Sell Apple Before Earnings? Why The Best Days Could Be Over

Summary:

- I recommend selling Apple shares due to risks in its China business and limited upside potential.

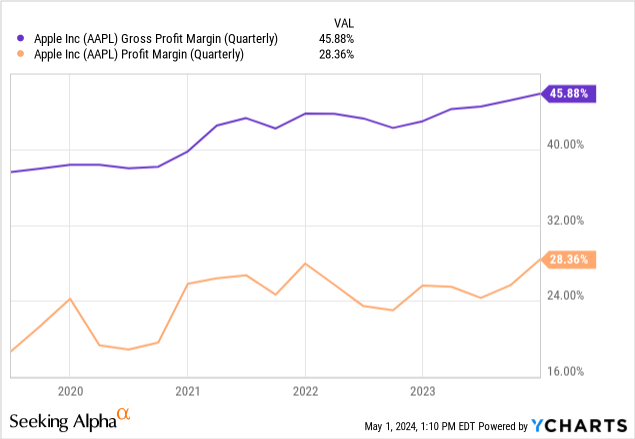

- AAPL’s revenue has been stagnant, but its margin has increased due to the growing services division.

- The current fair value of the stock is estimated to be $167, and future stock price gains are expected to be in line with EPS increases.

bymuratdeniz/E+ via Getty Images

Investment Thesis

I owned Apple (NASDAQ:AAPL) for several years but sold my whole position in 2023. If I still owned shares, I would sell them right now. The company faces several risks, mainly its China business, and overall, the upside is limited. I think it is likely that the share price will rise at around the same rate as EPS growth over the next few years. The valuation is not as expensive as it used to be, but it’s still too high considering the stagnant revenues. My thesis is not that investors will lose money with this stock, but rather that the significant outperformance relative to the broad market will be over and that shifting into other stocks might make more sense.

The Past: Financial Progress & Trends

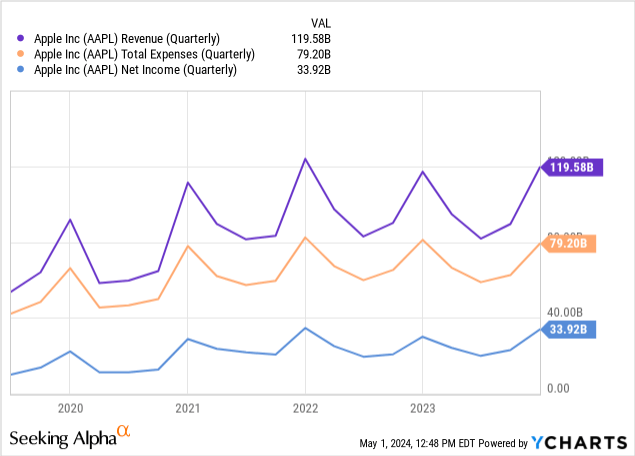

First, a short overview of revenues, expenses, and net income over a longer period. Revenue reached its high in 2022 and has been more or less stagnant since.

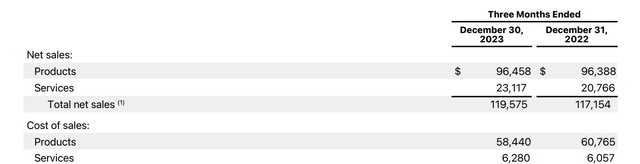

However, the company has increased its margin almost continuously for years, likely due to the increasing percentage share of the Services division. Here is a chart of the margin development, and below it is an excerpt from the last quarterly results, which shows that the cost of sales in the Services segment is significantly lower than in the Products segment.

Investor presentation

The Present: Valuation

The company is currently valued at an enterprise value of $2.57T. The market cap is $2.63T, and the debt is insignificant.

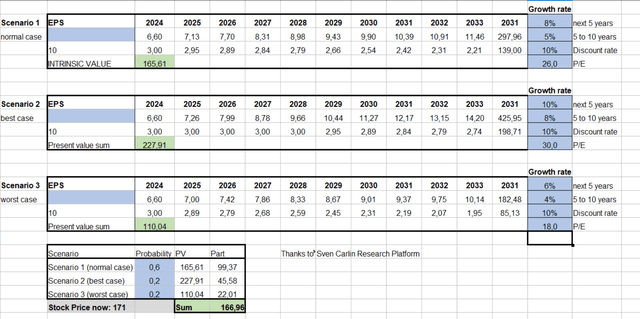

I have created a discounted cash flow model with three scenarios to determine the current fair value. A few remarks:

- This approach allows us to approximate a fair value: it could be seen here if a share were strongly overvalued or undervalued. It is also a systematic approach to comparing the current P/E ratio of various stocks to their growth.

- Of course, I had to make a lot of estimates, but the growth figures for scenario one are roughly in line with analysts’ profit estimates for the next few years.

