Summary:

- Johnson & Johnson’s acquisition of Shockwave Medical is expected to benefit J&J’s investors due to positive trends in sales, revenue, and cash flow.

- Shockwave Medical has a strong product portfolio and a growing market value in the intravascular lithotripsy (IVL) technology.

- The merger will expand J&J’s presence in the cardiovascular intervention market and prevent competitors from acquiring SWAV’s technology.

7activestudio/iStock via Getty Images

Thesis

Considering Shockwave Medical’s (NASDAQ:SWAV) latest Q1 2024 report, which revealed positive trends in sales, revenue and cash flow, the increasing market value and adoption of the intravascular lithotripsy (IVL) technology, together with the positive results of the multiple clinical trials associated with the IVL, I think SWAV stock is a “Buy”. Therefore, in my opinion, Johnson & Johnson’s (NYSE:JNJ) investors will be pleased with the acquisition of SWAV. Taking into account the value to investors and the potential to increase revenues of JNJ’s cardiovascular MedTech sector, I rate JNJ stock as a “Buy”.

Overview

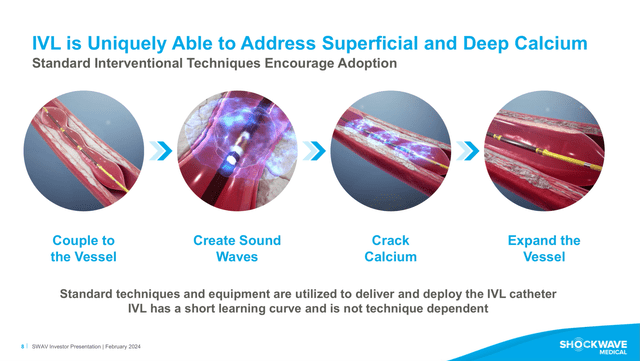

SWAV is a medical device company founded in 2009, it became public in 2019, and it is headquartered in Santa Clara, California. The company focuses on the development and commercialization of IVL for the treatment of calcified plaques with peripheral and coronary vascular, and heart valve diseases (see image below). The IVL technology has seen increasing adoption, given its safety and efficiency in the treatment of otherwise very difficult to treat calcified plaques. Recently, SWAV and JNJ announced that they have reached an agreement by which JNJ will acquire SWAV for $13.1 billion. The merger is expected to be completed by mid-2024. Previously, it was rumored that Boston Scientific (BSX) was interested in acquiring SWAV, however, as far as I am aware, BSX’s management never confirmed or denied the rumors.

IVL Mechanism of action (SWAV’s FY2023 Investor Presentation)

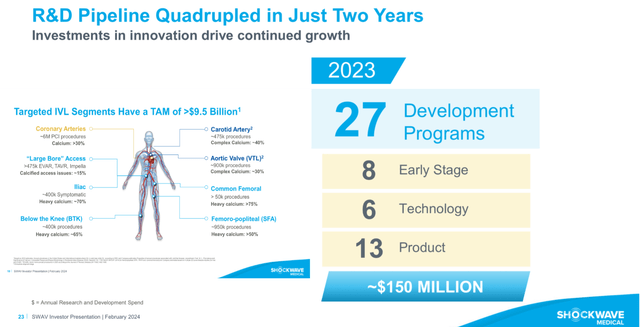

The global IVL market value was estimated at $193 million in 2023, and it is expected to grow at 9.3% CAGR, reaching $359 million by 2030. In this sense, Shockwave, in their FY2023 investor presentation, estimated the IVL global addressable market (TAM) to be $9.5 billion, while considering their total 27 development programs (including 13 products) the company estimated its TAM to be $14.5 billion. In addition, within the merger’s press release both companies stated:

The acquisition of Shockwave further extends Johnson & Johnson MedTech’s position in cardiovascular intervention and accelerates its shift into higher-growth markets. Cardiovascular intervention is one of the fastest-growing global medtech markets, with significant unmet patient need. With the addition of Shockwave, Johnson & Johnson will expand its MedTech cardiovascular portfolio into two of the highest-growth, innovation-oriented segments of cardiovascular intervention – coronary artery disease (CAD) and peripheral artery disease (PAD). The transaction follows Johnson & Johnson MedTech’s successful acquisitions of Abiomed, a leader in heart recovery, and more recently Laminar, an innovator in left atrial appendage elimination for patients with non-valvular atrial fibrillation (AFib).

