Summary:

- Schlumberger is less significantly impacted than its competitors by the big drop in US rigs because its focus is more international.

- Still, the company is experiencing consolidation in its customer base due to the extraordinary M&A activity among large oil companies.

- Because SLB’s stock is near its 12-month low, it may appeal to energy value-seekers. However, its dividend is modest at 2.4% and so SLB stock is not recommended for dividend investors.

Thank you for your assistant/iStock via Getty Images

The lower stock price of international oilfield services giant SLB (NYSE:SLB) (formerly Schlumberger) presents an entry point for growth-oriented energy investors.

SLB has just announced the acquisition of specialty oilfield services company ChampionX. The acquisition is expected to close later in 2024.

Although only 20% of SLB’s revenue comes from North America — and its operations have been under as much pressure as all others in the North American oilfield services sector — the company gets a healthy 80% of its revenue from international operations. With the US shale market maturing, companies able to do so are again increasingly looking for oil offshore and internationally.

SLB’s market capitalization is down by -24% from my last review eight months ago.

The company expects to return considerable capital to investors through dividends and share repurchases — $7 billion in the next two years. However, it is not recommended for dividend hunters due to its modest 2.4% dividend and the availability of higher returns elsewhere.

But given the nearly 50% upside to its one-year target and the current low-priced entry point, I recommend SLB stock to energy investors interested in capital appreciation from international oilfield services growth. I own shares of SLB.

Acquisition of ChampionX

In April 2024, SLB announced it was acquiring ChampionX in an all-stock transaction that has been valued at $7.75 billion. ChampionX manufactures production chemicals and provides processes for artificial lift.

ChampionX shareholders are to receive 0.735 shares of SLB for every share of ChampionX. (So ChampionX shareholders would own about 9% of SLB.) Once approved and merged, SLB expects annual pre-tax synergies (savings) to reach $400 million within three years.

According to SLB, “The transaction is subject to ChampionX shareholders’ approval, regulatory approvals and other customary closing conditions. It is anticipated that the closing of the transaction will occur before the end of 2024.”

Although anything is possible because ChampionX is so much smaller than SLB, SLB may not be subject to the same lengthy regulatory reviews as companies like Exxon Mobil (XOM) Chevron (CVX), Diamondback Energy (FANG), Chesapeake (CHK), and others have been in their acquisitions of large companies much closer to their own size.

Macro

With over a hundred billion dollars of recent US oil sector mergers and acquisitions announced, the sector’s drive is more toward consolidation than organic growth (drilling). Further, as part of the merger efficiencies they seek, producers have been and will be drilling less, thus putting pressure (again) on the oilfield services sector.

Nonetheless, as companies produce reserves both onshore and offshore, to stay in business, they seek to at least replace that production.

Moreover, while there is significant appreciation for the size of US onshore unconventional reserves, particularly in the west Texas Permian, larger US and international companies have renewed their search for reserves abroad, particularly offshore.

A macro factor affecting all businesses is the US Federal Reserve’s upcoming decision on interest rates at their June meeting. At present, the general belief is that the Fed will hold off on interest rate decreases through the end of 2024.

The anti-hydrocarbon Biden administration has found many ways to limit hydrocarbon production and consumption in the US via regulatory actions. For SLB, this is most meaningful in the much-reduced number of offshore Gulf of Mexico lease auctions.

Several local and state entities, like the city of Honolulu, are trying their hand at suing oil and gas companies over climate change. It remains to be seen how the Supreme Court will approach — or if it will — this latest lawfare.

Nonetheless, momentum in energy policy has shifted from energy transition (to renewable, non-hydrocarbon sources) to the importance of energy security, affordability, and flexibility, all of which favor hydrocarbons and extant nuclear.

