Summary:

- Qualcomm, a global semiconductor company, is poised for growth with strong revenue from wireless connectivity and emerging technologies like AI, VR, and autonomous systems.

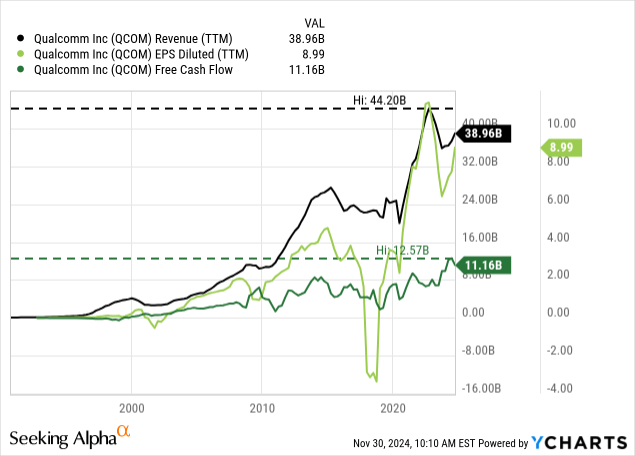

- Despite fluctuations, Qualcomm has shown solid growth, with a CAGR of 3.93% in revenue and 6.79% in EPS over the last decade.

- Diversification into IoT and Automotive segments is expected to drive long-term growth, with high revenue projections for both sectors by fiscal 2029.

- Qualcomm’s intrinsic value suggests it is slightly undervalued, making it a cautious “Buy” with potential for future growth despite some risks.

JHVEPhoto

In the last few years, it was rather an exception for me to cover a business I had not previously written about. But there are companies and stocks I find interesting, and that deserve a closer look. I have already written about several semiconductor companies in the past – including Intel Corporation (INTC), NVIDIA Corporation (NVDA) and Skyworks Solutions, Inc. (SWKS) – and in the following article I will cover Qualcomm Incorporation (NASDAQ:QCOM) for the first time.

Semiconductor companies are not really fitting the companies I am usually searching for. I like to invest in companies that are growing at a stable pace and with high levels of consistency and have a wide economic moat around its business. And semiconductors are not really fitting that description. However, when assuming that the next decades are characterized by an AI revolution and the need for semiconductors, these companies are worth a closer look.

In the following article, I will follow my template I often use when covering a business for the first time. Not only will we provide a short description of the business, but especially focus on the question if the company has a wide economic moat around its business. Additionally, we will also focus on the question if and how Qualcomm can grow in the years to come and of course we will calculate an intrinsic value for the stock to determine if it is a good investment at this point.

Business Description

(As always when covering a business for the first time, I offer a small business description, but you can skip the next paragraph if you are already familiar with the business)

Qualcomm is a global semiconductor company and especially focused on wireless connectivity – including 3G, 4G and 5G wireless connectivity. Of course, it is also focused on the emerging 6G standards. The company, which was founded in 1985 and is headquartered in San Diego, has about 50,000 employees and is innovative in areas like artificial intelligence, virtual and augmented reality and autonomous systems. The company is operating a dual business model combining chip manufacturing on the one side and technology licensing on the other side.

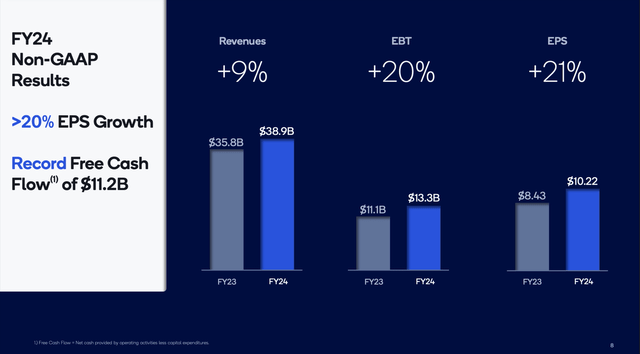

And in fiscal 2024, Qualcomm was once again generating the biggest part of revenue from Equipment and Services, which generated $32,791 million in revenue (resulting in 9.2% year-over-year growth). Licensing generated $6,171 million in revenue and grew 6.5% compared to fiscal 2023. Overall, revenue increased from $35,820 million in fiscal 2023 to $38,962 million in fiscal 2024 – resulting in 8.8% year-over-year top line growth. Operating income increased even 29.3% year-over-year from $7,788 million in fiscal 2023 to $10,071 million in fiscal 2024. And finally, diluted net income per share increased from $6.42 in the previous year to $9.09 in fiscal 2024 – resulting in a bottom-line growth of 41.6% year-over-year growth.

