Summary:

- SLB has reorganized its business to focus on less cyclical products and services needed by the broader oil/gas industry.

- Profit margins are continuing to improve and will support a growing dividend.

- Valuation is near 20-year lows.

- Institutional ownership lags behind peers and could be a catalyst for a rising share price if institutional buying picks up.

Floriana

Investment Thesis

SLB (NYSE:SLB), formerly known as Schlumberger, is a company in transition from a highly cyclical and services heavy revenue mix to a more stable, product-driven business. The new revenue mix is driving higher profit margins and is aimed at a larger addressable market, which should result in more stable, predictable operating results. Already three years underway, this transformation and the potential for continued dividend growth is underappreciated and under owned by institutional investors. Individual dividend growth investors should add SLB to their portfolio.

Evolution of SLB

To put SLB’s transition into context, we need to reflect on the past decade of the business and the oilfield services industry more broadly. The industry dynamics in the lower 48 U.S. states have changed markedly in the past decade from 2014 to present.

Ever since the discovery in Pennsylvania of oil in 1859, the oil and natural gas industry has been characterized by commodity booms and busts. As demand and price increased, speculators known as “wildcatters” would drill exploratory wells hoping to strike “black gold”. With enough successful wells drilled, supply would catch up with demand and prices would collapse. When not supply induced, downturns were caused by economic recession, with the same results; lower prices and dramatic reductions in drilling activity.

Along the way, there have been numerous technological improvements in well drilling and completions. Perhaps the most significant technological feat in the past 25 years has been the application of hydraulic fracturing (more commonly known as “fracking”).

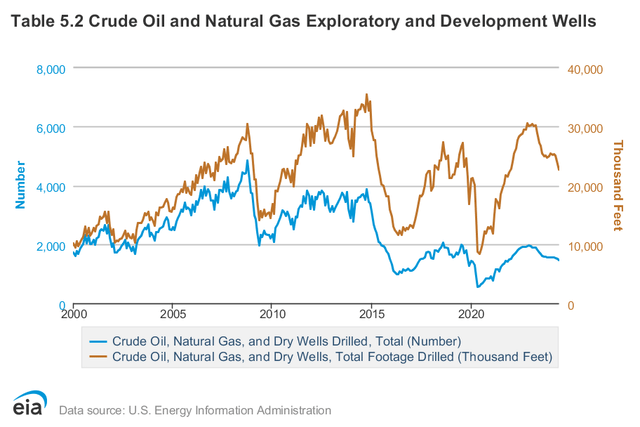

Fracking was developed in 1947, and was employed in specific geologic conditions and generally on a small scale for the next 50 years. Things really began to change in 1997 when slickwater fracking, which uses much greater volumes of water injected by high-pressure pumps, proved successful for natural gas production in the Barnett Shale of North Texas. Natural gas and oil well drilling grew rapidly in the U.S.A. as shown by this chart from the U.S. Energy Information Administration.

25 years and three cycles of oil/gas well drilling in USA (U.S. Energy Information Administration)

Wells drilled per year tripled from 2,000 in the year 2000 to 6,000 heading into the great recession of 2008. The recession put a temporary dent in drilling activity, but as the economy recovered, drilling resumed and even exceed the peak of 6,000 wells drilled in a year by 2014.

The 2020 downturn was another macroeconomic-driven cycle due to the COVID pandemic. It was the 2014 crash that really set the stage for oil and gas companies and their service providers to change their capital expenditure management and shareholder return practices.

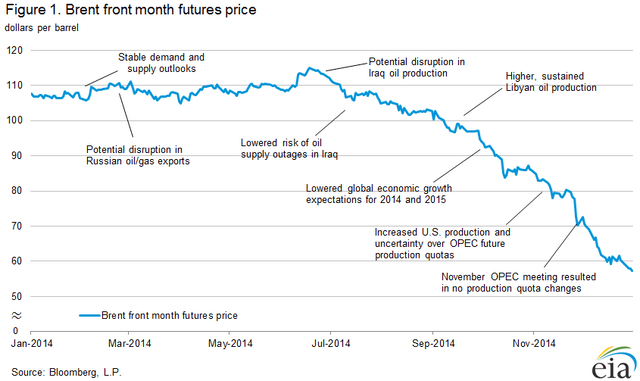

Slowing economic growth and OPEC sank oil prices (U.S. Energy Information Administration)

The 2014 downturn was when OPEC determined they had seen enough of the surging oil production coming from the fracking of shale basins in the USA. Imports of oil to the USA peaked at 327 million barrels in August 2006 before declining 33% to 218 million barrels in November 2014 when OPEC decided to crush the price by maintaining their production and leveraging their low-cost producer position to squeeze the shale fracking producers.

