Summary:

- PepsiCo, Inc.’s recent underperformance presents a buying opportunity due to its strong pricing power, brand loyalty, and focus on margin improvement.

- Despite headwinds like slowing U.S. sales, PepsiCo’s solid international growth and commitment to dividends and buybacks make it a reliable defensive investment.

- PepsiCo’s Dividend King status, with over 50 years of hikes and a 3.1% yield, underscores its appeal for income-focused investors.

- The company’s mix of stability and growth potential, especially in emerging markets, makes it a great long-term investment for steady, reliable returns.

antorti

Introduction

Guess what?

Consumer staples are back!

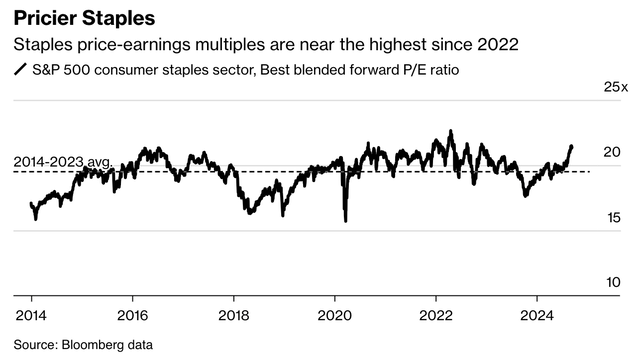

After being significantly undervalued last year, the Consumer Staples Select Sector SPDR ETF (XLP) has returned roughly 17% year-to-date. This has pushed its forward P/E ratio to roughly 21.5x, the highest multiple since 2022.

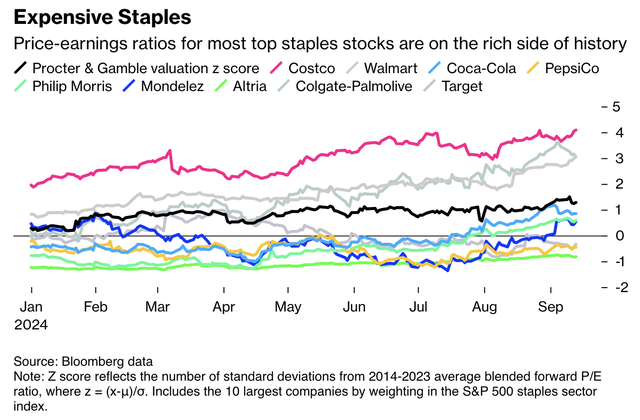

Interestingly, this is skewed by numerous outliers, including Costco (COST) and Walmart (WMT), which have valuation z-scores of more than 3x!

Bloomberg’s Jonathan Levine hit the nail on the head when he wrote that this performance is due to the safety these stocks bring to the table in an environment of elevated uncertainty. Consumer staples also tend to provide solid dividend income, which is a great alternative in a situation where risk-free bond yields are falling.

[…] it made sense to seek a degree of safety in companies with steady cash flows and high dividend yields that are less sensitive to economic cycles, part of what we in the commentariat labeled the Great Rotation.

Moreover, consumer staples were really cheap last year.

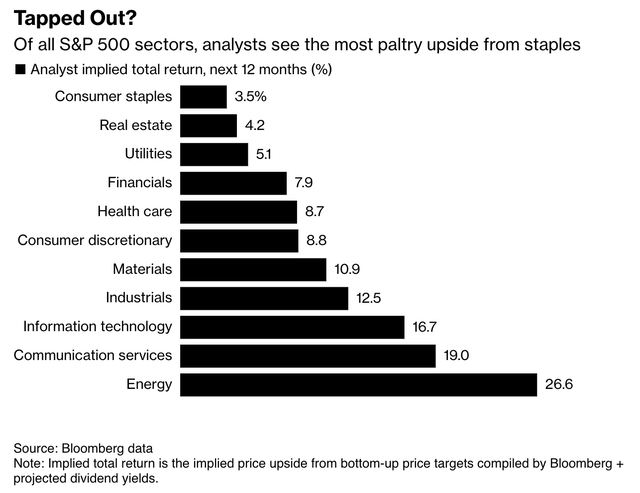

Now, analysts are less upbeat, as the consumer staples sector has the lowest total return expectations for the next 12 months.

