Summary:

- Accountant resigns with concerns around the company’s financial integrity and governance.

- Back in 2018, the company settled SEC charges around revenue recognition and related matters.

- There’s a risk of delisting from the NASDAQ.

- A delisting can result in the company being removed from the S&P 500.

Thomas Barwick

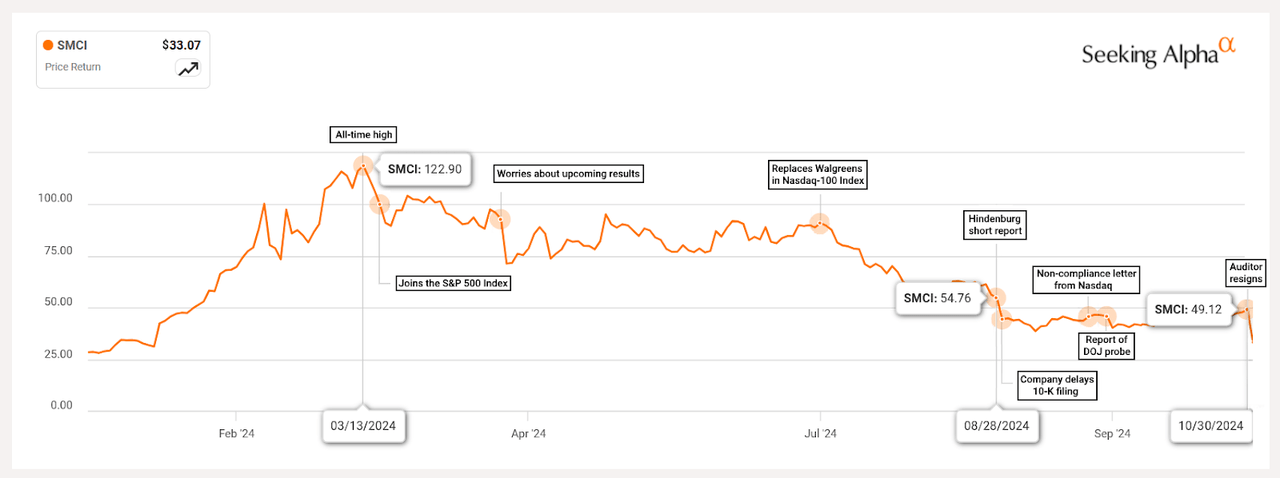

Super Micro Computer (NASDAQ:SMCI) continued an ongoing, more gradual decline with a severe sell-off of 30%+ as its auditor Ernst & Young resigned. The company had already announced it is delaying its annual 10-K filing. This subsequent to a short report by Hindenburg Research. Seeking Alpha actually provides a really great chart with many significant events for the stock here:

history SMCI (seekingalpha.com)

Worryingly, these events are potentially setting the company up for a delisting and potentially even a default, via Seeking Alpha:

“Not only does Ernst and Young’s resignation raise considerable questions about the validity of Super Micro’s current and past financial statements, but it also raises significant questions about Super Micro’s corporate governance and management’s commitment to integrity and ethical values,” Needham noted.

Needham also sees a significant risk of Super Micro defaulting on the company’s Term Loan Agreement with Bank of America.

Something I really don’t like is that Super Micro Computer is giving a business update next week on November 5. Now, if you have some bad news, and you don’t really want to draw a lot of attention to it, you publish on a Friday. However, if there’s a U.S. election coming up, election day is better! I’m not expecting the company to come out on Tuesday and reassure us everything is fine and there is nothing to see here.

The EY resignation letter reads pretty bad (emphasis by me):

“We are resigning due to information that has recently come to our attention which has led us to no longer be able to rely on management’s and the Audit Committee’s representations and to be unwilling to be associated with the financial statements prepared by management, and after concluding we can no longer provide the Audit Services in accordance with applicable law or professional obligations,”

Usually, these resignation letters are exceptional in how little information they contain. This reads to me like they don’t think they can trust the company to deliver correct data.

What really matters in the short term is whether SMCI will get delisted (possibly within the next 60 days) and how bad any potential historical misstatements will turn out to be.