Brent oil dropped from over $120 per barrel to under $48 in January 2015. By January 2016 the price had fallen further to $28. Up to this point, investors, both private equity and public, had been clamoring for production volume growth over profitability as the means to increase shareholder value. Once the new reality of an OPEC determined to maintain its market share globally set in, investors began to demand higher returns on invested capital, dividends and share buybacks; in short, capital expenditure discipline.

The Turn

SLB had a banner year in 2014 earning $4.15 per share. It took a few years for the industry and SLB to accept the new realities of the market and investor expectations. In this time period (2016) SLB also made the large acquisition of Cameron International. Finally, in 2019, SLB charted a new course.

As CEO Olivier Le Peuch explained at the 2022 Investor Conference, when referring to the strategic shift in 2019:

We strengthened the core by high-grading our portfolio, exiting many margin-dilutive, commoditized, and capital-intensive businesses and projects. And we executed the largest restructuring in our company’s history, to become more agile, leaner, and better aligned with customer workflows.

Across 2018 and 2019, SLB booked $13.15B of restructuring charges against earnings. Of this total, $9.9B was goodwill and intangible asset impairment (mostly related to the Drilling division and Cameron business for goodwill, $1.1B intangible impairment from the Smith acquisition in 2010 and other smaller deals, and $1.58B exit of pressure pumping assets, and $310M other).

The divestment of the onshore hydraulic fracturing unit, pressure pumping, and pumpdown perforating businesses were the most significant in terms of the shift in strategy, capital intensity, margins and cyclicality. The final step of this move was completed December 31, 2020, when SLB contributed it’s onshore hydraulic fracturing business in the United States and Canada, including its pressure pumping, pumpdown perforating, and Permian frac sand businesses, to Liberty Energy Inc., in exchange for a 37% equity interest in Liberty.

These businesses are very profitable in boom times, highly pro-cyclical to the price of oil, and they are a service model that requires a lot of capital expenditures and lots of employees in the field. As long as crews are on-site and billable to customers, they are profitable. Any downtime causing lower billable utilization creates a dilemma between laying off experienced employees and not being ready to service any new customer orders. The longer you wait for business to materialize, the more cash you burn.

Strategic Shift is Showing Positive Results

Three years into the new strategy, SLB had turned the corner and was performing much better. While the company was smaller in terms of revenue, gross margins were climbing back towards the 2014 peak, and they have continued improving into last year and so far, in 2024.

| SLB Key Figures | 2014 | 2019 | 2022 | 2023 |

| Total Revenue ($ billions) | 48.6 | 32.9 | 28.1 | 33.1 |

| Gross Margin % | 23.02% | 12.75% | 18.37% | 19.81% |

| Operating Margin % | 19.53% | 9.02% | 14.78% | 16.56% |

| Net Income % (including special charges) | 11.19% | -30.80% | 12.25% | 12.68% |

| Diluted EPS | $4.15 | -$7.32 | $2.39 | $2.91 |

Source: SLB 10-K filings

Reorganized Business Focused On Growing Markets

In 2019, the company changed its reporting segments as a result of the divestitures and restructuring.

| Revenue in $ Billions | 2014 | 2019 | 2022 | 2023 |

| Reservoir Characterization | 12.22 | 6.31 | ||

| Drilling | 18.46 | 9.72 | ||

| Production and Cameron | 18.11 | 17.33 | ||

| Digital & Integration | 3.73 | 3.87 | ||

| Reservoir Performance | 5.55 | 6.56 | ||

| Well Construction | 11.4 | 13.48 | ||

| Production Systems | 7.86 | 9.83 | ||

|

*all figures subject to rounding and intercompany eliminations |

Source: SLB 10-K filings

The pressure pumping, water management and other completions related services were included in Production from 2014 to 2019. Revenues in that division decreased nearly $10 billion from 2019 to 2022 due primarily to divestitures.

During this time, software, machine learning and AI began to find greater application in the oil and gas industry. SLB started reporting its software and data processing business revenues under a new segment titled Digital and Integration. We’ll look more at that business below.

The company even changed its business description in the 10-K.

In the years from 2014 to 2019, the description was along these lines [underlines are mine, and this excerpt is from the 2014 10-K:

Founded in 1926, Schlumberger is the world’s leading supplier of technology, integrated project management and information solutions to the international oil and gas exploration and production industry. Having invented wireline logging as a technique for obtaining downhole data in oil and gas wells, Schlumberger today provides the industry’s widest range of products and services from exploration through production.”

Starting in 2022, the description in the 10-K was updated to:

We are SLB. In October 2022, we announced our brand which is built around a new name-SLB-and a logo that underscores our vision for a decarbonized energy future. This move affirmed our transformation from the world’s largest oilfield services company to a global technology company focused on driving energy innovation.