I’m bringing all of this up because one of the biggest stocks in this sector is also one of the biggest defensive stocks in my portfolio. That company is PepsiCo, Inc. (PEP).

My most recent in-depth article on this company was written on January 17, when I went with the title “Salty Snacks, Sweet Dividends: PepsiCo’s Battle-Tested Investment Appeal.”

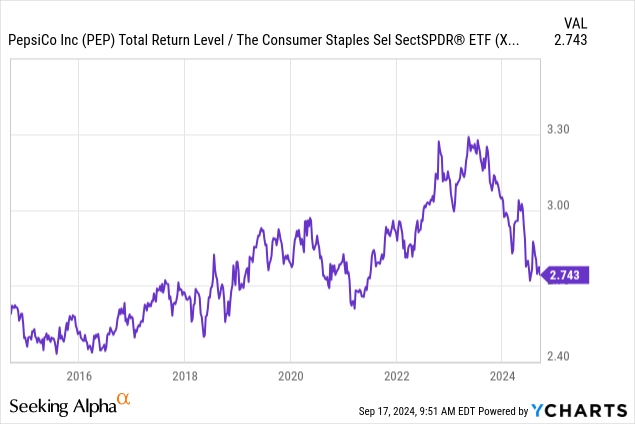

Since then, PEP shares have returned 9%, lagging the S&P 500 (SP500) by roughly 10 points. In general, PEP has been lagging in its sector, as the XLP ETF has consistently performed better than PepsiCo since May 2023.

As I am fearful of winding up owning a slow-growing laggard in a defensive sector, I’m consistently monitoring PepsiCo.

In this article, I’ll update my thesis and explain why I continue to believe that PEP is the right pick for me.

So, let’s dive into the details!

Underperformance Is An Opportunity

God willing, I still have many decades to invest. That is why I constantly look for outperformance when I buy companies in somewhat slow-growing sectors. The consumer staples sector is one of them.

PepsiCo’s recent underperformance has been a red flag for me. However, as I’ll tell you in this article, I believe this offers opportunities, as the company continues to do extremely well — except for reporting weaker-than-expected 2Q24 earnings.

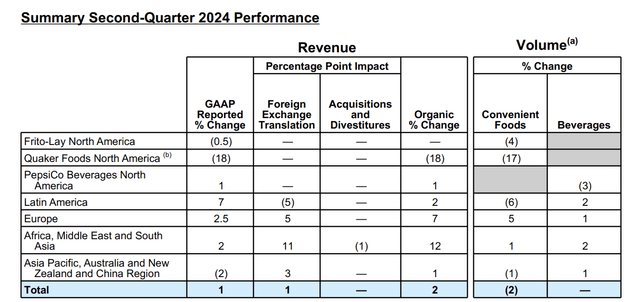

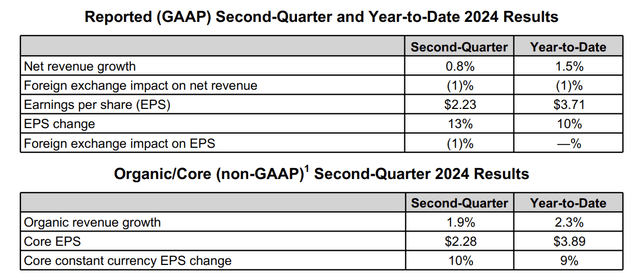

As reported by Bloomberg, the producer of snacks and beverages continues to rely on pricing power in a challenging macroeconomic environment. It reported organic revenue growth of just 1.9%, a full point below the 2.9% growth rate analysts surveyed by Bloomberg were looking for.

To visualize the company’s pricing power, we see that total selling volume was down, mainly due to weakness in the snack segment. Thanks to stronger pricing, it was able to generate positive organic revenue growth.

This pricing power is one of the reasons why I bought PepsiCo in 2020. The consumer staples sector is competitive and the “war” for shelf space is fierce.

