Summary:

- GameStop’s stock has surged recently, but with high short interest and an earnings report imminent, consider taking profits before potential volatility.

- The company faces declining revenue, no earnings, and lacks a viable turnaround plan, making its current $10 billion valuation unsustainable.

- Despite some improvements in margins and a strong balance sheet, the core business model remains flawed, with retro store concepts unlikely to drive significant growth.

- Given the high price-to-sales ratio and operational challenges, I remain bearish on GameStop.

RiverNorthPhotography

It’s that time again: GameStop (NYSE:GME) is due to report earnings before the market open on September 10th. The stock has taken off in the past few days with short interest still high, and as I was last time I covered the stock, I think the prudent play is to take the money and run before the earnings report.

The bottom line is that this is a $10 billion company with perpetually declining revenue and no earnings. In addition, it has no viable plan – as far as I can tell – to ever fix either of these things. I don’t like the valuation and while I admire the company’s management team for trying different things, I don’t think there’s a lot of hope here. Let’s dig in.

The bulls take control (for now)

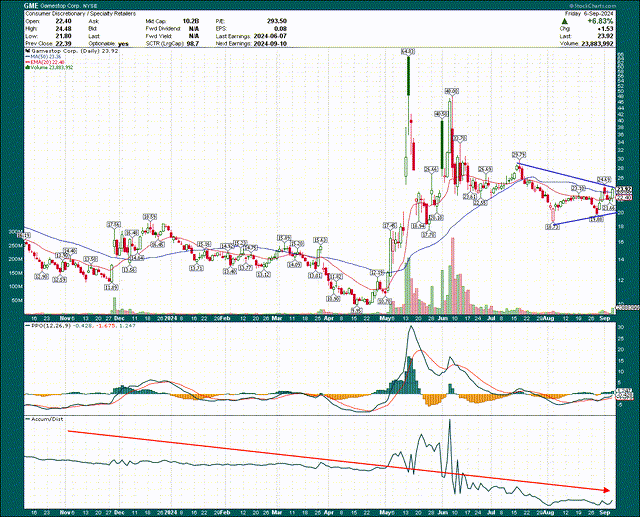

Let’s start with the price chart, which is showing a symmetrical triangle pattern at the moment. Symmetrical triangles are continuation patterns, meaning they generally resolve in the direction of the prior trend. In this case, that means GME should be going lower. Of course, no pattern is ever a guarantee, but it’s not something I can ignore.

The boundaries of the triangle are roughly $20 and $24, so we’ll see what happens. But whichever way this triangle breaks, we could see a pretty significant move in that direction.

Now, the PPO in the second panel shows improving momentum, but still below the centerline. My opinion is that the PPO is neither bullish nor bearish at the moment. The accumulation/distribution line, however, is quite bearish. This indicator moves up when the close of the day is higher than the open, and vice versa, and is volume weighted. This very clearly shows there’s a lot more distribution over time than accumulation, which is the exact opposite of what you see with leading stocks.

My view of the chart is that we’re likely to see another breakdown and lower prices, but we’ll see what happens on Tuesday.

What could turn the tide?

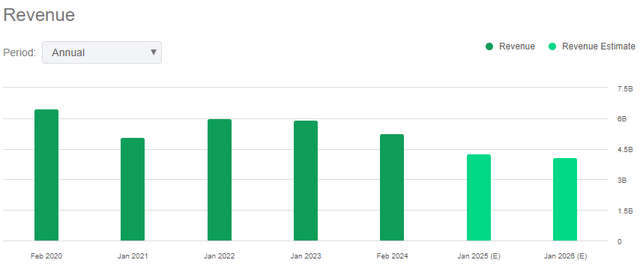

GameStop’s issue is really as simple as attempting to compete in an industry that started dying out a while ago. If you don’t believe me, just have a look at this.

Any company that has a revenue chart that looks like this is a tough buy for me, and the fact is that this year’s revenue (and next year) are set to be lower than the past several years. Who wants to own this chart? I definitely don’t.