- The “normal case” under scenario one is indicated as the most probable variant (weighted with 60%).

- The result is that based on the growth estimates, the current fair value would be a stock price of $167. So, according to this model, the stock would be fairly valued right now.

What does this mean?

If the P/E ratio remains as it is now, future stock price gains should be roughly at the level of the EPS increase. So, if EPS rises 7% in a year, the stock should rise about 7% as well. The company is buying back shares on a massive scale, but remember that this is already reflected in the EPS. My three scenarios above assume three different P/E ratios, as this significantly impacts the upside or downside potential of the share price.

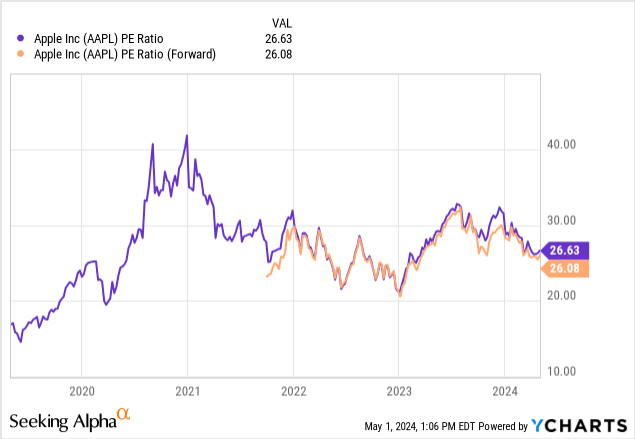

Long-term, a revaluation of the share is also possible. A company that consistently increases profits by less than 10% per year will probably not be able to maintain a P/E ratio of 26. This corresponds to a PEG ratio of almost four at current growth rates (PEG ratio = PE ratio/growth rate). According to Peter Lynch, the PEG ratio of a fairly valued company should be 1.0 or less. This figure may be outdated and no longer applies to today’s tech companies, but a PEG ratio of almost 4 is still very high. In Apple’s case, the calculation is a PE ratio of 26 / 7% = 3.7.

The following chart shows that the share is currently valued rather averagely, even on its five-year average; there were several phases when the share was cheaper.

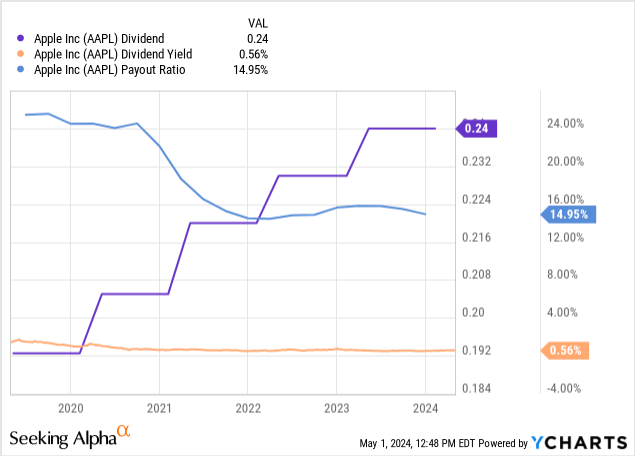

I want to briefly mention the dividend, mainly to show that the payout ratio has not risen for years but has sunk even though the dividend has increased. Since the payout ratio is low, investors can probably look forward to many more years of dividend growth.

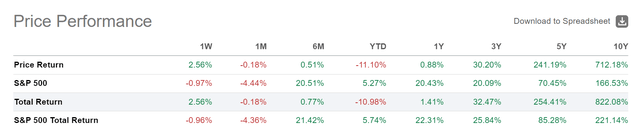

My overall argument is not that investors will lose money on this stock, but that the periods of massive outperformance are likely over. And the outperformance has already been over for a while, as we can see in the chart below, compared to the S&P 500.

There has still been a slight outperformance over three years, but the decisive factor is how things will continue in the future anyway, so what developments are there, and why am I rather skeptical?

The Future: Outlook

Usually, I would write about a future outlook here, followed by the risks section. However, the outlook section of this article already describes the risks. Then follows the upside risk to my thesis, i.e., why I could be wrong.

China

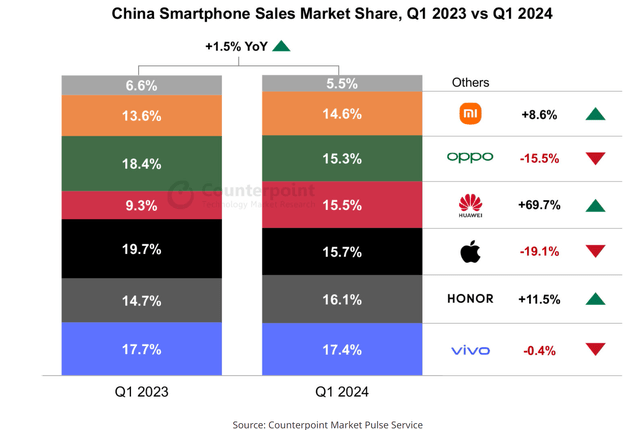

Let’s start with a huge development for Apple, namely falling sales in China. Anyone following the news has probably already heard about this, but the figures are astonishingly high.

