Summary:

- Snap Inc.’s Q1 ’24 guidance for DAUs and revenue fell slightly below consensus, but disappointed investors missed the progress on returning towards 15% growth.

- Snapchat+ is growing towards the 14 million target for the end of 2024 with an updated number for the end of Q1 providing a catalyst.

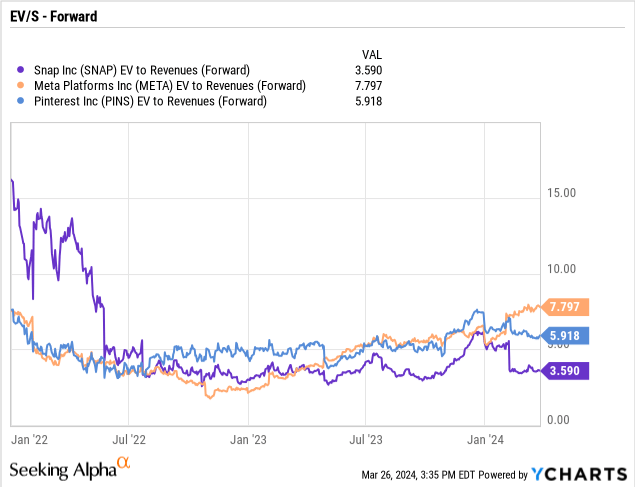

- The stock only trades at 4x EV/S targets, a discount to social media peers.

Vivek Vishwakarma/iStock via Getty Images

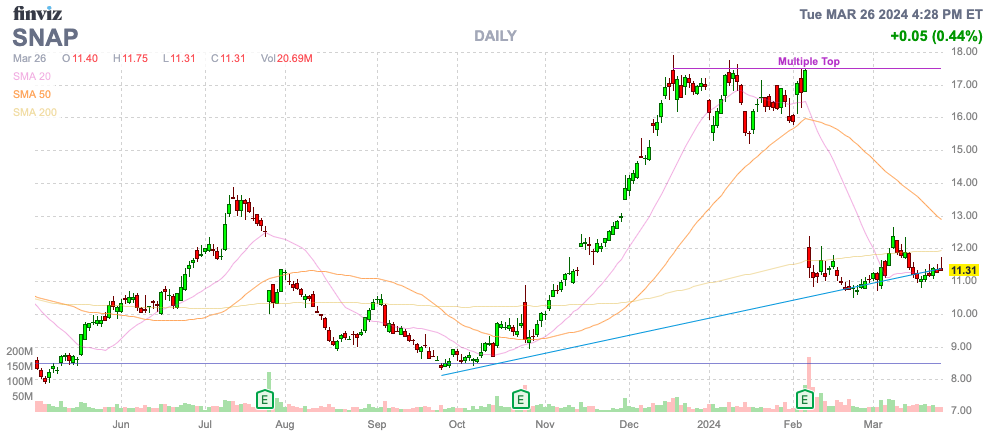

Snap Inc. (NYSE:SNAP) remains the most volatile player in the social media space. The Snapchat operator soared on exiting subscription news and a bounce back in sector stocks, yet Snap plunged back when reporting Q4 ’23 numbers that missed the high-end expectations. My investment thesis remains ultra Bullish on the stock, which is down ~$6 from the yearly highs while subscriber growth continues to bolster a more positive long-term view.

Source: Finviz

Q4 Wasn’t That Bad

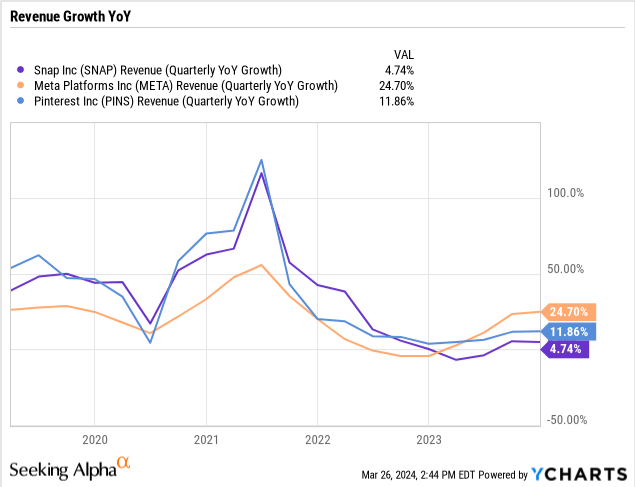

Snap slumped following Q4 results, but the company did grow revenues 5% YoY to reach $1.36 billion. The social media business did miss consensus estimates by a meager $20 million, while peer Meta Platforms (META) soared beyond estimates to reach 25% growth.