SLB is a global technology company driving energy innovation for a balanced planet.

Is this just wordsmithing and marketing mumbo-jumbo? Yes; to a limited extent, but I believe that words matter when matched with action, especially to employees and customers. Dropping the reference to wireline logging, arguably the technology that the company was most known for, is significant. It signals a break with the past, while honoring the spirit of innovation that lies at the core. Innovation drives higher margins, and that’s what will enable the company to sustain and grow a dividend.

The bottom line is that SLB is now positioned for more predictable (relative to the past) operating results and focused on long-term growth opportunities within oil and gas. The CEO summarized this during the Q2-2024 release saying:

As the cycle continues, investments will increasingly be targeted to in the most resilient area of the market, including key international markets such as the Middle East and Asia and in offshore globally. In these areas, we are seeing long-cycle gas and deepwater projects, production and recovery activity to address natural decline and increased digital adoption to drive efficiency and performance.

Larger addressable market, offering higher margins

The effects of the industry’s new focus on capital allocation discipline which slowed the pace of new oil discoveries, the gradual bending of the oil demand curve due to growing electric vehicle sales and energy efficiency are rippling through the industry.

Gone are the days of rampant exploration and drilling activity. The name of the game now is optimizing existing oil/gas fields to extract the most value with the least cost for the longest time. This translates to a shift in spending from more capital expenditure heavy to more operating expense heavy.

The refocused SLB now estimates that its total addressable market has almost doubled, to $700 billion by 2030. And, management believes that they can grow revenues at a 15% compound annual growth rate from 2021 to 2025.

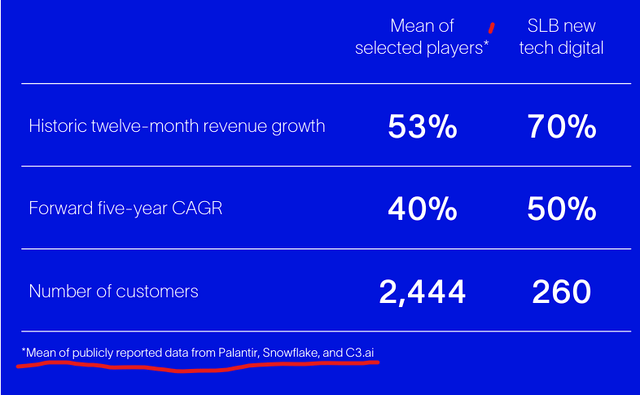

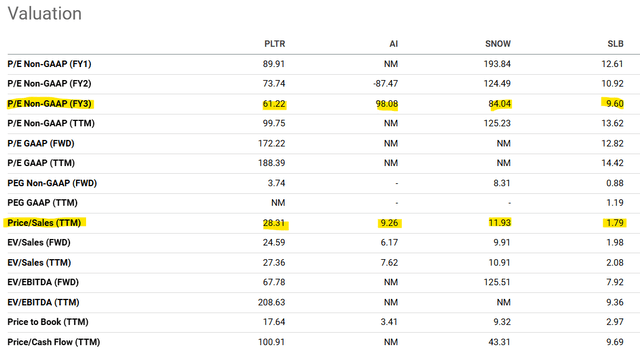

A key growth area is the Digital and Integrations business, which is expected to double from 2021 to 2025. In 2021, this business did $3.29 billion in revenue. Doubling that is $6.6 billion revenue for 2025. Here’s a chart from the 2022 Investor Conference comparing growth rates of SLB’s digital business with publicly traded AI companies.

SLB’s digital business compares well with other public AI companies (SLB 2022 Investor Conference)

Those three companies, PLTR, SNOW and AI, trade for 9 to 28 times sales. If you put even a 5X multiple on SLB’s digital business, it would be worth $21 billion using the latest Q2 revenue (annualized) for the Digital segment ($1.05 billion in Q2) against SLB’s market cap of just over $62 billion. This means that you are getting the entirety of the remainder company that contributes over $32 billion in revenue and about $4 billion in expected earnings for just $41 billion. That’s about 10 times earnings and represents a great value.