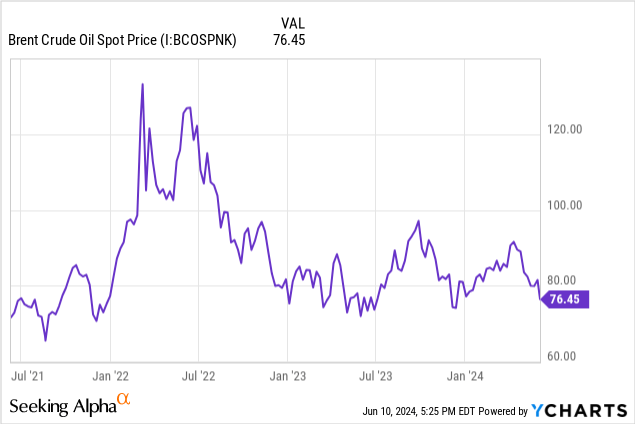

Oil and Gas Prices

The June 10, 2024, Brent NYMEX oil futures price (for August 2024 delivery) was $81.96/barrel. On June 10, 2024, for July delivery:

*West Texas Intermediate (WTI) oil price was $77.74/barrel, and

*Dutch Title Transfer Facility (TTF) liquefied natural gas price was $10.80/MMBTU.

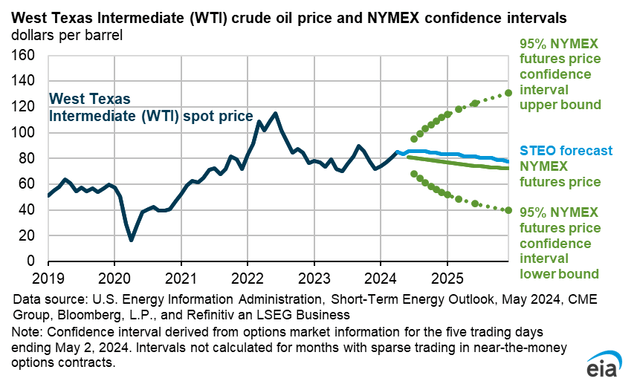

In early May 2024, the EIA’s 5-95 confidence interval for future oil prices was $40-$130/bbl by year-end 2025.

EIA STEO

First Quarter 2024 Results

In the first quarter of 2024, SLB earned:

*$8.71 billion of revenue

*$1.07 billion of net income ($0.74/share)

*adjusted EBITDA of $2.06 billion at a 23.6% margin

*pretax segment operating income of $1.65 billion at an 18.9% margin.

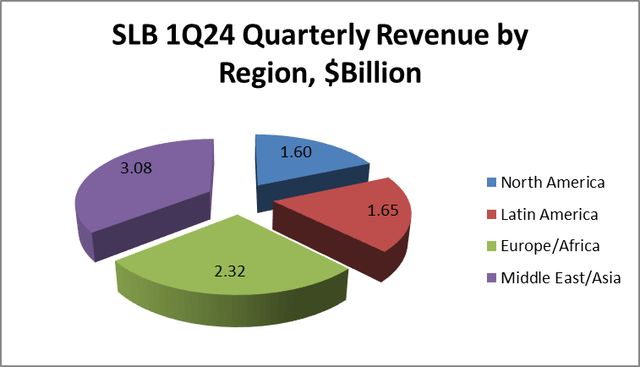

Over 80% of SLB’s revenue was international; less than 20% came from North America.

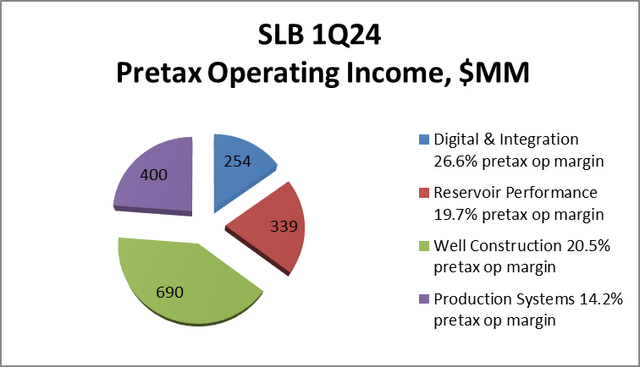

SLB is organized by four operating divisions and four geographical regions. Operating divisions are 1) digital & integration, 2) reservoir performance, 3) well construction, and 4) production systems. The company’s first-quarter pretax operating income by division, with margin, is shown below.

