Summary:

- Tesla, Inc. achieved record quarterly deliveries in the first three months of the year, after two straight quarters of delivery misses in 2H22.

- Price cuts may have contributed to Tesla’s strong kickoff to 2023, staving off concerns about demand risks.

- But with macro- and industry-specific challenges still running fluid, the sustainability of Tesla’s recent market rally remains in question.

Justin Sullivan

Tesla, Inc. (NASDAQ:TSLA) stock has brought home gains of almost 70% this year, buoyed by several tailwinds spanning a flight to growth stocks with durable fundamentals and robust balance sheets, and hopes for monetary policy easing before the end of the year – both as a result of crumbling confidence in the financial sector. Record deliveries in the first quarter released during the weekend also bolstered support for assuaging investors’ concerns over demand risks, corroborating CEO Elon Musk’s recent statement that “affordability is what matters.”

Yet, with market valuations not yet out of the woods when it comes to the mounting macro overhang comprised of persistent inflation, monetary policy tightening, and looming recession, the sustainability of Tesla’s recent upsurge remains to be seen. On the one hand, the luster over hopes on easing monetary policy – which growth valuation multiples thrive on – is dulling after the OPEC+’s abrupt decision to cut crude output next month, effectively redirecting attention back to inflationary concerns and related impacts on the broader economy and market performance. Meanwhile, on the other hand, Tesla’s competitive price cuts implemented in the first quarter across some of its high-demand regions is also expected to bring about an inevitable impact on its profit margins over the near term.

The anticipated combination of a resurgence in valuation multiple compression as optimism for a Fed pivot dims, alongside potential fundamental deterioration at Tesla in the near term, may weigh on sustainability of the stock’s latest rally. And the market’s muted response to record first quarter deliveries may be an early sign that Tesla stock’s valuation is entering frothy territory hungry for fundamental support that may not be available within the foreseeable future as ASP declines hurt margins.

Tesla Delivery and Production

Quarterly deliveries reached a new record at Tesla. The electric vehicle (“EV”) pioneer increased deliveries by 36% y/y and 4% q/q to 422,875 cars in the first quarter. Production volumes also carried forward the breakneck pace observed in the fourth quarter, totaling 440,808 vehicles in the first quarter. Both figures exceeded consensus estimates for deliveries of 421,164 vehicles and production of 432,513 vehicles. Considering the challenging operating backdrop today, the results have been viewed as “very good numbers,” but still fall short of Musk’s aspirations to grow sales at a multi-year annual pace of 50%, adding to execution risks for the remainder of the year – especially as further economic deterioration awaits.

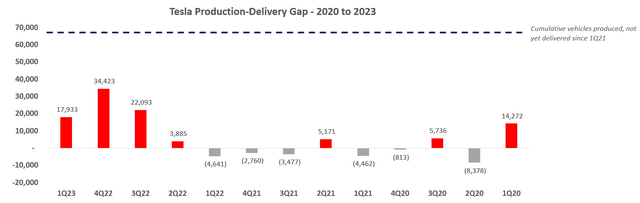

While the latest delivery figures show optimism that demand remains robust for Tesla vehicles, inventories are still expanding at a rapid pace relative to past quarters nonetheless. This suggests a trajectory towards normalizing growth.

Tesla production-delivery gap (Data from ir.tesla.com)

Much of the first quarter’s sales continue to be concentrated in China – a region where its early stages of post-pandemic recovery remains subdued – which underscores shakiness to the resilience of Tesla’s near-term demand story, as well as potentially growing weakness in its core American market amid acute macroeconomic challenges.

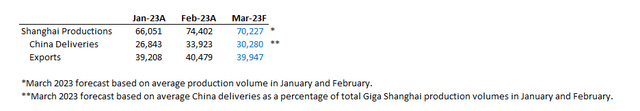

Specifically, monthly passenger vehicle sales data from the China Passenger Car Association shows Tesla had delivered more than 140,000 vehicles made from its Shanghai plant in the first two months of the year. And extrapolating that pace of monthly deliveries for March, for which official data is not yet available, Tesla vehicles rolling off of Giga Shanghai’s production line likely contributed to half of total first quarter deliveries. Of this figure, approximately 60,800 were delivered within China in the first two months of the year. And extrapolating the percentage of Shanghai-produced Tesla vehicles subjected to local deliveries in the first two months of the year as a proxy for March, the EV titan likely delivered close to 120,000 vehicles in China during the first quarter, representing almost a third of its auto global sales over the same period.