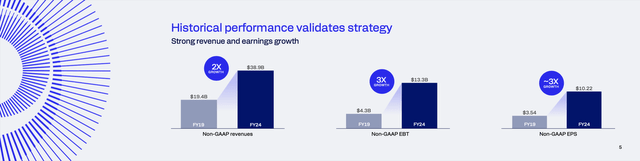

But to get a feeling for the business, we cannot only look at the last fiscal year (although results were good), we have to look at longer timeframes. And during the last Investor Day, management was pointing out the strong growth in the last five years.

Qualcomm Investor Day 2024 Presentation

Clearly, Qualcomm is growing with a solid pace, but when looking at the last few decades, we also see fluctuations. Not only earnings per share and free cash flow are fluctuating (which is often the case), but also revenue is not as stable as it could be. But overall, we see growth over the last few decades and revenue increased with a CAGR of 3.93% in the last ten years, while earnings per share increased with a CAGR of 6.79% in the last ten years.

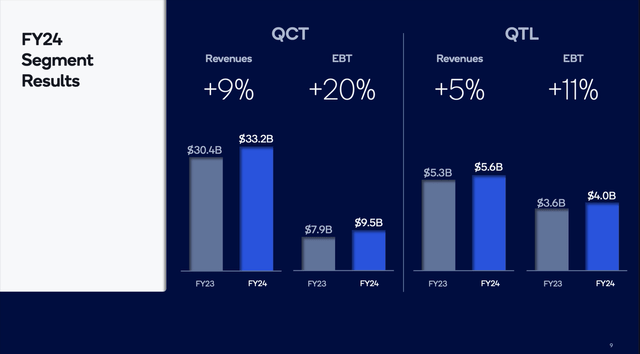

When looking at segment results, Qualcomm’s revenue is stemming especially from two different segments. On the one side we have Qualcomm CDMA Technologies (QCT), which generated $33,196 million in revenue and grew 9.3% year-over-year. Earnings before taxes for the segment increased 20.2% year-over-year to $9,527 million. On the other side we find Qualcomm Technology Licensing (QTL) as second segment, which generated $5,572 million in revenue – 5.0% more than in the previous year. Earnings before taxes increased 11.0% YoY to $4,027 million.

Growth

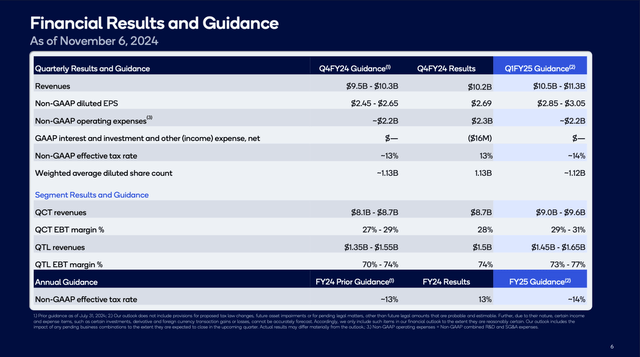

And while the past is telling us a lot about a business and how it performed (and can perform in the future), we also have to look at the future and what growth rates we can expect. We could start by looking at the company’s guidance for Q1/25 and management is expecting revenue to be in a range of $10.5 billion and $11.3 billion resulting in about 5.5% to 13.5% top-line growth. And non-GAAP diluted earnings per share are expected to be between $2.85 and $3.05 resulting in 16% to 24%.