SLB & Starks Energy Economics, LLC

The importance of the European/African and Middle Eastern/Asian operations is illustrated in the graph of 1Q24 revenue by region.

SLB & Starks Energy Economics

Discussing growth, in its 1Q24 earnings release, CEO Olivier Le Peuch said:

We have had an exciting start to the year with our announced agreement to acquire ChampionX Corporation (ChampionX), which will bolster our production and recovery portfolio…

Compared to the same quarter last year, revenue increased 13%, EPS (excluding charges and credits) rose 19% to $0.75, adjusted EBITDA grew 15%, and adjusted EBITDA margin expanded year on year for the 13th consecutive quarter. Approximately half of the year-on-year revenue increase came from the Aker subsea business, which was added as part of our OneSubsea joint venture in the fourth quarter of 2023.

International revenue grew 18% year on year, compensating for a softer North American market where revenue declined 6%. Excluding the contribution of the Aker subsea business, international revenue grew 10%.

During the quarter, we continued to benefit from our favorable exposure to the international markets, with remarkable year-on-year growth of 29% in the Middle East & Asia, in addition to growth of 18% in Europe & Africa.

Via dividends and buybacks, SLB company plans to return $3 billion to shareholders in 2024 and $4 billion in 2025. (If continued at the current level, annual dividend payouts are $1.57 billion/year.)

Competitors

SLB is headquartered in Houston, Texas.

SLB’s largest oilfield service competitors are Baker Hughes (BKR), Halliburton (HAL), and NOV Inc. (NOV). As a leading oilfield services provider to national oil companies (NOCs), it also competes with Middle East/North Africa oilfield service companies like National Energy Services Reunited (OTCPK:NESR).

Smaller offshore oilfield services competitors are Weatherford (WFRD), Transocean (RIG), and Tidewater (TDW).

Governance

Institutional Shareholder Services (ISS) ranks SLB’s overall governance on June 1, 2024, as an excellent 1, with sub-scores of audit (6), board (2), shareholder rights (4), and compensation (1). On the ISS scale, 1 represents lower governance risk and 10 represents higher governance risk.

Shorted shares were 2.0% of floated shares on May 15, 2024, and insiders own a tiny fraction (0.19%) of the outstanding stock.

At 1.58, the company’s beta is quite high given its large size: its stock moves directionally with the overall market but with far more volatility. However, this reflects the large supply and demand uncertainties in the global oil services sector, even for a company as big as SLB.

On March 31, 2024, much of SLB’s stock was held by institutions, in some cases representing index fund investments that match the overall market. The five largest institutional holders were Vanguard (9.4%), BlackRock (7.8%), Capital World (6.2%), and State Street and T. Rowe Price, both at 6.0%.

All but Vanguard are signatories to the Net Zero Asset Managers initiative, a group that manages $57 trillion in assets worldwide and which limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner.

SLB

Financial and Stock Highlights

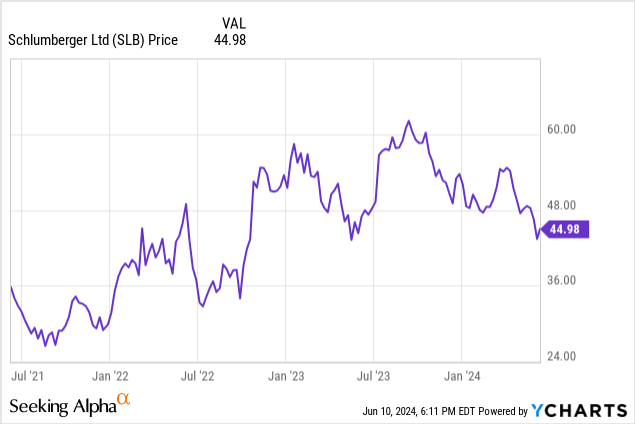

At the June 10, 2024, closing price of $44.98/share, SLB’s market capitalization is $64.3 billion.

The 52-week price range is $42.77-$62.12 per share, so the closing price is at the low end of the range, registering at 72% of the 52-week high and 68% of the average one-year target of $66.41/share.

