Summary:

- SLB is not cheap but has been growing revenue and earnings at impressive rates.

- The market has been penalizing the company due to misunderstanding Saudi Arabia’s shift from new offshore developments to the Jafurah unconventional gas field.

- SLB will benefit from the Saudi focus on Jafurah and the latest earnings report confirms the growth trend in the Middle East remains intact.

- The resumption of SLB’s buyback program should be a further tailwind.

JHVEPhoto

Investment thesis

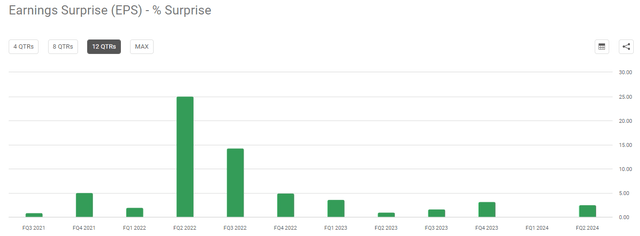

SLB (NYSE:SLB), formerly Schlumberger, beat earnings yet again last Friday:

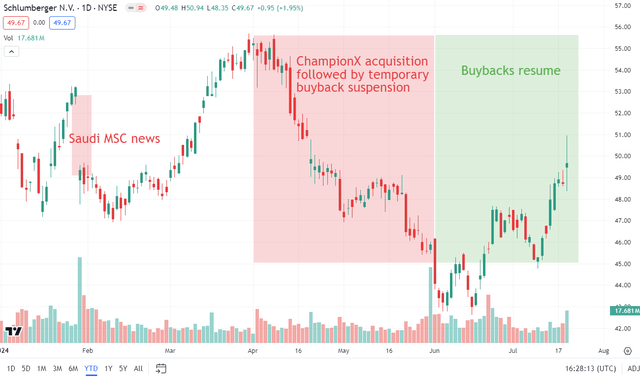

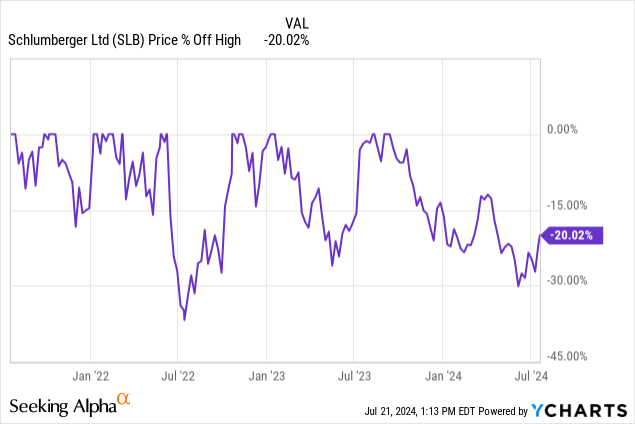

However, SLB stock hasn’t had a good 2024 and is 20% below last year’s highs:

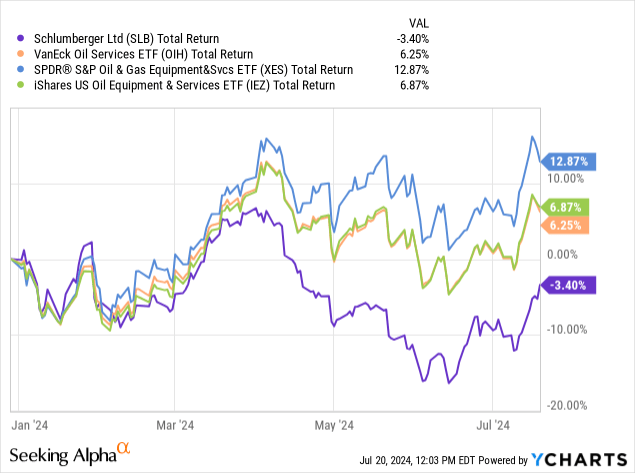

Despite being the largest energy services company in the world and the fourth largest constituent of the S&P 500 (SPY) energy index (XLE), right after Exxon (XOM), Chevron (CVX) and EOG (EOG), SLB has lagged behind its smaller and less liquid peers:

In my view, there were two reasons for this underperformance:

- Misplaced fears about SLB’s growth prospects in the Middle East, after a surprise Saudi Aramco announcement from January that was widely misinterpreted as a capex reduction but should be more properly seen as a redeployment of capex from offshore to land, thus still benefiting SLB;

- The temporary suspension of buybacks in the second quarter to comply with U.S. securities laws at a time when the market was already putting pressure on energy stocks.