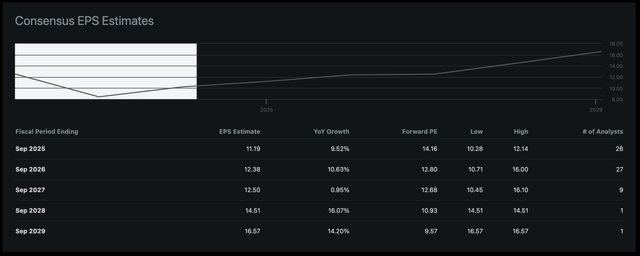

Of course, looking at one simple quarter is not enough, and instead we can look at analysts’ estimates for the years to come. Between fiscal 2024 and fiscal 2029, analysts are expecting earnings per share to grow with a CAGR of 10.15%.

Qualcomm: Consensus EPS Estimates (Seeking Alpha)

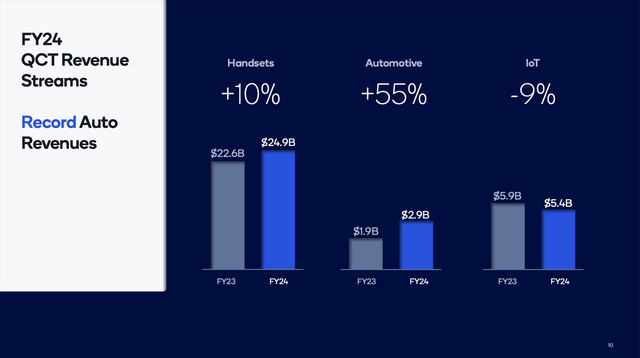

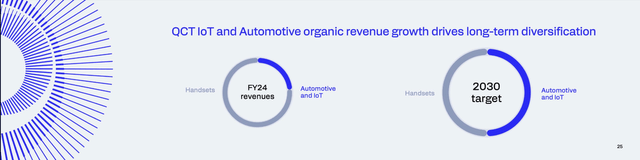

When asking the question of how Qualcomm might achieve these growth rates in the years to come, one pillar of Qualcomm’s strategy is to diversify. The Internet of Things as well as Automotive are expected to grow at a high pace in the years to come and drive long-term organic revenue growth. And while revenue from Automotive was growing 55% in fiscal year 2024 (and therefore one of the drivers of growth), revenue from Internet of Things declined 9% year-over-year.

But over the next five or six years, Qualcomm is expecting revenue from IoT and Automotive to reach 50% of revenue (compared to about one fourth of revenue right now).

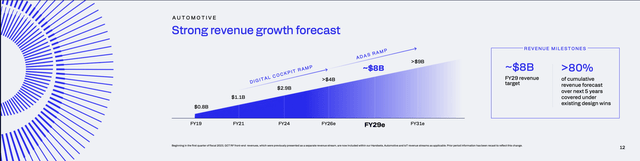

Qualcomm Investor Day 2024 Presentation

For the Automotive segment, management has high growth expectations. In fiscal 2024, Automotive generated about $2.9 billion and for fiscal 2026, expectations are $4 billion in annual revenue and until fiscal 2029, revenue is expected to double again to $8 billion. This would result in a CAGR of 22.5% in the next five years.

Qualcomm Investor Day 2024 Presentation

And although the Internet of Things was struggling a little bit in the recent past, Qualcomm still has high-growth expectations for the next five years. Revenue from IoT is expected to grow at a similar pace as Automotive and between fiscal 2024 and fiscal 2029, management is expecting an annual growth rate of 21% resulting in $14 billion annual revenue in fiscal 2029. And in the connected and embedded world, Qualcomm (and many others) are expecting to see gigantic use cases for IoT – including in Retail, Smart Home, Energy, Industrial Automation or Enterprise & Buildings.

Qualcomm Embedded World Presentation

And as long as we are talking about growth potential, when can mention the Snapdragon platforms, which Qualcomm introduced recently, and emphasize the on-device AI capabilities. With the adoption of AI accelerating – for example on smartphones – the demand could rise and Qualcomm’s AI chips, the Snapdragon, might play a critical role. Additionally, the Snapdragon Digital Chassis will expand the footprint of Qualcomm in the automotive market – a market where Qualcomm is expecting high-growth rates (see section above).

