Summary:

- The Healthcare sector has performed well and dividend-paying stocks are perhaps gaining some preference among investors.

- UnitedHealth Group is a strong player in the healthcare industry, with consistent earnings growth and solid yield – it was recently put on BofA’s High Quality & Dividend Screen.

- UNH is expected to have another strong quarter with rising earnings and dividends, although the chart shows some challenges.

- I point out key price levels to monitors on this underperforming name.

SOPA Images/LightRocket via Getty Images

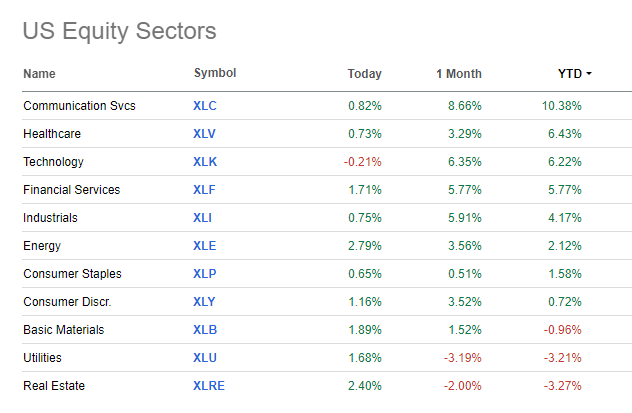

The Healthcare space has been second only to Information Technology on the performance rankings year to date among S&P 500 sectors. Investors continue to prefer quality growth names, even amid a period of AI euphoria. What’s also perhaps perking up as a factor preference are dividend-paying stocks.

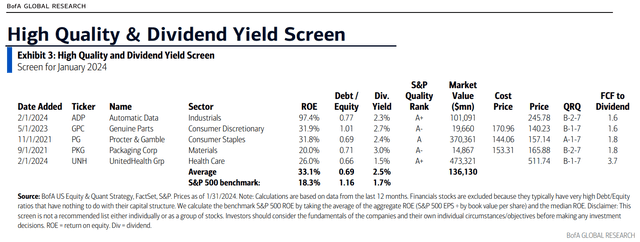

I am upgrading UnitedHealth Group (NYSE:UNH) from a hold to a buy. BofA recently included this largest component by weight in the Dow Jones Industrial Average on its High Quality & Dividend Yield Screen for January, and the valuation has turned more attractive as EPS growth persists, though the UNH’s current yield is just 1.4% on a forward basis.

2024 YTD S&P 500 Sector Performances: Healthcare Up 6%

Seeking Alpha

UNH: Strong ROE & Debt/Equity Trends, Solid Yield

According to Bank of America Global Research, UnitedHealth Group is one of the largest Managed Care Organizations (MCOs), serving members both in the US and internationally. UNH is the most diversified payer, either by product line, geography, or customer type. The company’s operating segments include United Healthcare, OptumRx, OptumInsight, and OptumHealth.

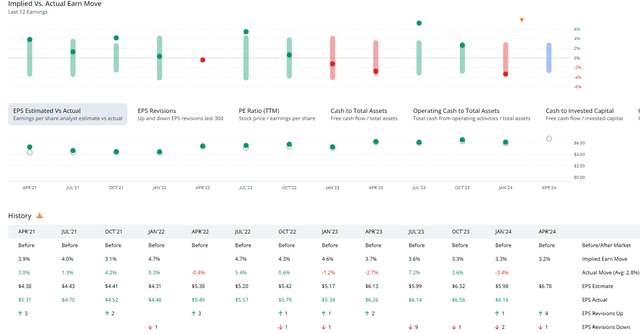

UNH posted a solid earnings beat despite rising costs in its Q4 2023 report issued in January. The major Healthcare sector company has topped analysts’ estimates in each report going back three years, though shares traded lower post-earnings on January 12, 2024. Year-over-year EPS growth was impressive at more than 15%.

Ahead of UNH’s Q1 2024 report due out on April 12, shares trade with a modest implied volatility percentage of just 19% while short interest on the stock is muted at 0.7% as of February 15, 2024. Data from Option Research & Technology Services (ORATS) shows a small 3.2% implied earnings-day move for the upcoming quarterly report.

UNH: A String of EPS Beats, Another Strong Quarter Expected

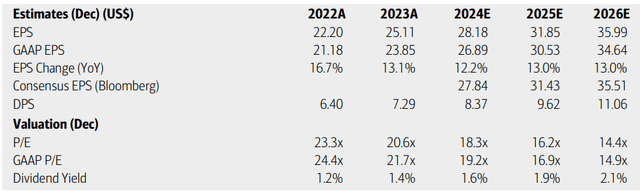

On valuation, analysts at BofA see earnings rising at a healthy clip over the next several quarters. A low-teens EPS growth rate is forecast through the out year and 2026 while Seeking Alpha’s EPS consensus numbers show nearly $28 of EPS for 2024 and potentially more than $35 by 2026. Sales growth is seen steady in this somewhat predictable business, in the 7% to 9% range over the next two-plus years.

Dividends, meanwhile, are forecast to rise at a rate commensurate with per-share profit growth, and its free cash flow yield is 5%. Now trading with a high teen’s earnings multiple, shares are not a screaming deal, but continued earnings growth has helped the valuation lately.

UnitedHealth Group: Earnings, Valuation, Dividend Yield Forecasts

If we assume $28.50 of normalized EPS over the next 12 months and apply the stock’s 20.2 five-year average P/E, then shares should trade near $575. That is an intrinsic value increase of $50 versus my estimate last year while the stock has rallied only modestly in that time. Hence my upgrade from a hold to a buy. The PEG ratio remains a concern, but UNH’s steady business and quality earnings growth are attractive.

