Summary:

- Nvidia’s share price has bounced from ETF buying demand based on its DJI inclusion.

- The company is heavily overvalued and doesn’t have a great path to maintain sales let alone grow.

- Fundamentally, we expect the company to face threats to its margins and struggle to compete.

JHVEPhoto

Nvidia (NASDAQ:NVDA) is up after hours on news that the company will be replacing Intel (INTC) in the DJI. That could push the company back up to almost 52-week highs as the company’s share price has continued to run-up on minimal news. Despite that, we’ve been largely bearish on the company. As we’ll see throughout this article, the company’s largest customers are looking for efficiency.

With growth becoming more predictable in the industry, we expect unreachable exuberance to exit from the company’s share price, hurting future shareholder returns.

AMD Threat

Nvidia is facing competitive threats, not just to volumes, but additionally to the company’s margins.

Meta, which as we’ll discuss below is one of Nvidia’s largest customers, is committed to open source models. In late-July 2024, the company launched its 405B model described as:

Llama 3.1 405B is the first openly available model that rivals the top AI models when it comes to state-of-the-art capabilities in general knowledge, steer-ability, math, tool use, and multilingual translation.

– Meta

Now there’s two parts of model running, training and predicting and Nvidia is a very major player in training. However, bigger isn’t always better for models, as we expect in the long-term the parade of new models will slowdown. Instead, existing models that are “good enough” will be used.

Meta, one of Nvidia’s largest customers, running its cutting edge model exclusively on AMD GPUs is a major risk for 2 reasons.

(1) It shows weakness in Nvidia’s moat. The company, for running models, doesn’t have any products that simply have no competitors. AMD is clearly capable of sustaining traffic.

(2) AMD GPUs are apparently cheaper to run. That’s not surprising AMD in its two leading segments has consistently had lower margins than Intel and Nvidia for CPUs and GPUs respectively.

However, we expect the combination of the two to lead to what we expect to be one of Nvidia’s biggest headwinds. Nvidia’s massive profit from GPUs was partially driven by growth in their margins. The company’s margins appear to have peaked, which is the first sign of slowing down demand in our view. Having to compete with AMD could result in even lower margins.

That could fundamentally stop the company from ever justifying its valuation.