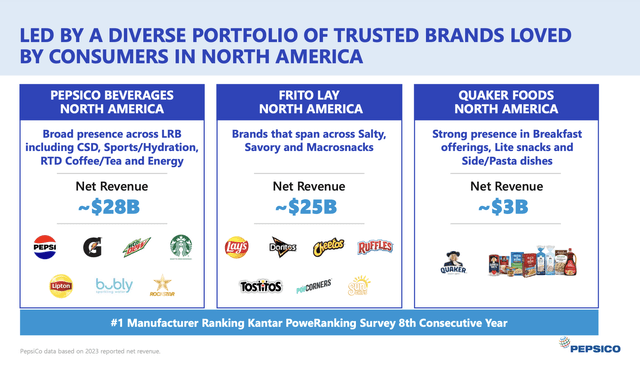

Hence, it helps that the company has some fantastic brands that enjoy strong customer loyalty. This includes its Pepsi, Gatorade, and Lipton brands in beverages, its Lay’s, Doritos, and Cheeto’s brands in the snack segment, and breakfast offerings like Quaker — among many others, including a multi-decade partnership with Starbucks (SBUX) to sell Starbucks-branded drinks.

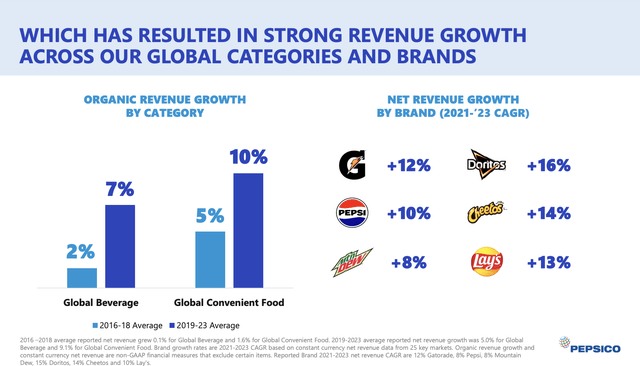

Looking at the overview below, the company has achieved impressive results, outperforming its peers in beverages and convenient foods. In the 2019-2023 period, it has grown its snack business revenue by 10% per year. Even in the beverage segment, it saw 7% compounding growth.

Unfortunately, as 2Q24 earnings showed, the business has run into some headwinds, as it is increasingly tough to hike prices in an environment of consumer weakness.

After years of price increases and sales growth, PepsiCo’s US business is struggling. Persistent inflation has forced many shoppers to cut back on spending and switch to cheaper supermarket-owned brands. The salty snacks category has been particularly lackluster as consumers focus more on nutrition and affordability. – Bloomberg.

The good news is that the company is doing a great job growing margins, which allowed it to grow its constant-currency EPS by 10% in 2Q24. This is on top of 15% growth in 2Q23. The two-year compounded EPS growth rate is 12%.

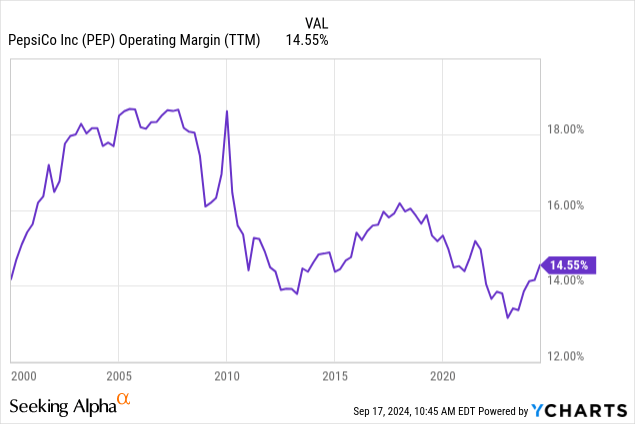

Going forward, PepsiCo aims to grow its margins through efficiency improvements, optimized advertising spending, and better cost control. This is key, as margins have been rather weak recently.

It also helps that emerging markets offer a lot of room for growth, as these markets are less saturated. In 2Q24, international organic revenue was up 5.5%, driven by market share gains in nations like China, India, Brazil, and Australia.

As this business accounts for roughly 40% of its total annual net revenue, there’s a lot of room for organic growth.