Risks

And trying to diversify is certainly a good strategy for Qualcomm as the business is certainly facing some risks. One major risk is the fact, the Samsung Electronics Co. (OTCPK:SSNLF) as well as Apple Inc. (AAPL) are each responsible for more than 10% of total revenue. Qualcomm does not disclose accurate figures, but estimates are that Samsung and Apple combined were responsible for more than 40% of revenue in 2022. The number might be a little lower now, but such a concentration gives the customer some kind of pricing power over Qualcomm, which is not good.

And this is a huge risk if suddenly one of those two customers is deciding not to be a customer anymore. Especially Apple has demonstrated in the past that it might try to produce as much as possible in-house and has surprised companies in the past (like Intel). Apple is working on its own 5G modem, but it obviously has troubles and is not expecting to be successful before 2027. Apple is already working on its own modem since 2019, and this is also demonstrating that it might be rather difficult and not so easy – speaking for some kind of moat around Qualcomm’s business. Now, let’s look at the question in more detail if Qualcomm has an economic moat or not.

Economic Moat

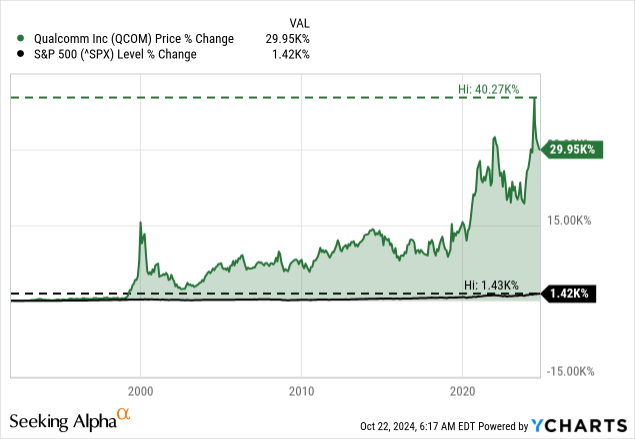

We already saw that the income statement of Qualcomm is not really demonstrating stability and consistency. And this is a first sign that the company might not really have a wide economic moat around the business. However, when looking at the stock price in the last few decades, we see an impressive outperformance over the S&P 500 and a stock outperformance over several decades is a hint that a company might have a wide economic moat

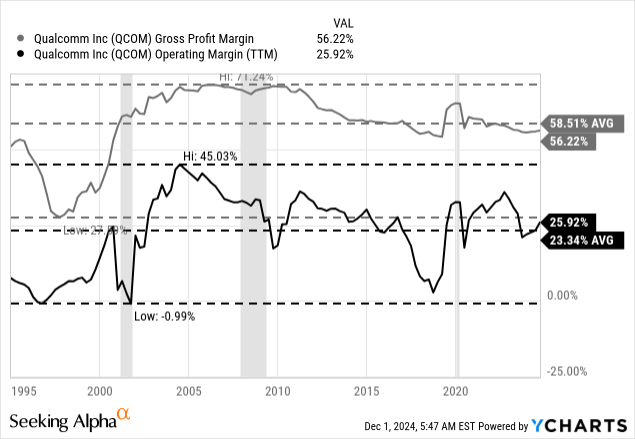

And while we might come to the conclusion that Qualcomm has an economic moat when looking at the stock performance, the margins of the business are speaking a different language. We can start by looking at the gross margin and we certainly see some fluctuation. And when looking at the operating margin, the picture gets even worse as the operating margin is missing any signs of consistency and is fluctuating heavily.

Of course, there is an explanation for the fluctuations, and it is more or less the same explanation as for the wildly fluctuating earnings per share and free cash flow. Qualcomm is a cyclical business, and it is extremely difficult for a cyclical business to report stable margins. And it is not like a cyclical business can’t create a wide economic moat around its business, but it is certainly more difficult for such a business to create a competitive advantage.

