Summary:

- The Nasdaq’s 15-year period of zero returns highlights the importance of valuation in the long term.

- Eli Lilly is in an epic bubble, pricing in all growth through 2036 and trading at almost 60X forward earnings.

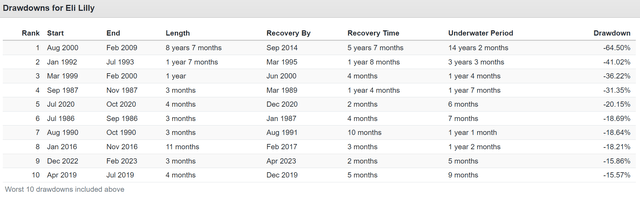

- The last time LLY was a 60 PE was the tech bubble. It fell 65% and took 14 years to break even.

- In contrast, this dividend legend is a 32% undervalued hyper-growth dividend aristocrat that has 50% upside potential through 2025 alone and is growing at almost 20%.

- I’m 80% confident this coiled spring aristocrat will be a far better investment than LLY over the next five-plus years. That’s the Templeton/Marks Wall Street certainty limit and means “I’ll die on this hill confidence.”

lucadp

If you pay a dumb price for even God’s own company, you are asking to suffer poor returns for many years. Here’s the ultimate example.

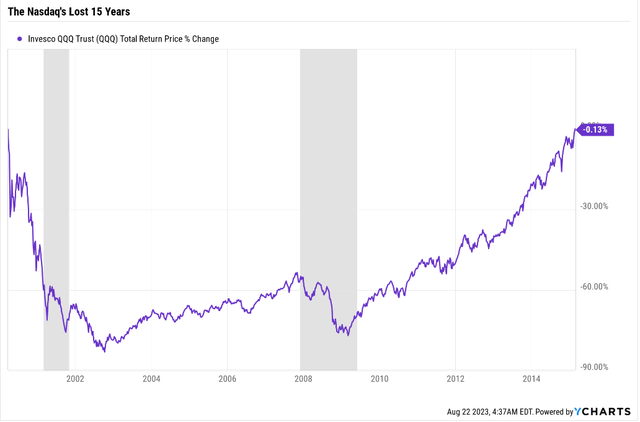

The Nasdaq’s Lost 15 Years Was Pure Valuation

Ychart

The Nasdaq is the best-performing index in history, with 38 years of 13.5% annual returns.

And yet, if you bought it at the peak of the tech bubble when the S&P was 50% overvalued and tech stocks were even more absurdly valued, you saw zero returns for 15 years.

- 17 years adjusted for inflation

Those are the world’s most dominant and innovative and richest growth stocks. They have about $6.5 trillion in cash, 10X more than the Vatican. They’re expected to keep growing at double digits for the foreseeable future.

- 11.7% long-term growth consensus for Nasdaq 100 vs. 8.5% S&P vs. 6% historical S&P earnings growth

You could argue that this portfolio is as wide moat, Ultra SWAN as possible. The most dominant world beaters ever assembled. And yet 17 years of flat real returns.

I point out this extreme example to make two important points.

1. Valuation always matters in the long term, and it matters a lot

2. Cherry-picking dates to argue about value traps is illogical and statistically wrong

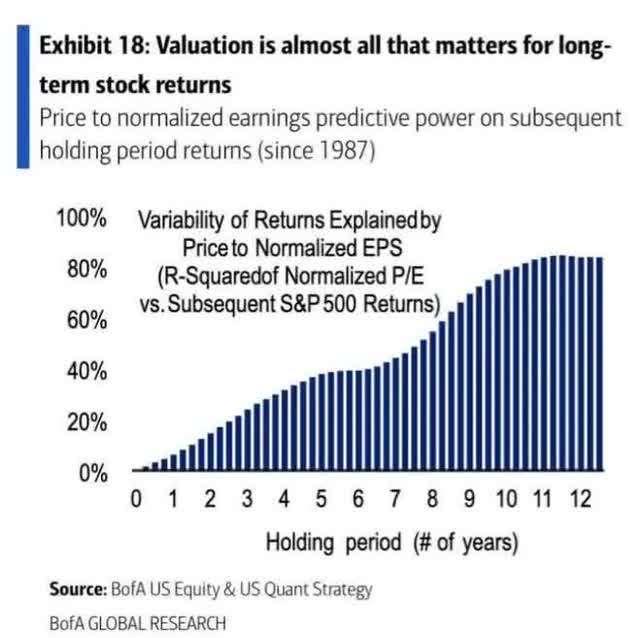

Bank of America

Think that valuations don’t matter? In the short term, they’re meaningless; that’s why bubbles exist.