Tesla production and delivery volumes from Giga Shanghai (Data from the China Passenger Car Association)

Month-on-month deliveries within China also grew only modestly in February compared to subdued volumes in January due to the Lunar New Year holiday, compared to bigger jumps observed in past post-Lunar New Year sales. While the figure’s increase still outperforms the 20% y/y decline in total passenger vehicle sales in China during the first two months of the year, it suggests demand remains relatively modest when compared against the market’s breakneck growth observed in the past two years as consumer spending remains conservative amid post-pandemic recovery uncertainties.

Retail sales rose 3.5% in January and February compared to the same period last year, the National Bureau of Statistics said Wednesday. Industrial output rose 2.4% and fixed-asset investment grew strongly, as local governments increased infrastructure spending to spur the recovery. However, the unemployment rate increased, pointing to weakness in domestic demand.

Source: Bloomberg News.

The modest acceleration observed in Tesla’s deliveries in China also suggests that the aggressive price cuts put into place to compensate for the removal of financial incentives from the central government on eligible EV purchases beginning this year, and to shore up local demand can only do so much in the face of stiffening competition against local automakers. This is further corroborated by Tesla’s 11.5% share of total China EV sales over the same period, which is flat from the prior year. As EV demand continues to normalize in the Chinese market, which is consistent with Tesla’s potential decision to pull this year’s planned capacity expansion at its Shanghai facility despite multiple production-line upgrades already implemented last year in preparation for the endeavor, risks remain skewed to the downside when it comes to the extent of positive impact that Tesla’s primary pricing lever may have on overcoming near-term changes in the both the macroeconomic environment as well as EV demand dynamics in the Chinese market.

Similar concerns are also observed in the U.S. While the recent price cuts of as much as 21% on some top-end premium models have been key drivers to the uptick Tesla’s first quarter deliveries, the broader auto sector remains fixed on entering a “demand-constrained” environment – a 360-pivot that stands to dwarf any hopes for recovery after two years of acute supply chain disruptions in the capital-intensive industry. Consumer spending remains challenged, with the latest data on U.S. retail sales showing a m/m decline in February, dragged primarily by weakening demand for autos. Specifically, vehicle sales fell 1.8% in February from the prior month – likely due to the combination of an industry-wide price war, as well as a pullback in consumer demand on big ticket items as the pinch of inflation persists.

Although recent expectations for resurgence in prices at the pump resulting from the OPEC+ sudden decision to further reduce crude output in the coming months could serve as a tailwind for the EV demand environment like in 2021, any related momentum is unlikely to match that of 2021’s this time around as the economic environment has deteriorated substantially since. The aggressive pace of Federal Reserve rate hikes over the past year have pushed financing costs on auto loans towards a record 7%, while average MSRP prices for EVs like Tesla’s remain a burden on shrinking consumer wallets, effectively pricing a meaningful portion of prospective buyers out of the equation. And although Tesla’s aggressive price cuts across its lineup, alongside federal tax incentives under the Inflation Reduction Act for eligible EV purchases, may have played a favorable role in restoring demand in the first quarter, structural cracks are likely forming in the U.S. EV market that will deem this fix unsustainable.

Profit Margins

Investors have largely already taken into consideration the impact of Tesla’s recent price cuts –aimed at restoring demand and compensating for federal incentives on ineligible models – on auto margins. Management has been upfront on the impact of recent ASP reductions, while Musk has also made high-profile comments indicating his preference for volume over profitability. While Tesla’s pricing lever has long been an advantage available for use at its discretion thanks to its market-leading manufacturing efficiency, the aggressive MSRP cuts alongside persistent inflationary pressures and incremental ramp-up costs to support new manufacturing facilities, combined with other capital-intensive undertakings will remain a challenging feat to juggle without leading to further margin contraction. Incremental output as the company’s new production facilities ramp up will likely be another challenge to profit margins, as further price cuts may be required to clear inventory – another indicator that repeatedly pulling the pricing lever may not be a sustainable fix to demand risks facing Tesla as structural competition heats up alongside near-term cyclical headwinds.

