Summary:

- Shares of Snap Inc. have been on a roller coaster since our initial ‘Sell’ article at the end of 2023.

- Despite profitability challenges, green shoots in user growth, engagement, and ad tech make SNAP shares look more attractive than they have been in a while.

- Snap’s user base is criminally undervalued, especially as evidence mounts that monetization is moving in the right direction.

- We’re upgrading SNAP to ‘Buy’ on the belief that the stock’s multiple is set to expand dramatically in the coming years.

10’000 Hours/DigitalVision via Getty Images

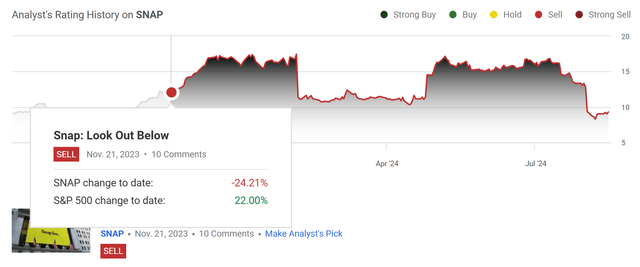

In November of 2023, we wrote an article on Snap Inc. (NYSE:SNAP) that was not particularly positive.

Titled “Snap: Look Out Below“, the article talked at length about how we thought the company was significantly overvalued based on operational results, and that the recent stock rally was too extended on a technical basis.

Since then, shares have been on a roller coaster ride, which has made our prediction’s accuracy swing with the seasons. However, where things sit now, the stock is down a quarter from our initial sell rating, while the market has rallied nearly as much to the upside:

We’ll call that a win.

Over time, though, our view on the company has changed somewhat.

While SNAP still has a long way to go in terms of profitability, there are a number of green shoots around monetization, engagement, and growth which could foreshadow serious long-term upside for investors.

Trading at an attractive valuation, we think SNAP shares actually look like a decent buy, assuming you’re willing to ride out the inherent volatility that comes with the company’s quarterly earnings reports.

Today, we’ll break down the main reasons why we’ve become bulls on SNAP, and explain why we see the stock potentially heading back to $50 over time.

Sound good? Let’s dive in.

Snap’s Financials

On the face of it, SNAP is actually quite a simple firm.

The company runs a core social media platform called ‘Snapchat‘, along with a few ancillary businesses that compliment SNAP’s aim of improving people’s lives through visual communication.

In our view, it’s a bit of a ‘hokey’ vision, which makes it easy to dismiss, but we also think there’s something to it. People love communicating with the people they love, and doing so visually can be a lot more personal than emailing or texting alone.

The company’s success in growing users over time is a testament to this fact.

Financially, the company also has a similar level of focus and simplicity.

SNAP’s revenue is mostly generated from selling advertising inventory to marketers, along with some Snapchat+ subscription revenue that has been growing quickly as of late.

The company’s balance sheet is sound, and SNAP has significant cash and receivables & only around $3.6 billion in long-term debt.

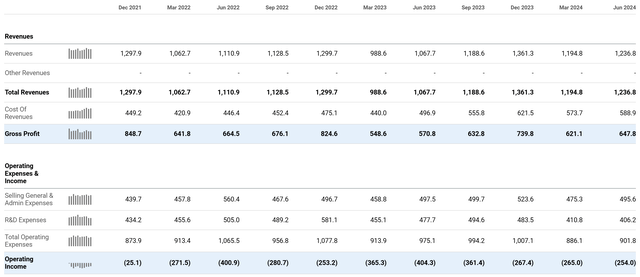

There is some tension around the company’s income statement, which looks terrible on an operating basis:

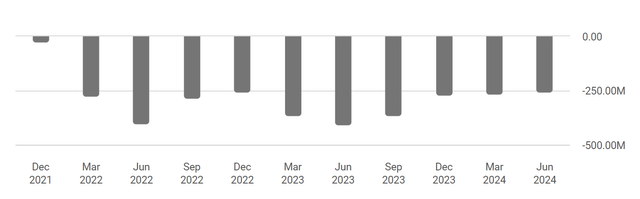

As you can see above, operating margins mostly hover between -20% and -30% in any given period, and the company looks like its losing money quarter after quarter:

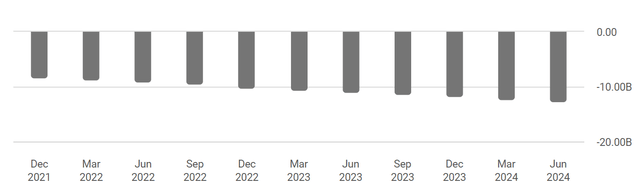

Retained earnings are negative -$12.5 billion, which shows that the company has made basically zero progress on the profitability front over time, preferring to focus on revenue growth:

However, the company actually is profitable on a cash basis for the most part, only appearing to be so negative based on high levels of stock-based compensation, which skew the picture considerably:

While things may not be as bad as feared, we’re not fans of this arrangement, as it kicks the can down the road for management.

Functionally, you can’t stop paying people in SBC; otherwise you’d suffer from high turnover. However, you also can’t continue posting negative quarter after negative quarter, as continually diluting shareholders isn’t a path to long-term success.

Gross margins aren’t the problem, it’s SG&A and R&D which are sucking up a huge portion of the budget.

Management is likely aware of this tension and has been working to fix it by improving revenue growth and profitability.

Snap’s Green Shoots

As we said before, SNAP is a simple company, and there are really only two key metrics that matter when it comes to improving things on the financial front: Users, and Monetization Per User.

Broadly, there are 4 reasons we think SNAP is headed in the right direction on these two important metrics:

1.) Demographics – this is the biggest reason, but SNAP has actually done a good job growing and retaining users over time. Initially, there were a lot of fears that SNAP’s users would monetize at lower rates due to their lower purchasing power, which has been largely true.

However, only 20% of SNAP users at present are under 18, which means that the company’s fortunes should rise with the buying power of the increasing number of adults using the platform.

[We] serve more than 75% of 13 to 34-year-olds in over 25 countries. As Snapchat has grown, our community has grown with us, and approximately 80% of Snapchatters are above the age of 18.

To us, high drop-off following school / college has been a large concern historically, but SNAP is proving, quarter after quarter, that user retention and growth for younger cohorts is better than expected.

2.) Engagement – While SNAP’s demographic tailwinds should support higher monetization over time, higher per-user engagement and time spent within the app has also increased, which functionally increases the amount of ad inventory which can be sold.

Not only has time spent increased, but users are sending more snaps than ever, which is indicative of increased entrenchment on the part of users. This is bullish for ARPU, in our view:

We also continue to broaden and deepen engagement with our content platform in Q2, with global content viewers growing 12% year-over-year, and global time spent watching content growing 25% year-over-year.

In addition, we are investing to enhance iOS app performance by making improvements to battery management, app and screen loading latency, and camera quality… These improvements have contributed to all-time highs in the number of daily active users sending Snaps in every region, which is an important input to sustained daily engagement.

Thus, we see continued strength in SNAP’s ability to create a quality social media product that users love and continue to use. The growth in Snapchat+ is a part of this as well.

3.) Improving Ad Tech Stack – On the business side is where things have historically fallen down a bit.

Sure, SNAP’s user base has less buying power, but SNAP’s tools for advertisers have historically been inferior for advertisers seeking solid ROAS, which has really been the core problem for monetization. SNAP’s advertising experience has historically compared poorly to Meta (META), which is the ‘go-to’ gold standard of targeting.

Thankfully, we’ve seen some progress on this front as well, with improvements to SNAP’s core advertising engine and targeting capability:

We continued to make progress on three foundational advertising platform initiatives, including larger ML models, improved signals, and more performant ad formats.

For app-based advertisers, we have invested in improvements across the entire ad stack. We also expanded 7-0 Optimization to app install and app purchase and, after testing showed consistent improvement in cost-per-install and cost-per-purchase, we recently began scaling these products with our advertising partners.

We have also begun testing Value Optimization, which allows advertisers to bid on the value of purchases, and we are seeing encouraging early results.

By all accounts, META’s ad platform is still better for advertisers overall, but there’s no doubt that SNAP is making progress.

4.) Future Proofing – Finally, something stuck out to us when we were re-reading the quarterly report and transcript, which was a massive increase in AR ad performance.