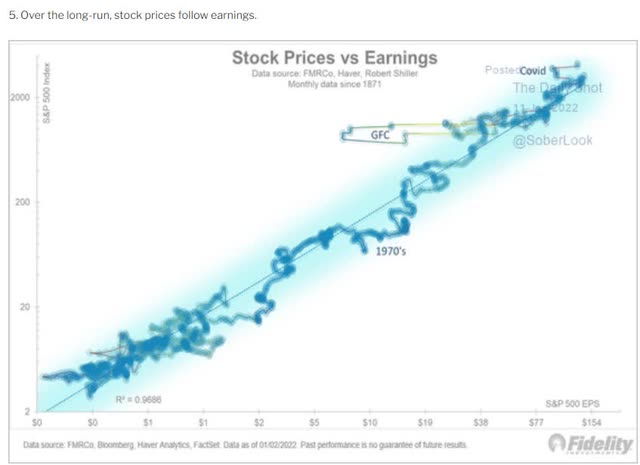

Daily Shot

In the long term, 97% of stock returns are determined by fundamentals, meaning earnings and cash flow.

In the short term, luck and sentiment are 20X as powerful as fundamentals.

In the long term, fundamentals are 33X as powerful as luck.

That’s why you’ll never see me trying to time a stock with technical analysis. If you want to use that? Go ahead, but long-term fundamentals are destiny, and for stocks in which the thesis breaks? That’s what prudent risk management is for.

So today, I want to warn you about a red-hot Wall Street darling world beater, Eli Lilly (NYSE:LLY) that’s firing on all cylinders but cruising for a bruising. And I want to explain why Lowe’s (LOW) is a far superior hyper-growth income growth alternative for smart investors today.

Eli Lilly: Great Company, Terrible Buy Right Now

Let’s get down to the bottom line up front on LLY, one of the world’s greatest companies.

I’ll explain why LLY is in a bubble, but this summary is all you need to know. If you buy LLY today, you’re almost certain to regret it relatively soon and for a long time.

Fundamental Summary

- Our quality score: 96% low risk 13/13 Ultra SWAN hyper-growth

- Our safety score: 99% very safe (A+ stable credit rating, 0.6% 30-year bankruptcy risk, 32 years without dividend cut, 8 year dividend growth streak)

- Historical fair value: $214.69

- Current price: $550.05

- Discount to fair value: -156%

- Our rating: potential trim/sell

- Yield: 0.8%

- Long-term growth consensus: 24.0%

- Consensus long-term return potential: 24.8%.

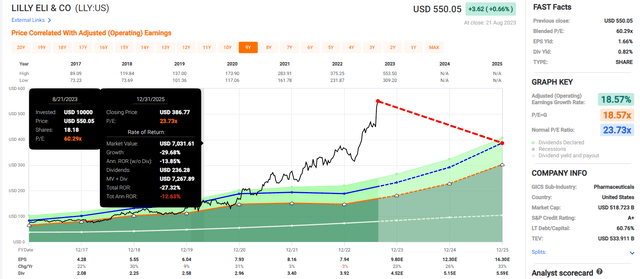

What does a 156% historical premium for a world-beater blue chip look like?