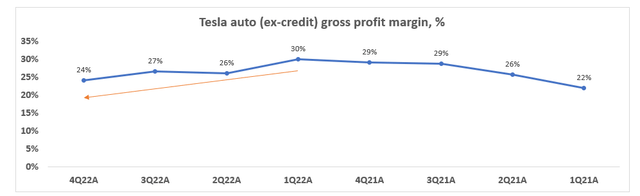

Tesla auto (ex-credit) gross profit margin (Data from ir.tesla.com)

Tesla’s auto (ex-credit) gross profit margins have already been decelerating at a substantial pace over the past year, with current operating dynamics contributing to reduce visibility into when might the metric expand again. While mentions of a new vehicle platform during Investor Day 2023 were touted as the key to eventually cutting current production costs by half, details remain lacking on the aspiration’s timeline to realization, which keeps us incrementally cautious on when Tesla’s potential return to near-30% auto margins (ex-auto credit sales) might take place. In the current market climate where investors continue to favor profitability over growth, focus will likely shift back towards the recent price cuts’ impact on Tesla’s progress in preserving auto margins considering all that is going on, making the EV pioneer’s upcoming earnings release for the first quarter a key focus area.

Market Valuations

Despite expectations for subdued fundamentals in the near-term due to both macro-driven challenges and heated industry-wide competition, Tesla’s shares have benefited from expectations for easing monetary policy as the year progresses. Specifically, the shares rallied through the first two months of the year despite a looming narrative on demand risks after a second straight delivery miss in the fourth quarter, as markets remained confident in at least one rate cut before the end of the year.

But this optimism was briefly cut short when Fed Chair Jerome Powell doubled down on policymakers’ commitment to keeping rates higher for longer to ensure inflation falls back within the 2% range. During testimony to Congress in early March after a slew of stronger-than-expected economic data, he said:

The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes. Restoring price stability will likely require that we maintain a restrictive stance of monetary policy for some time.

Source: Semi-annual Monetary Policy Report to the Congress, March 2023.

Tesla shares gave up some of its gains in the beginning of March, alongside the broader tech sector, as markets priced in expectations for a peak rate near 6% with no prospects for any pivot in the current year. Yet, optimism for the tech sector was swiftly restored when policymakers were hit with the collapse of Silicon Valley Bank SVB Financial Group (OTC:SIVBQ), Signature Bank (OTC:SBNY), and Credit Suisse Group AG (CS), with an urgency to counter contagion to other regional banks and the broader financial sector. Markets had subsequently dialed down expectations for the peak rate, with long-end Treasury yields coming down in favor of growth valuations – including Tesla’s – pinned on cash flows further out in the future.

But the OPEC+’s sudden decision to further curtail crude output beginning next month has swiftly reversed the narrative once again. Tight energy supply has been one of the key drivers to the uptick in price pressures over the past two years. And fears are running high that recent deceleration observed in key inflation gauges, including the Fed-preferred PCE, may run-up again and push monetary policy to a tighter clip. Long-end Treasury yield has already responded immediately to the development, ticking up five basis points in early Monday trading past 3.5%.

The returning burden on growth valuations has likely overshadowed Tesla’s record delivery volumes disclosed this weekend, with the stock also trading lower at the week’s open. The twists and turns of market performance over the past year in response to still-fluid macroeconomic factors continue to accentuate the fundamental weakness brought upon by persistent inflation. It remains a significant and prominent overhang precluding markets from finding solid ground in supporting a sustained recovery rally, underscoring the susceptibility of Tesla’s lofty valuation accrued year-to-date to another potential downward adjustment in the near-term.

Final Thoughts

The key concern hanging over the Tesla stock right now is likely the inevitable shrinkage of profit margins as a result of recent price cuts, and potential valuation multiple contraction in response to persistent inflationary pressures that may keep monetary policy tighter within the foreseeable future. Uncertainties remain on whether Tesla’s record quarterly deliveries achieved in the first three months of the year have brought upon sufficient scale to offset some of the margin impact from recent price adjustments. It also remains unsure whether some of the recent signs of restored demand would be sustainable and enough to stave off compounding pains that have already taken place due to input cost pressures and other inefficiencies ensuing from the ongoing production ramp-up at new facilities.

Over the past two quarters, investors have largely continued to view growth as the preferred performance metric at Tesla, with the stock’s valuation sliding as a result of increased angst over demand risks. And the narrative likely remains true, despite profitability being investors’ preferred gauge for quality and durability of performance in the broader markets amid the shaky market climate, considering the Tesla stock still being on a momentum-driven upsurge this year in response to recent expectations for improved demand and an easing monetary policy trajectory. The upcoming release of Tesla’s first quarter financial results will be a tell-tale on whether investors will shift focus back towards the company’s progress on preserve profit margins, and whether the pace of the stocks’ recent breakneck gains will be sustainable. But with macro pressures still looming large, and a price war seemingly not sustainable for any automaker – large or small – as dynamics adjust in the broader EV demand environment, Tesla’s rally this year remains susceptible to another fallout from current levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!