Trailing twelve months (TTM) earnings per share (EPS) is $3.00 for a current price/earnings ratio of 15. The average analysts’ estimates for 2024 and 2025 EPS are $3.52 and $4.16 respectively, giving a forward price/earnings ratio range of 10.8-12.8

TTM EBITDA, operating cash flow, and levered free cash flow were, in order, $7.5 billion, $6.6 billion, and $3.0 billion.

TTM return on assets and equity were 7.8% and 22.0% respectively.

On March 31, 2024, SLB had $25.9 billion in liabilities, of which $10.7 billion was long-term debt, and $47.9 billion in assets, giving it an improved liability-to-asset ratio of 54%, down from 58% at the last report.

The company’s debt/EBITDA ratio is 1.6 and its debt/market capitalization is 0.19.

SLB’s dividend of $1.10/share yields 2.4%.

SLB has a share repurchase program and bought back $270 million (5.4 million shares) during 1Q24. In its 1Q24 report, the company said it expected to return $3 billion to shareholders in 2024 and $4 billion in 2025 in the form of dividends and buybacks.

Book value per share is $14.51, about a third of the current market value per share.

The ratio of enterprise value to EBITDA is 9.6, just below the maximum of 10.0 or less, which suggests a bargain.

Mean analyst rating is a 2.1, or “buy,” from 37 analysts.

Positive and Negative Risks

SLB’s two major medium-term exposures are to changes in oil and natural gas prices and thus changes in worldwide drilling budgets, and efficiency efforts after the numerous large-scale consolidations, which have and could lead to less drilling and other activity.

As an international operator, SLB has political risk in every country in which it operates, including the US.

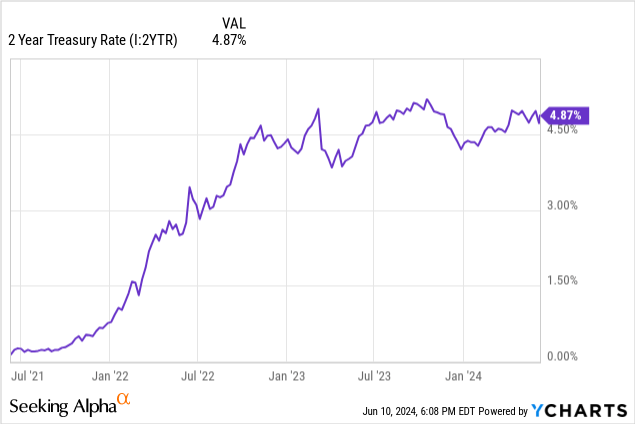

SLB’s dividend yield alone, excluding share repurchases or stock price appreciation, is not competitive with rates for 2-year Treasuries.

Recommendations for SLB

Although SLB has a share buyback program as well as a modest 2.4% dividend, it is not recommended to dividend investors. Dividends from other companies and interest rates on debt securities, and even the less-risky 2-year US Treasury rate, pay investors more than SLB’s dividend.

Despite the current downshift in oilfield services spending as oil and gas companies undergo consolidation, SLB’s growth prospects are good, particularly as large companies turn their long-term growth sights on international prospects, SLB’s strength.

The company has excellent governance scores, and the stock is at the low end of its 52-week range. Positive (value) metrics include a ratio of enterprise value to EBITDA of 9.6, and a forward price/earnings ratio of 10.8-12.8. The upside to SLB’s one-year target price is almost 50%.

Given the move toward offshore and international, the company’s upside potential, and its relative bargain price, I recommend SLB to growth investors interested in globally diversified, large-scale oilfield services. I own SLB shares.

slb.com

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SLB, CVX, XOM, CHK, FANG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I hope you enjoyed this piece. I run a Marketplace service, Econ-Based Energy Investing, featuring my best ideas from the energy space, a group of over 400 public companies. Each month I offer:

*3 different portfolios for your consideration, summarized in 3 articles, with portfolio tables available 24/7 to subscribers

*3 additional in-depth articles = 6 EBEI-only articles;

*3 public SA articles, for a total of 9 energy-related articles monthly;

*EBEI-only chat room;

*my experience from decades in the industry.

Econ-Based Energy Investing is designed to help investors deal with energy sector volatility. Interested? Start here with an initial discount.