Taking it all into account, it seems to me that JNJ might have found the perfect synergy in order to boost their MedTech cardiovascular portfolio. This deal not only allows JNJ to secure the ownership of the technology developed and marketed by SWAV, but also ensures that competitors such as BSX, Medtronic (MDT) or Abbott Laboratories (ABT) do not acquire it and become bigger competitors in the area. In my opinion, the merger also brings some value to SWAV, as given the fierce competition in the MedTech cardiovascular field, it was unlikely that SWAV was going to be able to capitalize the IVL TAM, but things might be different if you are part of one of the Pharma and MedTech leaders. Saying that, I also have to point out that Shockwave as an independent company would have continued to increase their sales revenue and increase their cash flow for the time being, as it was shown in its Q1 2024 report.

Shockwave’s pipeline and product sales

Shockwave has 27 development programs (see image below), which includes 13 products. Twelve of those are based on the IVL system, accounting with various catheters and IVL platforms in order to adapt better to the anatomy of the site and the application, e.g. coronary and peripheral.

SWAV’s pipeline (SWAV’s FY2023 investor presentation. Modified by the author)

In terms of sales, the company has seen a fantastic revenue increase of 36% when comparing Q1 2024 vs Q1 2023 and net income of $55.3 million in Q1 2024 vs $39.1 million in Q1 2023. The results in Q1 2024 are not a surprise if we consider that, the management has been reporting an onwards trend in adoption during the last five years, with approximately 182K patients treated with IVL in 2023 alone, as reported during the FY2023 earnings call.

Interestingly, one of the advantages of this technology is the possibility of synergistically working with other technologies to improve the patient’s outcome. For instance, IVL can be utilized to facilitate the implantation of transfemoral TAVI in patients with calcium plaques, improving the rate of success of the procedure and minimizing the risks.

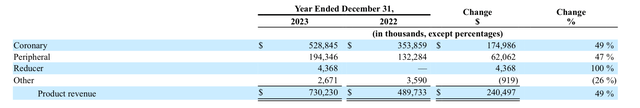

Given the deal with JNJ, Shockwave has cancelled the Q1 2024 earnings call, and the Q1 2024 10Q did not provide enough details into the product’s sales. However, in the FY2023 10K the company reported the coronary product revenue to be the largest (see image below), accounting for $528.845 million out of the total $730.230 million revenue in 2023. In second place is the peripheral, which accounted for another $194.346 million in 2023. Both sectors, coronary and peripheral, saw an increase of nearly 50% when compared against 2022.

SWAV’s sales by business sector (SWAV’s FY2023 10K report)

Shockwave’s Q1 2024 report

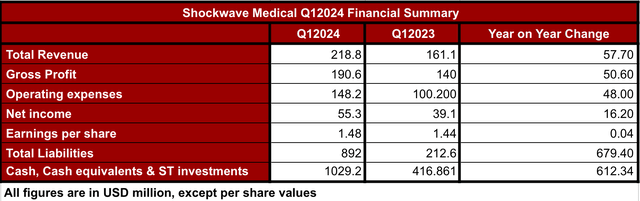

In general terms, SWAV Q1 2024 results beat all expectations. The company reported an increase of 36% in revenue and gross profit when comparing Q1 2024 vs Q1 2023 (see image below). Similarly, the net income increased 41%, and the cash, cash equivalents and short-term investments increased 146.9% in the same period of time. This has translated into an EPS increase of 2.8%.

SWAV’s Q12024 financial summary (Data collected by the author from SWAV’s Q12024 10Q report, )

On the other hand, the company also reported nearly 48% increase in operating expenses, which was attributed to the higher headcount and larger sales force when comparing Q1 2024 to Q1 2023. In addition, the total liabilities have also increased by 320% in the same period of time.

Considering that the company is generating nearly $1 billion in revenue per year, and it holds another billion in cash, cash equivalents and ST investments, I would consider that the debt (which is below 1 billion) is well under control. It is also worth noting that usually Q1 is the lowest quarter in terms of revenue for SWAV. Thus, if the trend was to continue, without taking into account the merger, the next quarters the company would see larger numbers in its sales-driven revenue.

