Summary:

- Snap Inc. likely trades at a lower valuation multiple due to inconsistent growth despite strong Q1 ’24 results.

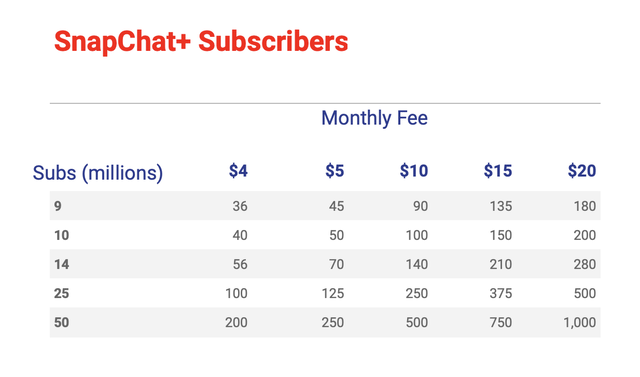

- The Snapchat+ subscription service with AI features is a game changer, with a corporate goal to reach 14 million subscribers by year-end.

- The stock is undervalued compared to social media peers, offering up to 60% upside potential, though a possible dip to sub-$12 is a risk.

Vivek Vishwakarma/iStock via Getty Images

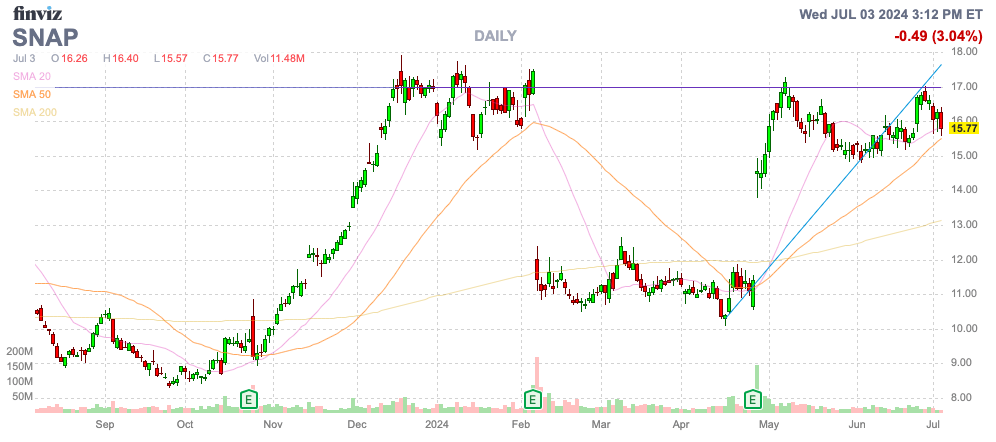

Due to inconsistent growth, Snap Inc. (NYSE:SNAP) likely trades at a lower valuation multiple now than in the past. The social messaging company is back in growth mode, yet the market doesn’t appear too interested in aggressively investing in the promising growth story, despite the game-changing subscription model. My investment thesis is ultra-Bullish on the stock, though the company has a history of disappointing the market and another drop to $12 would be an opportune time to load up.

Source: Finviz

Misunderstood Growth

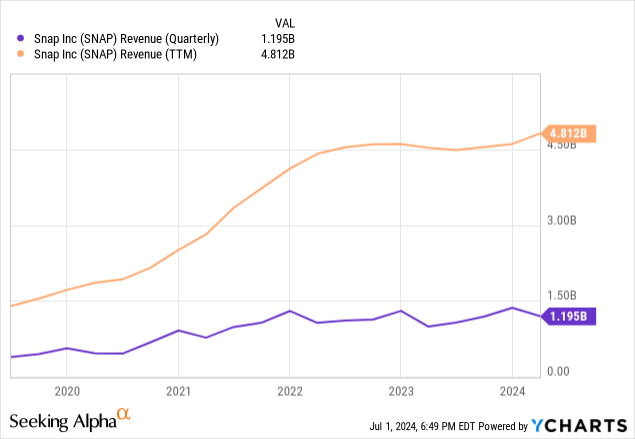

As with any company that benefited from the Covid stay-at-home boost, the following period faced tough comps. Snap was a prime example of the Covid beneficiary, with sales soaring from just above $1.5 billion heading into 2020 to over $4.5 billion when peaking in 2022. The social media company saw Q2 ’21 sales soar an incredible 116% YoY.

Naturally, Snap had a tough time topping those difficult comps in 2023. Yet, the company just hit 20% growth again in Q1’24 while smashing estimates by $74 million.

Oddly, the stock bounced back to resistance around $17, but the market hasn’t been overly convinced Snap is back for good. Even despite strong growth from the subscription service Snapchat+.

The subscription service boosted by AI features is a huge game changer. Snap reported monthly subscribers of 9 million in Q1 with the plan to end the year with 14 million subscribers, providing the following revenue opportunities.