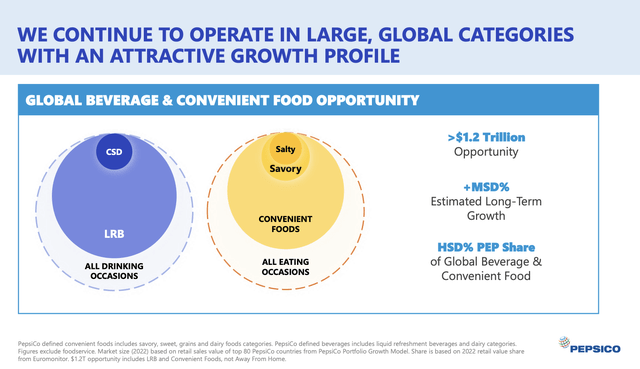

The global market is estimated to offer a $1.2 trillion opportunity, supported by mid-single-digit annual growth. PepsiCo has a “high-single-digit” market share.

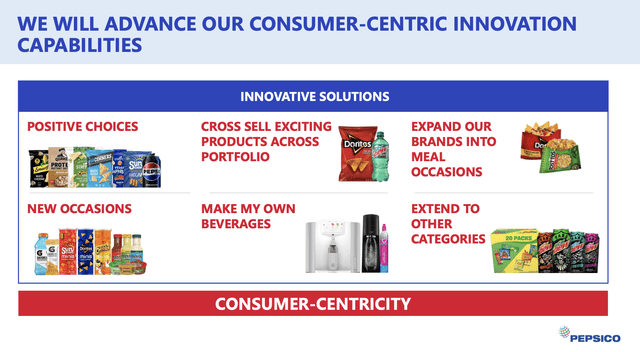

To accelerate growth, the company is not only refining its marketing but also improving products and using other “innovative” solutions, including cross-selling, smaller portion sizes, and adding new categories.

Personally, I am a huge fan of the company’s SodaStream business. I own the entry model, which is great for making your own sparkling water. In nations like Germany (my country of birth), this is a very popular product. In general, it is seeing strong international adoption.

So, what does this mean for shareholder value?

Dividends & Valuation

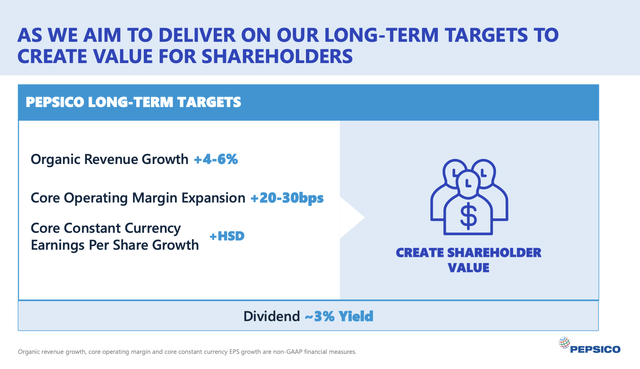

Although 2024 is not a great year, the company is avoiding contraction, as it is guiding for roughly 4% organic revenue growth this year. Its prior guidance was “at least 4% growth.”

Constant-currency core EPS is expected to grow by at least 8%.

Geopolitical tensions and macroeconomic volatility are expected to remain elevated, while disruptions associated with ongoing conflicts in certain international markets may persist. Separately, we expect the revenue impacts associated with product recalls at Quaker Foods North America to moderate in the second half of this year. – PepsiCo

Moreover, the giant expects to distribute roughly $8.2 billion to shareholders this year. This translates to 3.4% of its market cap and includes $7.2 billion in dividends and $1.0 billion worth of share buybacks.

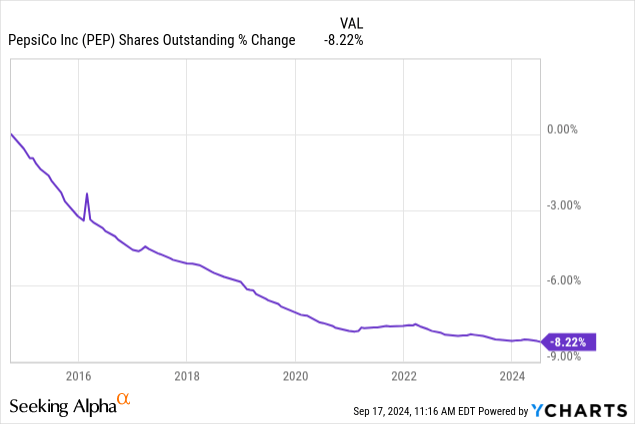

Over the past ten years, PepsiCo has bought back roughly 8% of its shares. This isn’t as much as buyback-focused companies, but it certainly had a significant impact on the per-share business of its business.