SWAV’s Valuation

In previous sections of this article, I mentioned that JNJ valued SWAV at $13.1 billion; this amount valued each share at $335. At the time of writing this article, the price per share is $331 with a $12.48 billion market cap. As it is expected, the share price has not seen much variation since the announcement of the acquisition deal. According to Seeking Alpha’s summary table, the forward EPS is 5.26, which would be a 31% increase when compared against the EPS in FY2023. In addition, SWAV’s TTM EV/sales ratio is 15.45 and the forward-looking consensus estimates the EV/sales to be 13.05. In my opinion, a sign of a fair valuation at this point.

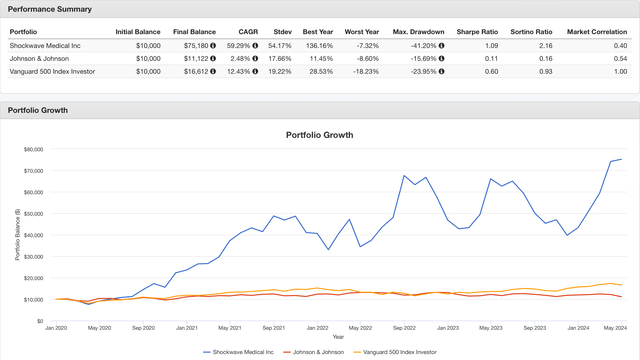

Interestingly, when performing a back test comparing a hypothetical investment on SWAV, JNJ or SP500, with a starting point of $10,000 in January 2020 (just after SWAV became public), the results shown the good performance of SWAV, beating both JNJ and SP500, even when reinvesting dividends (see image below). Needless to say that JNJ investors haven’t been particularly impressed with the last 5 years returns, which largely underperformed the SP500 and its own historical values, thus probably it is not the fairest comparison at this moment in time.

Backtest comparing SWAV vs JNJ vs SP500 (Portfoliovisualizer.com)

Despite the potentially unfair comparison of SWAV vs JNJ, in my opinion, Shockwave’s performance with nearly 60% CAGR during the last 5 years might be a good sign of the attractive investment opportunity that the company represented to JNJ. Thus, securing not only the technology and the know-how that has enabled SWAV to increase its year-on-year revenue, but also hampering the growth of other MedTech companies with products for similar applications.

Although, in this particular case, speculating about the fair value of SWAV is a bit pointless, my base case calculation using the forward EPS ($5.26), a 25% discount rate and 5-year growth of 50% (close to the CAGR from the back test above) and a 40% growth going forward, resulted in a base case target share price of $363.71.

Similarly, for the worst-case scenario, I estimated that the 5-year growth would be 30% close to its current Q1 2024 vs Q1 2023 growth. And a 20% growth in the following 5-years. Thus, the worst-case scenario target share price is $162.35.

For the bullish case scenario, the 5-year growth was estimated as 60%, while the following 5-years growth was estimated as 40%. Resulting in a bullish case target share price of $460.18. Finally, the total intrinsic value for the company was $342.73, rating the company a 3.5% undervalued at the current share price.

Shockwave’s value to JNJ

In the previous section, I estimated Shockwave’s intrinsic value as $342.73, which means that SWAV is 2.33% undervalued when compared against the $335/share that JNJ has agreed to pay.

Moreover, if we stick to the financials of SWAV, where the company has shown increasing revenues Q1 2024-Q1 2023 accounting to 36%, positive cash flow, low debt, and large TAM values ($9.5 billion) for IVL, it suggests that JNJ’s management has taken the right decision at acquiring Shockwave, but more importantly, in my opinion they got a fair deal.

The acquisition of Shockwave Medical by JNJ adds on to a series of transactions that the pharma giant has been announcing. Those acquisitions included Abiomed (a heart pump maker) and Laminar (a heart implant developer). In relationship with the Shockwave merger, JNJ’s EVP & CFO Joseph Wolk commented the following in the latest JNJ’s Q1 2024 earnings call:

Before we delve into segment highlights from the quarter, I want to touch upon some important announcements that we made that will further enhance our competitive positioning. Earlier this month, we announced a definitive agreement to acquire Shockwave Medical. Johnson & Johnson has a long history of addressing cardiovascular disease through both our Innovative Medicine and MedTech businesses. The acquisition of Shockwave with its leading intravascular lithotripsy or IVL technology will provide us with a unique opportunity to impact coronary artery and peripheral artery disease, two of the highest growth innovation oriented segments within cardiovascular intervention. This addition is not only adjacent to our other cardiovascular businesses, but also consistent with our strategy of becoming a best-in-class MedTech company.