The buybacks have now resumed while the Q2 earnings showed impressive Middle East growth and were accompanied by encouraging management commentary.

Barring some systemic issue like a recession, I think it is only a matter of time until the market works off the growth anxiety and the stock returns to last year’s highs and the analyst price targets.

This implies upside in the 30% to 40% range.

Please note that I have covered SLB before on Seeking Alpha. This article should be seen as an update to my prior articles.

The Middle East growth fears are unfounded

The market started doubting the SLB growth story when Saudi Aramco surprisingly announced back in January that it was scrapping plans to expand oil production capacity to 13 million barrels per day from the current 12 million. Aramco is a major SLB customer so at first glance the negative reaction makes sense but the Saudi events have been misunderstood.

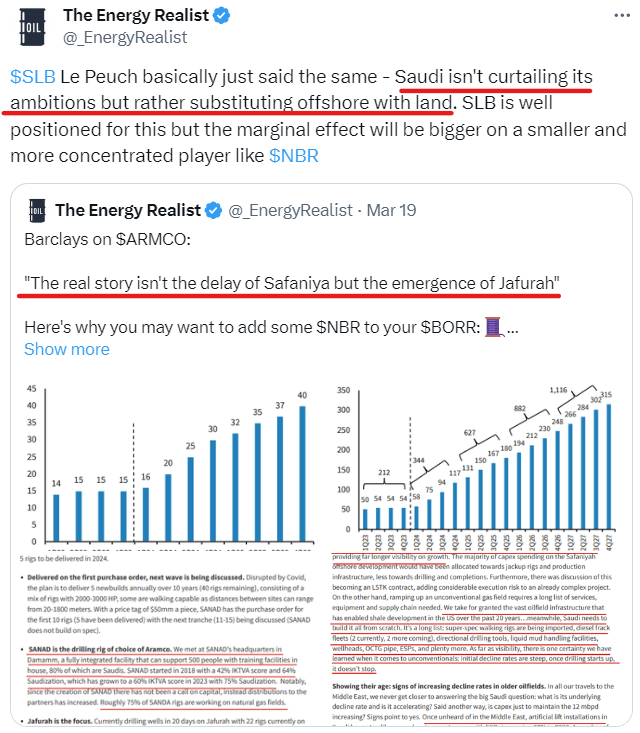

As I have pointed out before, the real story in Saudi Arabia wasn’t the curtailment of its oil expansion objectives that led to the cancellation of two offshore developments, Safaniyah and Manifa, but rather the success of the Jafurah unconventional gas field onshore:

X (Twitter)

In other words, we aren’t dealing with a cut to the Saudi capex, but rather with the substitution of one type of capex with another. To explain, Saudi Arabia uses some of its oil production for domestic power burn, so discovering large quantities of gas that can displace oil as a power source automatically frees up more oil for export. Second, by Aramco’s reports the Jafurah gas is also rich in condensate that is commonly mixed with crude oil and thus also supports more export volumes.

Saudi Arabia reallocating capital from offshore conventional developments to an onshore unconventional play isn’t necessarily bullish for smaller services providers like Borr Drilling (BORR) that target shallow water but a diversified behemoth like SLB is fully capable of capturing the onshore upside. In fact, Jafurah may be a goldmine for SLB, given unconventional onshore is much more services intensive. As the U.S. shale experience shows, decline rates are steep and once you start drilling you can’t really stop.

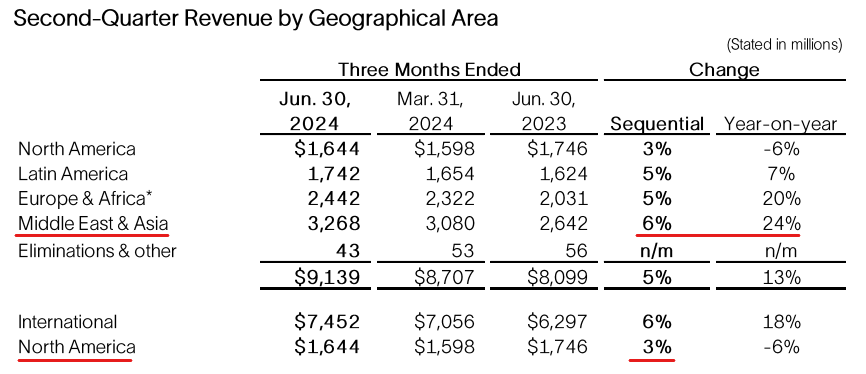

Meanwhile, Saudi Arabia’s neighbors Kuwait, the UAE and others are going full stream ahead with their original plans and SLB’s second quarter press release now shows a remarkable 24% YoY growth from the Middle East region (despite the well-known slowness in North America which is only 1/5th of SLB’s revenues):

SLB Press Release

Management’s Q2 comments expressed continued confidence in the Middle East region:

As the cycle continues, investments will increasingly be targeted to in the most resilient area of the market, including key international markets such as the Middle East and Asia and in offshore globally. In these areas, we are seeing long-cycle gas and deepwater projects, production and recovery activity to address natural decline and increased digital adoption to drive efficiency and performance. This is an optimal environment for our business, and we are seizing each of these opportunity.

