Summary:

- SLB, an oil field service company, is a potential investment opportunity in the energy market for those who are bullish.

- SLB’s revenue has grown rapidly, driven by strong drilling activities and increased sales of production systems.

- The company’s digital and integration activities have shown slower growth, but overall profitability has increased.

- Recent acquisitions are interesting and could bode well, but SLB shares are a bit pricey compared to similar firms.

- In all, it’s alright to be cautiously optimistic about its ability to generate a nice upside.

zhengzaishuru

Right now seems to be a very bullish time for the energy markets. In some recent articles, such as here and here, I detailed exactly why this is. Restrictive policy by OPEC+ nations, combined with strong demand and geopolitical disruptions, have all come together to push prices higher. One way to invest in this is to buy into companies that focus on the exploration and production of crude. But there are other approaches to take as well. Oil field service companies can also be an interesting avenue for investors to explore. And one of the best companies in this space happens to be SLB (NYSE:SLB), previously known as Schlumberger Limited.

I have followed the company on and off for the last several years now. In fact, it’s one of the first publicly traded companies, outside of the regular big names that you would expect to see, that I ever learned about. The last time I wrote about the company was in a bullish article published in April of last year. At that time, I was reviewing analysts’ expectations for what was then its upcoming first-quarter earnings release. Based on my own assessment at the time, I noticed that the enterprise was healthy and relatively affordable. This led me to rate the company a ‘buy’ to reflect my view that the stock would likely outperform the broader market for the foreseeable future.

Unfortunately, things have not gone exactly as planned. While the S&P 500 has jumped 23.6% since the publication of that article, shares of the company have risen by only 1.8%. While I am more bullish on energy markets today than I was back at that time, and while shares are priced similarly to what they were then, where the company ranks compared to similar firms has gotten worse. Add on top of this my own move in the direction of being a bit more conservative in my assessments because of uncertain economic conditions, and I very nearly downgraded the stock from a ‘buy’ to a ‘hold’. Of course, this picture could change. Before the market opens on April 19th, the management team at SLB is expected to announce financial results covering the first quarter of the company’s 2024 fiscal year. Analysts are expecting some solid year-over-year growth, particularly on the top line. If the company fails to meet expectations and/or ends up lowering guidance, my mindset could change, and a downgrade might then be appropriate. But because of the valuation of the firm on an absolute basis, current expectations for growth, and some recently-announced acquisitions that could bring growth and synergies to the board, I am keeping the business a soft ‘buy’ at this time.

A look at SLB’s current conditions

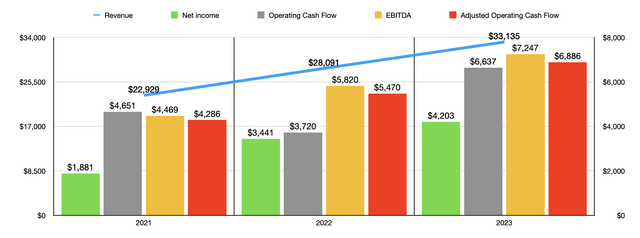

From a purely fundamental perspective, things are going really well for SLB and its investors. Over the last three years, as you can see in the chart above, revenue for the company has grown at a rapid pace. Sales jumped by 44.5% from $22.93 billion to $33.14 billion. The growth from 2022 to 2023 amounted to $5.04 billion, or 18%. Strong land and offshore drilling activities in North America pushed sales up from that continent by roughly 12%. But even more impressive was the international arena. Overall revenue there expanded by roughly 20%. In the Middle East and Asia, growth was 21% thanks to higher drilling and intervention activities. But Europe and Africa as a combined group were not far behind, with an 18% rise. That growth was mostly because of higher sales of production systems in Europe, as well as increased offshore drilling activity in Africa. Latin America was also fertile territory for the company, with revenue up 17% because of strong drilling activity and because of higher production systems sales.