Source: Stone Fox Capital calculations

Snap reported Q1 other revenue of $87 million in a sign of how Snapchat+ revenues are starting to add up. The company can top $200 million in quarterly revenues by reaching the 14 million sub-target for year-end and hiking the monthly fee to $5.

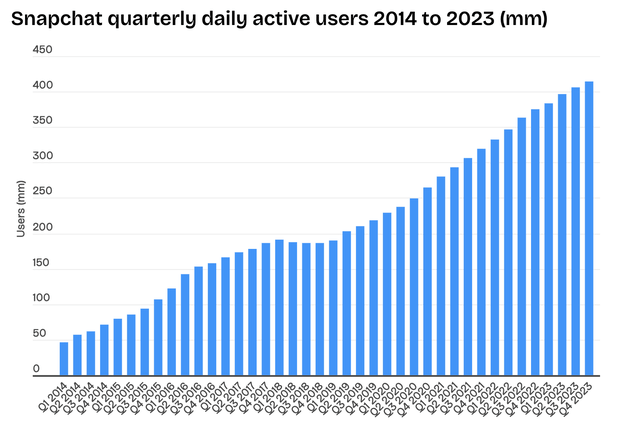

Snap has seen substantial growth in daily active users (“DAUs”) over the last few years, regardless of the revenue issues. The company ended Q1 with 422 million total DAUs and has growth substantially from the levels of hardly above 200 million DAUs to start 2020 due to a large user in India.

The large user base provides a steady stream of new subs for Snapchat+, though one has to wonder how many users beyond the nearly 200 million users in North America and Europe will ever afford a $4/month subscription.

At the current growth rate of 10% annually, Snap would reach 500 million DAUs around the start of 2026. The company only needs 5% of total DAUs to subscribe to Snapchat+ while hiking the monthly price to $5/month to generate nearly $1.5 billion in annual revenues on the 25 million subs.

Snap not being as reliant on ad revenues would be positive for the stock market, but the above data highlights the company hasn’t actually done so bad. The biggest issue was Covid volatility as much as company operational issues.

Odd Discount

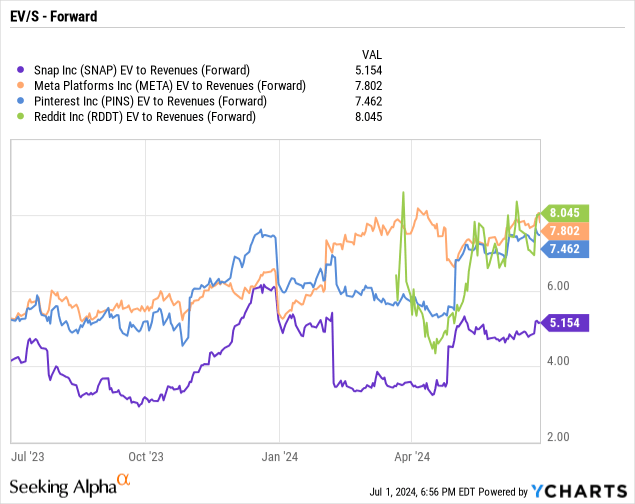

Snap reported Q1 ’24 sales surged 20% in a sign the company is finally overcoming the Covid comps and solving the Apple (AAPL) privacy issues. Meta Platforms (META), Pinterest (PINS) and Reddit (RDDT) all grew at a faster chip, but Snap closed the gap significantly in the March quarter.

Snap is cheap here compared to social media peers at only 5x EV/S targets. The group averages a nearly 60% higher multiple at 8x.

The big opportunity is for Snap to beat the meager growth targets going opportunity. Meta is targeted to reach $160 billion in annual sales and grow at a nearly 18% clip this year followed by years of 10%+ growth, while Snap is only forecast to top those growth rates slightly.

In essence, Meta will add over $20 billion in annual revenues, while Snap is only forecasted to top $5 billion in sales this year alone. The social messaging company wouldn’t even add $1 billion in additional annual revenues going forward.

Snap should’ve ended Q2 with around 10 to 12 million subs. Even with just 10 million subs, the social messaging company should top $100 million in quarterly subscription revenues for the first time, with the potential to end the quarter with a nearly $150 million run rate.

The company appears unlikely to ever get a boost from a TikTok block, with former President Donald Trump now promoting the concept of not banning the Chinese owned platform. Though, a TikTok ban does provide a major catalyst for the business with a major player out of the social media space.

Takeaway

The key investor takeaway is that Snap Inc. is a huge bargain here, trading at only 5x EV/S targets. The stock would have up to 60% upside to just match the EV/S multiples of other social media stocks.

The big opportunity is for investors to scoop up Snap on another possible dip to the sub-$12 levels, with the stock unable to blast through strong resistance around $17 despite the big quarter and surging subscription revenues.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SNAP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start July, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.