Summary:

- Schlumberger offers a compelling value opportunity with strong business performance, low P/E, and forward growth expectations.

- The company’s focus on resilient market segments and robust digital growth, combined with the pending ChampionX acquisition, positions SLB well for continued growth.

- SLB has a solid balance sheet, expanding margins, and a robust capital return strategy, including dividends and share buybacks, enhancing shareholder value.

CalypsoArt

Famed investor Peter Lynch once said that if you look at 10 different stocks, you might find one that is interesting. That also goes for bull markets like the one we are in now.

Despite headline-making gains in the DJIA and S&P 500 (SPY), there is plenty of value to be had so long as one is willing to do a bit of digging, or “drilling” as it relates to this particular stock.

This brings me to SLB (formerly known as Schlumberger) (NYSE:SLB), which strikes me as the pick and shovel play to the oil industry what NVIDIA (NVDA) is to the AI industry. I last covered SLB a while back in July of 2022, noting its deep undervaluation and positioning to benefit from tight energy supplies due to geopolitical tensions.

The stock has done well for investors since then, with the stock giving a 43% total return since my last piece, sitting behind the 48% rise in the S&P 500 over the same timeframe.

SLB and the oilfield services industry in general remain highly cyclical, however, as the market appears to be concerned around a slowdown in the sector after 2-3 years of high oil prices and heavy investment following 2020. As shown below, SLB stock has dropped by 25% over the past 12 months.

SLB 1-Yr Price Return (Seeking Alpha)

In this article, I revisit the stock including its recent business performance, and discuss why value investors ought to consider SLB on the cheap for potentially strong total returns, so let’s get started!

SLB: Buy High Quality At A Discount

SLB is an oilfield services giant with a global footprint in 100+ countries, providing solutions such as subsurface evaluation, drilling, production, and processing services.

It’s recognized for having leading technology and extensive digital offerings to its clients, making it a crucial partner for oil and gas exploration and production companies worldwide.

SLB is being strategic in its pursuit of quality and sustainable revenue growth, by selectively targeting the most resilient segments of the market such as onshore drilling sites in the Middle East and Asia and offshore markets in Europe, Africa, and Latin America.

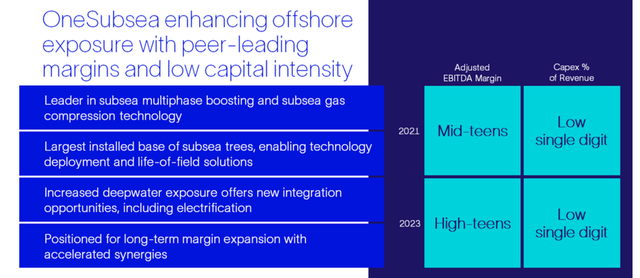

Offshore markets include deepwater basins in Brazil, West Africa, and Norway, where it continues to benefit from strong backlog conversion in OneSubsea, a leading solution in subsea multiphase boosting and subsea gas compression technology. As shown below, this technology has seen margin growth from mid-teens to high-teens while maintaining the same level of capex per revenue.

Investor Presentation

Meanwhile, SLB is executing well, with revenue growing by 5% sequentially during Q2 2024 to $9.1 billion, driven primarily in international markets, particularly in the Middle East and Asia. Adjusted EBITDA also grew by an encouraging 11% sequentially and saw margin expansion of 142 basis points to 25%. These factors helped to drive an 18% YoY increase in EPS.

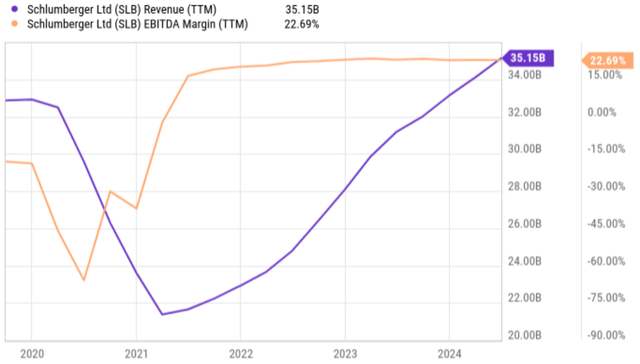

As shown below, SLB’s TTM Revenue has now fully recovered and risen past pre-2020 levels, all while TTM EBITDA margin has also risen since pre-2020 and held steady since 2022.

YCharts

Management is guiding for robust full-year Adjusted EBITDA growth of 14.5% at the midpoint of the range, with adjusted EBITDA margins at or above 25%. This includes third quarter revenue growth expectation in the low single digit sequentially.

