Summary:

- Sirius XM faces increasing competition and changing technology, but its unique content and loyal customer base provide a fighting chance.

- The company is transitioning to non-linear audio streaming to appeal to younger listeners and stay relevant in the evolving market.

- Sirius XM’s valuation is considered fair, and its stable cash flows could be better utilised through buybacks at Liberty Sirius XM.

Cindy Ord/Getty Images Entertainment

Sirius XM (NASDAQ:SIRI) is one of the US’s largest subscription-based audio entertainment platforms. The company has been dominating the highly profitable in-car satellite radio segment, unfortunately, the satellite is no longer the only method to deliver premium audio content to subscribers on the move. The moat of Sirius XM is shrinking and Company is expected to deliver its first-ever net subscriber losses this year.

siriusxm.com

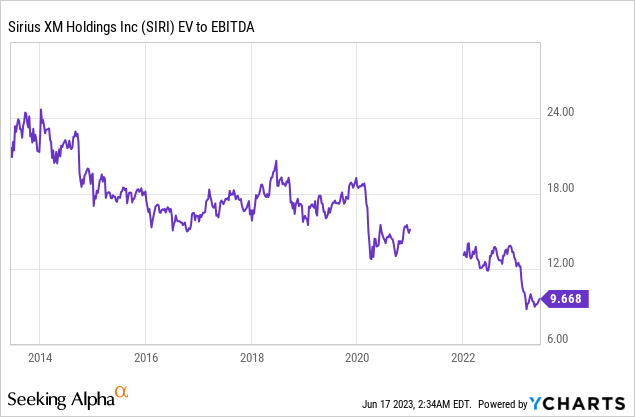

Given the slower growth expectations, SIRI stock re-valued to 9.6X EV/EBITDA, down from an average of c15X over the past 5 years. This valuation level could arouse investor interest, though we have to keep in mind that the competitive environment has changed significantly over those 5 years. Indeed, if SIRI continues losing customers it could potentially re-rate to a declining traditional media status. The members of this group, such as terrestrial radio stations, commonly trade at a 5-6X EV/EBITDA. Re-rating would result in a further c50% SIRI share price drop.

Sirius XM has actually continued performing well even after online music streaming services entered the in-vehicle market. Currently, Sirius is a profitable and cash-generative business capable of paying out a generous dividend. We want to find out if they can continue maintaining their strong position going forward.

Background

The satellite radio services of Sirius were launched in 2001. Back in those days Nokia 3310 was still the most popular phone and nobody has ever dreamed of being able to stream huge music libraries over mobile networks on demand. Satellite was the premium alternative to terrestrial radio, offering commercial-free listening and superior sound quality.

The satellite radio industry took off in a significant way in 2008, after Sirius has been allowed to merge with its main competitor XM. Consolidation enabled cost rationalisation as well as pricing discipline and therefore a larger share of gross profits started being invested in exclusive premium content, attracting an increasing number of customers to take on a subscription. Sirius XM subscriber numbers have doubled and Average Revenue Per User (ARPU) has increased 50% since then. By all accounts, the business has prospered.

The next significant turning point of the industry came in about 2010 when the first major 4G/LTE networks were launched in the US. On-demand streaming services have launched mobile apps and their subscription rates started rocketing. Spotify subscriber numbers, for example, have increased from c1m in 2010 to c205 million now. It is the largest subscription audio platform globally and in the US.

Streamers have pushed commercial terrestrial radio stations to the brink of extinction. Sirius XM, on the other hand, has held up and managed to grow, but it is possible that satellite radio is next in line. Only in 2017, all major carriers launched unlimited wireless data plans. Music streamers have been around for a number of years prior, but it was the rollout of 4G and the reduced cost of wireless data that has enables truly mobile music streaming. Nowadays streamers are increasingly penetrating in-car displays and infotainment systems – the distribution pipe has been commoditised and competition for satellite radio is increasing.

Sirius XM continues performing well

Actually, 2017 did not turn out to be a waterfall moment for Sirius XM, the Company continued to perform well. Over the past 5 years:

- Self-pay subscribers grew from 26m to 32m (23%)

- ARPU has increased from $13.3 to $15.6 (17%)

- Satellite radio revenues increased from $5.4 bn to $6.9 bn (28%)

- Churn has gone down from 1.8% to 1.5%

We believe this solid performance in an adverse market can be attributed to distribution gains and differentiated content offerings. An increasing number of new vehicles are equipped with satellite radios and this gradually drags up rates of satellite radio penetration among remarked used vehicles. Sirius XM has been signing up new manufacturers and also expanded partnerships with used car dealerships. Going forward, the used car segment has a significant growth opportunity, and new car penetration will also increase further. Increasing penetration would not be possible without a strong content package as automakers would not be installing the satellite radios if their customers did not see any value from them.