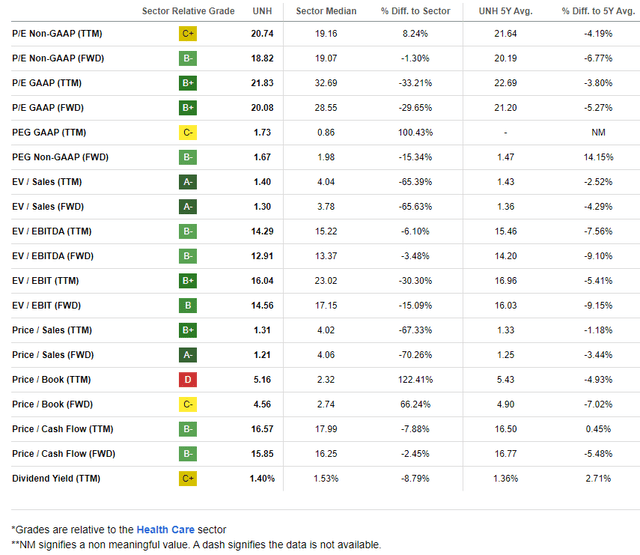

UNH: Improved Valuation Metrics as Shares Hold Steady in the Low $500s

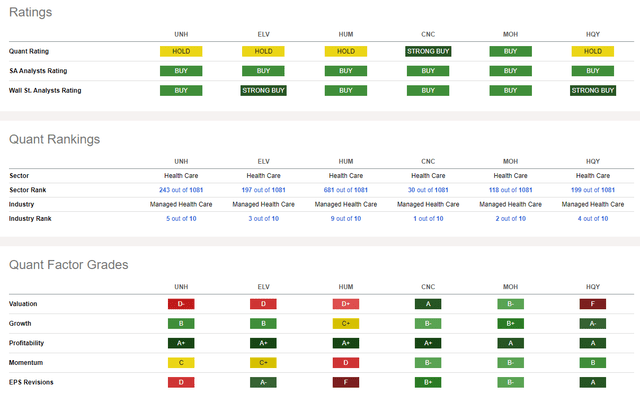

Compared to its peers, UNH features a below-average valuation grade, but considering the low-teens forward growth trajectory, I assert that a high teens multiple is at least fair. What’s more, profitability trends are very robust despite some recent negative EPS revisions dating back to last July. I will detail important price points on the chart later, which generally point toward soft share-price momentum trends.

Competitor Analysis

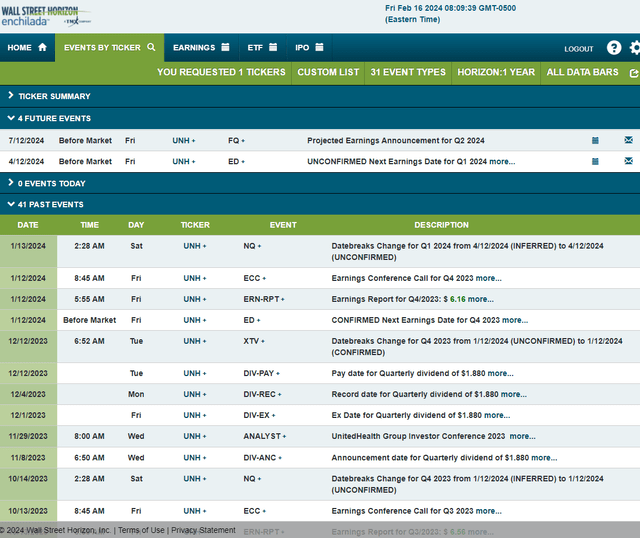

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q1 2024 earnings date of Friday, April 12 BMO. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

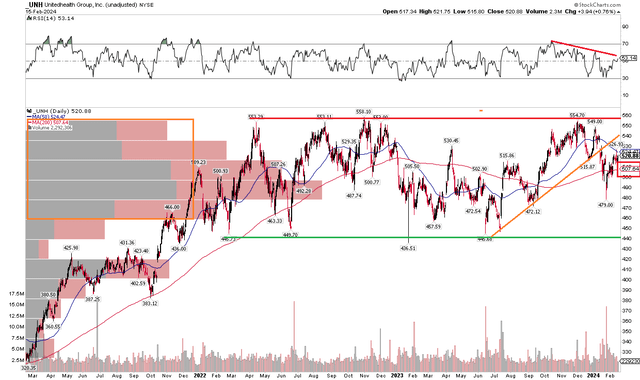

The Technical Take

While I like the more favorable valuation turn with UNH, the chart remains lackluster. Notice in the graph below that resistance is seen just above the $550 mark, but a sharp rally from late Q3 through early December last year helped to negate a key chart pattern that concerned me in my previous analysis. A bearish rounded top pattern is now no longer in play, but the bulls must still step up to the plate and take the major Healthcare sector stock above its $558 Q4 2022 all-time high. On the downside, I see ongoing support in the mid-$400s. That is also the base of a range featuring a high amount of volume by price, so I would expect ample buying demand if UNH endures a steeper selloff from the $555 late-2023 peak.

But take a look at the long-term 200-day moving average. It’s flat in its slope, suggesting that the broader trend is mixed. Contrast that with the S&P 500 which has been in rally mode – that means UNH sports relative weakness, something technicians do not want to see. Finally, the RSI momentum gauge at the top of the graph is another risk to weigh – it keeps drifting lower after a bearish price-momentum divergence revealed itself in November and December last year.

Overall, the chart continues to encounter challenges.

UNH: Bearish RSI Trends, Key Resistance in the mid-$500s

The Bottom Line

I am upgrading UNH from a hold to a buy. While issues linger on the chart, the valuation has turned more compelling in my estimation. This quality growth stock with a yield could come into favor if volatility sparks some sector and style rotation in the market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.