Summary:

- Amazon’s overreliance on AWS and potential regression in e-commerce segments pose downside risks amid rising unemployment and consumer spending pullbacks.

- Historical net margin trends and economic indicators suggest a challenging environment, with potential stagflation and reduced holiday sales growth.

- Despite AWS resilience, valuation concerns arise as North America’s performance faces economic risks that threaten Amazon’s bottom line.

- Given these factors, I am reversing my Buy recommendation, awaiting further economic data into 2025.

AntonioSolano

I was positive on Amazon (NASDAQ:AMZN) stock almost a year ago, and the share price has improved by around 29%. I am now reversing my outlook on the company and will explain why I believe the downside risks now outweigh the upside potential.

Amazon’s segment performance is heavily concentrated

The first red flag for Amazon is its concentrated segment performance.

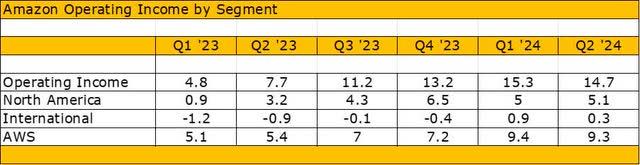

Amazon has become hugely reliant on the Amazon Web Services (AWS) segment for its revenue and operating income. Operating income in the company’s international segment is almost non-existent, and the company has benefited from a rebound in the North American segment since a slump into the first quarter of 2023.

Amazon Operating Income ($ billions) (Amazon)

That rebound coincided with the arrival of the generative artificial intelligence frenzy, and the company’s AWS segment is now contributing to the majority of the company’s profit.

Even if AWS spending continues to edge ahead, the real risk for Amazon is a regression toward the 2023 levels in its e-commerce segments.

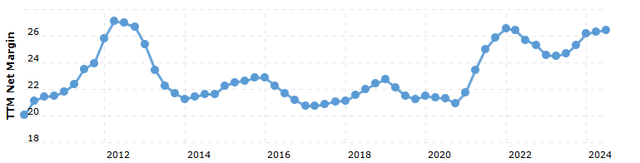

On a historical basis, Amazon’s net margins are also at a level that has been a roadblock in the past. A move above 25% net margins in 2012 preceded a slowdown to 21% and the dip in early 2022 was supported by the rise in AWS spending.

Amazon Net Margins (MacroTrends)

Regardless of your thoughts on artificial intelligence, I believe that recessionary risks over the next year outweigh the upside potential. A pullback in consumer spending could also be accompanied by a pullback in business spending, which raises further risk for Amazon’s bottom line.

Although analysts have projected healthy cloud spending over the next year, a recession could see businesses pulling back. Amazon has reported in recent earnings releases that new clients are signing up for AI projects on its Bedrock platform. However, AI and cloud spending could be the first area for companies to cut back on, in the event of an economic downturn.

Amazon’s AWS segment was resilient throughout the 2022 at the onset of the Ukraine-Russia conflict. But that was a different environment where a sharp rise in interest rates affected confidence. A slowdown in consumer spending and profits in the services sector could create a tougher environment.

Recession risks are looming in the U.S.

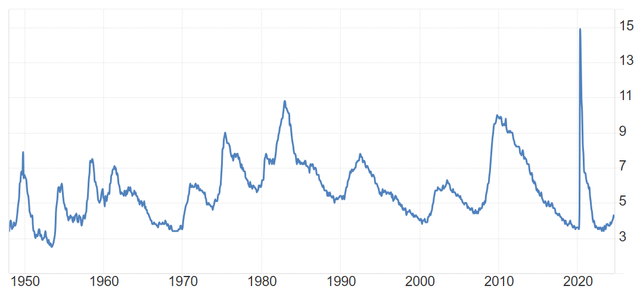

The recession risk from an inverted yield curve in the United States treasuries has eased with the latest jobs report, which showed that the unemployment rate edged down slightly in August.

However, another recession indicator was triggered, in which a return to an uninverted yield curve happens ahead of a Federal Reserve rate cut cycle.

As noted by CNN:

When the yield curve turned positive in December 2000, the Fed cut interest rates a month later. Two months after that, a recession began. A similar sequence of events happened in the lead-up to the Great Recession.