What’s even more impressive is its dividend. It’s also the reason most people invest in PEP.

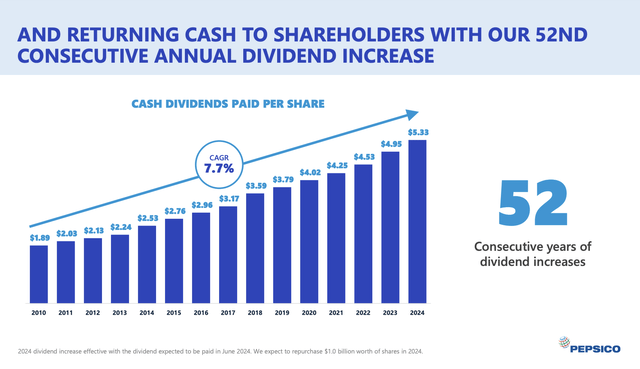

The Dividend King has hiked its dividend for more than 50 consecutive years, with a 7.7% average annual growth rate since 2010.

Currently yielding 3.1%, the most recent dividend hike was 7.1% on April 30.

This dividend is protected by a 65% payout ratio, a great business model, and a balance sheet with an A+ credit rating. This is what rating agency S&P Global wrote:

PepsiCo’s business strength is underpinned by its strong brands, balanced portfolio of businesses (with leading and defendable market shares in the relatively stable nonalcoholic beverage and savory snack product categories), and disciplined cost management. The entity is the largest global convenience food (59% of sales) and second-largest nonalcoholic beverage (41%) company in the world. – S&P Global.

On a longer-term basis, the company expects to maintain 4-6% annual organic revenue growth and high-single-digit EPS growth, supported by higher margins and buybacks.

Analysts agree.

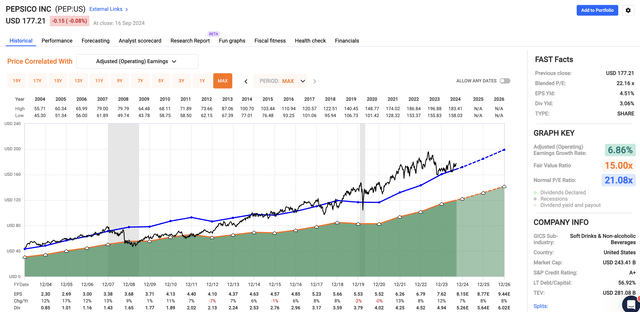

Using the FactSet data in the chart below, analysts expect PEP to generate 7% EPS growth this year, potentially followed by 8% growth in both 2025 and 2026.

Applying its long-term P/E ratio of 21.1x and 3.1% dividend yield, we get a total return outlook of 8-10%.

As a result, I’m consistently buying PepsiCo stock on corrections, as I believe it is difficult to find better defensive dividend growth in the market.

Takeaway

PepsiCo’s recent underperformance is a potential opportunity for long-term investors like myself.

Despite facing some headwinds like slowing U.S. sales and consumer weakness, PepsiCo’s strong pricing power, brand loyalty, and focus on margin improvement give me confidence in its future.

Moreover, with solid growth in international markets and a commitment to shareholder returns, including dividends and buybacks, I continue to see PepsiCo as a fantastic choice for defensive dividend growth.

Hence, for me, the company’s mix of stability and growth potential makes it a great long-term investment.

Pros & Cons

Pros:

- Strong pricing power: PepsiCo can raise prices without losing too much volume, which helps protect margins in tough environments.

- Reliable dividends: As a Dividend King with over 50 years of consistent hikes, the 3.1% yield and consistent dividend growth make it a solid pick for income.

- Global growth potential: With 40% of revenue from international markets, there’s a significant upside in emerging economies.

Cons:

- Consumer weakness: Sluggish U.S. sales and shifts toward cheaper, store-brand alternatives have been pressuring PepsiCo.

- Competition: The battle for shelf space is fierce, with competitors constantly innovating and pricing aggressively.

- Pricing limitations: After years of price hikes, PepsiCo may face headwinds when it comes to raising prices, especially with price-sensitive consumers.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.