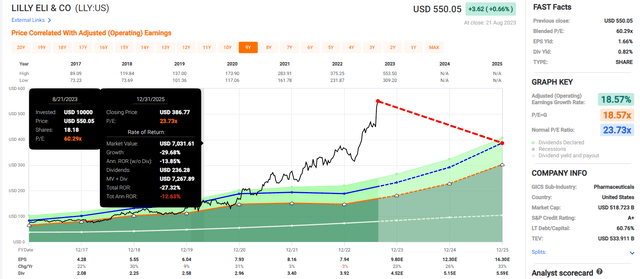

27% Annual EPS Growth, 105% Earnings Growth, And Still A Terrible Buy

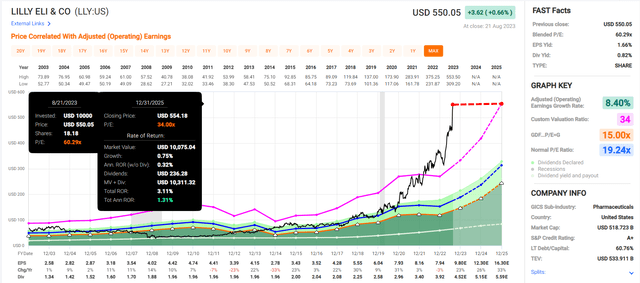

FAST Graphs, FactSet

LLY growing at 19% is worth 24X earnings according to the millions in investors over the last seven years. That’s not opinion; it’s objective fact.

Today LLY is trading at 57X forward earnings and 41X forward cash-adjusted earnings. There’s nothing that can possibly justify these valuations.

Morningstar Thinks LLY Is Worth 34X Forward Earnings, And It’s Still Overvalued Even If True

FAST Graphs, FactSet

Morningstar’s fair value estimate on LLY is now worth 34X forward earnings, a valuation it has never commanded before the current bubble.

And even under Morningstar’s super bullish discounted cash flow model, LLY has priced in three years of hyper-growth, 27% annual earnings growth that will see earnings more than double.

Mounjaro is the reason Eli is going vertical. This is a diabetes drug, a weekly injection that reduces appetite and is effective at weight loss if you take it forever.

A high-priced patented drug that has to be taken for life but that insurance companies will still pay for because it saves them money on treating other ailments related to obesity? That’s the drug industry’s holy grail!

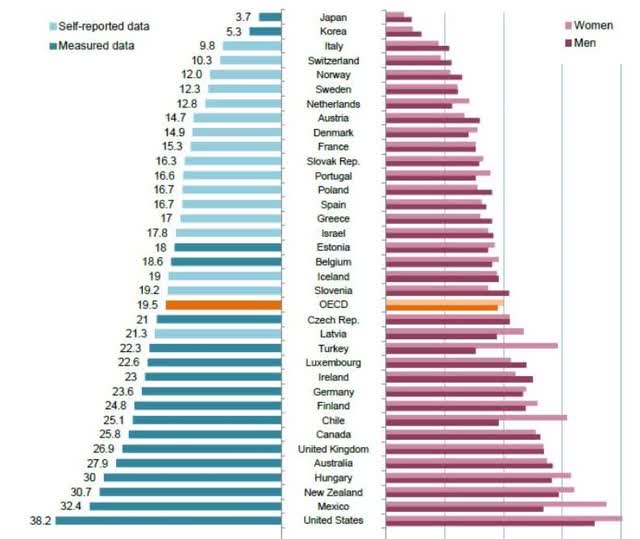

OECD

Already almost 40% of Americans are obese, and by 2030 the OECD estimates it will be 50%, with the CDC estimating as high as 85% by 2050.

Imagine 85% of Americans getting weekly injections of high-margin drugs covered by insurance! That’s what has Wall Street going nuts right now—dreams of trillions in sales in the coming decades for the ultimate drug.

A kind of drug without which the nation could not survive. 85% of Americans with diabetes and heart disease would bankrupt the country, never mind how unhealthy we’d all be.

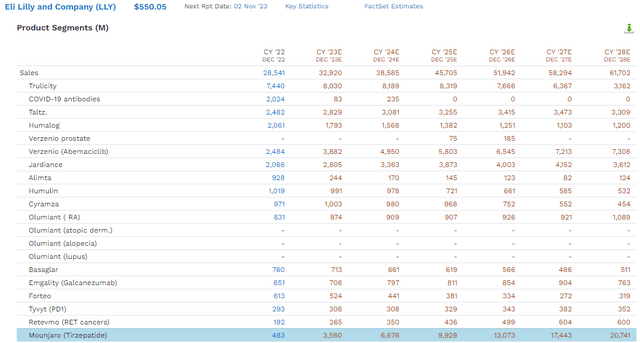

FactSet Research Terminal

From $483 million in sales in 2022, Mounjaro is expected to see sales soar to almost $21 billion annually by 2028.

- 87% annual growth for six years

Imagine sales doubling every year for six years; that’s what analysts currently expect for this drug.

