Summary:

- Snap reported very impressive earnings for Q1, with double-digit top line momentum and improving EBITDA.

- The company’s paid subscription service, Snapchat+, showed consistent growth, adding 2 million new paid subscribers in the last quarter.

- Snap’s outlook for Q2 is favorable, with potential year-over-year revenue growth of up to 18% and positive adjusted EBITDA.

- Shares have a ton of revaluation potential.

J Studios/DigitalVision via Getty Images

SNAP (NYSE:SNAP) submitted a solid earnings sheet for the first fiscal quarter on Thursday after the market closed that included double-digit top line momentum, improving monetization and consistent growth for the company’s paid subscription service Snapchat+. Snap also beat estimates and submitted a very strong outlook for the second fiscal quarter… which caused shares of the social media company to take off after earnings and surge 25%. Since shares of Snap have not yet fully recovered from the Q4’23 earnings-related drop-off, I believe the social media company continues to make an excellent value proposition for growth investors!

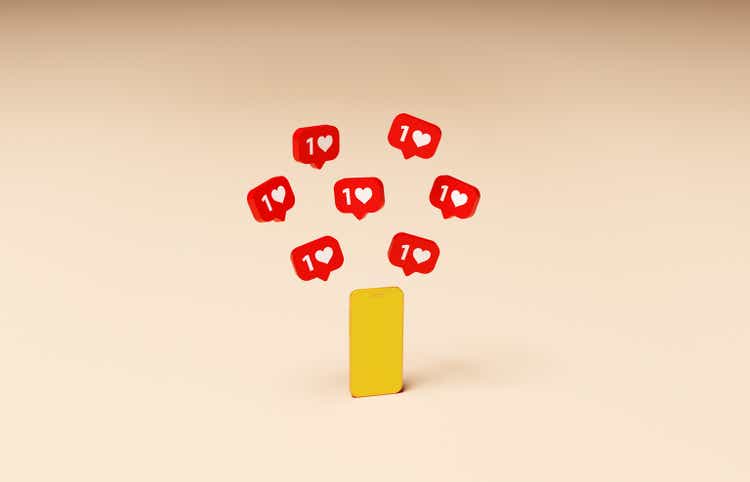

Previous rating

I rated shares of Snap a strong buy in February after the company reported disappointing Q4’23 earnings that created a massive gap in Snap’s price chart: Be Greedy When Others Are Fearful. Shares have increased 21% since with all of the gains being due to Friday’s sharp price increasing following earnings. Snap, however, really delivered a very strong Q1’24 earnings report that showed strong revenue growth, improving profitability and a growing user base… which I will discuss in this article. I also take another look at Snapchat+ as well as Snap’s DAU growth and monetization. The outlook for Q2’24 is favorable and shares continue to have upside revaluation potential.

Snap delivers surprise profit, sees strong Snapchat+ adoption

Snap generated revenues of $1.19B in the first fiscal quarter which beat the top line consensus estimate by $70M. The social media company also surprised with a profit for Q1’24… with Snap reporting adjusted EPS of $0.03 per-share while the market expected a loss of $0.05 per-share.

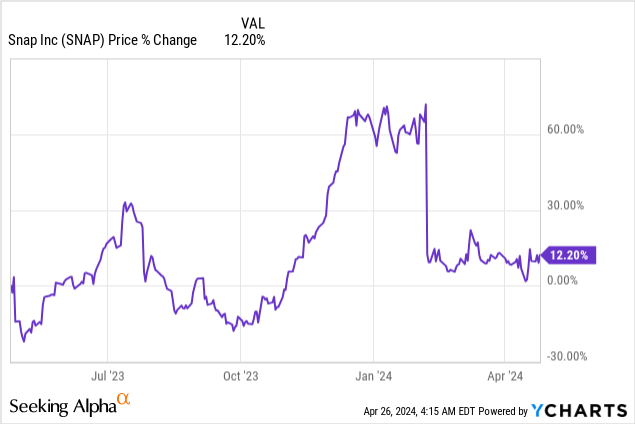

It was overall a very solid earnings sheet for Snap, especially in terms of top line and average revenue per user performance. The social media company had revenues of $1.19B, showing 21% year over year growth. This growth was driven by a number of factors including a broad rebound in digital advertising spending, but also significant user growth for the company in the first-quarter. Snap attracted 39M users in the last year, 8M of which came to the Snap platform just in the last quarter.

Snap

Especially impressive is Snap’s continual momentum in terms of its Snapchat+ business. Snap started its paid subscription service only in FY 2022 at a cheap cost of $3.99 per-month and it has seen consistent adoption by users. After just about two years, Snapchat+’s user base has grown to 9M at the end of Q1’24, meaning the social media company added a massive 2M new paid subscribers just in the last quarter. Since Q1’23, Snapchat+’s user base tripled.

Snapchat+ represents a huge monetization opportunity for Snap, besides allowing the company to diversify its revenue streams. At the current rate of growth, Snapchat+ could have 15M paid users by the end of the year. Snap has been extraordinarily successful in converting regular users to the Snapchat+ offer as it allows for the early testing of features, including AI products. The strong growth in Snapchat+ users highlights that the paid offer is very competitive and with a monthly cost of less than $4 very affordable even for younger users. The low price-point for the subscription is likely the biggest lever for continual user growth in FY 2024 and beyond.

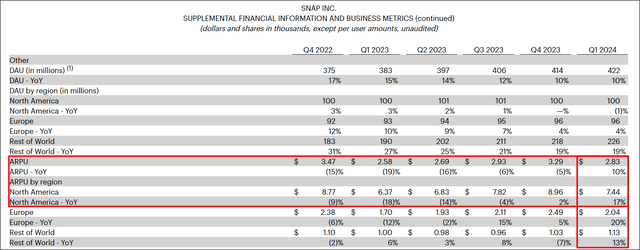

Improving ARPU, especially in Snap’s core market

Snap’s results as well as its outlook for the second fiscal quarter are further supported by monetization improvements, especially in the important North American market which is where the company can strike the most lucrative brand deals with advertisers.