Apple’s smartphone shipments dropped 16% to 48.7 million units in the first-quarter, reducing its global market share to 16%. Samsung regained the top spot with 60 million shipments, marking a fall of 1%. Xiaomi maintained third place with shipments jumping 33% to 40.7 million units. TRANSSION and OPPO rounded out the top five, shipping 28.6 million and 25 million units respectively.

Seeking Alpha news

According to a report by Counterpoint Research, which is only a few days old, sales have even slumped by 19%. An excellent graphical representation shows Huawei’s rise, and Honor surpasses Apple. Quick personal note: I am happy with an Honor phone, especially the price-performance ratio, which is phenomenal.

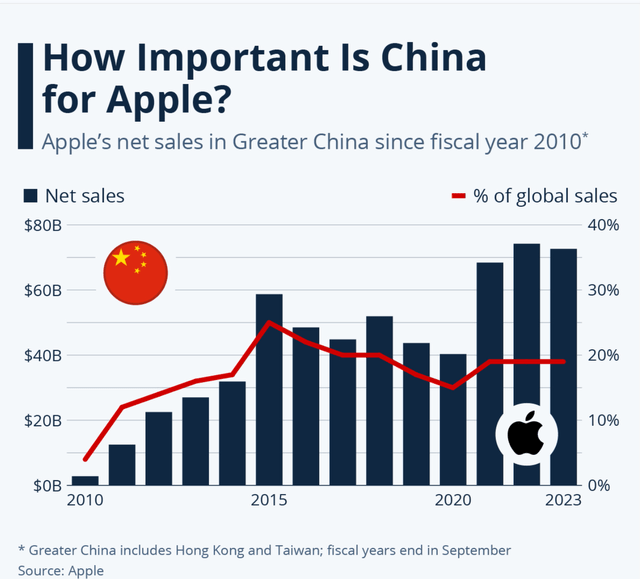

According to Statista, China accounts for about 20% of Apple’s sales. In particular, 2021 – 2023 were new highs, which means that the long-term upward trend is still intact. However, you can already see on the graph that sales were lower in 2023 YoY. Given the current development, they will likely fall again in 2024.

There are several reasons for this development. Firstly, the government has banned employees from using Apple phones for security reasons. Secondly, Huawei’s return is part of China’s national pride. It is probably the most sanctioned Chinese company of all time. The Chinese know they are already in the middle of a trade war, and just as Americans tend to support American companies, the Chinese also help Chinese companies. Huawei also symbolizes success in the trade war, especially with the 7nm processors produced entirely in China.

Of course, Apple still has a strong brand in China, but that could slowly change. If the company continues to relocate jobs from China to other countries, such as India, sentiment could deteriorate even further. The government could also support this by portraying a negative image of Apple on social media.

The M-chip-series is not that far ahead anymore

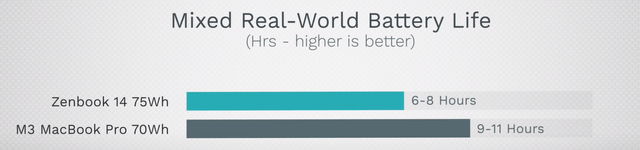

One of the most significant advantages of Apple’s MacBooks is their excellent performance combined with low-power consumption, which leads to long battery life. Apple is still the leader here, but the competition has caught up. The latest chips from AMD and Intel (INTC) have greatly improved watt consumption, so Windows laptops now also have long battery runtimes. They are still not quite as long as Apple’s machines, but the gap has narrowed significantly compared to 2021. All this at a similar weight and for almost half the price.

One last point I would like to mention is that MacBook sales have already collapsed considerably in 2023

Apple achieved $29 billion in sales from its Mac lineup, accounting for 8% of total sales. Mac sales experienced a decline of 27% YoY.

forrester.com FY 2023 analysis

AI won’t be a huge advantage

Many rumors exist about how much and what kind of AI Apple will incorporate into its future products. Siri will probably become a real assistant with a ChatGPT-like ability to respond. It is also likely to integrate various aspects of generative AI to alter photos or turn photos into short videos.

During Apple’s most recent earnings call, Cook said Apple is spending a “tremendous amount of time and effort” on artificial intelligence technologies, and the company is “excited to share the details of our ongoing work in that space later this year.”