And that’s why momentum-chasing analysts like Bank of Montreal’s Evan Seigerman are willing to slap a $633 12-month price target on LLY right now.

- 44X forward earnings 12-months from now = 100% historical premium

- S&P 500 was “only” 50% overvalued at the height of the tech bubble

How does BMO justify such a price target?

Take LLY’s record sales so far, $29 billion in 2022. Then double it. And this single drug might sell more in 2035, the final year of patent protection.

That’s the most bullish call on the street right now. It would make Mounjaro the best-selling drug in history by far.

Best Selling Drugs In History Through 2024

| Drug | Company | Condition |

Total Sales Through 2024 ($ Billions) – BMO 2036 Estimate For Mounjaro |

| Mounjaro | Eli Lilly | Diabetes/Obesity | 465 |

| Humira | AbbVie | Autoimmune (primarily arthritis) | 240.5 |

| Lipitor | Pfizer | Cholesterol | 180.2 |

| Enbrel | Pfizer | Psoriasis | 139.8 |

| Rituxan | Roche | Cancer | 136.07 |

| Revlimid | Bristol-Myers | Cancer | 123.64 |

| Remicade | Johnson & Johnson | Autoimmune (primarily arthritis) | 117.2 |

| Epogen | Amgen | Kidney Dialysis | 115.9 |

| Herceptin | Roche | Cancer | 114.9 |

| Avastin | Roche | Cancer | 114.3 |

| Advair | GlaxoSmithKline | Asthma | 113.6 |

| Total | 1861.1 |

(Sources: EvaluatePharma, BMO)

There are three reasons why these “miracle” weight loss drugs don’t justify the kind of mania we’re seeing today. A mania that surpasses even the AI hype mania of 2023.

- patent cliffs

- government regulation

- biosimilar competition

Mounjaro has patents that expire in 2036, so yes, that’s a very long time for LLY to cash in on what appears to be one of the top two or three drugs of all time.

But remember that an ocean of biosimilar rivals will be coming to market in 2036, drastically reducing Mounjaro’s pricing power.

No, LLY isn’t getting $52,000 per year per patient from insurance companies; they negotiate much lower prices.

But you can see that Mounjaro is a cash-minting machine.

LLY is going to try to do everything it can to extend those patents. They will tweak the formula, claiming it restarts the patent clock.

They will battle many rivals in the courts, who will try to invalidate its patents like several pharma giants did with AbbVie over Humira.

But ultimately, if this drug is as effective as it seems, that will act as a double-edged sword.

People who used the largest dose of Mounjaro, 15 milligrams, lost as much as 21% of their body weight. “They were able to achieve unprecedented amounts of weight loss.” – UC Health

Even a 5% decline in body weight for an obese person can have significant medical benefits. A 21% decline?

- 10% decline in body weight = 12% decline in mortality risk

- 15% decline in body weight = 17% decline in risk of dying from type 2 diabetes

- 21% decline in body weight = 25% decline in mortality risk

Cut your risk of dying by 25%? That’s one of the most effective drugs ever developed. Or so the marketing goes.

Is it a cure for obesity? Of course not, but that’s what has Wall Street so excited. They don’t ever want a cure for obesity; they want a treatment that has to be taken for life, and at least through 2036, that’s what Eli Lilly has with Mounjaro.

Just remember that if this drug proves to be as successful as analysts expect, the US government will likely use the new IRA’s Medicare drug negotiating powers to try to reduce the price of Mounjaro.

Will LLY try to fight that? Yup. Will they try to raise the price before the negotiated prices kick in? Yes.

Will LLY get away with charging $52K per year for this obesity drug, even the list price? Not once did the biosimilars come out. And every drug maker in the world will have a biosimilar for a drug with $500 billion in potential sales, according to BMO.

Using current net margin consensus estimates, that’s about $125 to $150 billion in total lifetime earnings from this drug.

That’s impressive, but remember that it’s over 15 years, meaning best case, about $10 billion in annual earnings.

LLY is trading at 50X amount right now. Now if you assume it will be able to find other sources of revenue to match Mounjaro by 2036 (so it’s 50% of sales), then maybe you could argue that LLY is 25X cumulative earnings through 2036.