Shockingly, this is not the first time this is happening with SMCI. In 2018, the stock was also delisted from the NASDAQ. The SEC charged SMCI with some of the following but it was settled and SMCI didn’t admit to it:

…According to the SEC’s orders, Super Micro executives, including Hideshima, pushed employees to maximize end-of-quarter revenue…

…Super Micro improperly and prematurely recognized revenue, including by recognizing revenue on goods sent to warehouses but not yet delivered to customers, shipping goods to customers prior to customer authorization, and shipping misassembled goods to customers. The orders also find that Super Micro misused its cooperative marketing program, which entitles customers to reimbursement for a portion of cooperative marketing costs. According to the orders, Super Micro improperly reduced the liabilities accrued for the program in order to avoid recognizing a variety of expenses unrelated to marketing, including for Christmas gifts and to store goods…

…Super Micro’s CEO, Charles Liang, while not charged with misconduct, is required to reimburse the company $2.1 million in stock profits

A quick word about the CEO. I have the impression this is a driven founder/operator. He’s actually a major shareholder (just short of 10%), which is a major positive. But he also has an unusual compensation package, with virtually no base salary and bonuses tied to very aggressive revenue and share price targets.

Ultimately, the stock was relisted on the NASDAQ in 2020.

There’s also a lawsuit by a former employee with allegations the company isn’t always properly recognizing revenue. According to the WSJ:

Luong’s lawsuit alleges that the company improperly recognized revenue from 2020 to 2022, including booking sales that had not been completed and shipping incomplete equipment to customers.

This adds up to a few reasons why I would avoid the company for now:

1) I do think the odds are high that the company will end up restating past financials (because of the strongly worded accountant’s resignation, CEO incentive package, employee allegations and the history of settlement with the SEC)

2) I do think it’s highly likely the company will get delisted from the NASDAQ. This seems very hard to avoid. A new auditor needs to be found, and a substantial amount of work needs to be done.

3) In my opinion, the company is highly likely to get thrown out of the S&P 500 (SPY) in the next 6 months.

It is currently at the bottom end of the market cap range that’s required for inclusion. Not meeting the index criteria isn’t necessarily enough to get thrown out of the S&P 500 by itself. At the end of the day, it is (in most cases) a discretionary decision by the S&P 500 commission. Having said that, I don’t know of a stock that was removed from the NASDAQ or NYSE that remained in the S&P 500 afterwards. When a stock is removed from the NASDAQ or NYSE, it likely starts trading over the counter. If a stock is moved to the pink sheets or the bulletin board, the stock is automatically removed from the S&P 500 (see documentation here). The bulletin board has been replaced. There are different levels of OTC-traded stock (see here). The best categories are OTCQX and OTCQB. But to qualify for these, financial statements need to be current. That would leave the pink sheets or grey market. If this relegation is avoided, it is entirely up to the S&P 500 committee whether it wants to throw the company out. The committee does want to avoid a lot of turnover, but there are a few criteria like the following (from the earlier linked documentation):

Security Filing Type. The company issuing the security satisfies the U.S. Securities Exchange Act’s periodic reporting obligations by filing certain required forms for domestic issuers, such as but not limited to: Form 10-K annual reports, Form 10-Q quarterly reports, and Form 8-K current reports.

Exchange Listing. Must have a primary listing on one of the following U.S. exchanges: • NYSE • Nasdaq Capital Market • NYSE Arca • Cboe BZX • NYSE American • Cboe BYX • Nasdaq Global Select Market • Cboe EDGA • Nasdaq Global Market • Cboe EDGX

The committee could ignore these, but S&P has to protect its own product as well (the index).

To counterbalance my negativity, I’d like to add it also seems likely to me that SMCI will still be a reasonable business after potential restatements. Mainly because I have the impression this is a real business, making real products with a fast-moving, hard-charging founder/operator at the helm.