Moreover, it is important to highlight that the patents currently owned by SWAV have a long life. In other words, the expiry date of the patents range from 2029 to 2042, as described within SWAV’s FY2023 10K. This is without a doubt of great value to JNJ, as it allows a long runway to capitalize the investment. In this sense, one of the caveats of SWAV as an independent company, was the fierce competition in the cardiovascular MedTech field, in which they are competing against larger and more established companies such as MDT, BSX and ABT. In this sense, SWAV had described in its FY2023 10K report that they face intense competition against the aforementioned companies and stated:

Some of these competitors are large, well-capitalized companies with greater market share and resources than we have. As a consequence, they may be able to spend more on product development, marketing, sales and other product initiatives than we can.

In this sense, the merger with JNJ is likely to boost Shockwave’s products-driven revenue growth, as JNJ will be leveraging on its large amount of resources, well established sales routes, marketing initiatives, and in general larger resources than SWAV’s, which will make up for a fairer competition against MDT, MSX and ABT. Hence, in my opinion, JNJ will be able to capture a larger portion of the IVL TAM than SWAV would have done if it stayed as an individual company.

Risks

My “buy” rating for JNJ is based on the analysis of the potential synergy implicated in the JNJ and SWAV merger, recently announced by both companies. In my opinion, the acquisition has great value to both JNJ as a company and to its investors, as it secures the leadership of JNJ in a fast-growing MedTech area (cardiovascular).

However, my analysis is by default very limited, given that JNJ is currently facing a number of legal issues and settlements associated with its baby talc powder. As a consequence, the company spun out most of its consumer health products into Kenvue (KVUE) and it is now centering its efforts on the growth of its MedTech sector. Thus, it is possible that the potential revenue growth in JNJ’s cardiovascular sector driven by SWAV’s products do not move the needle in terms of net profits for JNJ and, as a consequence, do not support a share price increase in the future.

In addition, in the latest JNJ earnings call, Joseph Wolk, when referring to Shockwave’s acquisition, announced:

As previously communicated, we assume the closing of the transaction will take place by midyear 2024 at which time we will update our guidance to reflect the expected dilution to adjusted earnings per share in 2024 of approximately $0.10 per share driven by financing costs.

Thus, JNJ’s shareholders should expect to be impacted by the dilution, which may impact their total returns on investment.

On the plus side, in my opinion, JNJ is currently trading at a discount. Indeed, Wall Street consensus target share price for the next twelve months is $173.26, or a 14% undervalued rating against its current $151/share.

Conclusions

In this article, I have analyzed a number of factors involving the merger between Shockwave and Johnson & Johnson. When focusing on SWAV as an independent company, considering its robust pipeline, financial growth as shown in its Q1 2024, the IVL TAM and its intrinsic value, I consider SWAV would be a “buy” if it were to remain as an independent stock.

From the value to JNJ point of view and taking into account the performance of Shockwave, I consider that JNJ got a fair deal on the acquisition of SWAV. Moreover, the synergy between the robust product portfolio of SWAV, and JNJ’s resources will likely have a positive impact on JNJ’s cardiovascular MedTech driven revenue growth.

Despite the positive assessment, JNJ is currently facing strong headwinds. Hence, in the short term it is possible that investors won’t see a positive change in their returns, but in turn they will need to face the effects of the dilution associated with the acquisition.

Similarly, SWAV’s share price has not reached JNJ’s target price ($335/share) even after the deal announcement. I believe, one of the main reasons is precisely the upcoming merger of the stocks. At the moment, buying shares of JNJ, which are undervalued, looks more attractive than buying SWAV’s shares, which are almost fully valued.

Considering all of the above, I think JNJ is a “buy” given the positive moves done in a fast-growing area of MedTech, and the robust product portfolio with a long-lasting patent safety, that will likely secure the leadership of JNJ in the cardiovascular MedTech area.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.