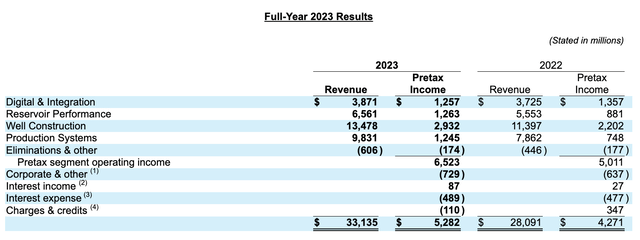

When looking at the different types of revenue the company generates, it’s important to note that well-construction sales jumped by 18.3%. Strong demand for drilling fluids and measurements, both onshore and offshore, combined with higher pricing, led to this improvement. Reservoir performance revenue grew similarly at 18.2%. Management did not provide much in the way of detail here. But they did say that it was mostly because of increased international activity. The strongest growth, however, came from the sale of production systems. This spiked by 25%, shooting up from $7.86 billion to $9.83 billion. Based on the data provided, all of the areas in which the company operates saw higher demand for these systems. This makes sense when you consider the global oil and gas production continues to climb. In the US, for instance, we are at all-time highs when it comes to output.

To me, the only part of the company that really disappointed involved its digital and integration activities. This is the smallest portion of the company, accounting for only 11.7% of revenue last year. But the reason why I was upset that sales grew only 3.9% from $3.73 billion to $3.87 billion is because of what it means for the bottom line. Despite accounting for only a small portion of overall sales, this part of the company accounts for 18.8% of profits, with a pretax profit margin in 2023 of 32.5%. Management has spent years trying to build up this part of the company because they view technology as incredibly important moving forward for this industry. And also because of the margins involved. In fact, the company even describes itself as a technology provider. Decreased exploration data licensing sales, as well as a reduction in demand for the firm’s Asset Performance Solutions, very nearly offset strong demand for digital sales.

Despite these troubles on the top line, the bottom line for the company continued to grow nicely also. From 2022 to 2023, for instance, net profits expanded by 22.1% from $3.44 billion to $4.20 billion. The growth in revenue was undoubtedly the largest contributor to this. Other profitability metrics followed a similar trajectory. Operating cash flow, for instance, jumped 78.4% from $3.72 billion to $6.64 billion. Though if we adjust for changes in working capital, we get a more modest increase of 25.9% from $5.47 billion to $6.89 billion. And finally, EBITDA for the company expanded from $5.82 billion to $7.25 billion.

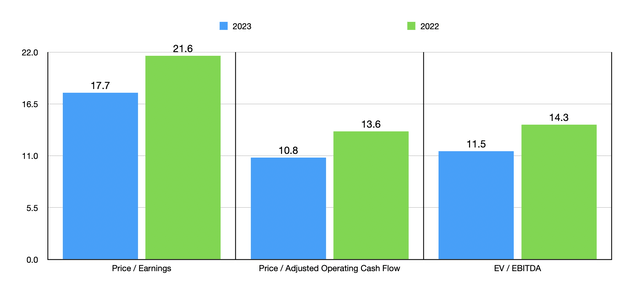

If we use the results that management provided for 2023, we can see how shares of the company are valued as shown in the chart above. I also included calculations based on 2022 figures as well. In the grand scheme of things, shares don’t look all that bad. In fact, when it comes to adjusted operating cash flow and EBITDA, shares look pretty solid. But relative to similar firms, the stock is a bit pricey. In the table below, you can see five such businesses stacked up against SLB. When it comes to the price to earnings approach, I found that four of the five firms were cheaper than our prospect. On a price to operating cash flow basis, only two of them were more expensive, while another was tied with it. But then, using the EV to EBITDA approach, SLB ended up being the most expensive of the group.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| SLB | 17.7 | 10.8 | 11.5 |

