Summary:

- Sirius XM Holdings Inc. is recommended for a Sell rating due to an uncertain future coupled with overvaluation built up recently due to short squeeze.

- The company’s stock rallied by 113.4% in the month leading up to July 20, but fell significantly on July 21 due to analysts downgrading their recommendation ratings.

- Sirius XM’s Q1 2023 results showed a 2.3% year-over-year revenue decline to $2.14 billion, and a decrease in free cash flow by 44.2% year over year to $144 million.

- The short squeeze has decoupled stock prices from fundamentals, shares are technically very high, high short-term interest rates are bearish this time.

- The outlook is not suitable for driving the company’s growth.

JHVEPhoto

A Switch from Buy to Sell for Sirius XM Holdings Inc.

In the previous article, a Buy recommendation was given to the stock of Sirius XM Holdings Inc. (NASDAQ:SIRI) – a New York-based audio entertainment operator in the United States. The previous rating was supported by the expectation of an increase in the share price amid a more favourable outlook with people showing greater interest in the company’s various audio content products.

As it faces a very uncertain future, this stock is unlikely to thrive, so the retail investor should consider easing the position by selling shares of SIRI while taking advantage of the strong valuation SIRI has recently built up. This article is therefore for a Sell recommendation rating.

What Happened to the Stock in SIRI in the Meantime

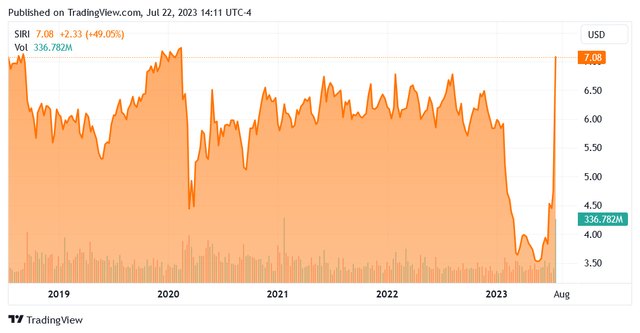

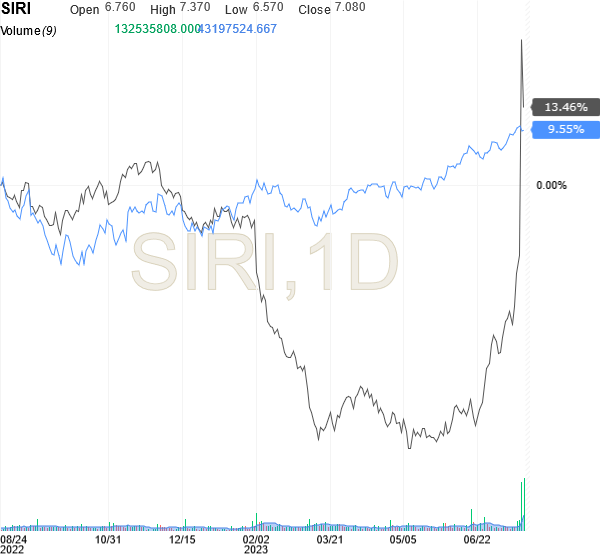

SIRI had a great rally, gaining 113.4% in the month leading up to July 20, when shares hit $7.81 apiece, albeit for different reasons than those that supported the previous Buy rating. In fact, analysts attribute the rally to a short squeeze at a very small float that forced the stock price to rise very quickly.

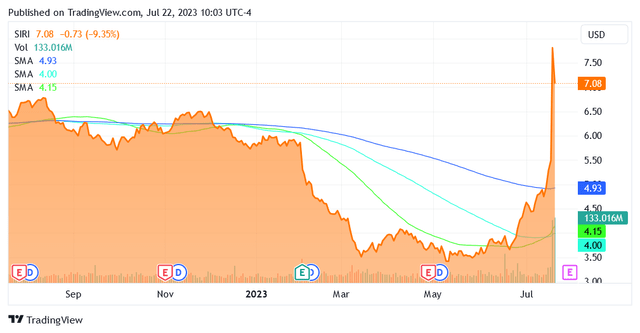

On July 21, SIRI stock price fell significantly, losing 9.35% to an adjusted closing price of $7.08 per share as some analysts downgraded their recommendation ratings to a Sell rating before the market opened, as the current valuation is not warranted by the company’s fundamentals.