|

Sirius XM |

2019 |

2020 |

2021 |

2022 |

||

|

New car sales |

17 |

14.6 |

15 |

13.9 |

||

|

Penetration by volume |

79% |

80% |

82% |

83% |

||

|

Conversion |

34% |

34% |

34% |

34% |

||

|

New car gains |

estimate |

4.6 |

4.0 |

4.2 |

3.9 |

|

|

Used Car Sales |

39 |

39 |

43 |

36 |

||

|

Vehicle Penetration |

44% |

51% |

||||

|

Channel Penetration |

62% |

62% |

||||

|

Conversion |

25% |

25% |

25% |

25% |

||

|

Used car gains |

estimate |

2.7 |

2.8 |

|||

|

Share of gross adds |

35.0% |

36.8% |

42.0% |

|||

|

Gross additions |

7.2 |

6.8 |

||||

|

Churn |

5.9 |

6.6 |

||||

|

Monthly |

1.7% |

|||||

|

Annualised churn rate |

20.4% |

20% |

||||

|

Net Addition |

1.3 |

|||||

|

Self-pay subs |

29 |

30 |

33 |

34 |

Sirius XM Financial statement, earnings transcripts and our estimates

Increasing penetration in new and used vehicles has been increasing gross additions even as conversion rates in new cars have been falling. Sirius XM explains that the decline in conversion rate is due to range expansion to the economy segment, which is a lot less likely to subscribe to SXM. Competition from streamers also has been a factor but it is hard to isolate the impact of this factor alone without having the track record of conversion rates of specific car models. All we can do is just follow the development of conversion rates.

Increasing in-car penetration (siriusxm.com)

Siri is now claiming that conversion rates are likely to go down for 2023 both in the new and used car segments. If this lower rate is sustained going forward, churn and gross additions could get close to one another for some time. The penetration rates will continue to increase, so if a lower level of conversion is maintained, then at some point net adds are likely to turn positive. It is a balancing game between declining conversion and increasing penetration.

Overall, it seems highly likely that:

- New car subscriber additions will be in excess of 4.3M or so in a normalised economic environment.

- Used car subscriber additions are likely to be in excess of 2.5m per annum and most likely will grow their share of overall gross additions.

- Annual churn will most likely be at least 6.5, depending on churn rates and the size of the subscriber base.

- Most likely subscriber base will grow over time but not by significant numbers, maybe by 0.3-0.7m per annum or c1.5%.

- A sudden decline in consumer numbers by numbers in excess of 1 million (3%) seems very unlikely unless churn rates jump meaningfully.

Pricing is another factor to consider. So far ARPU was climbing and in 2023 Sirius XM is pushing through another price increase. Satellite radio packages are indeed more expensive than Spotify SPOT or Apple Music subscriptions, on the other hand, these are not directly comparable products both in terms of content offered and technology. Satellite radio might be more expensive but it does not require an additional subscription to an unlimited wireless data plan. SXM streaming-only product is priced in line with other streamers. We do not see large scope to increase ARPU in satellite (on-platform) business, at the same time we do not believe that SIRI is facing significant pricing pressures. SIRI might face some pricing challenges when satellite ratio technology becomes obsolete, but we are not there yet.

Overall, subscriber numbers of Sirius XM seem to be driven by multiyear new and used car penetration growth trends, relatively low rates of churn and decreasing conversion. Penetration is increasing predictably, churn has been low for years and conversion has been trending down gradually. We believe it is very unlikely that Sirius XM would start losing customers rapidly. Having said, decelerating conversion is the best indicator of increasing competition for Sirius XM. The company has no control over the technological advances of the industry, therefore it has to focus on content to manage competitive threats.

Distribution pipe development – parallels with TV

Premium audio distribution pipe is being commoditised and an increasing number of competitors are now able to reach in-car listeners. Since the channel of distribution is no longer the differentiating factor, the content becomes increasingly important. The video content industry has gone through the same change, now audio is going through this as well.

In the TV industry, the initial step was also fragmentation based on consumer tastes. The few leading network TV channels continued losing audiences as technological advances made it possible to broadcast an increasing number of channels at an affordable price. These new channels catered to smaller customer groups and gradually kept taking viewers away from the incumbents. Then on-demand video streaming services entered the scene.

Cable TV did have the best content, but the new content consumption method has proven more appealing to consumers and streamers managed to build a sustainable business. TV media fragmentation has created a lot of complexity and the process of discovery has become increasingly complicated. Non-linear streaming with personalisation functionality in a way was the last step in the process of fragmentation. Now consumers were recommended what they most likely enjoy personally and they can watch it whenever they want, – a fully personalised experience.

The streamers have built their business on the back of the content distribution pipe innovation, but they could not have grown without good quality content. Initially, they licensed popular content. Once the scale was already acquired, Netflix NFLX was able to start creating its own content. And they have been successful at it. Pipe development was an industry-wide phenomenon and Netflix won because it had better content than other streamers.