This is supported by continued favorable conversion of backlog and strong international activity wells, and by high growth in the digital business, with the number of users on Delfi (a digital platform that enables collaboration between teams in the field) increasing by 28% YoY so far this year, and the number of connected assets growing by 57% over the prior year period. This digital momentum is expected to make significant contributions to margin expansion in the coming quarters.

Another growth catalyst includes SLB’s pending acquisition of ChampionX that’s expected to close by the end of this year. ChampionX is a leader in the chemicals production space, and greatly expands SLB’s presence in this segment, as noted by Morningstar in a recent report:

SLB ranked sixth in the industry per Spears & Associates, and ChampionX ranked first with about a 25% market share. ChampionX also adds a solid artificial lift presence, serving to strengthen SLB’s leading market share in the space.

SLB also covets ChampionX’s focus on the production portion of the well lifecycle, where revenue streams can last over decades versus the much shorter drilling and completion portion, which can be completed in weeks or months.

This area is more important as operators are incrementally valuing boosting recovery from existing operations over new exploration spending. These production recovery areas tend to be less capital intensive for oilfield services firms, boosting returns.

Importantly, SLB carries a strong balance sheet with an ‘A’ credit rating from S&P. This is supported by a low net debt to TTM EBITDA ratio of 1.2x. This enables SLB to target capital returns to shareholders, including $3 billion this year comprised of dividends and share buybacks, and $4 billion slated for 2025.

While SLB’s current dividend yield of 2.5% isn’t high, it does come with a very well-covered 32% payout ratio, leaving the window open to continued dividend raises down the line. The dividend was raised by 10% this year and should SLB return to its pre-2020 dividend rate, the yield would be 4.5%.

Lastly, SLB presents a good value opportunity at the current price of $43.99 with a forward PE of 12.6. At this valuation, SLB is priced for growth in just the mid-single digit range. However, sell side analysts who follow the company estimate 13% to 18% annual EPS growth over the next 3 years, which, I believe, is reasonable considering the catalysts mentioned above.

As shown below, the average price target for SLB ranges from a low of $53 to a high of $74, with $64.88 being the average. Even if SLB were to hit the low end of the target range, that would equate to a potential 20% gain on share price appreciation alone.

Seeking Alpha

Risks to the thesis include potential for a slowdown in the global macroeconomic environment, which could reduce demand for oilfield services from SLB’s clients. In addition, a faster than expected ramp in renewable energy could also dampen demand. However, with manufactures like Ford (F) and General Motors (GM) pivoting back from EVs to internal combustion engines and hybrids, that scenario seems unlikely in the foreseeable future.

Finally, SLB also carries execution risks as it relates to its ChampionX acquisition, should the anticipated synergies and market traction does not pan out as expected. SLB also carries a meaningful presence in Russia, although it’s not shipping products and technology into the country, and that carries uncertainties around its business there due to the conflict in Ukraine.

Investor Takeaway

SLB presents a compelling value opportunity at its current price, given its strong business performance, low PE, and forward growth expectations. The company’s strategic focus on resilient market segments, combined with its robust digital growth and pending acquisition of ChampionX, positions it well for continued growth. With a solid balance sheet, expanding margins, and a robust capital return strategy, SLB is poised to deliver potentially strong total returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

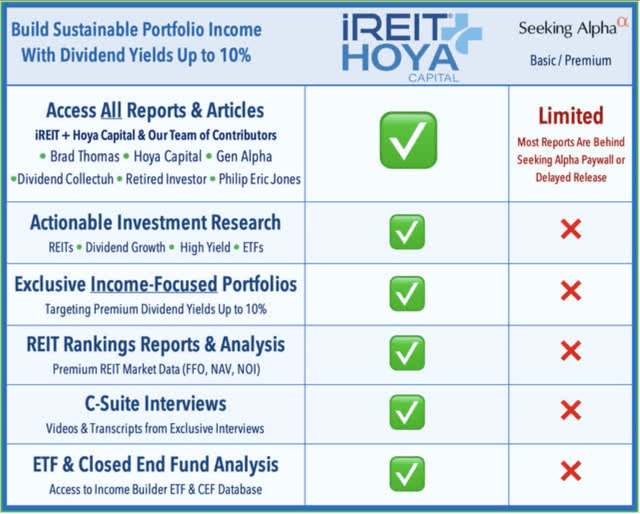

Read The Full Report on iREIT+Hoya

iREIT+HOYA Capital is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.