Regardless of what yields are doing, analysts are once again focused on the variance in monthly employment trends.

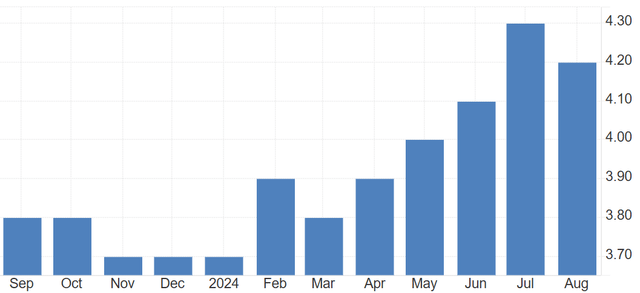

U.S. Unemployment Rate (Trading Economics)

The U.S. unemployment rate is on a clear upward trend in 2024, and it is surely a worry that the rate has hit 4.20-4.30% in what is seen as a healthy GDP environment for the economy.

U.S. Unemployment Rate (Trading Economics)

If we go further out in the timeframe, we can see that the U.S. unemployment rate has only touched levels below 4% since 1970, and that was just ahead of the dot-com bubble burst of 2021.

As we move into the end of the year, Deloitte is also predicting a slower season of holiday spending in 2024.

Deloitte estimates mild sales growth of 2.3%-3.3%, which would be sharply lower than 4.3% sales growth for the same period last year.

“Although the pace of increase in holiday sales will be slower than last year, we expect that healthy growth in disposable personal income, combined with a steady labor market, will support a solid holiday sales season,” Deloitte said.

If a recession does not arrive, there is still the potential for stagflation, which JPMorgan CEO Jamie Dimon said would be the “worst outcome.”

Investors cheered this week’s Federal Reserve rate cut, which was the largest since the 2008 crisis. I see it as a sign that the central bank is concerned about the recent labor market trends.

Downside risks to selling Amazon

The downside risk to the investment thesis would be a rebound in the U.S. labor market and continued strength in the underlying e-commerce business. AWS cloud growth was resilient during the market turmoil in 2022 and should continue to charge forward in the near term.

In my previous article on Amazon, I stated that the company’s price-to-sales ratio was -21.64% lower than the 5-year average. That gap has now been closed, with the current forward price-to-sales ratio 1.6% above the average. That gives me some confidence that the company is now more fairly valued.

In the recent second-quarter earnings release, Amazon’s North America segment accounted for around 36% of the company’s operating income. That is the potential hit to the recent valuation, which aligns with the 5-year average.

A deeper dive into recent earnings

Cash and cash equivalents were steady at the end of June 2024, with a small dip from $73.38 billion as of 31 December 2023, to $71.7 billion. Free cash flow was impressive on a trailing twelve-month basis at $53.0 billion, compared to $7.9 billion a year ago.

For the North America segment, a net sales improvement of around $7.5 billion saw a rise in operating expenses of more than $5 billion. That highlights the valuation risk once more, as AWS is powering more than 60% of the share price. The rest of the valuation is being driven by North America, which could see volatility in the event of an economic downturn.

Amazon’s move into car sales, which I mentioned in the previous article, is a potential revenue stream for the future. The company is also continuing to test its Zoox robotaxi with expansion to Austin and Miami in Q2.

These developments can add to the company’s growth prospects in the future, but I am more concerned about the underlying e-commerce business over the next year and the current valuation will need the support of continued AWS strength.

Conclusion

Amazon’s financial performance has rebounded smartly from a slump into the first quarter of 2023. That rebound in sales was driven by the company’s North American segment, but also coincided with the arrival of the artificial intelligence boom. With hot demand for Amazon’s Web Services capabilities, the company’s sales and profit have been supercharged. It is my belief that with shares near their all-time highs, this is a good place to reverse my earlier Buy recommendation. Recession risks are flashing in the United States, while the European and Chinese economies continue to struggle. Increasing unemployment and a slowdown in production now pose a double risk to Amazon through slower consumer spending and AI spending from corporations. Holiday spending is also projected to be lower as we close out 2024. For that reason, I am happy to step aside and allow the picture to develop further into 2025.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.