- not discounting the present value of money

So bottom line, the best-case scenario LLY has now priced in its bullish growth to 2036.

Unless you think BMO’s forecast for about $500 billion in sales for this single drug is conservative and LLY will shock everyone to the upside, this stock is not a good buy right now.

Lowe’s: The Smart Alternative To Eli Lilly’s Overvaluation

Further Reading: How Lowe’s Can Potentially 6X Your Retirement Income

Why Lowe’s Is A Potentially Great Buy Today

There are only about 15 dividend kings. And Lowe’s is the fastest growing one, yielding 2%, more than 2X that of Eli Lilly.

And when LLY’s patents finally expire in 2036, it’s comps are going to be impossible to overcome.

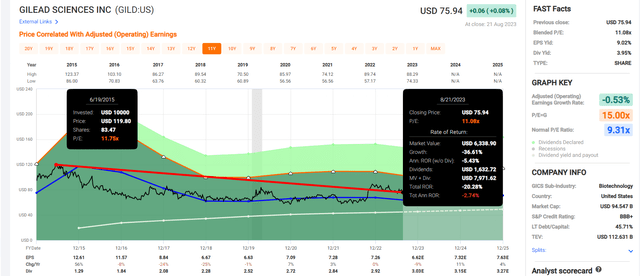

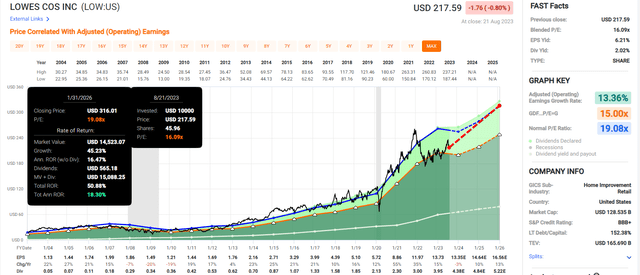

FAST Graphs, FactSet

Remember how HCV drugs Sovaldi and Harvoni caused earnings to jump 518% in two years? Well Gilead saw negative growth after that for the next decade. And here we are eight years later with investors who bought GILD at the peak, at less than 12X earnings, still with negative returns even including dividends.

Now imagine had GILD been trading at 60X earnings. What kind of carnage might that have caused investors?

And what about Lowe’s in the short term?

Lowe’s just beat earnings on the top and bottom line, reaffirming annual guidance for 2023.

- -3% EPS growth this year guidance

- followed by 10% and 13% growth in 2024 and 2025, respectively according to analysts

Fundamental Summary

- Our quality score: 100% very low risk 13/13 Ultra SWAN hyper-growth dividend king

- Our safety score: 100% very safe (1% risk of cut in severe recession, BBB+ stable credit rating, 5% 30-year bankruptcy risk, 62 year dividend growth streak)

- Historical fair value: $320.14

- Current price: $217.59

- Discount to fair value: 32%

- Our rating: potential very strong buy

- Yield: 2%

- Long-term growth consensus: 19.4%

- Consensus long-term return potential: 21.4%.

Bottom Line

The 80% Templeton/Marks certainty limit means you can never be more than 80% certain about individual companies. But I’m 80% certain that anyone buying LOW today will be a lot happier in five-plus years.

Lowe’s 2025 Consensus Total Return Potential

FAST Graphs, FactSet

Eli Lilly 2025 Consensus Total Return Potential

FAST Graphs, FactSet

What more needs to be said?

This isn’t magic, it’s just math. Disciplined financial science, the basis for making smart decisions that leads to a prosperous retirement.

The Last Time Eli Lilly Traded At 60X Earnings It Fell 65% And Took 14 Years To Break Even

Portfolio Visualizer Premium

If you buy LLY today you are not investing, you are speculating, just like tech investors buying the peak of the Dot.Com bubble.

I can’t tell you when things will turn and end badly, only that no one in history has ever paid 60X earnings for LLY and not lived to regret it.

And I can say with 80% certainty that this time is not different.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

-

Access to our 13 model portfolios (all of which are beating the market in this correction)

-

my correction watchlist

- my family’s $2.5 million charity hedge fund

-

50% discount to iREIT (our REIT-focused sister service)

-

real-time chatroom support

-

real-time email notifications of all my retirement portfolio buys

-

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.