In the Middle East, in addition to the exposure to the oil capacity expansion program across the region, we continue to benefit from the acceleration and scale of investments in gas development, both conventional and unconventional, leveraging our fit-for-basin technology and differentiated integration capability.

The gas development projects SLB talks about are a positive too because they are driven by energy security concerns and will be more resilient to an economic downturn. While oil consumption is more sensitive to the business cycle, gas serves baseload demand.

SLB is a technology company too

SLB’s growth story isn’t just cyclical but has some secular aspects too. First, with the ChampionX acquisition, SLB is looking to get more exposure to the production maintenance or “opex” part of the oil and gas business. In the long run, that should reduce revenue volatility and perhaps even drive counter-cyclical growth.

Second, SLB has been trying to become a less asset-heavy, more digital business that can generate annuity-type revenues. Management’s Q2 comments noted significant progress in that regard:

[We] were quite happy with the not only the top-line growth, but the margin expansion in the D&I division in the second quarter. And as I said earlier, it was all due to the digital business. So, APS was flat. And as it relates to the rest of the year, we do definitely expect the digital margins to continue improving in the second half. It will accelerate even more so in the fourth quarter on higher sales, but also on the effect of the changes we are making in the digital delivery and support organization to pull resources on a more global and regional basis to scale the business more efficiently.

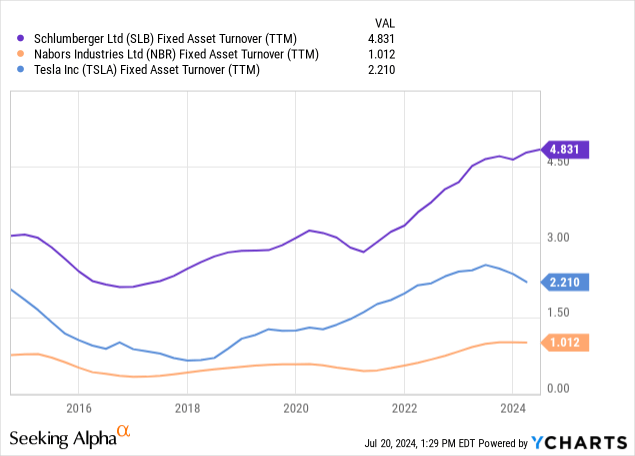

While many companies nowadays talk about “digital” or “AI”, in SLB’s case the fixed asset turnover has been indeed rising over time:

This means that SLB is generating more revenue from the same quantity of fixed assets because digital and the company’s know-how in general are not something that is typically recorded on the corporate balance sheet.

For comparison, SLB has even higher fixed asset turnover than Tesla (TSLA), implying that TSLA is relatively more asset-heavy than SLB. The chart also shows land driller Nabors (NBR) as an example of a more traditional oilfield services company that still very much depends on its tangible assets.

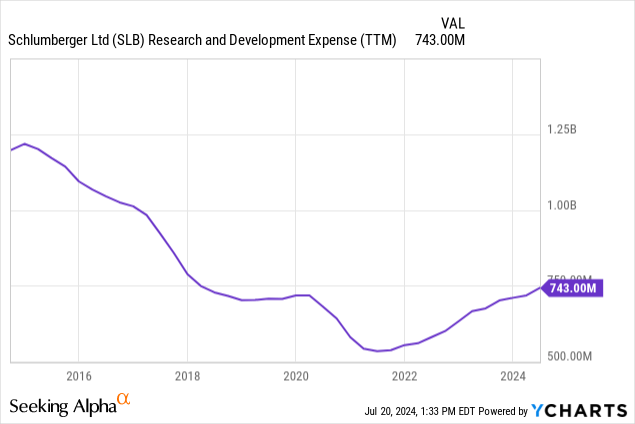

SLB cut down on R&D during the pandemic but the spend is on the rise again:

The point of this technology discussion is that SLB’s growth prospects aren’t solely limited to cyclical factors. A land or offshore driller that primarily owns tangible assets (i.e. rigs) can grow by improving utilization and dayrates, but the growth will be limited by the demand for rigs. In contrast, SLB can also grow by developing new products or services that didn’t exist before, and this adds a secular element to the growth.

