a terrific question. It may depend on our economic future into the important Christmas retail sales season. If a recession appears soon (think inverted Treasury yield curve, resumption of student loan payments, rising long-term borrowing rates this summer, housing, and real estate slowdown) at the same time as the government is preparing to rework many of Amazon’s competitive advantages in the marketplace, sub-$100 prices will be easy to attain. Such a price would remain an “overvalued” setup given today’s weaker company growth outlook vs. five or ten years ago.

Plus, multi-year lows under $85 are not impossible, especially if a major bear market returns to Wall Street, hitting all Big Tech names. To me, it looks like a large number of negative developments could combine to knock Amazon’s stock in a fashion not seen since early 2022. Historically, when other blue chips have suffered a streak of bad news events, price declines of -50% or more are somewhat common. For example, Amazon itself tanked -55% between November 2021 and January 2023, a function of disappointing operating results and sharply higher interest rates. Don’t say a similar wipeout cannot happen again in a serious economic slump globally.

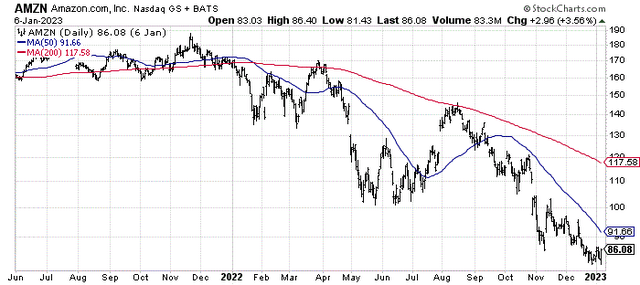

StockCharts.com- Amazon, Daily Price Changes, June 2021 to January 2023

What’s the upside for Amazon? A serious question for longs who don’t want to sell. If we can avoid recession and the Fed is allowed to drop interest rates (with even lower inflation should it occur), a soft landing in the economy could support share trading in the $125 to $155 range over the next 12 months (near today’s price). Bulls will say current valuation multiples are sustainable, explaining a slight drift higher in price is our future. Lacking catalysts to sell, valuations would remain high, as would optimism about the American future for Big Tech in a soft-landing scenario. Remember, the wildcard may be what happens with any breakup action by the FTC.

Given potential upside of +15% vs. worst-case downside of -50%, I cannot honestly suggest a Buy rating. The odds favor a flat to lower share quote over the next 12 months. As a consequence, I am keeping Amazon in the doghouse with an Avoid to Sell rating. I do not own shares, while having only limited interest in shorting the company. Focusing on other businesses with better growth rates (above +10% annually) sitting at realistic valuations (P/Es under 15x) is where I expend my energy and research.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.