Summary:

- I reiterate hold rating for SIRI due to weak growth drivers and subscriber trends.

- The New Generation app has potential, but I prefer to wait for actual results before evaluating its impact.

- I reduced my target price for SIRI based on subdued growth assumptions and valuation multiples.

Aliaksandr Litviniuk/iStock via Getty Images

Summary

Following my coverage on Sirius XM Holdings Inc. (NASDAQ:SIRI), which I recommended a hold rating due to my expectation that SIRI is unlikely to convert more subscribers despite the positive auto outlook for FY23. This post is to provide an update on my thoughts on the business and stock. I am reiterating my hold rating for SIRI as I hold a pessimistic outlook for the near term, especially with the key growth drivers being weak. The reason I am not downgrading to a sell rating is because of the potential impact of the New Generation app. I do see potential with it; however, I am not inclined to model in all the upside, as I prefer to wait for actual results before evaluating how impactful it is.

Investment thesis

In the recent 3Q23, SIRI reported consolidated revenue of $2.271 billion, driven by $1.729 billion in subscriber revenue, $460 million in advertising revenue, $49 million in Equipment revenue, and $33 million in music royalty fees and other revenue. Collectively, the $2.271 billion was down by a modest 0.4% vs. 3Q22. The flattish revenue was met with an increase in adjusted EBITDA. Adjusted EBITDA improved by 3.8% to $747 million, implying a margin of 32.8%.

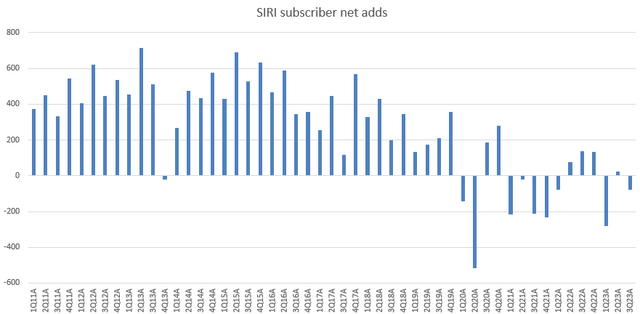

The focus of the result was weak subscriber performance, which was my main concern. In 3Q23, SIRI saw a churn of 96k self-pay net losses and 94k subscriber net losses. This was a horrible performance when compared to 3Q22, where SIRI saw a net subscriber add of 138k. This quarter’s results have cemented my view that SIRI is facing a structural issue with its ability to add subscribers. Specifically, from a cost-to-value perspective.

The absence of a rebound in SIRI’s conversion rate suggests that the company may be reaching a juncture where the perceived value of their offerings in relation to the cost incurred by consumers is diminishing. Jay Capital SIRI 2Q23 update

SIRI appears to be stuck in a tough situation where it is unable to raise prices to cushion further subscriber losses. In the ideal environment, SIRI could have raised prices to continue supporting its growth. However, there are two key issues that I expect will continue to put pressure on ARPU growth in the near term. The first issue is that SIRI is going to continue facing the pain of the mix shift towards self-pay promotional and paid promotional plans (led by the increase in vehicle inventory that is on trial), which typically have lower ARPU. The second issue relates to the core issue I see with SIRI: its deteriorating cost-to-value proposition that consumers are perceiving, as evident from the sequential increase in subscriber churn rate to 1.79% (from 1.57%). Further increases in prices without any additions in value (more on this below regarding the Next Generation version) would simply cause churn to rise even further.

We benefited from a March price increase on select full-price plans and saw headwinds to reported ARPU from promotional self-pay subscription plans, the lowering advertising revenues I mentioned and lower paid promotional plan rates from certain OEMs, as well as higher balances on paid trials, subs and unsold vehicle inventory. 3Q23 earnings results call

The knock-on implication of a weak subscriber base is that SIRI advertising revenue will be negatively impacted. In my view, SIRI’s ability to capture more advertising budget is tied to the overall advertising spend environment (impacted by macro conditions) and the size of SIRI’s subscribers. Advertisers are likely to pay more if there are more subscribers (i.e., a larger audience). Based on the 3Q23 results, I know that the subscriber growth trend is not doing well. This, coupled with management’s comment that the overall ad market remains soft, led me to believe that the SIRI advertising segment is going to face pressure as well. Notably, on the call, management also noted that progress on the recovery in advertising in 2023 has not materialized at the level previously expected.

Overall, the key takeaways I have from the recent performance are that the subscriber growth trend continues to be weak, pricing is going to face pressure in the near term, and advertising is going to be weak as well. Put together, it paints a gloomy outlook for SIRI, in my opinion.

The only positive update that I see for SIRI is the announcement of its new Next Generation app and user experience, which will begin rolling out on December 14. This could be the solution to the core issue that, I believe, SIRI is facing (cost-to-value proposition). During the 2023 Liberty Media Investor Day, several key enhancements were made, namely:

- Better pricing.

- New manufacturer agreements and partnerships.

- New content.