In the first-quarter, Snap generated $2.83 in average revenue per user (on a consolidated basis), showing 10% growth year over year. In the North American market, however, the company’s ARPU grew 70% faster year over year and reached $7.44 per user… which was 3.6X higher than the next important geographic market for Snap, Europe.

Snap

Solid outlook for Q2’24

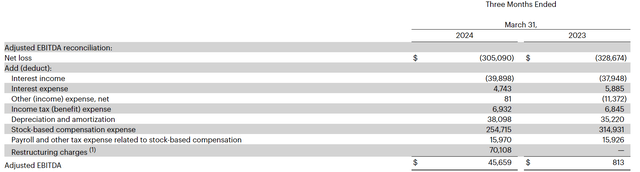

Snap’s outlook for the second fiscal quarter calls for $1,225M to $1,255M in revenues, potentially showing up to 18% year over year growth. Snap also said that it expects positive adjusted EBITDA of $15-45M in Q2’24. Given that the company achieved double-digit revenue growth in Q1’24 on improving fundamentals in the digital advertising market and improved its monetization, I believe Snap even has a good chance of beating its guidance next quarter.

The positive adjusted EBITDA outlook for Q2’24 implies the fourth straight quarter of positive EBITDA margins as well… which suggests that Snap may have turned a corner here in terms of its profitability trajectory. In Q1’24, Snap generated EBITDA of $45.7M, a massive upsurge compared to last year’s $813k EBITDA profit. The improvement in EBITDA is being driven by a strong growth in advertising spending, daily active user growth, improving monetization in Snap’s core market as well as aggressive cost-savings. Snap also added back restructuring charges in the amount of $70.1M that are related to cash severances and Snap benefited from a Y/Y decline in stock-based compensation. The social media company announced a cost restructuring program at the beginning of the year that will see the lay-off of 10% of staff. I expect those restructuring charges to be non-recurring and Snap to be able to return to positive adjusted EBITDA throughout FY 2024.

Snap

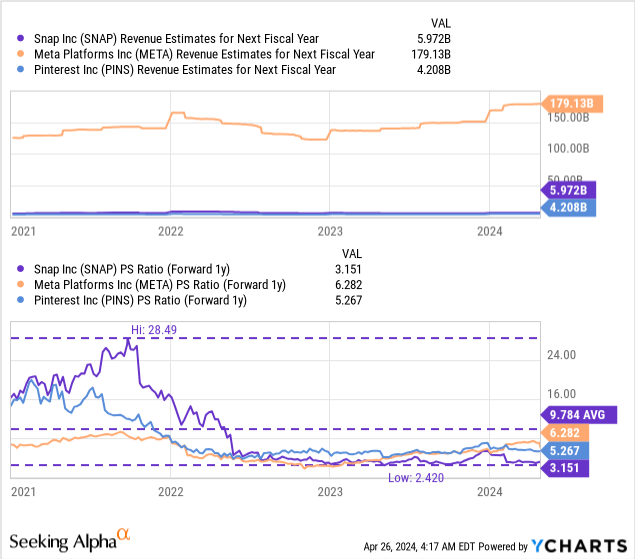

Snap’s valuation

Snap has a P/S ratio of 3.2X which to some may appear as expensive, especially because the company is not yet profitable on a net income basis (which is why a P/E ratio cannot be used). The multiplier is based off of $6.1B in FY 2025 revenues (implying 15% average annual top line growth in FY 2024 and FY 2025). The revenue figures are reasonable to use, in my opinion, as Snap is experiencing a massive acceleration of revenue growth and managed to grow its top line 21% just in Q1’24.

Snap, however, has considerable revaluation potential if the company manages to sustain its current business trends. Companies like Meta Platforms (META) or Pinterest (PINS) trade at higher P/S ratios, but are also already profitable… and in the case of Meta have a significantly higher revenue volume.

But if Snap continues on its current trajectory and monetizes its Snapchat+ services, then I see a path for the social media company to revalue to the industry average P/S ratio which in this case is about 4.9X. This industry average earnings multiplier implies a fair value for Snap of about $18. With Snap also delivering a surprise adjusted profit on a per-share basis, I believe EPS estimates are also going to reset to the upside, potentially further supplying upside breakout momentum.

Risks with Snap

The biggest risk for Snap, as I see, is the platform’s lack of net income profitability. While Snap made a lot of progress in terms of growing its adjusted EBITDA, Snap’s young audience is not spending a lot of money on the company’s products and services which is part of the reason why the social media company is not yet able to post positive earnings. What would change my mind about Snap is if the company were to lose customer acquisition momentum for its paid subscription service Snapchat+ and if it were to see weakening ARPU trends in its core business (two metrics that I am monitoring going forward).

Final thoughts

Snap remains a promising social media investment following the Q1’24 report: the social media company continued to see double-digit top line momentum, is taking steps to improve its EBITDA trajectory through cost savings and is aggressively growing its Snapchat+ user base which represents a unique monetization opportunity for the company. With now 9M users in the paid subscription service, Snap is also moving away from its reliance on brand deals/digital advertising which helps create a more diversified revenue profile. While shares are not a bargain, I believe the company’s valuation has upside potential as Snap moves toward profitability and grows its user base. With a fair value closer to $18 and significant post-earnings breakout momentum, I believe Snap remains an attractive investment for growth investors!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNAP, GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.