Before the big rally, SIRI had a very disappointing performance in the stock market, particularly in the new year, likely due to the deterioration in certain economic conditions as rising costs of living prompted people to make decisions including cutting their entertainment spending. These macroeconomic factors may not yet have fully impacted the company’s fundamentals, so the downward trend in revenue and company profitability seen in the first quarter of 2023 results could continue in the coming quarters. However, concerns about the impact that high inflation and tight monetary policy on consumption and investment could have on SIRI’s business was enough to push the stock down very sharply until last month’s rally due to the aforementioned technical factors.

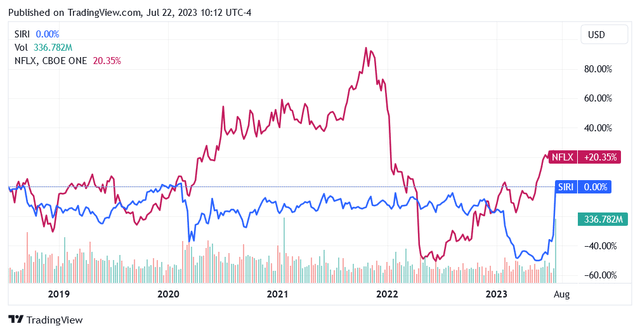

Eventually, these severely depressing headwinds for equities also affected Netflix, Inc. (NFLX), whose stock price seemed to have taken a major tumble at a certain point. And in my opinion if it weren’t for a bit of artificial intelligence propaganda lately shaping the narrative in financial markets, NFLX would still be well below pre-pandemic levels.

And if it happened to a digital entertainment leader like NFLX to lose ground to a fall in subscriptions, why couldn’t SIRI also take the toll of lower consumer purchasing power for higher inflation and higher debt? Looking at the company’s Q1 2023 results, SIRI seems to be taking its toll.

The Seeking Alpha chart below shows the trends SIRI and NFLX have taken in the US stock market.

As such, last month’s rally allowed SIRI stock to recover from the lag it developed compared to the rest of the stock market (US 500 is the benchmark index on the Investing.com chart).

Source: Investing.com

Technical factors have propelled shares of SIRI higher as the rising artificial intelligence narrative has been positive for NFLX and tech stocks in general.

This market valuation now appears to be a godsend based on a number of technical and fundamental analyses, coupled with an outlook that promises stronger headwinds for stocks, including SIRI. So the retail investors, whether it is the case, might consider taking advantage of these valuations that have come about and selling shares.

The Stock Valuation

Shares of Sirius XM Holdings Inc. traded at $7.08 apiece as of this writing giving it a market cap of $27.39 billion.

As shown by below chart from Seeking Alpha, shares are now trading significantly above the 20-day simple moving average line of $4.93, above the 100-day simple moving average line of $4, and above the 50-day simple moving average line of $4.15.

Shares are also trading at a 79.6% discount to the middle point of $5.635 of the 52-week range of $$3.32 to $7.95.

So these are market valuations for the SIRI stock that were unthinkable until a few weeks ago, even from a fundamental analysis point of view.

Indices of Fundamental Analysis in Comparisons

In the first quarter of 2023, SIRI reported a 2.3% year-over-year revenue decline to $2.14 billion, missing median projection of analysts by $30 million as a) a lower average revenue per user [ARPU] of $15.29 caused a 2% year-over-year decline in SiriusXM business segment revenue to $1.7 billion and b) a 2% decrease in self-pay subscribers led to a year-on-year revenue decrease of 1% in the Pandora and Off-Platform business segment to $4 62 million.

As such, the company’s total 12-month revenue for the first quarter of 2023 was $8.961 billion which, when combined with the stock’s current market valuation, results in a price-to-sales [TTM] ratio of 3.08x versus the industry median of 1.22x. Additionally, SIRI’s revenue grew slower year-over-year than the industry average: 1.55% versus 4.92%.

SIRI’s revenue growth of 1.55% year-over-year is well below SIRI’s 5-year average of 11.44%, while the share price is currently one of the highest in the past 5 years.