Looking at this from a positive lens, I believe that these enhancements and content additions may enable SIRI to regain subscribers and differentiate itself from other audio services like Spotify, Apple Music, and YouTube Music.

In terms of pricing, SIRI has announced a new, lower streaming price point: $9.99 per month for all of its content. Since the reduced pricing resolves the cost-to-value issue-which was one of my concerns with the SIRI product-I believe this will work and attract subscribers.

As for new manufacturer agreements and partnerships, management announced that the company has renewed and expanded its agreements with three major automakers-Honda, Mercedes-Benz, and Volvo-all of which have pledged to incorporate 360L into their vehicles. Additionally, it was announced that SIRI is nearing the finalization of new multi-year contracts with Audi and Volkswagen. Two other major EV manufacturers are also expected to make significant announcements about their 2024 launches with SiriusXM in the coming weeks. As for existing EV agreements, SIRI already has an agreement with Polestar to include 360L as a standard feature for their models. This is obviously good news for SIRI, as it means that the business can continue to distribute its product. More importantly, from an investor perspective, this, in a way, might be an indication that OEMs are seeing demand from consumers that they want SIRI. As for partnerships, progress was made as well. For instance, SiriusXM will be available at select properties in the Hilton portfolio and Amazon’s Audible. While I don’t see anything major that will move the needle in the near term, It was great knowing that management is attempting to shift out of the automobile ecosystem to find more users of its product, which might help extend the long-term growth runway.

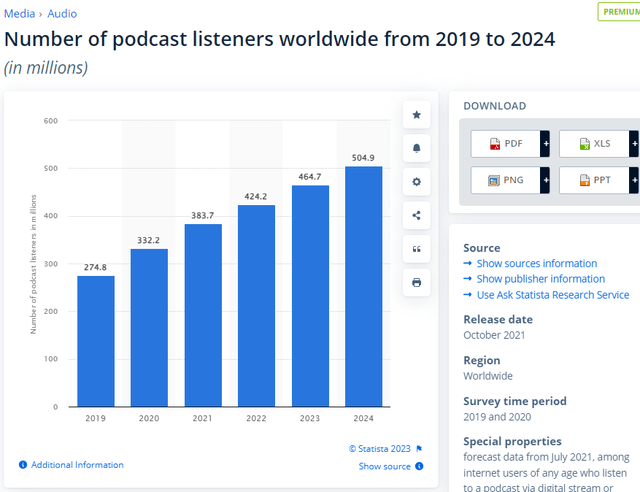

Finally, regarding new content, the management focus seems to be on human-curated content. In the event, some of the introduced content includes The Kelly Clarkson Connection, The Highway, and This Life of Mine with James Corden. I don’t have an explicit view of how impactful this content will be. However, I do note the growing demand for podcasts. According to Statista, the number of podcast listeners has grown by almost 1.7x since 2019. The introduction of such content might be a driver for subscriber growth.

Overall, my take is that while we believe that these enhancements may help SIRI sustain positive subscriber and revenue growth in the coming years, it is premature to underwrite a material acceleration in those metrics before seeing signs of robust consumer adoption of Sirius XM’s new digital service today.

Valuation

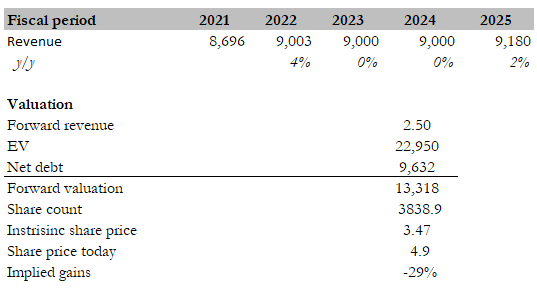

Own calculation

My target price for SIRI based on my model is $3.47, a reduction from my previous price target of $4.35. The changes to my model assumptions are that I now expect growth to be flat in FY24 as I hold a more pessimistic view of near-term performance. All the key growth drivers (subs growth, ARPU, and advertising) were weak in 3Q23, and I do not see any solid catalyst that will drive them up in the near term. Some would argue that the New Generation app is the catalyst, but while true, I prefer to be conservative and wait for the actual results before evaluating. Putting aside the potential for the New Generation app, at the current status, I am revising (previously at 2.8x forward revenue) my view on what multiple SIRI should trade at given my weaker expected growth. I am now valuing SIRI using its trough multiple of 2.5x forward revenue.

Risk

The risk to my hold rating is that the New Generation app works like a wonder, driving sub and ARPU growth. If so, revenue should accelerate, and bearish investors (like myself) will be inclined to believe that the new strategy is working. In addition, a recovery in macro conditions would also boost further car sales and advertising spend, both of which are very positive for SIRI.

Conclusion

Overall, I reiterate my hold rating due to a pessimistic near-term outlook, marked by weak growth drivers and concerning subscriber trends. The headwinds from promotional plans also impede ARPU growth. Notably, the weak subscriber base forecasts a dampened advertising revenue potential. While the New Generation app has potential, my conservative stance holds until concrete results validate its impact.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.