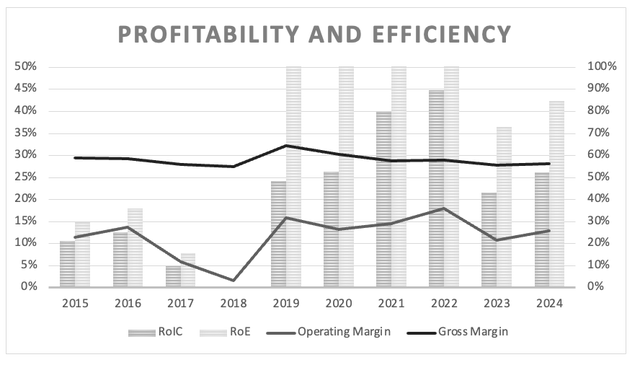

Additionally, we can look at return on invested capital and over the last ten years, the reported RoIC of Qualcomm was on average 19.10% and in the last five years it was even 31.36%. These are extremely high metrics for return and a sign of a wide economic moat. But once again we see huge fluctuations between the different years. When trying to summarize the metrics, we can at best call the metrics a very mixed picture.

Qualcomm: Margins and return on invested capital (Author’s work)

And when trying to identify from which source an economic moat might stem, it is difficult to identify sources of an economic moat. I don’t see any network effects; I don’t see the brand name playing a role.

Of course, we can mention patents, which might be important. In its earnings call, Qualcomm is mentioning its patent portfolio again and again and this is certainly an intangible asset that is important. But I don’t know if these patents are enough to justify a wide economic moat. And a second source for a potential moat might be cost advantages. And in the case of semiconductors, we can speak of a commodity to some degree. And commodities are often very difficult – especially when a company is trying to generate a wide economic moat. In such a case, cost advantages are mostly possible when a company is able to lower its costs and produce cheaper compared to its competitors. For commodities, the price is often determined by the market and for all market participants the same, meaning the individual companies don’t have any pricing power. Of course, semiconductors are not really a commodity – like oil, salt or petroleum. Semiconductors can differentiate in quality and a company might charge a higher price for a semiconductor that is seen as better by the market. The problem remains that competitors might copy innovations over time and produce chips with similar quality – and this is undermining pricing power.

Overall, there might be signs for an economic moat around Qualcomm’s business, but I would see the moat as rather narrow and certainly not so deep.

Intrinsic Value Calculation

In the end, one step is missing, but that step is essential – calculating an intrinsic value for the stock to determine if it might be fairly valued or over/undervalued. To get a first feeling if a stock is over- or undervalued, we can look at simple valuation metrics.

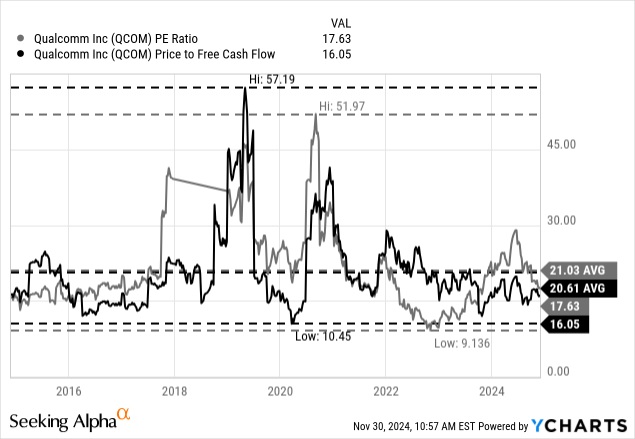

In case of Qualcomm, the price-earnings ratio as well as the price-free-cash-flow ratio as fluctuating heavily – which is not surprising after we now know that margins are fluctuating and even revenue is not really stable. At the time of writing, Qualcomm is trading only for 17.6 times earnings and for 16 times free cash flow. These valuation multiples are not only below the 10-year average (21.03 for P/E ratio and 20.61 for P/FCF ratio), but also low on an absolute basis.

