Summary:

- I reiterate a hold rating due to my expectation for continuous weak conversion rates, driven by price sensitive consumers and competitive pressure.

- 2Q23 results continued to show disappointing self-pay net adds and ARPU, although advertising revenues exceeded expectations.

- My model indicates that the current share price is around fair value.

stockarm/iStock via Getty Images

Summary

Following my previous coverage on Sirius XM Holdings (NASDAQ:SIRI), I recommended a hold rating due to my expectation that the outlook is going to be bleak given the limited opportunity for SIRI to grow revenue in this weak auto market driven by high rates, weak conversion rates, and an uncertain advertising backdrop. This post is to provide an update on my thoughts on the business and stock. I continue to recommend a hold rating for the stock as I believe SIRI is not in the best position to continue converting more subs despite the positive auto outlook for FY23. In addition, my valuation model suggests the stock is fairly valued.

Investment thesis

I still find SIRI’s 2Q23 results disappointing in terms of self-pay net adds and ARPU, despite the fact that they were slightly better than consensus expectations for revenue and adjusted EBITDA. The earnings report revealed a notable positive aspect, namely the performance of advertising revenues, which exceeded my expectations. This was primarily driven by a higher-than-anticipated growth in Ad revenue per impression, reaching $97.13, which can be attributed to a stronger advertising market. The outperformance of adjusted EBITDA can be attributed to a combination of surpassing revenue expectations and a decrease in sales and marketing expenses, which the company has proactively reduced in anticipation of its upcoming product launch scheduled for later this year.

While my bearish view on the advertising outlook has turned slightly better given 2Q23 performance, the other two negative factors I mentioned previously remain a concern of mine: (1) being unable to grow revenue in this weak auto market (i.e., net adds are going to be weak); and (2) weak conversion rates.

In relation to the first point, it is noteworthy that SIRI, as anticipated, reported self-paid net additions in the second quarter of 2023 that were below expectations. This was accompanied by a churn of 133,000 self-pay subscribers (self-pay churn rate was recorded at 1.54%). During the conference call, the management expressed their anticipation of observing a modest increase in self-pay net additions during the latter half of the year. Furthermore, they expect to witness a gradual improvement in this regard as the year progresses. It is worth noting that management had previously indicated its anticipation of a modestly negative increase in self-pay net additions for the year 2023. From my perspective, it can be argued that there is a certain degree of validity to the management’s outlook, given that the projected sales of light vehicles in the United States seem to be surpassing what I would have expected given the prevailing high interest rates. Although there is a positive trend in auto sales, it is important to highlight to readers that an increase in auto sales does not necessarily guarantee a corresponding increase in SIRI’s revenue. It just means there are more opportunities for conversion.

This leads to the subsequent point regarding conversion. According to the management’s statement, the conversion rates have exhibited stability, implying that they have consistently remained within the low-30%s range for new cars and the low-20%s range for used cars. These figures indicate a deviation from historical patterns (high 20s to 30s% for used cars and high 30s to low 40s% for new cars). The absence of a rebound in SIRI’s conversion rate suggests that the company may be reaching a juncture where the perceived value of their offerings in relation to the cost incurred by consumers is diminishing. In my opinion, conversion rates have dropped as SIRI has gotten more ingrained in the auto base and begun focusing on the more price-sensitive customers. The aforementioned phenomenon, coupled with intensified competition in the realm of high-quality audio services, specifically in the domain of streaming, will persistently exert influence on the process of conversion. Management expresses optimism regarding the potential conversion benefits associated with initiatives such as 360L. However, I maintain a concern regarding the heightened competitive intensity within the premium audio sector and the increased availability of applications in the dashboard, both of which may exert pressure on subscriber trends.

The clearest signal of the competitive environment can be seen in the ARPU metric. SIRI recently disclosed an ARPU of $15.66, and this figure shows only slight fluctuations compared to the previous year, even though they raised prices on certain full-price plans in March. I believe that, in the coming year, Sirius XM may face constraints in its ability to increase prices and ARPU due to macroeconomic conditions and strong competition. It is probable that Sirius XM will have to maintain discounts to appeal to cost-conscious consumers.

Valuation

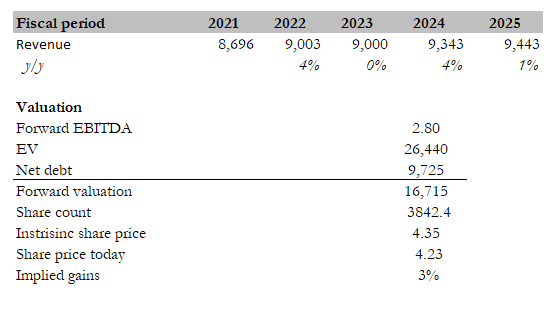

Own calculation

I believe the fair value for SIRI based on my model is $4.35. My model assumptions are that growth will basically be muted for FY23 given all the negative headwinds and also just as management guided. FY24 will see a growth acceleration to 4% given the easy comps in FY23, but decelerate back to 1% (using the consensus estimate). My take is that SIRI will no longer see historical growth given the saturation of its target consumers and increasing competition.

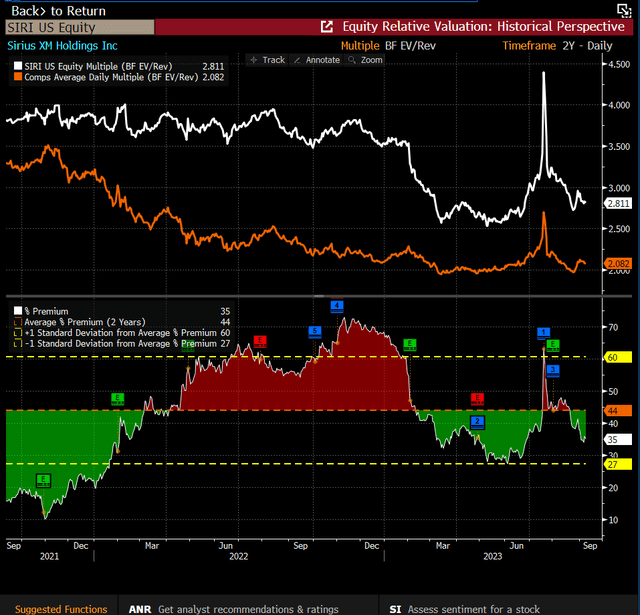

As Spotify (SPOT) is not generating meaningful profits, I used a revenue multiple to compare peers. SIRI is currently trading at 2.8x forward revenue, which is a premium to its peers. This gap exists likely because SIRI is the most profitable player among the group and is still showing positive growth so far. I expect this gap to remain for the foreseeable future. Peers include Spotify and IHeartMedia (IHRT). The average forward revenue multiple peers are trading at is 2, and the average EBITDA margin between them is 8%, which is way lower than SIRI.

Conclusion

Despite a positive performance in advertising revenues and the anticipation of increased self-pay net additions in the latter half of 2023, SIRI faces significant challenges. The stability in conversion rates at lower levels compared to historical patterns suggests diminishing perceived value among consumers. Additionally, heightened competition in the premium audio sector and the availability of dashboard applications may further impact subscriber trends. The ARPU metric remains a crucial indicator of SIRI’s competitive environment, with limited ARPU growth despite price increases. In the upcoming year, economic conditions and strong competition may constrain SIRI’s ability to raise prices, likely necessitating discounts to attract cost-conscious consumers, in my view.

Overall, I maintain my hold rating on SIRI, as the company faces ongoing challenges in a dynamic market landscape.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.