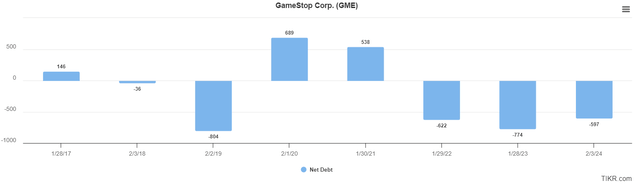

The interesting thing about GameStop is that since the company has (very wisely) used the stock’s incredible performance to issue billions of dollars in new shares, its balance sheet is in excellent condition.

Net debt is well into negative territory (which is a good thing), and it means investors are rightly wondering what in the world the company’s management team is going to do with all that extra cash, which is rumored to be around $4 billion.

We know cost cutting is one thing management is focused on, but it appears at least for now that the company’s coffers are full simply to ride out the chronic unprofitability it suffers from.

The company disclosed it was looking to open retro locations that sell old consoles, games, and hardware, as yet another attempt to woo customers back into their stores. I have my doubts about whether this will work or not, as it’s not materially different than the company’s current store design; the products inside are just different. Keep in mind retro anything is designed to appeal to older customers that want that nostalgia from their youth back; it’s unclear how many of these people would actually want to go to a retro video game store. The big spenders in video games are young, and I have my doubts that a retro store will drive them in to spend money. We shall see.

To be balanced, video game sales are improving. They tend to go through cycles as new consoles and new games are released, so I don’t get too excited when spikes occur from popular franchises such as Call of Duty or sports games. The overwhelming odds are that sales will fall right back down once the initial spike has subsided, which has played out countless times in GameStop’s history.

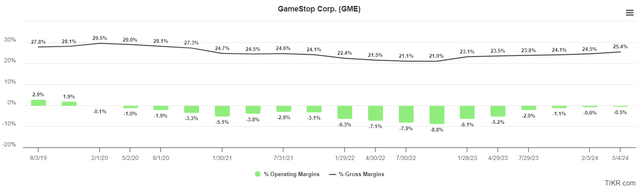

Now, one thing the company has been making some progress on is margins, which was desperately needed. Below we have trailing-twelve-months gross and operating margins.

We can see gross margins have ticked higher in recent quarters, with operating margins following suit. The issue is that SG&A costs are still drifting higher, which is why management is so focused on reducing that line item. The company is quite close to breakeven on an operating basis, so that’s certainly something I want to see progress on when the company reports.

If we boil all of this down, here are the three things I’m looking for in the earnings report. First, we need to know what the management team is planning to do with its massive hoard of cash. Keeping in on the balance sheet and earning 3% or 4% from Treasuries is not good enough. Second, what is the strategy for the company’s dying stores? A few retro locations is worth a try, but that is not going to save GameStop’s stores from going extinct over the long-term. Third, how is progress on margins coming along? Much of this has to do with operating leverage from revenue, which has been negative in recent quarters. We need an update on progress, but also the go-forward strategy on how to get back to profitability, if indeed there is one.

A very high bar

It’s totally possible we get a strong report from GameStop, and that shorts start to cover and send the stock higher. I certainly will not claim to have a crystal ball and act like I have 100% certainty of what is going to happen on Tuesday. However, the odds to me still favor the bears. This is for all the reasons outlined above, but also the valuation below.

Since the company has no earnings, we must use price-to-sales, which is extremely high right now. In fact, at ~2.4X forward sales, the stock is almost as expensive as it was during the initial meme craze. For a company with chronically unprofitable operations, 2.4X sales is absolutely bonkers to me.

So, on a valuation basis, I think we should be looking at something like 0.5X sales, which is obviously a long way down from here. Given my dim view of operations, the valuation is enough for me to remain bearish into earnings.

I am completely unwilling to short GameStop into earnings simply because the risk is too high. If you own it, however, I think it would be imprudent to try and hold through the earnings report, as I believe the odds are stacked against you. Maybe the management team has an ace up their sleeves nobody knows about yet that sends the stock flying, but color me skeptical.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.