Aside from looking at simple valuation multiples, which are rather indicating that Qualcomm is fairly valued or cheap, we can also use a discount cash flow calculation to determine an intrinsic value. As always, we are using the last reported number of diluted shares outstanding (1,129 million) and are calculating with a 10% discount rate. The basis in our calculation can be the free cash flow of the last four quarters, which was $11,160 million. When being rather conservative in our assumptions and assume not only 4% till perpetuity but also for the next few years, we get an intrinsic value of $164.75, and the stock is slightly undervalued.

However, we can also be a little more optimistic and assume higher growth rates for the next few years. We could argue for 10% growth annually in the next ten years – in line with analysts’ assumptions – followed once again by 4% growth till perpetuity. This would result in an intrinsic value of $245.62 for Qualcomm and the stock would certainly be undervalued at this point.

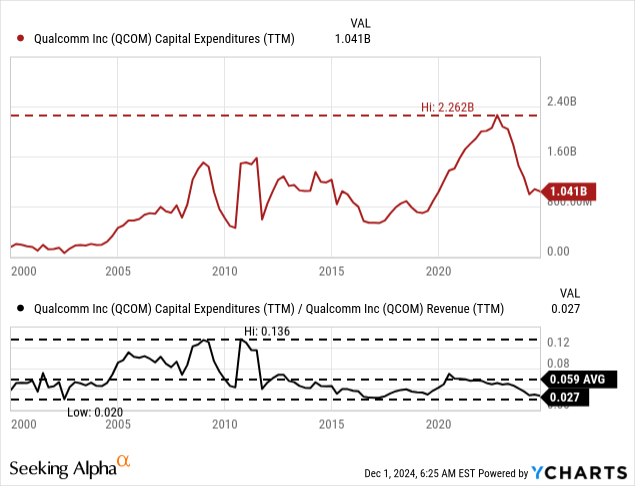

We also can look at capital expenditures and see the amount declined on an absolute basis in the last few quarters. Especially when comparing capital expenditures to revenue, we see that Qualcomm is spending only a fraction of its revenue in the last few years. Maybe the current capital expenditures are enough for Qualcomm to keep up and there are certainly business with low capital expenditures – by the way, these are often great businesses. But it might be possible that Qualcomm must spend higher amounts as capital expenditures in the coming years and this might reduce free cash flow.

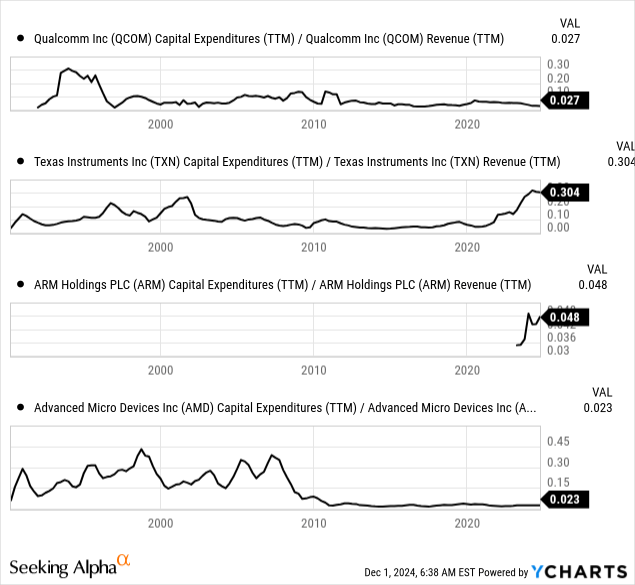

And when looking at some of the peers of Qualcomm, we see a wide range of capital expenditures – from extremely low to extremely high (Texas Instruments for example). In the end, higher capital expenditures seem possible and maybe 10% growth is a little too optimistic, but Qualcomm might be slightly undervalued at this point and a good investment.

Conclusion

Qualcomm seems like a business well positioned for the future. We certainly should not ignore potential risks, but the company’s efforts for diversification should make the business less dependent on Apple and Samsung in the years to come. Aside from diversification, the “new” business segments Automotive and Internet of Things also offer high growth potential in the years to come. Overall, I think Qualcomm could be a cautious “Buy” now. It is probably not a bargain, but it is certainly not trading above its intrinsic value.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.