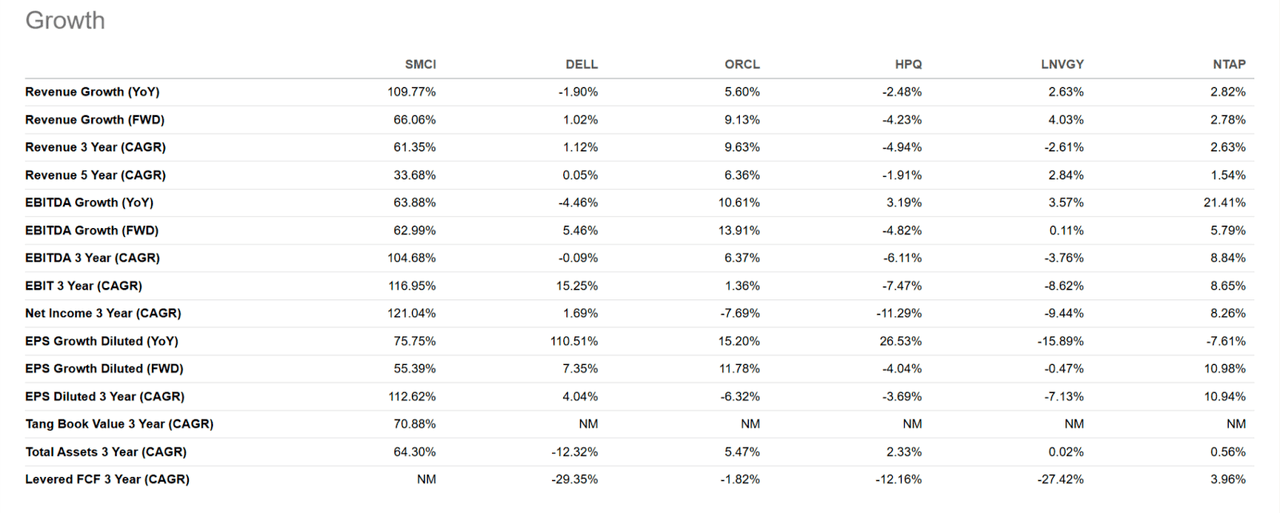

The valuation picture is starting to look compelling. SMCI has been fully capitalizing on the AI boom and its growth figures seem to reflect that. This is a very different picture when compared to other firms that put server racks together (among other things):

growth rate SMCI (seekingalpha.com)

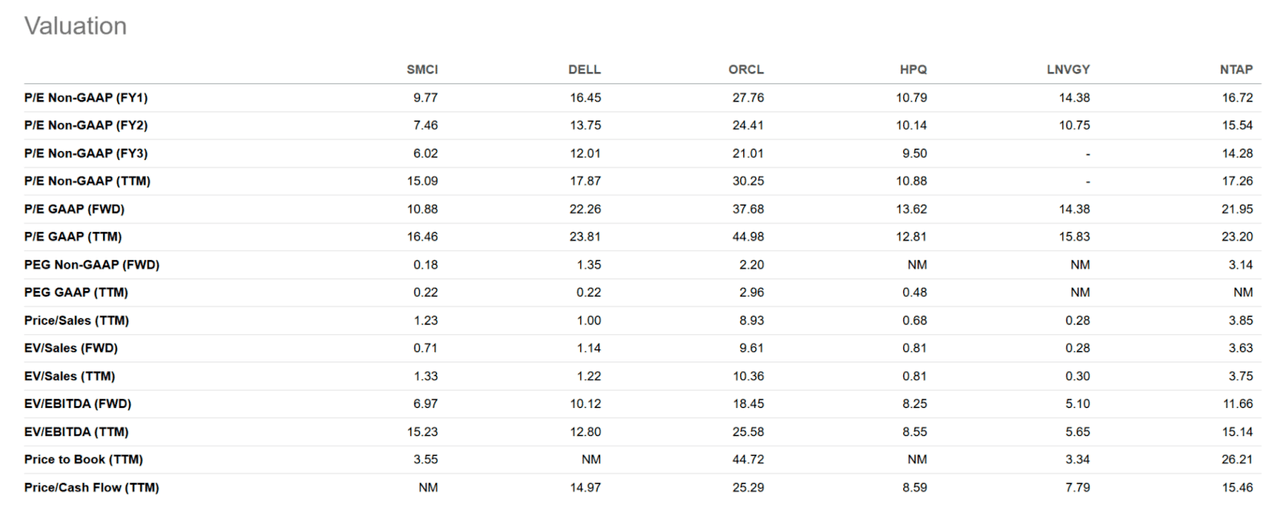

I think it’s necessary to see the discrepancy in growth numbers to appreciate the valuation discrepancy:

Valuation SMCI (seekingalpha.com)

Of course, all of the above numbers are based on currently available financials, while the accountant has just resigned. I’m still providing it for two reasons. Reason 1) the relatively high revenue growth, 2) If the figures are only modestly overstated, there is a lot of upside left.

The fastest grower over the past 5 years is Oracle (ORCL) at around ~5%. Per these figures, SMCI is growing at a CAGR of 33%. Oracle trades at an EV/sales multiple of 10x, SMCI at 1.33x. Even though the valuation is potentially attractive, I think odds are high that we’ll see a lot of painful news coming through in the next few months. Mainly because of the high likelihood of delisting/the company getting thrown out of the S&P 500. That in turn would lead to a lot of forced selling because so many funds and ETFs are tied to that index and will have to sell indiscriminately on a delisting. In conclusion; sell now and potentially buy lower.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.