Valuation

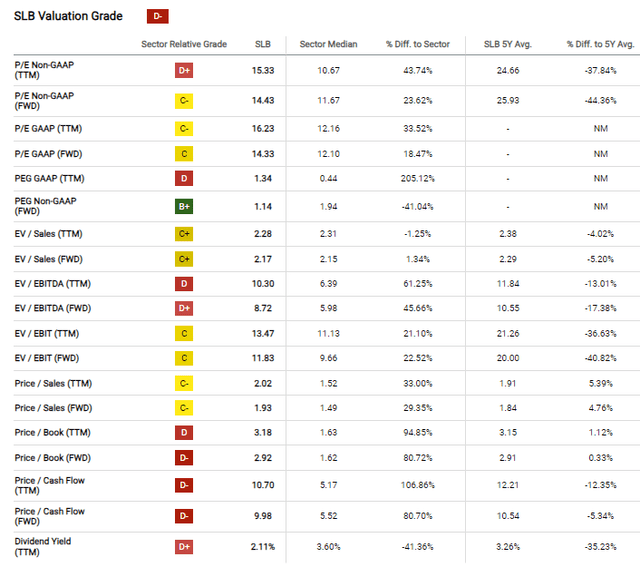

At 15x price to earnings, SLB isn’t cheap:

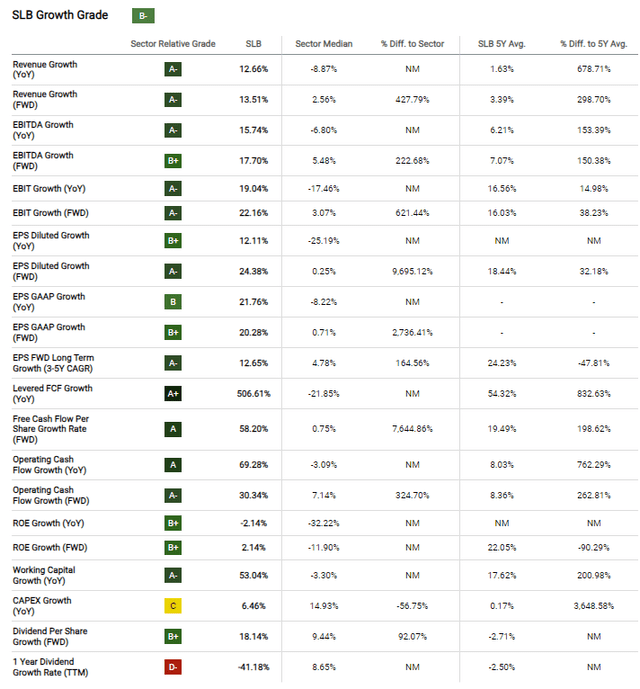

However, the company boasts excellent growth metrics, which naturally support higher valuation multiples:

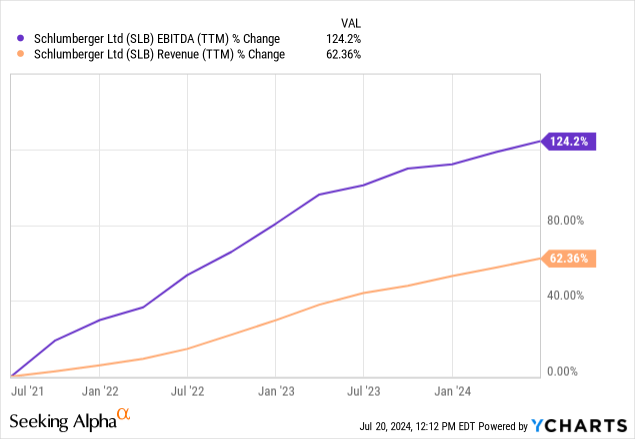

SLB has now been on a 5-year growth streak and EBITDA growth is outpacing revenue due to rising profitability:

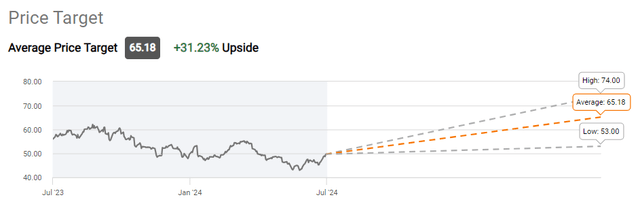

The growth expectations explain why Wall Street analysts see 30% upside:

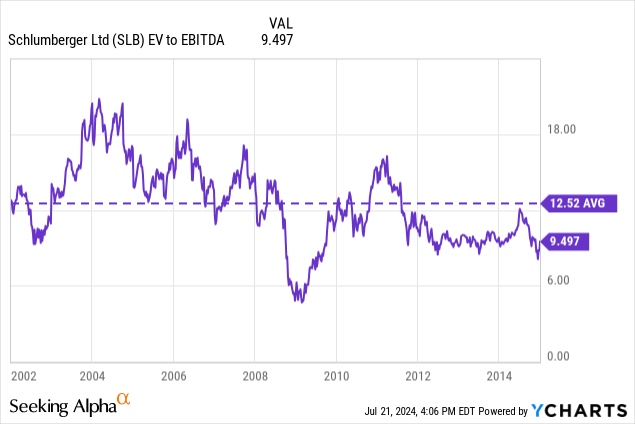

The $65 average target is consistent with a 12x forward EV/EBITDA multiple, up from the 9x multiple baked into the current stock price. This is not out of line with how the stock was valued in the prior energy capex cycle:

A $65-$70 price target range is very reasonable in my view, and we could very well get there in 6-12 months if the market finally moves beyond the misconstrued narrative about stagnating growth in the Middle East.

Capital flows may be a tailwind in H2 2024

The underappreciated growth potential of SLB is an active thesis. Its fulfillment would imply new investors have recognized the opportunity and allocated incremental capital to the stock.

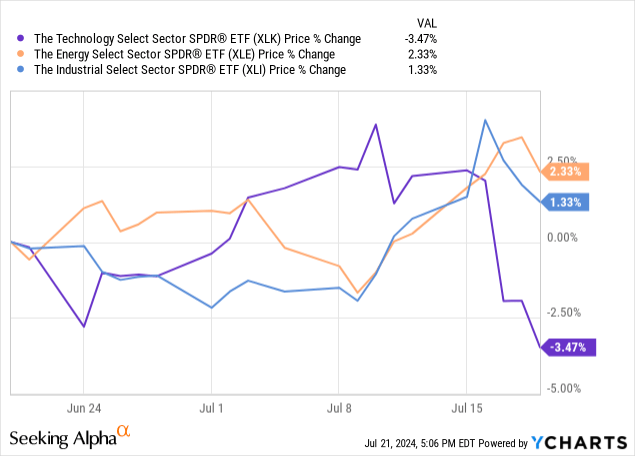

However, as probably 50% of money is now managed passively, how SLB fares will also depend on these passive flows. The first half of 2024 wasn’t helpful from this perspective as technology dominated, but there are signs that a rotation out of tech into energy and industrials may have started last month:

As the largest energy services company and top constituent of most oilfield services ETFs, SLB will naturally benefit from any passive allocations to the sector.

Apart from active and passive money, SLB’s buybacks are also a very important capital flow, especially at times when investor demand is weak.

Unfortunately, in the aftermath of the ChampionX acquisition I covered before, SLB was forced to temporarily halt its buybacks to comply with U.S. securities laws:

SLB’s management explained this issue on their Q1 earnings call:

During the period after ChampionX mails its proxy for the merger until its shareholder vote, we are required to suspend our share buyback program. While this will not impact our total share repurchases for the year of approximately $1.5 billion, it will potentially result in our buybacks being more heavily weighted towards the second half of the year.

Management seems to have caught up with buybacks in June and that likely helped the 25% rebound from the 52-week lows.

I expect the buybacks to remain a tailwind for the second half of the year too.

Risks

The main risk to the SLB thesis is a recession that could result in multiple compression. Upstream capital spend in North America, which accounts for about 20% of SLB’s revenues, is going to be highly sensitive to an economic downturn. However, international markets which make up the remaining 80% of the company’s topline are characterized by longer cycle, multiyear projects that are more robust to short-term cyclical factors.

Conclusion

SLB is an underappreciated growth stock that may offer 30-40% upside if the market stops penalizing it based on misplaced fears about slowing growth in the Middle East. A rotation away from tech in H2 2024 and the resumption of SLB’s buybacks may also act as tailwinds.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Growth Idea investment competition, which runs through August 9. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SLB; NBR; BORR; XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

My articles, blog posts, and comments on this platform do not constitute investment recommendations, but rather express my personal opinions and are for informational purposes only. I am not a registered investment advisor and none of my writings should be considered as investment advice. While I do my best to ensure I present correct factual information, I cannot guarantee that my articles or posts are error-free. You should perform your own due diligence before acting upon any information contained therein.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.