Here’s what SNAP management had to say about this:

Our sponsored AR advertising solutions offer marketers the opportunity to leverage unique and engaging augmented reality experiences that lift the measurable performance of their brand campaigns. Specifically, research has shown that campaigns that pair AR Ads with Video Ads on Snapchat deliver 1.6x ad awareness lift when compared to Video Ads alone.

Research from our partnership with OMD and Amplified Intelligence found that Snapchat campaigns that include AR in their mix drive 5x more active attention compared to industry peers.

While it’s easy to see SNAP as a less performant advertising platform due to inferior targeting capabilities, in some respects, they are ahead. SNAP’s user cohort clearly feels much more comfortable using & interacting with AR on a daily basis than META’s, for example, and now we’re finding out that AR advertising formats drive better results per dollar of ad spend vs. baseline.

We’re not sure how large this will get as a percentage of overall revenue for SNAP, but the company has consistently innovated on the UX front, which has led to this interesting data, which we think bodes quite well for the company.

Put this all together, and we’re actually quite bullish on ARPU over the short, medium, and long term.

But how does this translate to SNAP getting out of the SBC stalemate they’re currently in?

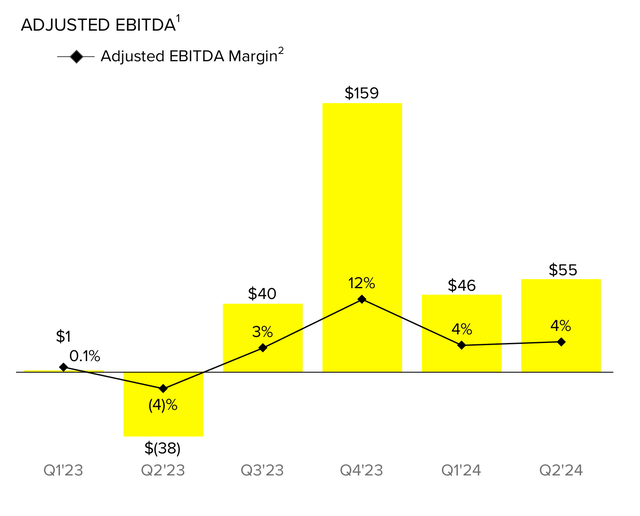

In short, it’s hard to see because of the high costs, but dramatic increases in revenue, like in Q4, actually drive MUCH higher EBITDA, which indicates that SNAP has more operating leverage than expected, as you can see below.

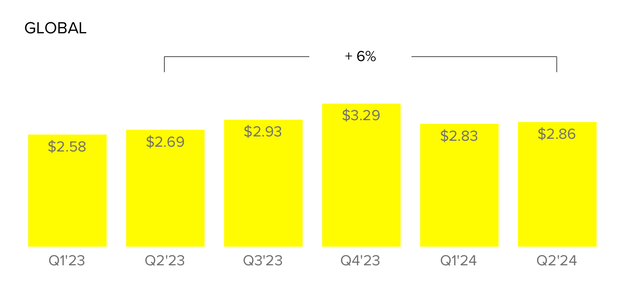

Here’s ARPU (note the increase in Q4):

Now, see how that increase in ARPU translates to dramatically improved EBITDA:

If SNAP can drive ARPU higher without expanding the fixed cost base much, then the company could become dramatically more profitable over time.

Given the green shoots we’ve just covered, this appears possible, if not likely.

Snap’s Valuation

If SNAP can reach sustained profitability, then we think the stock looks dramatically undervalued.

Let’s use META as a point of easy comparison, as the market leader in the space and really one of the only other scaled competitors for digital attention in this day and age, aside from Elon Musk’s ‘X’, GOOG‘s YouTube, and Reddit (RDDT).

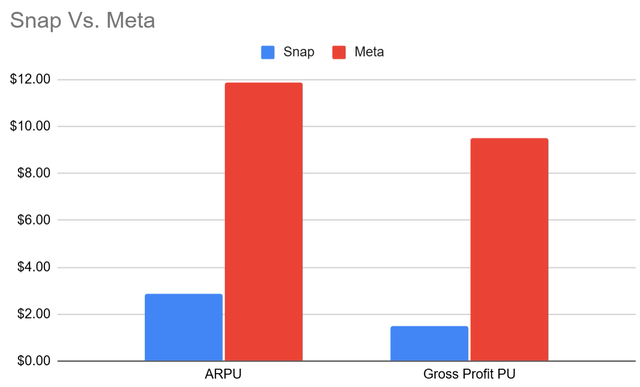

Right now, META has significantly higher ARPU and Gross Profit Per User than SNAP, which makes sense given the superior targeting and demo advantages we discussed earlier:

On percentage terms, SNAP’s per-unit costs of serving content to users are higher than META’s, which also has economies of scale and less compute-heavy content mediums to work with. This instantly puts a cap on comparing SNAP to META in an ‘If SNAP was valued like META’ argument.