Apple teases ‘Absolutely Incredible’ AI-focused WWDC (Source)

This may all happen, but I don’t believe it will change much because the competition will do the same. For years, companies like Samsung and Apple have been running side by side at a similar pace, and as soon as one company innovates, the next generation of the competition’s devices will do the same. Incorporating various AI tools will be the standard, and I think won’t be a specific advantage for any company. And if it is, then only for a short time until the competition has caught up. Moreover, Apple is a newcomer when it comes to AI and will first have to prove what its own AI products can do.

Risks to my thesis

Of course, there are also many reasons why I could be wrong and why Apple’s outperformance could continue in the coming years.

Firstly, there are direct counterparts to the above risks, especially China. It could also become apparent in the next few quarters that sales in the Chinese market are starting to rise again and that the emergence of Huawei was only short-lived, like a brief flare-up of patriotic exuberance. One reason for this could be that the sanctions in the semiconductor sector will continue to weaken Chinese manufacturers for many years. For example, I have read that China could still produce the 7nm processors with the existing lithography machines from ASML, but the jump to 5nm and less will be the real challenge. Apple continues to be supplied by Taiwan Semiconductor (TSM), the most technologically advanced company.

Another catalyst over the next few years could be the virtual reality business, which was recently launched with the Vision Pro. This business could gain considerable importance and might become another financial pillar of the company. However, due to the company’s immense revenues, any new business will be barely noticeable in the financial report for several years.

Another reason for a renewed euphoria could be that Apple delivers more in the AI business or something completely new that no one has seen. So, I don’t have a concrete example of what that could be, but an innovation or idea is always possible.

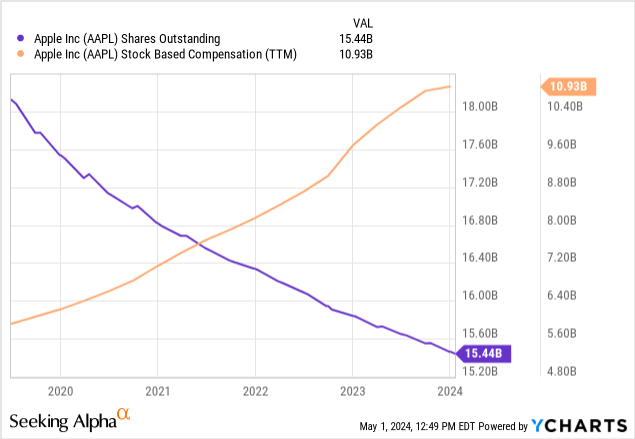

Share dilution, insider trades & SBCs

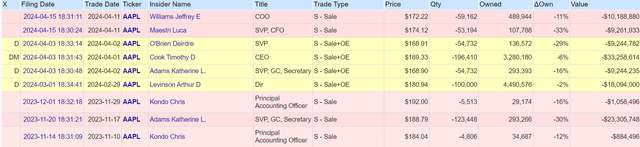

These three things are standard checks I make in every article, as excessive stock dilution and stock-based compensation can disadvantage shareholders. In addition, insider trades sometimes contain valuable information about management’s confidence. The SBCs look high, but considering the $100B net income in 2023, it´s justifiably. For example, a few days ago, I analyzed META; here, the SBCs are much higher than the net income.

These are all insider trades from the last six months. There were some sales, but considering the market cap, it´s not massive.

Conclusion

I hope this article is not misunderstood. Apple is still a great company with a strong brand and a moat through its ecosystem.

Overall, my argument is that sudden upside surprises are unlikely. Instead, the Chinese market, in particular, is a considerable risk to future sales. Due to the risks, already stagnating revenues, and falling sales figures, e.g., for MacBooks, I believe the potentially negative trends outweigh possible positive surprises. This increases the likelihood that we could see a revaluation of the shares sooner or later. By this, I mean that 25-30 could no longer be the average P/E ratio of the company, but rather 20-25.

Or, to put it the other way around, this downward revaluation is, in my opinion, more likely than an upward revaluation. Even if there is no revaluation and the valuation in three years’ time is still 26 (i.e., the same as today), the return for investors will be nowhere near as good as in recent years. I believe Apple is still an investment that will generate positive returns for investors, but I also know that some people have extensive positions in the company. This article is intended to encourage them to think about possibly reallocating a portion.

|

Investor’s Checklist |

Check |

Description |

|

Rising revenues? |

No |

Increasing over longer periods |

|

Improving margins? |

Yes |

Possible competitive edge |

|

PEG ratio below one? |

No |

PEG ratio below one may suggest undervaluation |

|

Sufficient cash reserves? |

Yes |

Vital for the survival & growth, especially of unprofitable companies |

|

Rewards shareholders? |

Yes (buybacks & dividends) |

Returning capital to shareholders |

|

Shareholder negatives? |

No |

Actions that disadvantage shareholders |

|

Stock in an uptrend? |

No |

Trading above its 200-day moving average? |

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.