As well, the market wasn’t fond of the Q1 ’24 guidance, with the following key metrics:

- Daily Active Users, or DAUs, will be approximately 420 million in Q1

- Revenue of $1,095 million to $1,135 million, YoY growth of 11% to 15%

- Adjusted EBITDA will be between negative $55 million and negative $95 million

Investors were disappointed in DAUs only growing 6 million sequentially to 420 million for nearly 10% growth YoY, and revenue guidance falling slightly below consensus. Analysts were up at $1.2 billion and the midpoint guidance is at $1.17 billion.

The ultimate key to rewarding shareholders is the actual growth rate, not the amount above or below analyst estimates. Snap saw revenue growth return to the 5% range in the last couple of quarters, with guidance forecasting a return to double-digit growth rates.

The company is in full turnaround mode after the social media ad market dipped in the prior year. As highlighted before, Snap saw a much larger boost during Covid and has seen a tougher time returning to growth due to this higher hurdle and the bigger impacts from the Apple (AAPL) device ID privacy change.

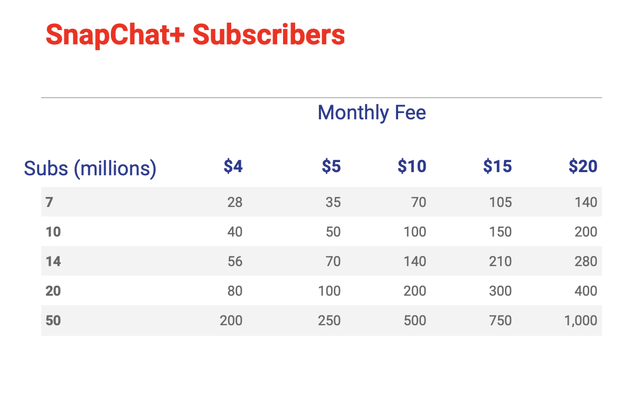

While Snap continues to improve direct response advertising impacted by the Apple ID privacy change, the company is building a strong subscription business. At the end of 2023, the company reported 7 million Snapchat+ subscribers paying $3.99 per month for special features.

Snap forecasts reaching 420 million DAUs in Q1 and has already topped 800 million MAUs. The social media platform has a long runway for boosting the subscription goal to 14 million Snapchat+ users by year end, which amounts to only 3% of DAUs.

The subscription service ended the year with a reported annualized revenue run rate of $249 million. The number doesn’t add up to 7 million Snapchat+ subscribers at $4 per month producing $336 million in recurring revenue, though Snap management might have just annualized the revenue generated in Q4.

Snap went from 5 million to 7 million subscribers just in the last quarter of the year. The company could easily have 8 to 10 million subscribers at this point towards the end of Q1, with the below chart highlighting the monthly revenue based on the subscriber level and monthly fee.

Source: Stone Fox Capital calculations

Our view remains that Snap has the potential to ultimately hike the monthly fee. With a $5/monthly fee, Snapchat+ could generate $70 million in monthly revenues and $840 million in annual revenues by reaching the 14 million subs versus the internal target of hitting $500 million in reported subscription revenue for 2024.

Snap remains one of the better AR and AI plays with features built into the social messaging platform. The company has the ability to build new features to make Snapchat+ even more valuable to subscribers.

Load Up On Discount

Snap trades at a discount to the other social media companies now. Not a huge surprise, valuations usually follow revenue growth. Snap has seen growth trend below Meta Platforms and Pinterest (PINS) leading to the stock now trading at below 4x EV/S targets, while even Pinterest is up at 6x and Meta is closer to 8x EV/S targets.

A prime reason for the weakness was the massive adjusted EBITDA loss forecasted for Q1. Most of the guided loss of $55 to $95 million appears related to the costs of the work force reduction announced in Q1 costing up to $75 million.

Snap cut ~10% of the work force Q1 ’24. Management apparently saw an improvement in the product productivity after removing layers of management in 2023 and this additional employee reduction expands on those efficiency moves.

The market likely read too much into further cost cuts and the slight revenue misses. Snap is taking a huge step up in revenue growth in Q1 ’24 and a lot of the cost structure is fixed. The company generated solid operating cash flow growth in 2023 of $247 million while absorbing higher infrastructure costs.

The higher revenue growth in 2024 should help absorb the additional cost hits in 2023 and when combined with the cost cuts lead to strong cash flows in 2024 along with Snap actually reporting a profit this year, even after absorbing an estimated $0.05 loss in Q1, apparently mostly related to one-time costs.

Snap has seen the market cap dip below $20 billion with a revenue target for topping $5 billion. The social messaging company should be on a path to topping $1 billion in subscription revenues for 2025 making the stock far more attractive to investors over the long run.

Takeaway

The key investor takeaway is that investors should again use the dip in Snap Inc. to load up on shares. The market constantly gets too high and too low on the stock, providing the opportunity to buy weakness knowing the subscription business is building a long-term recurring revenue stream more attractive to the market than just relying on the volatile ad market. Not to mention, a TikTok ban would provide a major catalyst to the business not even forecast into this bullish case.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SNAP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market to end Q1, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.