Going forward, the context for SIRI will likely be at least as challenging as it is today. Interest rate hikes will continue to negatively impact consumer purchasing power, as will stubborn core inflation. It’s reasonable to still expect negative pressure on ARPU and subscriptions.

SIRI is judged to be overvalued compared to many other entertainment stocks based on past sales. The valuation based on forward sales does not have a different outcome at these share prices and expected prospects of the economy.

Assuming SIRI’s most recent TTM revenue will grow 2.17% to $9.16 billion (vs. company’s guidance of $9 billion) or $2.37 per share in the first quarter of 2024 (assuming that the amount of shares outstanding of 3.87 billion will not change), at current share prices, the Price to Sales Ratio [FWD] should then be approximately 3. But this metric still does not compare favorably to a sector median of 1.21 and SIRI 5Y average of 3.18%.

The Profitability of the Company and its Evaluation

The key component impacting free cash flow, which decreased 44.2% year over year to $144 million in the first quarter of 2023, was a 9% decrease in Adjusted EBITDA to $625 million in the first quarter of 2023 versus $690 million in the first quarter of 2022.

The adjusted EBITDA margin was 29.2% of total consolidated revenue in Q1 2023 versus 31.6% in Q1 2022, or a 240 basis points drop YoY.

On a 12-month basis, SIRI’s EBITDA margin was 28.69%, compared to the industry median of 18.08% and compared to the SIRI 5-year average of 30.64%.

SIRI has EV/EBITDA [TTM] of 14.47x versus industry median of 9.59x and versus SIRI 5Y average of 14.43x.

Profitability Going Forward

Looking ahead to full year 2023, SIRI is targeting adjusted EBITDA of $2.75 billion and free cash flow of $1.1 billion.

Looking ahead, SIRI’s EBITDA is expected to grow by 0.44% compared to the industry average of 4.69% and compared to SIRI’s 5-year average of 4.76%. This leads to SIRI’s EV/EBITDA [FWD] of 13.53x versus industry median of 8.37x and versus SIRI 5Y average of 13.32x.

However, despite lower free cash flow, the company was able to return approximately $161 million to shareholders in the first quarter of 2023, 58.4% of which by paying dividends and the remainder by repurchasing its own shares.

The company paid a very small quarterly dividend of $0.024 per share on May 24, resulting in a forward yield of 1.37%, below the S&P 500 yield of 1.51% as of this writing.

Due to a challenging outlook, SIRI’s sales and profitability could suffer a bit further going forward, potentially creating a negative impact on the stock price.

Oversold Levels and High Short Interest Rate

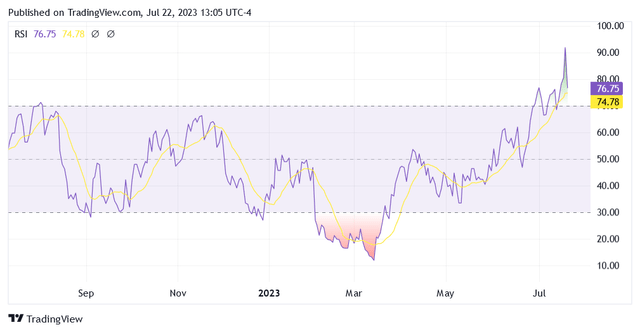

Shares already seem to be feeling the pressure of bearish sentiment, as the indicators below show, meaning that the positive trend of the past month is unlikely to continue.

A high Short Interest reading of 33.72% does not mean that another short squeeze could push the price higher, but rather suggests that there is clearly bearish sentiment towards this stock at the moment.

The 14-day relative strength indicator of 76.75 shows that shares of SIRI are near oversold levels with very, very little room for going higher.

Conclusion

The very enthusiastic short selling activity in SIRI shares created a counter effect to the expected pessimistic sentiment that stimulated investors, resulting in a very rapid increase in the share price.

This stock is characterized by a small float of 16.81% of the total number of the shares outstanding of 3.87 billion (on this page, scroll down to the “Ownership” section), and 72.52% of this float is held by institutions.

So for those retail investors who may have shares of SIRI in their portfolio and the sale of shares does not cause them a loss, they should consider selling and taking advantage of these price levels.

Given the high volatility that characterizes the economy and which does not help companies, including SIRI, to boost growth, there is a risk of having to wait a while for these prices to return.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.