The star of Sirius (siriusxm.com)

Satellite radio is similar to a cable TV operator that is being challenged by video streaming services. The audio pipe is developing along the same route of personalisation and easier discovery. Sirius XM Platinum package, for example, has 425 channels… 425! It has everything that almost anybody could wish for, but once you get the bundle, how do you find exactly what you want? How do you make sure it plays exactly when you are driving home from work? The older customers of Sirius XM have probably gone through that tedious process of discovery as there were no alternatives, and they are happy to stick with the habits they formed.

siriusxm.com

The younger generation of listeners though has a lot more options and they are already used to getting whatever whenever, and Sirius XM does have lower conversion rates with the younger generation of drivers. To stay relevant, SIRI does need to get on the bandwagon of technological pipe development to have a chance to survive long term. The acquisition of Pandora in 2019 and the current roll-out of the next-generation 360L receivers are significant moves in that direction. The company has also launched a streaming-only app and is continuing to upgrade its tech stack to suit on-demand listening. These actions should help SIRI to increase its rates of conversion with younger listeners.

When it comes to competition in the non-linear audio space, the content will be the key. Quite interestingly, Sirius XM offers completely different audio content from the likes of Spotify or Apple Music. The streamers mainly enable listeners to reach broad music libraries of record labels directly from one app and they spend most of their revenues on music royalty payments. SIRI, on the other hand, is focused on internally produced and licensed original content. If SIRI would be an add-free premium music-only linear radio station they would probably be going out of business by now. This is not the case. Unlike the streamers, SIRI is offering live business news, events and sports, big-name talk shows and political commentary as well as a number of thematic music stations. We believe that the content bundle of SIRI is so differentiated and so much more valuable to some customer groups, that they are able to compete successfully even against superior distribution technology.

Overall, SIRI does have a superior content bundle as compared to the music streaming services but it is lagging behind technologically. Non-linear audio streaming is favoured by younger listeners and SIRI is gradually making a transition. Superior content is buying it time, but eventually, it will have to move to non-linear or hybrid content distribution.

Valuation

The price of Sirius XM has declined by 30% this year, it is currently trading at about 9.6X EV/EBITDA and c7-8% Free Cash Flow yield, – it’s an all-time low for Sirius and reflects slower subscriber growth. This level of valuation is common for mature media businesses that are not in decline.

We take a long-term defensive approach to investing and seek to double our money over a period of 3-5 years. Sirius XM does fit the bill of a defensive business, but we do not see how it could double its value over the next few years as the organic growth opportunities are limited. The current valuation multiples also seem appropriate given the reduced growth expectation. But there is another, more profitable way to invest in Sirius XM and we can double our money that way.

The Liberty SiriusXM Group (LSXMK), managed by Liberty Media, controls 83% of SIRI shares and trades at a significant discount to the value of its holdings. Combining the defensive 7-8% free cash flow at SIRI with the discount and extra level of leverage at the holding company level, – yields a c16% look-through free cash flow. The risk characteristics of SIRI and LSXMK are almost identical, so it does make more sense to own LSXMK instead. For more information on this investment thesis, you can read our article on Liberty Sirius XM.

Is it a good investment?

Sirius XM is a stable subscription-based business with low churn. The company is facing increasing competition but the unique content bundle as well as increasing penetration in new and used cars is helping the company to grow subscriber numbers. We believe that these trends are likely to continue even as content delivery technology evolves. We deem it very unlikely that Sirius XM will start losing subscribers rapidly and turn into a value trap.

Having said it, rapid growth is not very likely either as conversion rates will most likely continue trending down as competition in the in-vehicle segment will only intensify. We believe that the valuation of SIRI is more-less fair and therefore we suggest “Hold” for this stock.

We are not recommending a “Sell” because SIRI is a capital-light business and most of its free cash flow can be paid in dividends or returned through buybacks and the current yield is quite attractive given the defensive characteristics of the business. We are not recommending “Buy” because we pursue returns greater than 7-8% per annum. On the other hand, we are Buyers of Liberty Sirius XM.

Risks to the investment thesis

- Subscriber growth of Sirius XM has been driven by the balance of increasing penetration and declining conversion. The penetration will keep on rising and the conversion rates will most likely continue trending down. A downward shift in conversion rates could push Sirius into a cycle of negative net subscriber additions. On the other hand, the losses would be only marginal as increasing penetration will support gross additions.

- On-demand is gradually becoming the industry standard and linear streaming is not popular with younger consumers who have formed habits different from their parents. Sirius XM does have lower conversion rates with younger customers and if it is not able to deliver an appealing non-linear listening solution to them, – the conversion rate decline will accelerate. 360L is the next-generation player that Sirius is now rolling out and it combines linear with non-linear capabilities. The success of this platform is very important for the future of Sirius.

- Going forward satellite radio technology could become obsolete and the ARPU of the business can start trending down towards the price of a premium streaming-only package price. So far there are no clear indication that customers would be cutting satellite subscriptions in favour of streaming-only products. Sirius is quite vague about streaming only customer numbers.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.