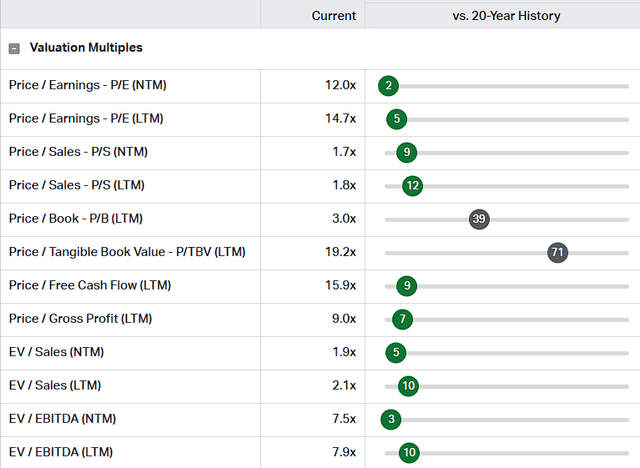

SLB is trading near two decade lows on multiple valuation metrics (Koyfin – Percentile Rank Chart for SLB)

Valuation metrics for publicly traded AI companies (Seeking Alpha)

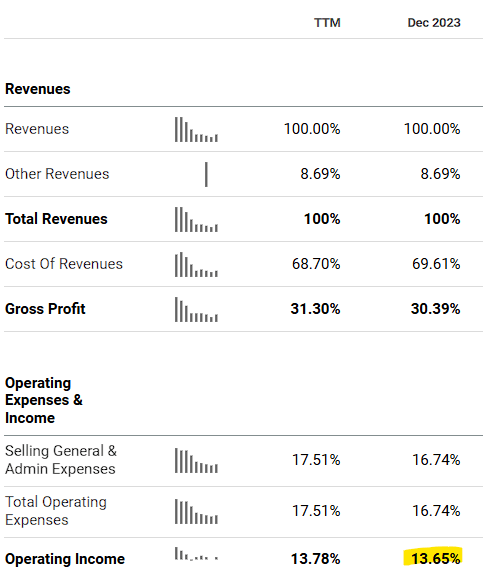

Digital is also the highest margin business of SLB’s portfolio, with operating margins of over 30%. The other business units produce lower margins but are improving year over year. Production Systems stands out for being below 20% but the ChampionX acquisition (CHX) will yield a more profitable business.

| Operating Margin Q2-2024 | |

| Digital | 31.0% |

| Reservoir | 20.6% |

| Well Construction | 21.7% |

| Production Systems | 15.6% |

SLB estimates that it can wring $400 million in synergies and costs savings from ChampionX, which did $3.75 billion in revenue during 2023. Nearly all of ChampionX’s revenue will be assigned to the Product Systems segment. On that revenue, ChampionX produced 13.65% operating income, or $513 million.

Seeking Alpha

When you add $400 million in synergies and cost savings, the operating income margin rises from 13.65% to 24.3%. It may not be fair to allocate all of the $400 million to the ChampionX income statement, but regardless of how it is split between SLB and ChampionX, it clearly shows that SLB sees a path to higher margins in the Production Systems segment.

Valuation and Ownership

You can buy this improving business mix focused on more stable, growing, and more profitable markets at near 20-year valuation metric lows.

Percentile ranks of SLB stock relative to 20 year history (Koyfin)

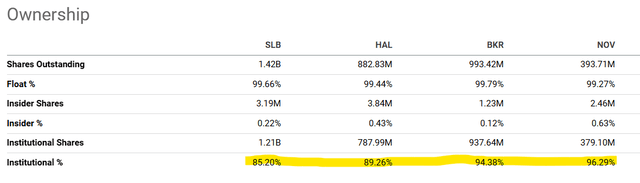

It’s also interesting that institutional ownership of SLB shares is 4-11 points below its peers like HAL, BKR, and NOV. If institutional buying picks up, it would likely be a catalyst for the share price to rise.

Institutional ownership of SLB is below its peers (Seeking Alpha)

Summary

SLB is a company nearing five years into its transformative journey, but the market has not rewarded the improvement in its performance with a large increase in price. Shares are trading around $45 compared to $40 back at year-end of 2019.

SLB shares are only $5 above where they were at year-end 2019 (Seeking Alpha)

Looking further into the future to judge the ability of the company to continue growing and increasing its dividend, we can look to this encouraging statement from the CEO.

Beyond 2024, the fundamentals of this cycle remain in place, and there is a long tailwind of growth opportunities, including long-cycle gas and deepwater projects, production and recovery activity, and the secular trends of digital and decarbonization. This represents a strong backdrop to continue our margin expansion and cash generation journey.

I rate the shares a buy up to $50 and would watch for these risks on the downside.

- The ChampionX acquisition is not approved by the government, or the projected $400 million in synergies do not materialize.

- It’s hard to tell how much emphasis the market is placing on the Digital and Integration segment, but if growth was too slow for a quarter and the market punishes the shares, you may need to reconsider the stock.

- Like the rest of the industry, SLB is highly correlated with oil prices. If oil drops below $70 per barrel for a sustained period of time (3 months or longer), the share price would likely suffer.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.