Customer Efficiency and Concentration

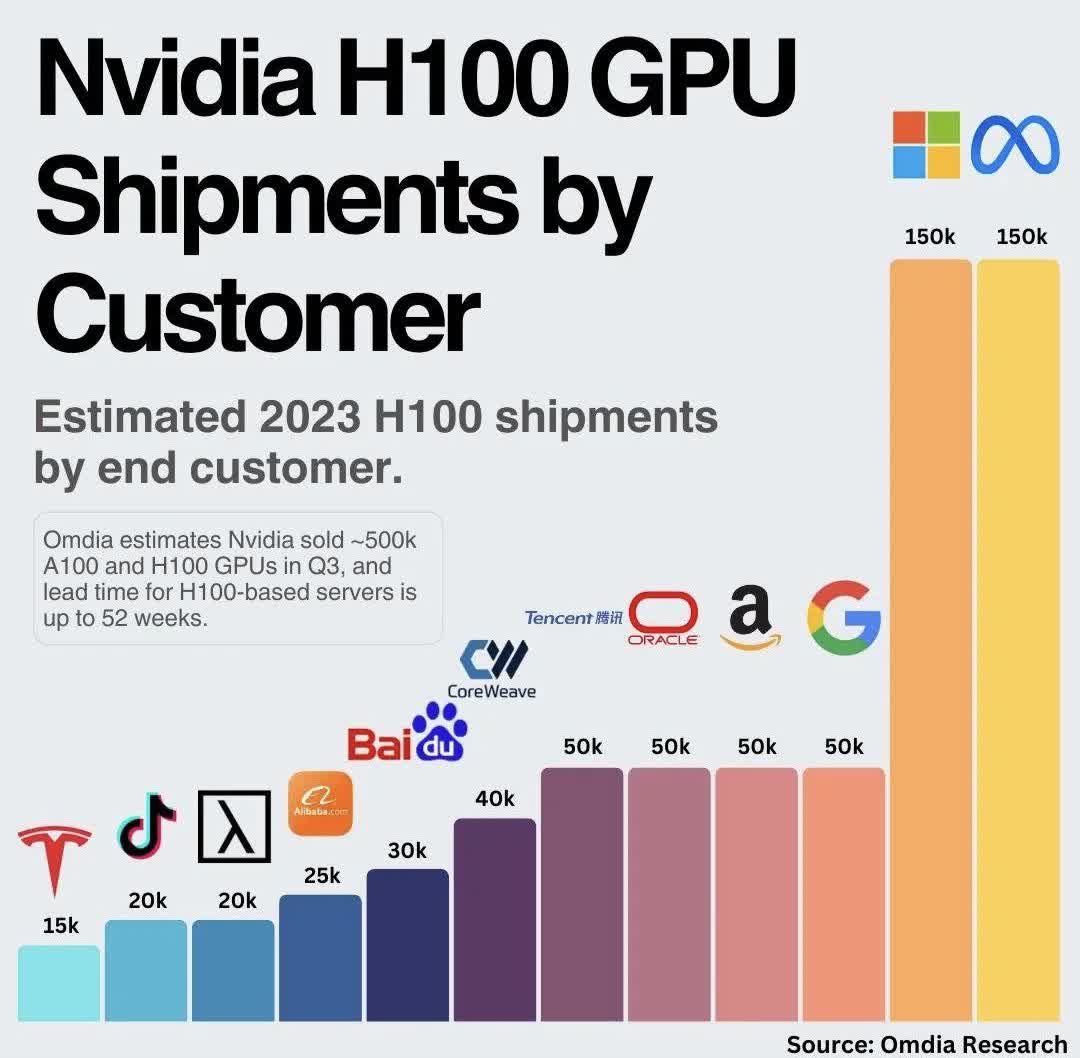

Meta is tied as one of Nvidia’s top 2 customers for its H100 GPUs and that concentration maintains a threat.

Nvidia GPU Shipments by Customer

As of today, the vast majority of Nvidia’s revenue comes from its datacenter business. And that datacenter business sees the vast majority of its revenue from a handful of customers. That means that the company’s required revenue growth, which we will discuss below, need to come from this handful of customers. That’s a major concern.

That’s because not only does Nvidia have competitors from non model producing companies, such as AMD, but its largest customers are technical leaders. Several have larger engineering staffs and R&D than Nvidia itself does. Google (GOOG) (GOOGL) is quickly becoming a leader in custom silicon, and won training deals with Apple, one of the largest companies at delivering AI to customers.

Google is also building its own models with the TPUs, enabling strong synergies, as it flexes its software development might. Open AI has 3.5k employees to Google’s 170k and Google has said its largest focus in AI. Nvidia has <30k employees. Microsoft (MSFT) is building its own processors as well, and Amazon (AMZN), which works with many smaller companies in AI with AWS, already has cost-leading options.

This competition from its largest customers, who work directly with the end models, unlike Nvidia, could place a massive threat to Nvidia’s margins. Nvidia’s margins have grown from incredible demand for its GPUs, and that’s the primary driver of profits.

Additionally, Nvidia’s valuation is so lofty that Nvidia doesn’t need just maintained revenue and profits it needs growing revenue and profits. With Nvidia’s largest customers spending much of their capital with Nvidia and concerns over overspending among largest tech companies, maintaining let alone growing spending could be tough.