| Baker Hughes (BKR) | 17.0 | 10.8 | 9.3 |

| Halliburton (HAL) | 13.4 | 10.2 | 8.1 |

| Tenaris S.A. (TS) | 5.7 | 5.1 | 3.7 |

| NOV Inc. (NOV) | 7.7 | 53.6 | 8.7 |

| ChampionX (CHX) | 23.5 | 13.6 | 10.4 |

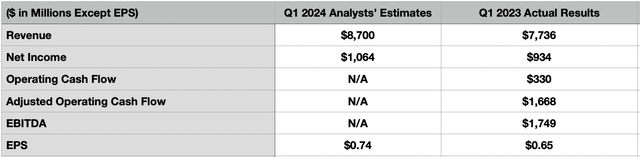

Heading into earnings, there is the opportunity for the picture to change. At present, analysts are forecasting revenue of $8.70 billion. If this comes to fruition, it would translate to an increase of 12.5% compared to the $7.74 billion generated in the first quarter of 2023. On the bottom line, analysts believe that growth will continue as well. Earnings per share are forecasted to come in at $0.74. That’s up from the $0.65 per share generated at the same time last year. This would imply an increase from $934 million in profit to $1.06 billion. Analysts have not provided estimates when it comes to other profitability metrics. But in the table below, you can see what some of these were for the first quarter of 2023. In all likelihood, if analysts are correct at least, these profitability metrics will rise year over year as well. But by how much is anybody’s guess.

An update on recent developments

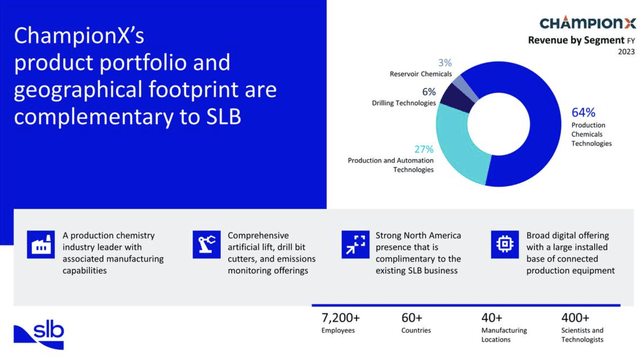

It’s also worth noting, as we approach earnings, that there could be some interesting developments that take place. This is because of some other developments announced by management earlier this month. On April 2nd, of this year, the company announced that it was acquiring competitor ChampionX in a deal valued at approximately $7.25 billion on an equity value basis. This is an all-stock deal that should translate to shareholders of ChampionX receiving 0.735 of a share of SLB for each share of ChampionX that they currently own.

In a lot of ways, this transaction makes a lot of sense. It appears as though management’s primary emphasis is in focusing on production chemicals and artificial lift technologies. The company lauded production chemicals as an asset-light business with ‘strong cash generation’ that has a history of being resilient throughout industry cycles. Based on data from 2023, 64% of the revenue generated by ChampionX comes from production chemicals technologies. Another 27% involves production and automation technologies. Drilling technologies comes in third place at 6%, while reservoir chemicals makes up the remaining 3%. When combined with the company’s own production operations and digital capabilities, management believes that this purchase can add a lot of value for shareholders.

Upon completion of the deal, shareholders of ChampionX will end up owning approximately 9% of SLB. But there’s also the expectation that the deal will create significant added benefits for investors. This is because they are forecasting, within three years of the deal closing, $400 million in annual pretax cost and revenue synergies. Most of this won’t be recognized until 2026. But by the end of 2027, it should be completed. Management is so optimistic, in fact, that they have even changed some of their plans. This year, the company is targeting returning $3 billion in capital to shareholders. That’s up from the $2 billion returned last year. And in 2025, this number is expected to grow to $4 billion. This has not stopped the company from making other moves. In late March, management announced the acquisition of an 80% ownership in Aker Carbon Capture. Assuming constant exchange rates, the price for that ownership is $380 million.

In general, I see these as positive developments for the firm. This is especially the case if synergies can be captured. But if you call back to the original comparison table between SLB and the five other firms, ChampionX is actually more expensive than SLB using two of the three valuation metrics. And even when it comes down to the EV to EBITDA approach, the multiple of 10.4 is not terribly different from the 11.5 that SLB can be picked up for. So while planned synergies do create an opportunity for the picture to get better, a failure to achieve them could make SLB more expensive.

Takeaway

Right now is an interesting time for SLB and its investors. I maintain that this is a quality company that, in the long run, should do quite well for itself. However, I am not as optimistic as I was previously. While I feel like the industry in which it operates is even more attractive than when I last wrote about the firm, shares have gotten pricey compared to similar enterprises. Even so, in the grand scheme of things, I fully expect that SLB will do well for itself. It’s because of this, how shares are priced on an absolute basis, and the prospect of synergies and growth from recent acquisitions that I am still holding out hope that shares can rise from here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!