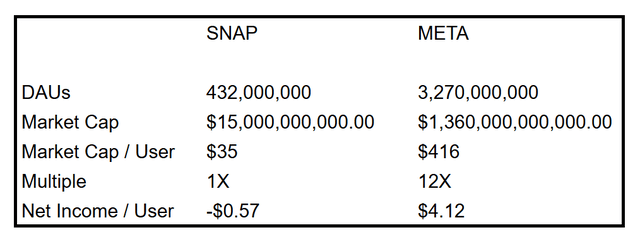

However, the valuation per user right now seems a bit stretched for META:

On a per-user basis, META’s users are worth roughly 12x SNAP’s.

You can see that SNAP’s users are valued roughly 3 years out in terms of ARPU and terminal value, and META’s are much more valuable, valued roughly 10 years out in terms of ARPU and terminal value.

This makes sense to some degree, given that SNAP loses nearly $0.60 per quarter per user, and META makes $4.12 per quarter per user. From this angle, SNAP’s valuation actually seems more ‘generous’, but it’s important to remember that the market is giving the company credit for building up such a large user base ‘asset’ that could eventually produce significant profit.

On the other side, though, SNAP’s path to generating positive net income per quarter doesn’t appear that difficult if the company can continue growing revenues and shrinking spend.

If Evan Spiegel and management can achieve even $100 million per quarter in net income, then we see SNAP’s valuation jumping from the ‘1X’ it is now, to closer to ‘4X’ vs. Baseline, and only 1/3rd of META’s. Remember that ‘baseline’, right now, is incredibly depressed given the poor reaction to earnings two weeks ago.

If you combine this potential multiple expansion with the top and bottom-line growth that would have to occur for SNAP to get there, then we think that SNAP has significant upside of more than 400% towards $50 per share, which would work out to a $75 billion dollar valuation.

The company has been here before in terms of the stock price, and it wouldn’t surprise us to see the company hit this level again in the future:

We understand that this projection may seem a bit aggressive, but SNAP’s multiple, in our view, has the built-in assumption that the company will never be more than basically breakeven on a per user basis. Valuing SNAP’s users at only 3x ARPU is incredibly cheap, and we anticipate that this multiple could re-inflate in very short order if and when the company finally gets over the fixed cost hump.

It’s very difficult to estimate when this could happen, but it’s worth picking up some shares now in anticipation of this opportunity.

Snap Risks

Obviously, there are risks to investing in SNAP as well.

For starters, the company may never actually produce profit, which would be a complete failure of everything we’ve posited in this article.

Green shoots may not be enough to power revenue higher than creeping operational costs, and the stock may remain stagnant forever.

Secondly, the company’s stock is wildly volatile due to the aforementioned tension between profitability and SBC. Management is walking a tightrope trying to get the company to profitability without sacrificing turnover, and slight swings in either direction have wild implications for the stock on a quarterly basis.

Strap in for earnings if you’re prepared to go on this ride.

That said, between these, in our view, the valuation really ameliorates a lot of the risk. With a user base of nearly half a billion DAU, it’s hard to see the company being worth any less than $15 billion on a nominal basis.

Any cheaper, and it seems likely that the company could be an acquisition target. This isn’t feasible, really, as Spiegel controls the company and it doesn’t seem like he’d sell out, but it gives us a reasonable ‘value floor’ from a broader market frame.

Summary

Ultimately, we think that investing into SNAP at this price looks like an attractive move, all things being equal. We see massive upside in shares if the company finally manages to enter the black, and the valuation right now, at 3x ARPU, looks very mispriced.

The stock is quite volatile, which means that a smaller position might be optimal, but nonetheless we’re upgrading our SNAP rating to ‘Buy’ from ‘Sell’.

Good luck out there!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNAP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.