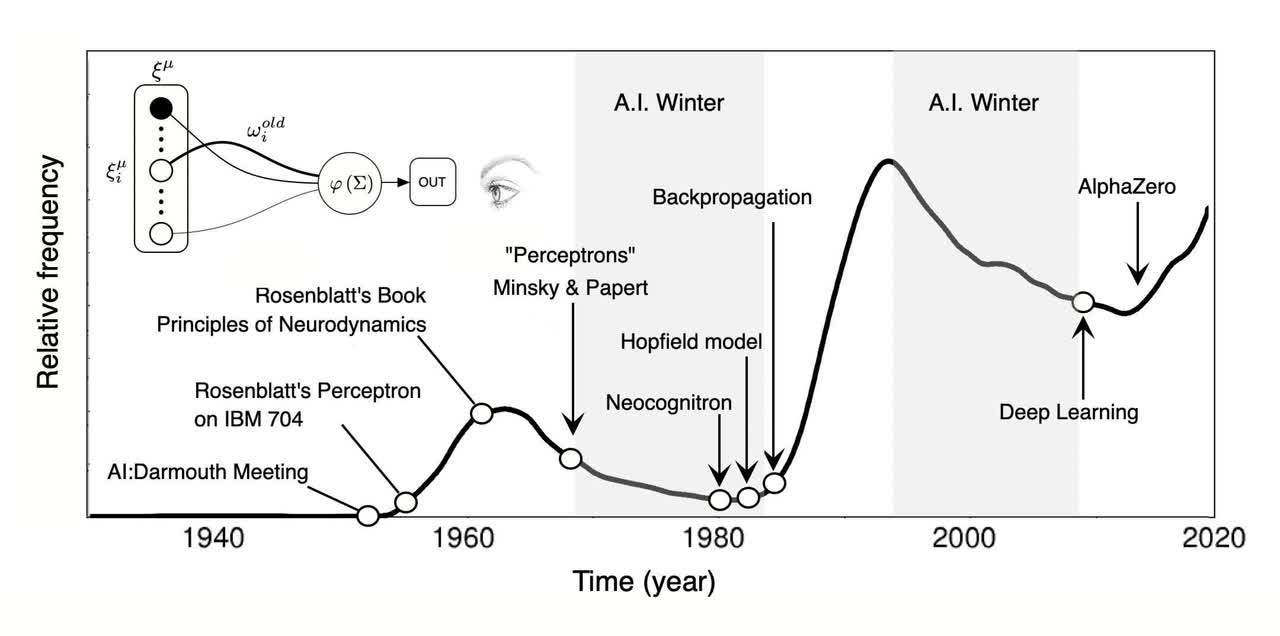

More existentially, artificial intelligence is known for coming in waves, as those in the 60s might recall from the movies indicating that today we’d have general artificial intelligence everywhere we go. LLMs are not AGI and there are some that are already indicating a potential AI winter. Hitting a wall for LLMs, one not even seen yet, could present an existential threat.

Modeling Nvidia’s Share Price Exuberance

A lack of beating expectations in Nvidia’s recent earnings caused the company to have the largest single-day market cap decline of any company in history.

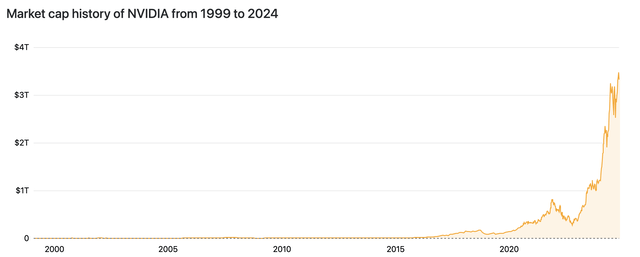

Since then, the company’s market cap has trended back up towards records of $3.3+ trillion. That matches the cycle we’re seeing, where the company will take a hit after tangible results, and then slowly recover as exuberance drifts back in. At some day, now or in the future Nvidia needs to justify a market capitalization of more than $3 trillion.

Not only that, but with historic S&P 500 growth around 10%, if the company takes until 2030 to justify its valuation before it stops growing, it needs to justify a $6 trillion valuation not a $3.4 trillion. For our non-growing example we’ll take the P/E of Intel pre-revamp at ~10. We can also use Apple’s P/E of ~15 when the market was pessimistic about its growth.

We’ll take the higher number of ~15x. That means Nvidia, by 2030, needs to hit $400 billion in annual profits.

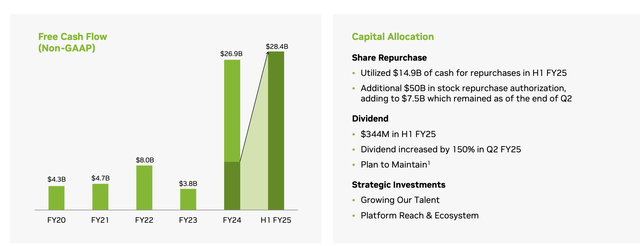

Today the company is sitting at ~$120 billion in annual revenue and $65 billion in net income. The company recently increased its dividend to an incredibly small yield (0.3%) but it will cost the company $10 billion annualized. The company has announced a plan to maintain its dividend, which in our view, highlights the risk of increased competition.

We also expect the company’s net margin to drop from ~55% currently to ~25% by 2030 as the industry becomes more mature. That’s our midpoint expectation, we can see much more substantial drops if AI exuberance dies down, as discussed above. Still that would imply a need to grow revenue from $120 billion today towards $1.6 trillion.

That’s 13.5x revenue growth in 6-years. That’s almost 55% annualized revenue growth. While that’s below the company’s current revenue growth rate of 122% annualized, slowing down QoQ vs YoY revenue growth along with the law of large numbers will both present massive headwinds in our view. That will make it very difficult for the company to meet the views.

Thesis Risk

The largest risk to our thesis is that in the short-term the market is a voting machine. In the long-term, it’s a weighing machine. Nvidia’s share price is clearly being driven by exuberance, and for those who are betting against the company, the market can remain irrational longer than you can remain liquid.

The second risk is that while we think generational AI is far way, a breakthrough could happen, that could increase demand for the company’s GPUs. That could enable it to earn the cash flow to justify its valuation, which we don’t see it as having a path to do right now.

Conclusion

For those looking to exit Nvidia, fortunately the market can remain irrational. However, at some point it’s time to take profits. Even if you think Nvidia will continue its growth, we see it as unlikely that the company will be able to continue beating the growth of the S&P 500. Nvidia has a $3.4 trillion valuation and it needs substantial growth.

Nvidia’s inclusion in the DJI, which will force ETF buying, potentially pushing the company back to all-time highs, is a great time to exit. Fundamentally, Nvidia has numerous risks. For those looking to bet against, options are a great way to do it with limited risk. Over the long-term though, we recommend against investing in Nvidia, expecting it to substantially underperform.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.